- Radar-as-a-Service

- Posts

- RaaS #496: Google's Agents Payment Protocol!

RaaS #496: Google's Agents Payment Protocol!

Aave V4 In Q4, Base Exploring Network Token: GM Web3!

Amex Launches Travel Stamp NFTs, Pumpfun Flips Hype, and Moar!

Want RaaS without digging through your inbox? Our Telegram channel gives you the same daily crypto roundup in a quick, scrollable format. Easy to read, easy to share. Join here → RaaS Telegram Group.

Quick Intro: Radarblock is a Web3-native growth agency that increases awareness, TVL, volume, and social metrics for its clients over a consistent time frame without uncertainty and confusion. All tweets are hyperlinked, so click to pull them up on Twitter!

Aave just locked in its V4 launch roadmap, aiming for Q4 2025. The rollout stacks formal verification, layered audits, and researcher reviews, plus a new interface for testnet trials. TokenLogic and ACI will handle GTM to drive adoption, manage V3 migration, and stabilize post-launch growth.

Shanks is reacting to Jesse Pollack's hint at a Base token. His point is that early crypto was about decentralization and censorship resistance, but now founders mask profit motives with “world-changing” narratives. Base, Polymarket, and Pumpfun work fine without tokens, so framing them as altruistic is disingenuous.

Boundless’ first ZKC token distribution via Kaito ran into delays, high ETH gas fees, and wallet loading issues from traffic spikes. Kaito is issuing 120% gas refunds on Base, adding credits for pending withdrawals, and moving from smart wallets to embedded wallets with exportable keys to prevent repeats.

Work ethic in these market conditions?

Ethereum’s scaling plan shifts from “hope L2s fix it” to snarkifying L1 itself. zkEVM and real-time proving allow validators to check math instead of re-executing txs, pushing L1 toward 10K TPS by 2031. Native rollups follow, making L2s as secure as mainnet.

Etherealize spent 9 months with institutions and released a report arguing that on-chain finance is inevitable, and Ethereum is the only viable base. Backed by insights from Securitize, it frames Ethereum as TradFi’s settlement layer of choice.

The Ethereum Foundation just kicked off the Fusaka $2M audit contest with Sherlock, backed by Gnosis and Lido. Findings in week one earn 2x rewards. The four-week contest aims to stress-test Fusaka before launch, reinforcing that protocol security is an ecosystem responsibility, not EF alone.

