- Radar-as-a-Service

- Posts

- RaaS #493: How Rich Is Arthur Hayes?

RaaS #493: How Rich Is Arthur Hayes?

ZKSync Leads Eth RWAs, Drift Upgrades Referral Program: GM Web3!

ETH White Swan Event, Hype’s Validator Weighs In, and Moar!

Want RaaS without digging through your inbox? Our Telegram channel gives you the same daily crypto roundup in a quick, scrollable format. Easy to read, easy to share. Join here → RaaS Telegram Group.

Quick Intro: Radarblock is a Web3-native growth agency that increases awareness, TVL, volume, and social metrics for its clients over a consistent time frame without uncertainty and confusion. All tweets are hyperlinked, so click to pull them up on Twitter!

Prediction markets utilize game theory to make truth-telling the most effective strategy. LMSR aligns incentives so that only confident traders shift prices. Liquidity is boosted via LP rewards, while manipulation is deterred through dominant strategies.

Solana hits a 7-month high at $225, driven by around $3 billion in new TreasuryCo buys and pending spot ETF approvals (Q4). With apps like Pump Fun launching buybacks and Meteora teasing airdrops, SOL’s setup mirrors BTC/ETH pre-ATH.

Web3 visibility on X is about signal, not spam. Smart replies build reputation and boost the algorithm. DMs come after public value. Calls happen after trust. Solve, don’t sell. Connect through insight, not clout-chasing. Lead with relevance, humans and algos follow.

Ensure to use the right tooling.

Hourly BTC prediction markets on Limitless offer an average of 470x implied leverage with no liquidation risk. As expiry nears and price hugs strike, leverage spikes to 760x. Perfect for short-term bets or arb plays vs perps/options when vol is mispriced.

Most crypto projects fail at launch by overspending on paid channels. To overcome the cold start problem, founders must build goodwill, grow a strong network, or become niche celebrities. Influencers only work when amplifying real momentum; used incorrectly, they drain cash with little ROI.

SOL DAT hype isn’t priced in for retail, zero mindshare despite some smart money positioning. On X and Google Trends, SOL restaking is flat YTD. If momentum kicks in, the reflexivity could mirror ETH’s summer run. Still early.

This is one of the most comprehensive yield and airdrop farming breakdowns of the year. It highlights a shift from speculative clicking to capital-efficient strategies, Pendle LPs, delta-neutral vaults, and stablecoin protocols. Required reading for DeFi grinders.

Who needs hardware wallets?

Kite AI is building the agentic internet by aligning incentives across supply (infra providers) and demand (agents/users). Unlike Uber’s capital-heavy model, Kite utilizes token economics to bootstrap both sides from day one, scaling faster through ecosystem incentives, rather than burning.

Falcon Finance is DWF’s $1.5B stablecoin play going public. With strong traction, Pendle integrations, and a Trump-aligned narrative, it checks every meta box. Token utility is weak (no rev share), but at $350M FDV, it’s a calculated bet on stablecoin rotation and RWA upside.

Chorus One is voting for Paxos in the USDH stablecoin proposal on Hyperliquid. Their reasoning: unmatched regulatory compliance, PayPal/Venmo access for mass distribution, zero fees until $1B TVL, and aligned long-term incentives.

SOAR redefines token launches with its DRP standard, aligning founders and holders through disclosures, lockups, and buybacks. It blends curated startups and open launches, reinvests fees into growth, and builds a transparent, accountable Internet Capital Market.

