- Radar-as-a-Service

- Posts

- RaaS #487: Polymarket to Go Live in the US!

RaaS #487: Polymarket to Go Live in the US!

xStocks Come To Ethereum, Paradigm Bug Disrupts Ethereum Nodes: GM Web3!

ONDO Launches Global Markets, Scaramucci Joins AlphaTON Capital, and Moar!

Want RaaS without digging through your inbox? Our Telegram channel gives you the same daily crypto roundup in a quick, scrollable format. Easy to read, easy to share. Join here → RaaS Telegram Group.

Quick Intro: Radarblock is a Web3-native growth agency that increases awareness, TVL, volume, and social metrics for its clients over a consistent time frame without uncertainty and confusion. All tweets are hyperlinked, so click to pull them up on Twitter!

ERC-6551 converts tokens into smart contract wallets, making wallets transferable. You can bundle and send assets as one NFT, sell DeFi strategies with built-in logic, trade point-farming wallets pre-airdrop, transfer entire game characters, or holiday itineraries.

The DoD just cleared its first AI agent, GARY by CORAS, with IL-5 authorization. Built for auditability, GARY uses Claude to deploy sub-agents, model data, and deliver expert outputs via no-code prompts. Signals a shift: agents can now be enterprise-safe.

xStocks brings tokenized equities to Ethereum, launching 60+ ERC-20s like AAPLx and TSLAx. After $400M+ volume and 25K+ holders on Solana, it now taps Ethereum’s $500B-secured ecosystem. Kraken support and DeFi integration are incoming.

