- Radar-as-a-Service

- Posts

- RaaS #458: BlackRock's ETHA Crosses $10B!

RaaS #458: BlackRock's ETHA Crosses $10B!

Solana's Capital Markets Roadmap, Cookie's Attention Capital Markets: GM Web3

Binance Integrates USYC Natively, Real Pay Of Marketing Folks, and Moar!

Quick Intro: Radarblock is a Web3-native growth agency that increases awareness, TVL, volume, and social metrics for its clients over a consistent time frame without uncertainty and confusion. All tweets are hyperlinked, so click to pull them up on Twitter!

Base pay for crypto CMOs is more grounded than Twitter suggests. Most earn around $140K median, with a few outliers hitting $600–850K. U.S.-based marketers dominate, India lags badly, titles are inflated, and yes, men still earn more.

The Uber Driver Paradox reminds us that markets peak not on bad news, but on belief saturation, when the trade feels obvious, and everyone’s already in. At that point, the edge vanishes, not because the idea is wrong, but because there’s no one left to buy.

Solana’s roadmap now centers on Application-Controlled Execution (ACE) to fix market microstructure. Upcoming upgrades like Jito’s BAM, Anza’s landing improvements, Alpenglow, DoubleZero, and Multiple Concurrent Leaders aim to make Solana the best place to run high-performance onchain markets.

Even Vitalik is bullying the newbie; this is why we don’t have mass adoption yet!

InfoFi got gamed, with spammy posts and no conviction. Attention Capital Markets aims to fix it by tying rewards to capital. Post + invest = cSNAPS. 80% of airdrops go to those with skin in the game. ACM rewards belief, real users, real upside, cleaner timelines.

Genesis has reset airdrop eligibility for veVIRTUAL holders; anyone with veVIRTUAL will now receive their full allocation in the next drop. No action needed. This update reinforces veVIRTUAL as the core signal of belief and long-term alignment in the Virtuals ecosystem.

Verifiability is crypto’s true edge. Not everything should be onchain, but the parts that matter must be provably correct. EigenCloud introduces off-chain verifiability for complex logic, enabling trust in AI, robotics, and agent systems where blockchain alone falls short.

deBridge launched a Reserve Fund to support the DBR token’s utility and sustainability by redirecting 100% of protocol earnings to buy DBR. Since June, it has acquired 1.35% of supply ($3.19M). The combined treasury now holds $28.65M across ETH, SOL, ARB, and DBR, with full onchain transparency.

ETH Strategy has officially closed its public sale after raising 1,242 ETH (~$4.5M). No further deposits will be accepted, and no additional public STRAT sales are planned. Participants are advised to watch for upcoming launch updates and avoid scams.

Signs are always there.

RoboCon, powered by PrismaX, brings together leaders in robotics, AI, and Web3 for a landmark event on the future of agent economies. From Ethereum’s AI roadmap to deep-tech VC bets, foundation models in robotics, and user-owned data, this is where physical AI meets crypto. Apply here.

Polychain has sold its remaining $62.5M in TIA to the Celestia Foundation, which is assigning the tokens to new long-term investors under the same unlock schedule. With Polychain undelegating its entire stake, this addresses months of TIA FUD and signals a reset for Celestia.

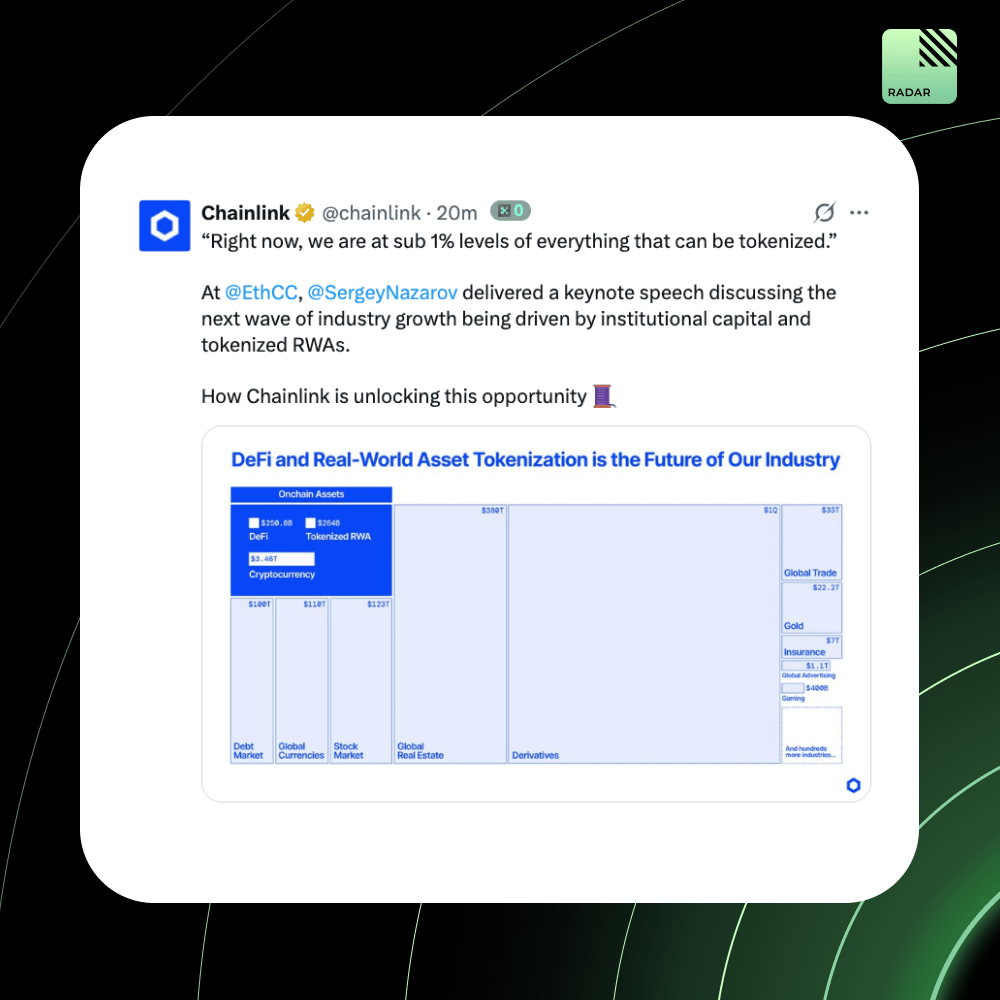

Sergey Nazarov’s EthCC keynote outlined Chainlink’s role in unlocking the next wave of onchain growth via tokenized RWAs and institutional capital. With over $22T in enabled volume, Chainlink infrastructure like CCIP, ACE, and CCID is powering cross-border, compliant RWA movement.

Binance is now integrating Circle’s yield-bearing USYC as off-exchange collateral for institutional clients, expanding their strategic partnership. USYC, backed by U.S. government securities, offers seamless conversion with USDC and is now natively issued on BNB Chain.

Top Gainers: SD, EDGE, REX, T, MORI.

Rabby now lets you top up your GasAccount using Apple Pay or Google Pay, so you stay funded and frictionless across chains.

BlackRock’s ETHA fund just became the third ETF in history to hit $10B AUM within a year, doubling from $5B in just 10 days. As ETH prices surged 160% since April, institutional inflows are accelerating, with treasury companies and ETFs driving a demand shock against limited ETH issuance.

That’s all for today!