- Radar-as-a-Service

- Posts

- RaaS #464: Symbiotic's Slashing Insurance Vaults!

RaaS #464: Symbiotic's Slashing Insurance Vaults!

PUMP Needs A Pivot, Stop Sleeping On Malaysia: GM Web3!

Lido CSM Vulnerability Fixed, Avax Appchains See Traction, and Moar!

Quick Intro: Radarblock is a Web3-native growth agency that increases awareness, TVL, volume, and social metrics for its clients over a consistent time frame without uncertainty and confusion. All tweets are hyperlinked, so click to pull them up on Twitter!

Butler isn’t just pushing content; it’s pressure-testing agent-native UX in public. No apps, no dashboards, just input → output on X. It’s the first real demo of ACP: agents that negotiate and execute across platforms. Content is step one.

Slashing Insurance Vaults offer real coverage for stakers, breaking risk into layers: high-risk stakers earn higher rewards but take the first hit if slashed; lower-risk ones earn less but are protected. Think structured insurance, but onchain, automated, and actually usable.

FaZe Banks is under fire (again) after admitting on a livestream with Adin Ross that he failed his fans. StarPlatinum’s thread details his sketchy crypto history, no airdrops, extractive launches, and now public acknowledgment. It’s a rare moment of accountability after years of questionable behavior.

PUMP is down bad. No airdrop, no new features, barely any transparency, just bags underwater and SOL sent to CEXs. BONK ate their lunch with community cred and 5x the revenue. PUMP still has mindshare, but if the team doesn’t show life soon, that name just means “rug” to most.

Malaysia quietly evolved into a key crypto hub, birthing giants like Etherscan and CoinGecko. With Shariah-compliant rails, strict-but-opening regulation, and regional access, it’s now positioning itself as Southeast Asia’s Islamic finance x Web3 gateway.

Lido just dodged a bullet. A whitehat found a bug that could’ve let bad actors fake withdrawals and burn validator bonds. No one got hurt, thanks to a fast patch, onchain vote, and upcoming fix in CSM v2. But yeah, proof handling needs to grow up.

Avalanche’s appchain thesis is gaining real traction. Daily txs surged 6x to 18M, contract deployments hit 250K/day, and giants like Nexon, FIFA, and J.P. Morgan are launching custom L1s. The value prop is clear: full sovereignty, low cost, and seamless interop, no gas hell, and tailored UX.

Ansem is reportedly in jail as of Aug 1. The community has rallied around “Free Ansem,” though the charges remain unclear. Speculation points to past pump-and-dump allegations, but no official info yet.

I wasn’t aware of Paolo’s meme game.

Congrats to Radarblock’s new Chief Betting Officer. The mission is to go full degen to fund growth. And placing daily yes-only bets on Polymarket. If CT’s going to gamble, we’re betting they’ll gamble with us. The trenches reopen next week. Make Trenches Great Again.