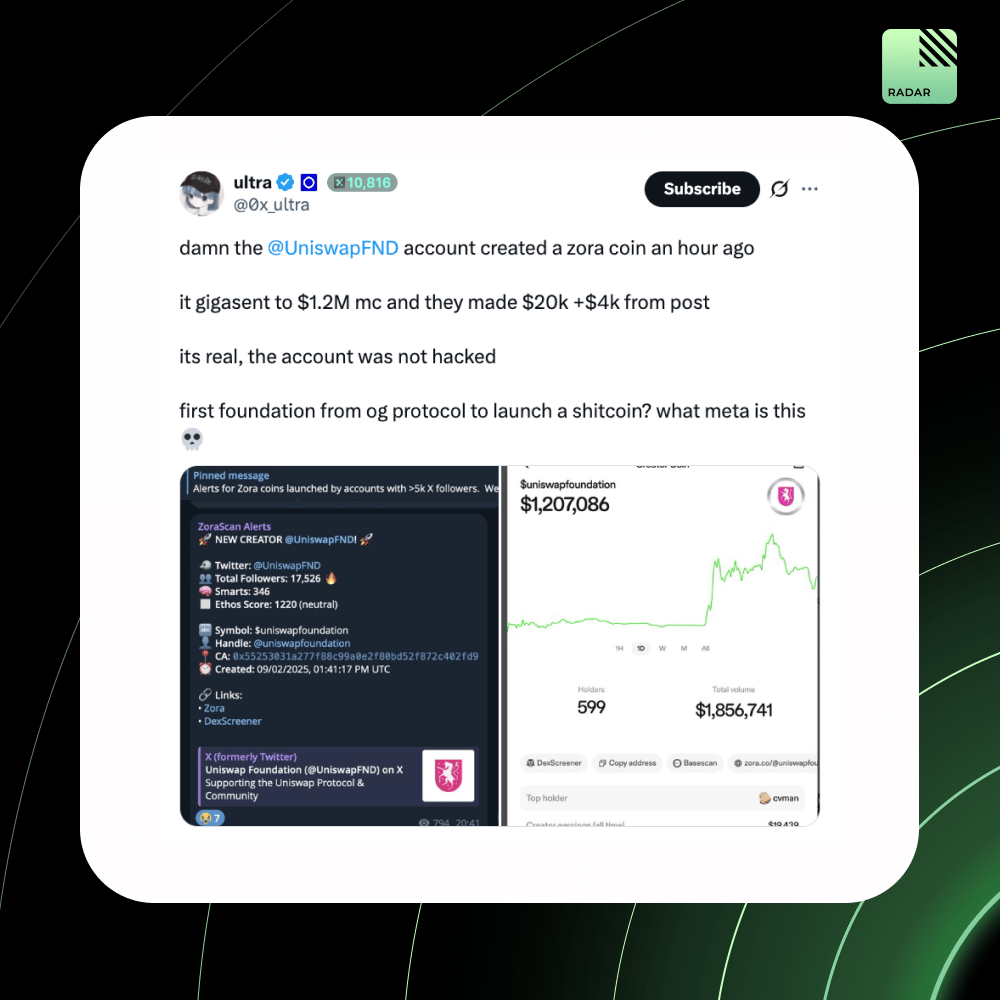

The Uniswap Foundation just dropped a Zora coin and made $24K+ in an hour, $20K from the coin, $4K from the post. First foundation shitcoin? This might be the ‘institutional pump & dump’ meta we weren’t ready for.

A bug in Paradigm’s Reth client caused Ethereum nodes to stall at block 2327426. Versions 1.6.0 and 1.4.8 were affected, but the issue was limited; Reth only powers 5.4% of execution clients. Paradigm shared recovery commands; root cause remains under investigation.

Most crypto marketing fails because it lacks structure. Two timeless copy formulas, PAS (Problem, Agitate, Solution) and AIDA (Attention, Interest, Desire, Action), can instantly improve your writing. Use PAS to solve pain points. Use AIDA to guide a journey. Structure = clarity = action.

Arbitrum just launched DRIP: The DeFi Renaissance Incentive Program. Season 1 kicks off with leverage looping, allowing you to deposit ETH/stables, borrow, loop, repeat. Designed by Entropy Advisors and backed by ArbitrumDAO, it’s real incentives for real DeFi action.

Virtuals just launched ALE (Agent Liquidity Engine), a dashboard filtering the noise from the agent economy. Only agents with real products, actual revenue, and value-accruing token models cut. A first step in tokenizing Silicon Valley, not meme farming it.

Babies have a higher attention span than CT.

Polymarket bets will soon have leverage. This week’s stream features Yugi and Arsenii (founder of GondorFi), the protocol that lets you borrow against your open positions. Tune in tomorrow at 1:30 PM UTC to find out more.

USD. AI is lifting deposit caps from $110M to $160M on September 4, 12:00 PM EST. The first cap filled fast, and this adds $50M more runway. The next cap jump will sync with the Plasma Foundation’s mainnet launch. If you’re eyeing stablecoin yield, the clock starts ticking soon.

Polymarket has received a CFTC no-action letter allowing it to operate in the U.S. via QCX and QC Clearing. This clears the way for its re-entry after a dropped investigation. CEO Shayne Coplan confirmed the news, citing record regulatory turnaround.

Crypto’s next wave needs to fix two frictions: ecosystem fragmentation and radical transparency. The solution? Chain-agnostic infra with selective disclosure. Adoption hinges on privacy that works with compliance, not against it.

Crypto native and lifelong Pokémon TCG collector reflects on the rise of Pokémon RWAs. TLDR: Tokenizing cards isn’t revolutionary; vaults, pricing, and liquidity already exist. Real value lies in using slabs as loan collateral.

Time to have some fun!