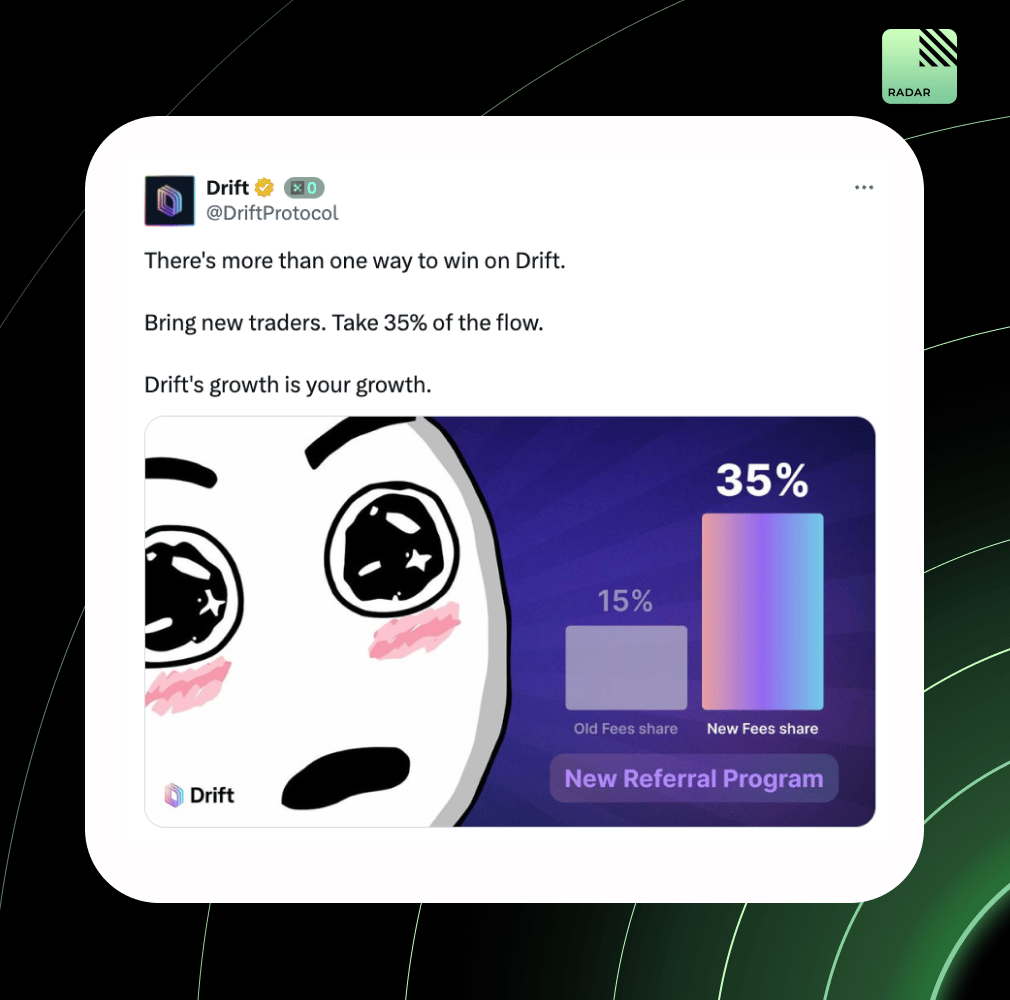

Drift just juiced up its referral program: earn 35% of trading fees from new users you bring in (up from 15%), while they get a 5% discount with no cap on rewards. Existing links are valid, and new terms apply retroactively. The 35% cut lasts until referees hit $10M 30-day volume.

On Sep 2, Starknet halted for ~9 hours after decentralizing its sequencer set (from 1 → 3). Two chain reorgs were required. Cause: divergent Ethereum views between sequencers, a manual fix gone wrong, and a bug in v0.14.0’s blockifier. No security breach; the proving layer preserved integrity.

ZKsync is now the top Ethereum L2 for RWAs, holding 15% market share and averaging $2.4B in monthly RWA value. While Ethereum still leads with 52%, ZKsync’s rapid growth positions it as a key driver in the onchain asset tokenization trend.

Arthur Hayes’ net worth is estimated at $200M–$400M, driven by $57M in on-chain assets, BitMEX equity, and venture bets via Maelstrom. Despite past legal issues, his ETH whale status, bold essays, and market influence keep him central to crypto’s narrative in 2025.

Top Gainers: ERN, KET, WORTHLESS, NOS, SAFE.

SharpLink’s $3.7B ETH treasury isn’t a black swan risk, it’s a “white swan,” says CEO Joseph Chalom. As a public company, SharpLink brings transparency, regulatory oversight, and Wall Street education to Ethereum. The goal? Institutional adoption that dwarfs Bitcoin’s.

Figure has priced its IPO at $25/share, valuing the blockchain lending firm at $5.3B ahead of its Nasdaq debut under the ticker “FIGR.” Led by SoFi’s co-founder, the company aims to raise $787.5 million, joining Coinbase and Circle on the list of crypto-native firms going public.

Perps belong on general-purpose chains, not appchains. Like traditional finance, crypto consolidates around shared rails and broad distribution. GP chains offer scale, network effects, and platform economics, making them the natural home for breakout apps.

That’s all for today!