- Radar-as-a-Service

- Posts

- RaaS #495: Polygon Poaches Stripe's Head of Crypto!

RaaS #495: Polygon Poaches Stripe's Head of Crypto!

Relay Bewares Users of EIP-7702 Delegation, EF Launches dAI Team: GM Web3!

Aave Proposes Leaner Model, Native Markets Wins USDH Bid, and Moar!

Want RaaS without digging through your inbox? Our Telegram channel gives you the same daily crypto roundup in a quick, scrollable format. Easy to read, easy to share. Join here → RaaS Telegram Group.

Quick Intro: Radarblock is a Web3-native growth agency that increases awareness, TVL, volume, and social metrics for its clients over a consistent time frame without uncertainty and confusion. All tweets are hyperlinked, so click to pull them up on Twitter!

Starknet just enabled BTC staking: Bitcoin now carries 25% of consensus weight alongside STRK, with delegation pools open and rewards starting Sept 30. Supported wrappers include WBTC, LBTC, tBTC, and SolvBTC. Unstaking cut to 7 days.

Three accomplices in South Korea’s $1.4B V Global scam avoided jail, receiving suspended three-year sentences and fines up to $436K. The fraud hit 50,000 victims, while the CEO got 25 years. The court called the damage “astronomical,” citing lasting economic and mental harm.