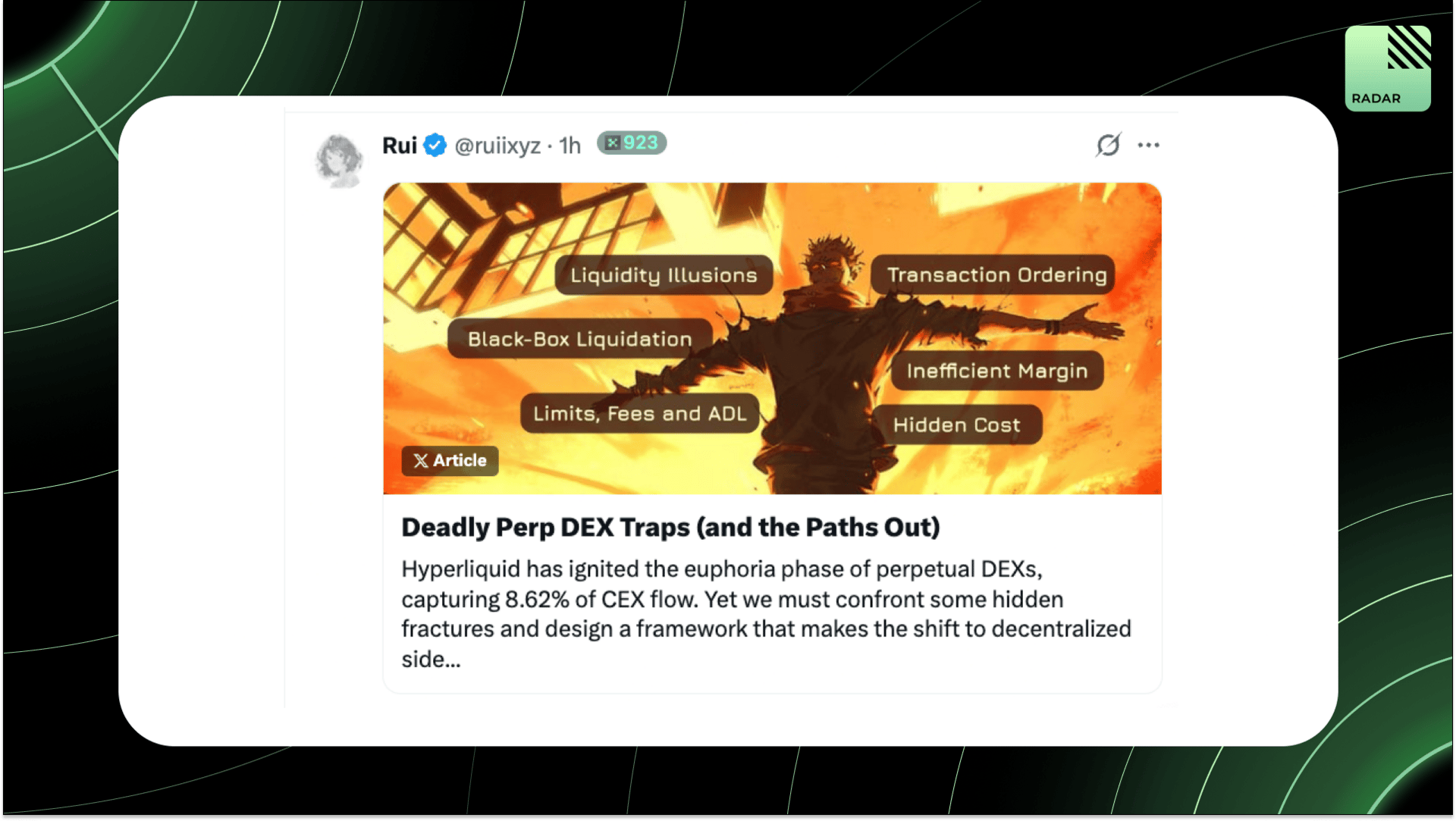

Perp DEXs are booming, but cracks are clear: fake volume, hidden maker costs, exploitable liquidations, and rigid margin systems. Hyperliquid leads, but even it has shown flaws. Next-gen DEXs must trade hype for hard design: fairer liquidations, smart margin, and real decentralization.