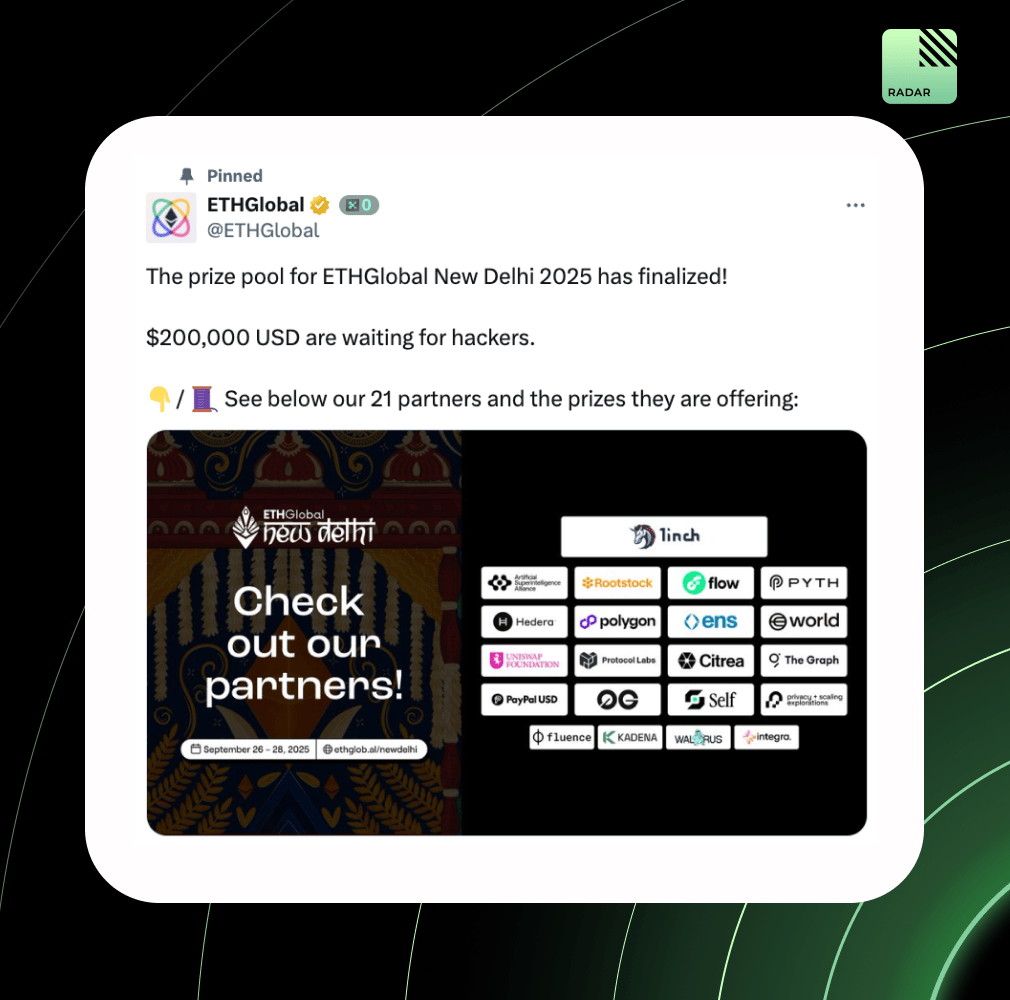

ETHGlobal New Delhi 2025 locks in a $200K prize pool across 21 partners. Backers include 1inch, Rootstock, Flow, Pyth, Hedera, Polygon, ENS, and more. Hackers will compete to build DeFi, infra, and consumer crypto projects at scale under Ethereum’s ecosystem.

And here I thought that being extractive was the only option!

PrismaX and GAIB are teaming up to merge teleoperation with financial infrastructure, creating a closed-loop robotics economy. Operators’ actions generate data, GAIB finances fleets, and together they tokenize and monetize robotic activity as a new asset class.