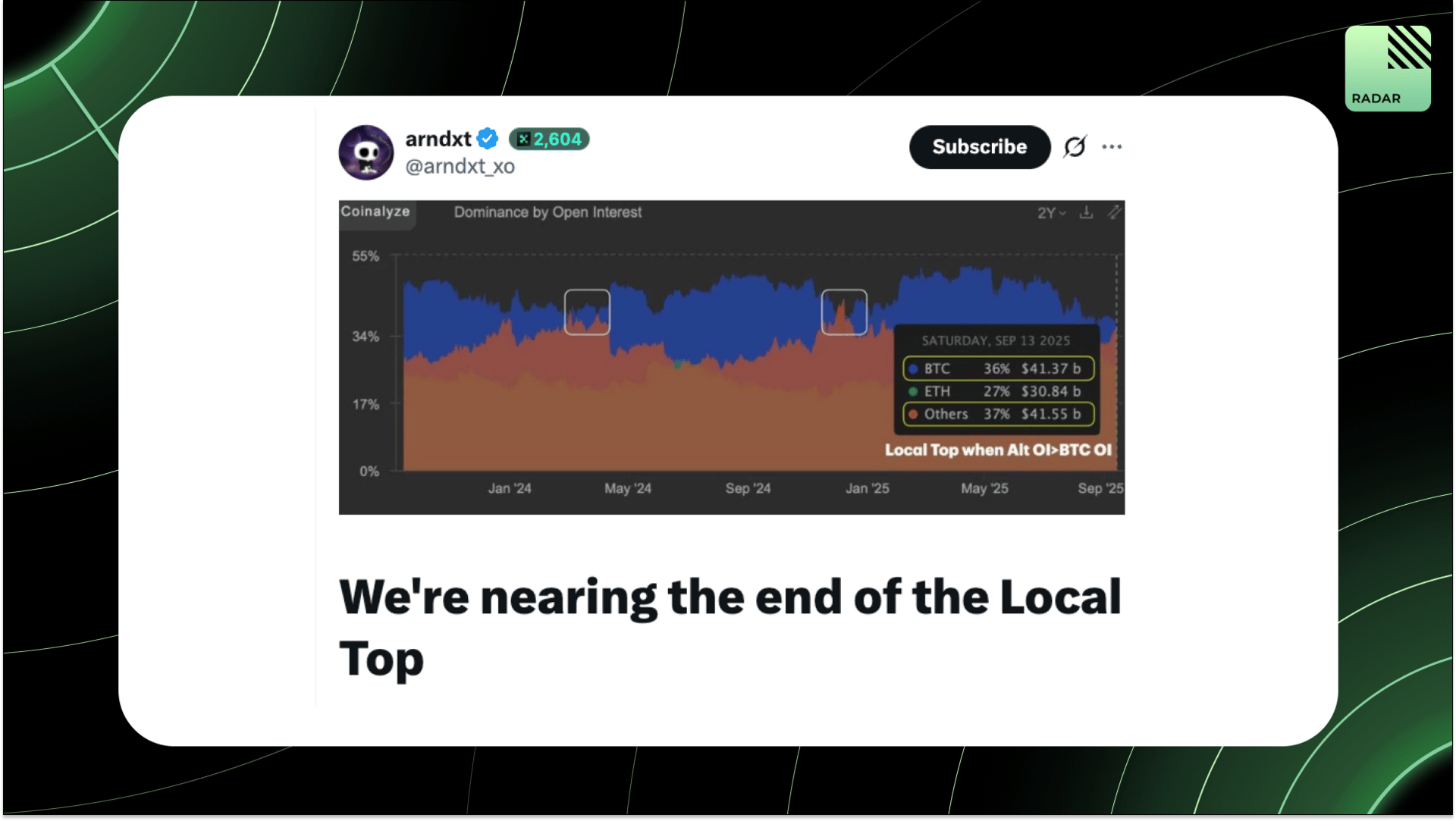

The market looks stretched. Alt OI > BTC OI flags a local top, with reversal risks, and macro being hostile despite asset strength. Unlike 2021’s liquidity-fueled run, 2025 rallies are fiat-debasement-driven. Selectivity, timing, and discipline will matter more than hype.

John Egan, ex-Stripe Head of Crypto, is now Polygon Labs’ first Chief Product Officer. He cites stablecoins as the biggest payments shift since credit cards and calls Polygon’s scaling and early stablecoin leadership “irresistible.” He’ll focus on product org, catalog, and dev experience.

Relay warns EIP-7702 delegations are being exploited in wallet-draining scams. Attackers lure users into signing malicious approvals via fake mints or front-ends, auto-draining funds. Safety tips: only sign with trusted apps, use RevokeCash, and check delegations if funds vanish.

A CT veteran curates 12 must-read crypto pieces from last week, covering airdrops, DATs, InfoFi campaigns, prediction market tactics, Hyperliquid’s stablecoin, CT branding, Sonic, and Pump plays. A mix of alpha, strategy, and narrative-building essentials.

The Ethereum Foundation just launched the dAI Team, led by Davide Crapis, to make Ethereum the base layer for AI and the machine economy. Focus: AI payments & coordination on-chain, open decentralized AI infra, and standards like ERC-8004.

DefiLlama pushed back on Figure’s claim of $12B in on-chain RWAs, pointing out inflated metrics and opaque accounting. Fake TVL practices, like minting dead tokens on zkSync, skew adoption data. DefiLlama insists on strict due diligence, refusing to list unverifiable RWAs despite public pressure.

Oh, you know, just Sunday night shenanigans!

Symbiotic, Chainlink, and Lombard just shipped the first cross-chain transfer solution backed by restaked collateral. LBTC transfers via CCIP now come with automated monitoring powered by $100M LINK and 20M BARD vaults, turning restaking into real economic security for Bitcoin DeFi.

Robotics tokens are exploding, jumping from less than $100M cap to $450M in months. Projects leading the charge: OpenMind, Auki, RoboStack, and Silencio.