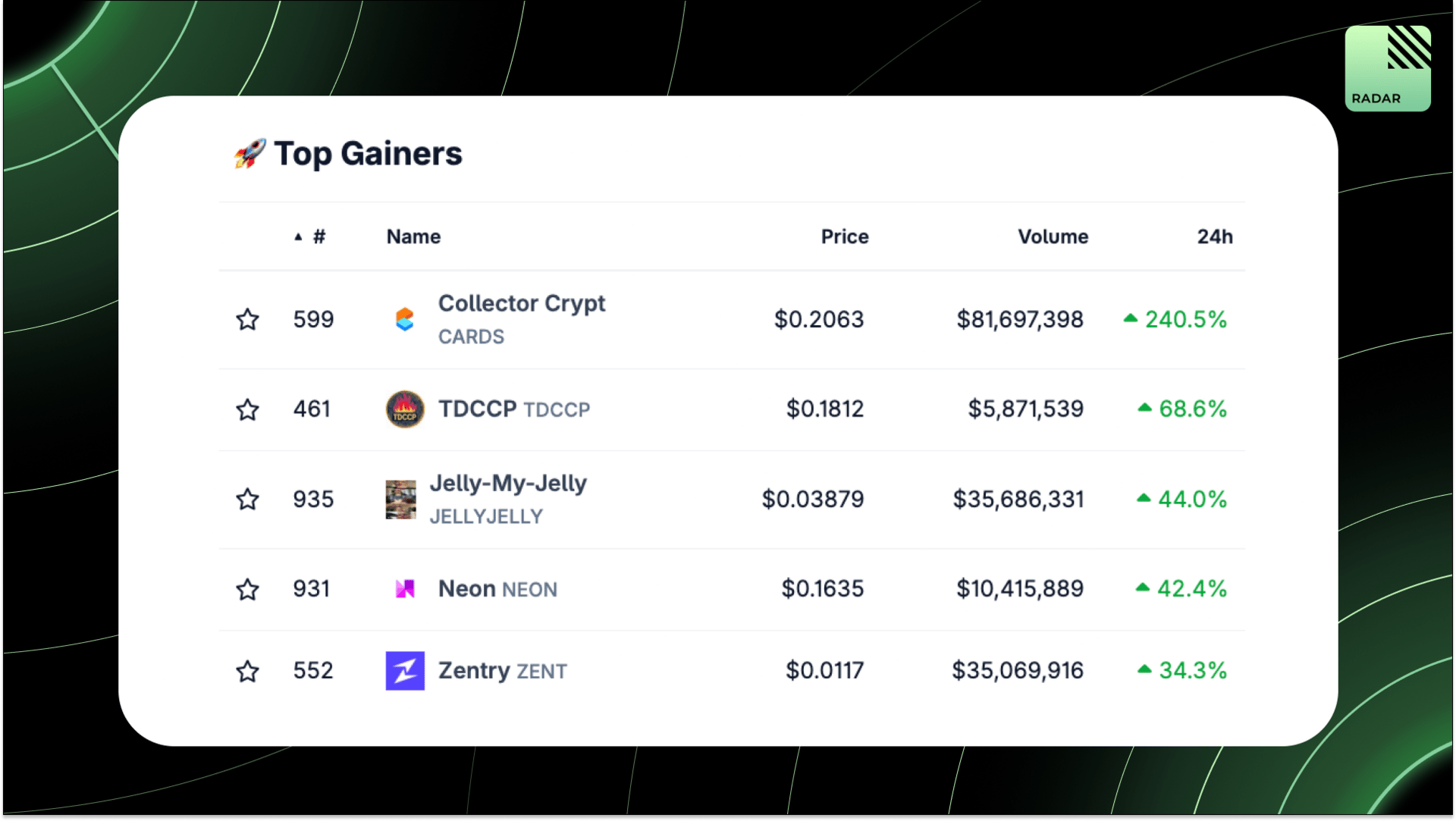

Top Gainers: CARDS, TDCCP, JELLYJELLY, NEON, ZENT.

Scaramucci joins AlphaTON Capital as advisor to a new $100M Toncoin treasury. The Nasdaq-listed DAT will acquire TON and build Telegram mini-apps, marking a pivot from biotech to crypto infra. Backed by BitGo, Animoca, and SkyBridge, it’s part of a broader TON ecosystem accumulation play.

Ondo launches Global Markets, bringing over 100 tokenized U.S. stocks and ETFs onchain via Ethereum. Assets inherit TradFi liquidity, are fully backed, transferable, and DeFi-compatible. Backed by major partners, it marks a new phase in capital markets access and tokenized equities.

Circle’s IPO and GENIUS Act compliance sparked interest in stablecoins. Frax Finance is emerging as the next leader, issuing frxUSD, GENIUS-compliant, and backed by tokenized treasuries. With FraxNet (frontend) and Fraxtal (backend), it’s building a full-stack stablecoin OS, mirroring Circle’s playbook.

Etherealize, led by Danny Ryan and Vivek Raman, raised $40M from Electric Capital and Paradigm to push institutional Ethereum adoption. Backed by Vitalik and EF, they’re building ZK privacy infra, tokenization rails, and pitching ETH as a reserve asset to Wall Street.

That’s all for today, see you tomorrow!