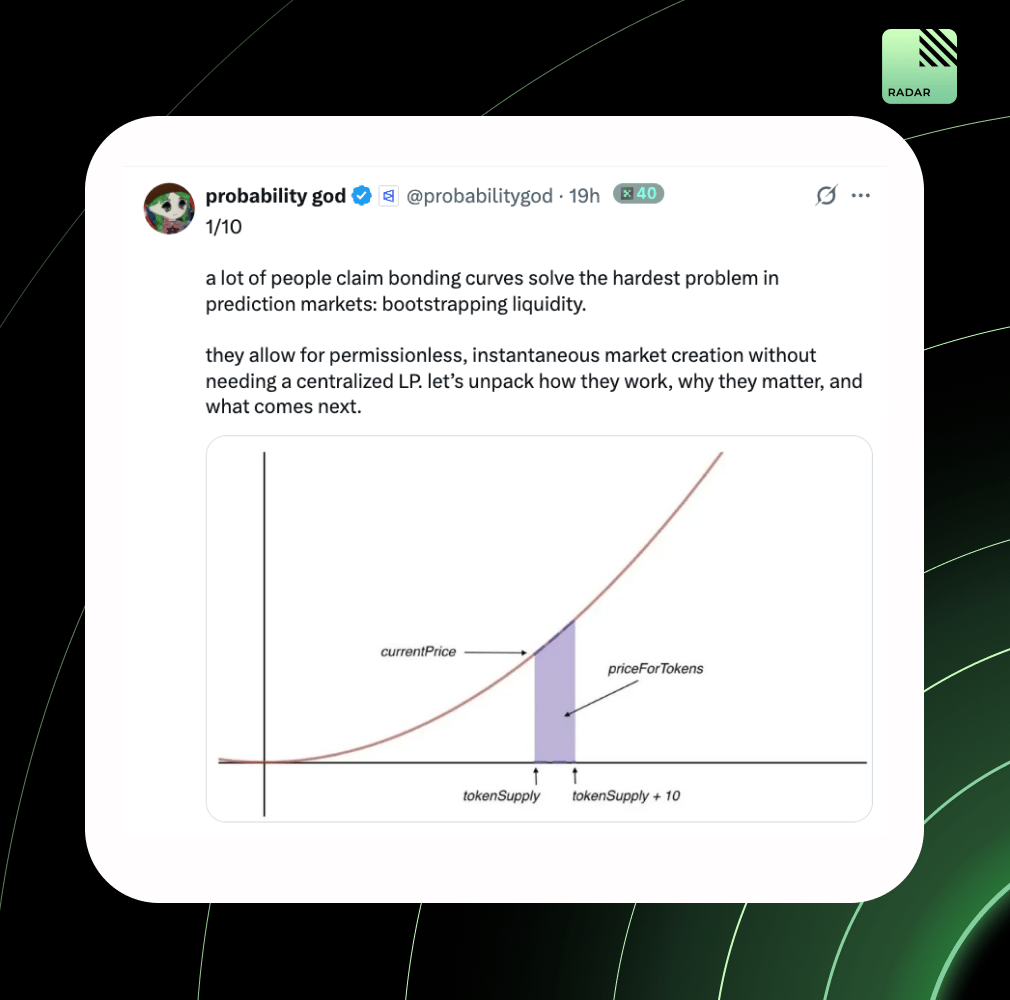

Bonding curves make liquidity programmable: token supply maps to price, contracts guarantee collateral, and markets can spin up instantly. They’ve powered AMMs, NFT mints, and now prediction markets, but risks in design mean PM liquidity still isn’t fully solved.

Amex just dropped onchain travel “stamps” on Base: ERC-721 NFTs minted behind the scenes when cardholders use their Amex abroad. Wallets are abstracted, stamps can’t be traded, and are meant more as digital keepsakes than a crypto onramp. Another quiet step in Amex–Coinbase’s premium web3 play.

Simon Dedic frames Arcium as the next big meta. After calling CARDS, Pump to HYPE, and robotics, he argues Arcium’s confidential Solana standard (C-SPL) could trigger a “privacy season.” With mainnet set for Q4, he sees its infrastructure unlocking new use cases and asymmetric opportunities.

Patagon is building a transparent, efficient platform for accredited investors to access private company shares. By aggregating secondary markets, cutting broker fees, and adding valuation data, due diligence, and portfolio tools, Patagon aims to make investing in firms like OpenAI or SpaceX safer and easier.

Circle expands USDC into Hyperliquid with native support on HyperEVM and soon HyperCore, plus CCTPv2 for seamless cross-chain transfers. Circle also invested in HYPE and is launching builder incentives, bringing deep liquidity and global rails to Hyperliquid.

Google launched the Agent Payments Protocol (AP2), an open standard for AI-driven purchases backed by 60+ merchants and financial institutions. AP2 adds auditability through “intent” and “cart” mandates, supports crypto via x402, and already has backing from Mastercard, Amex, PayPal, and Coinbase.

Based is building a consumer layer on Hyperliquid with mobile-first UX, XP rewards, and an in-app store for bots and strategies. Backed by Ethena Labs, it’s hit $9B in trading volume, $43M annualized revenue, and is pushing HyperEVM adoption through Hyperdrop and Launchpool.