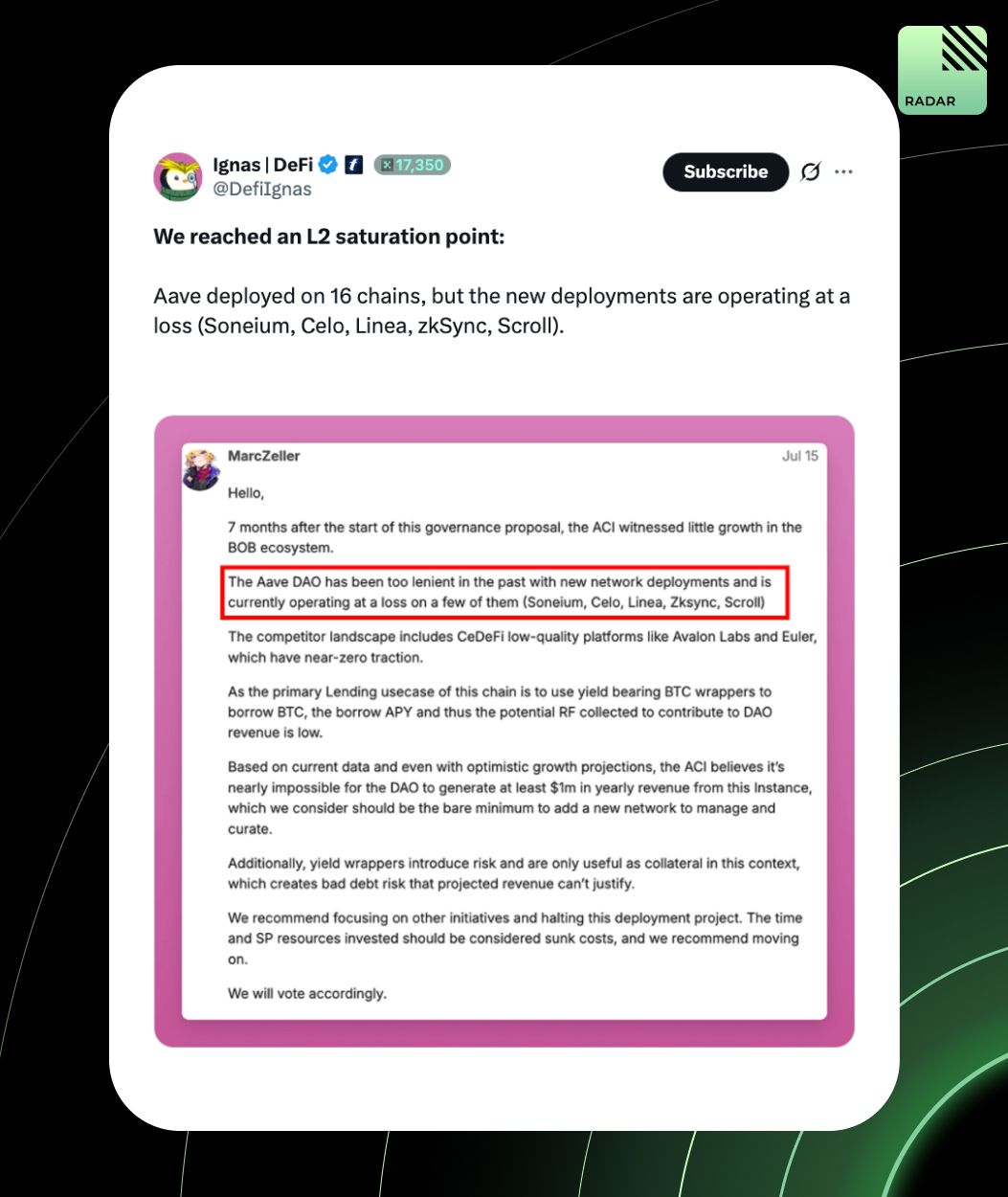

Aave’s new L2 deployments are burning cash, not making it. Chains like zkSync and Scroll barely generate $1.5K in fees, despite dev overhead. Now Curve wants to axe underperforming L2s entirely. The multichain gold rush is stalling, only the differentiated survive.

Custody is no longer backend plumbing. It’s the control layer for tokenized finance. Ripple Custody now powers live deployments at DZ BANK and SocGen, offering programmable governance, multi-party controls, and bank-grade compliance. Without it, tokenization doesn’t scale.

Top Gainers: LYX, EDGE, GEN, MEME, M.

Coinbase posted $1.5B in Q2 revenue, down 25%, as trading volume thins and superapp competition heats up. Still, Base is booming, JPMorgan is in, and stablecoin rails are expanding. The bet? Be the one-stop infra layer for crypto finance. But the moat isn’t guaranteed, yet.

Virtuals just launched the Virgen Ambassador Program, calling on its global community to lead the charge for agentic AI adoption. Ambassadors will host events, build local scenes, and shape culture, from Tokyo to Paris. POAPs included.

That’s all for today, happy weekend!