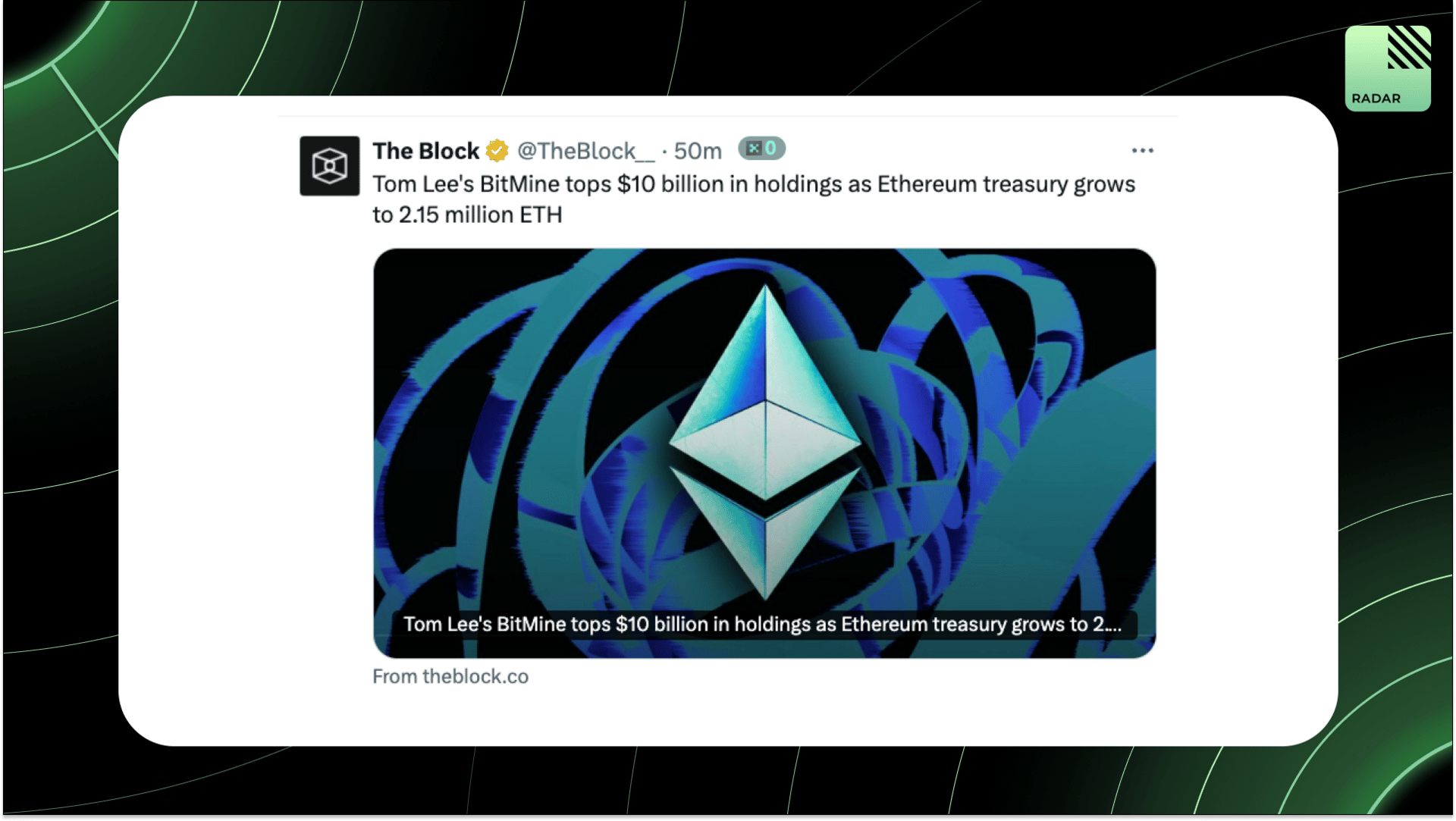

Tom Lee’s BitMine crossed $10.8B in assets, adding 82K ETH last week to reach 2.15M ETH ($9.75B). Now the largest ETH treasury, BitMine, trails only MicroStrategy in public crypto holdings. Backed by major funds, it’s targeting 5% of the ETH supply as Wall Street and AI converge on Ethereum.

Most crypto partnerships fail because they chase logos over outcomes. A good one drives users, liquidity, tech, or credibility with clear owners and timelines. Skip empty PR, aim for integrations, community value, or ecosystem plays that compound advantages.

Stephen breaks down a USDe/sUSDe looped leverage strategy: at 2x, $1k equity yields ~16.8% APR; at 5x, >30% APR. Risk is limited to Ethena, Aave, and USDC, making it a strong risk-adjusted play, though users must manually claim Merkl rewards.