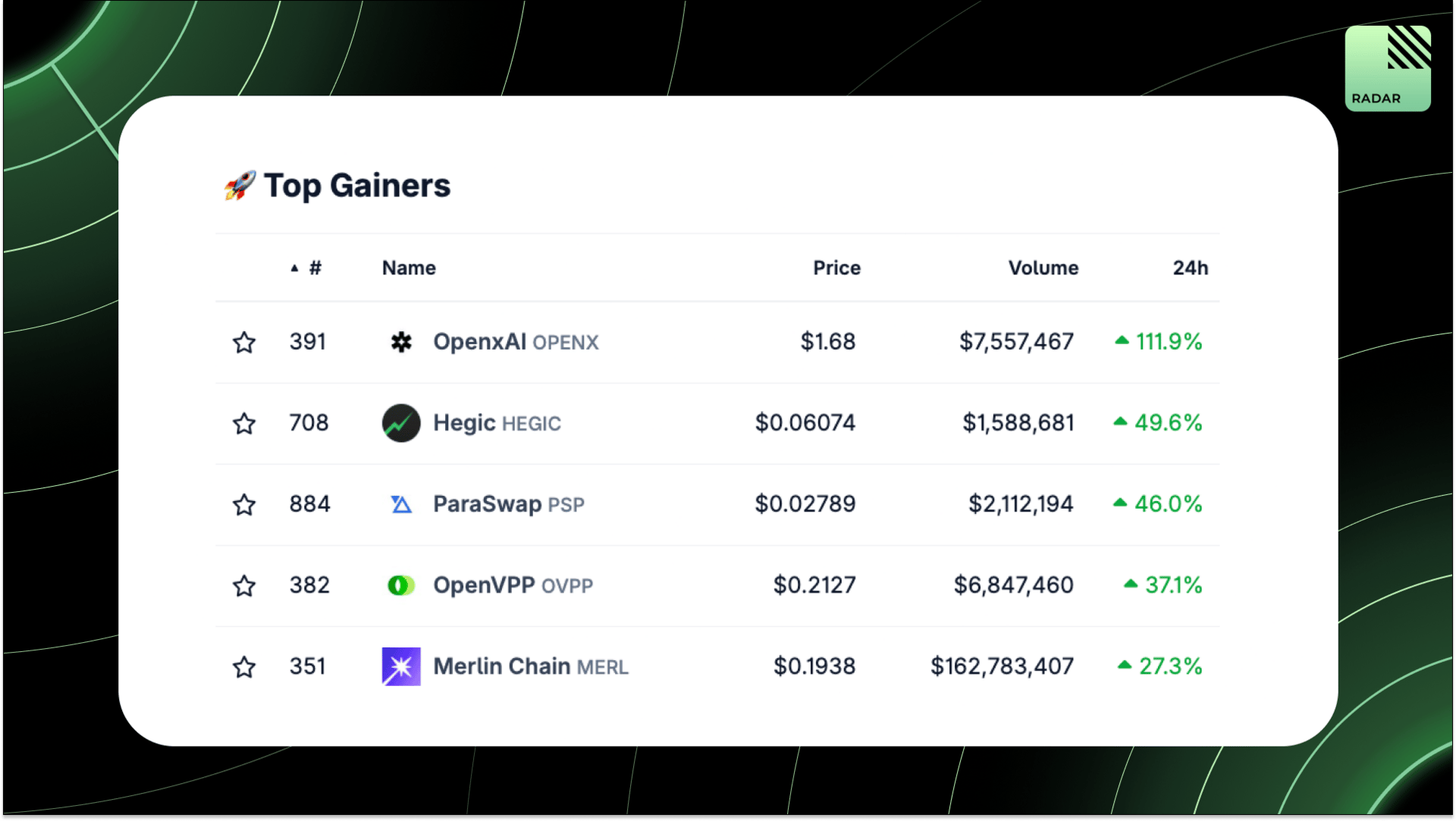

Top Gainers: OPENX, HEGIC, PSP, OVPP, MERL.

Ethereum’s PSE team is rebranding as Privacy Stewards for Ethereum, shifting from tech exploration to problem-first coordination. Their roadmap centers on private writes, reads, and proving, from zk transfers and private voting to network privacy, zkTLS, and modular identity. Goal: make privacy the default on Ethereum.

Pump.fun daily revenue hit $3.38M, topping Hyperliquid’s $3.06M for the first time since Feb. The rebound follows a 96% revenue drop earlier this year and is fueled by its aggressive buyback program, which has retired 6.7% of $PUMP supply and lifted the token 54% since July.

MoonPay acquired payments startup Meso to expand its global network linking banks, cards, stablecoins, and blockchains under U.S. and EU rules. Meso’s founders join as CTO and SVP of Product. This is MoonPay’s fourth acquisition in a year as it scales beyond onramps into global payments.

The Senate narrowly confirmed Stephen Miran, a crypto-friendly former Hudson Bay strategist, to the Federal Reserve Board in a 48–47 vote. Miran, who has called for streamlined crypto rules, will serve until Jan 2026, joining ahead of the Fed’s upcoming rate-setting meeting.

That’s all for today!