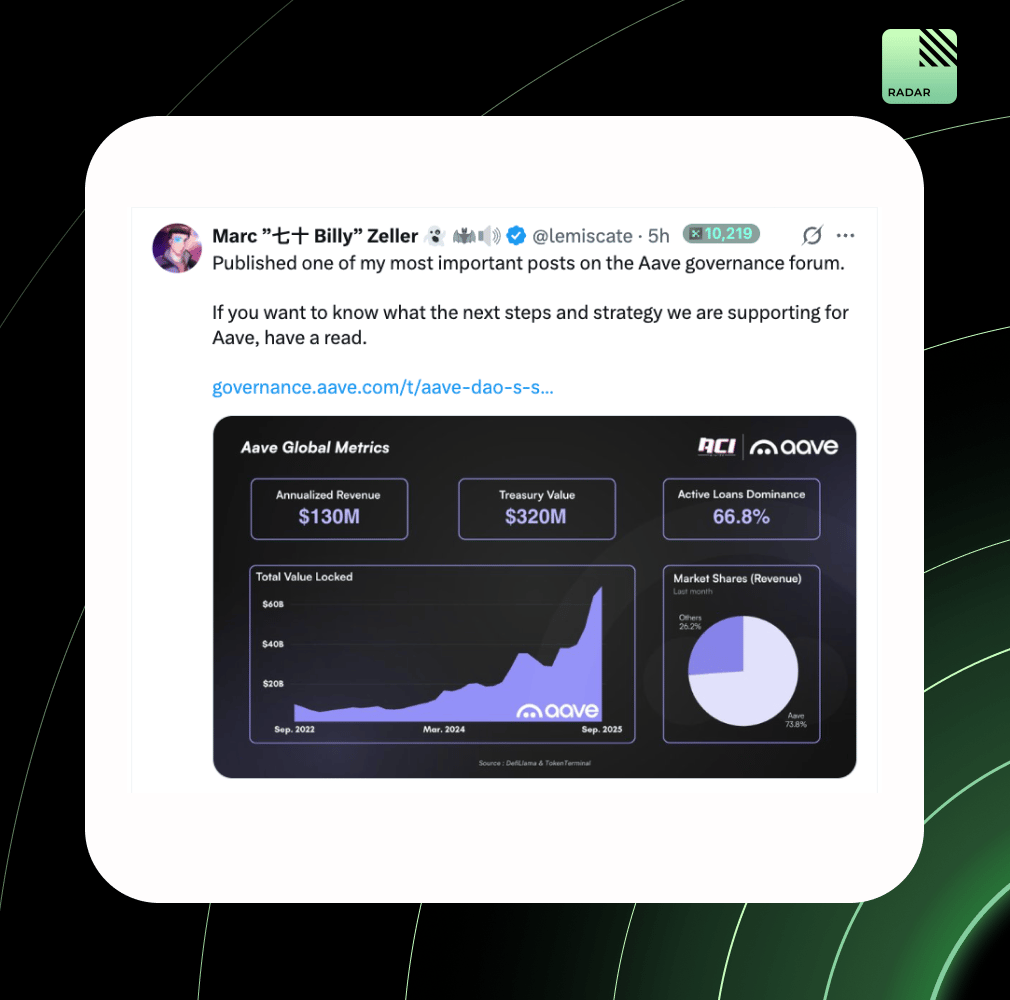

Aave’s “State of the Union” charts its rise from crisis to dominance. With $130M cash flow, buybacks live, and GHO maturing, the DAO plans to double down on growth, kill deadweight forks, and focus on high-margin plays.

Xiao Feng argues that DATs beat ETFs for crypto exposure. Unlike ETFs tied to NAV, DATs trade on market value, bringing price elasticity, faster liquidity via exchanges, built-in leverage structures, and downside buffers. He predicts that DATs could rival ETFs in scale within a decade.

Native Markets won the USDH ticker on Hyperliquid, with thanks to HYPE stakers and validators. Deployment of USDH HIP-1 and ERC-20 starts within days, beginning with capped test mints/redeems before opening the USDH/USDC order book and enabling uncapped flows.

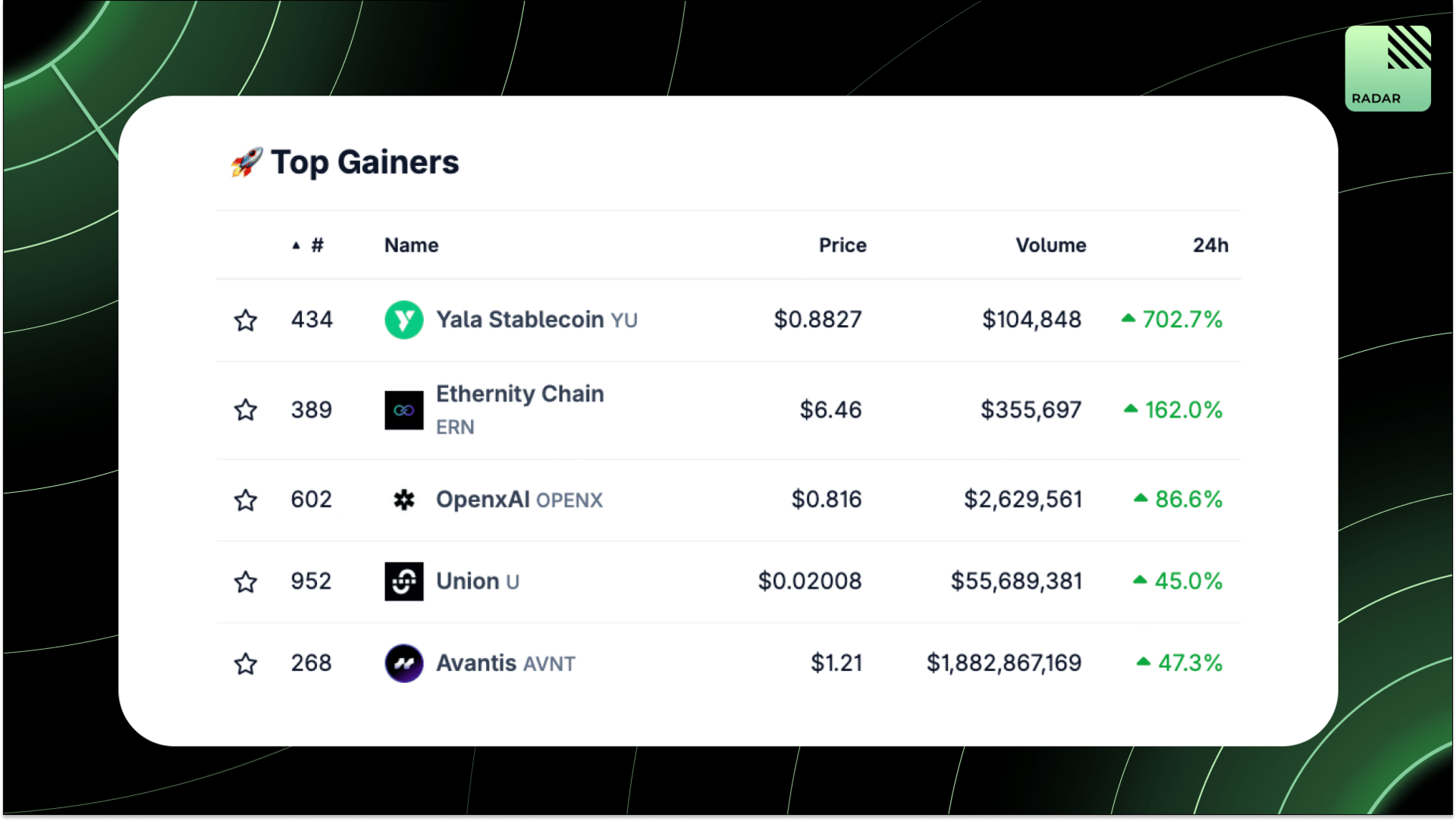

Top Gainers: YU, ERN, OPENX, U, AVNT.

Ethereum’s PSE team is rebranding as Privacy Stewards for Ethereum, shifting from tech exploration to problem-first coordination. Their roadmap centers on private writes, reads, and proving, from zk transfers and private voting to network privacy, zkTLS, and modular identity. Goal: make privacy the default on Ethereum.

Tether is launching USA₮, a U.S.-regulated, dollar-backed stablecoin built under the GENIUS Act, with Anchorage as issuer and Cantor Fitzgerald as custodian. Bo Hines, ex-White House Crypto Council, will serve as CEO. The goal is to reinforce U.S. dollar dominance with transparency and compliance.

Solana streamers Bagwork leaked unreleased Drake and Future tracks on Pump.fun, sending their meme coin to a $53M cap and netting $83K in fees. The duo has made $168K in four days as Pump.fun’s “creator capital markets” boom, with $20M in rewards claimed last week.

Mert is clarifying that the new $500M “Helius” DAT has nothing to do with him, Helius.dev, or related projects. Just an unfortunate name collision, no ties to Helius Labs, Helium, Helio, or anyone in his orbit.

That’s all for today, happy Monday!