- Radar-as-a-Service

- Posts

- RaaS #497: CME Launches Options On SOL, XRP, & Others!

RaaS #497: CME Launches Options On SOL, XRP, & Others!

0G Airdrop Registration Live, Maple Flips BlackRock's BUIDL: GM Web3!

Kalshi Launches Ecosystem Grant, Circle Partners With Kraken, and Moar!

Want RaaS without digging through your inbox? Our Telegram channel gives you the same daily crypto roundup in a quick, scrollable format. Easy to read, easy to share. Join here → RaaS Telegram Group.

Quick Intro: Radarblock is a Web3-native growth agency that increases awareness, TVL, volume, and social metrics for its clients over a consistent time frame without uncertainty and confusion. All tweets are hyperlinked, so click to pull them up on Twitter!

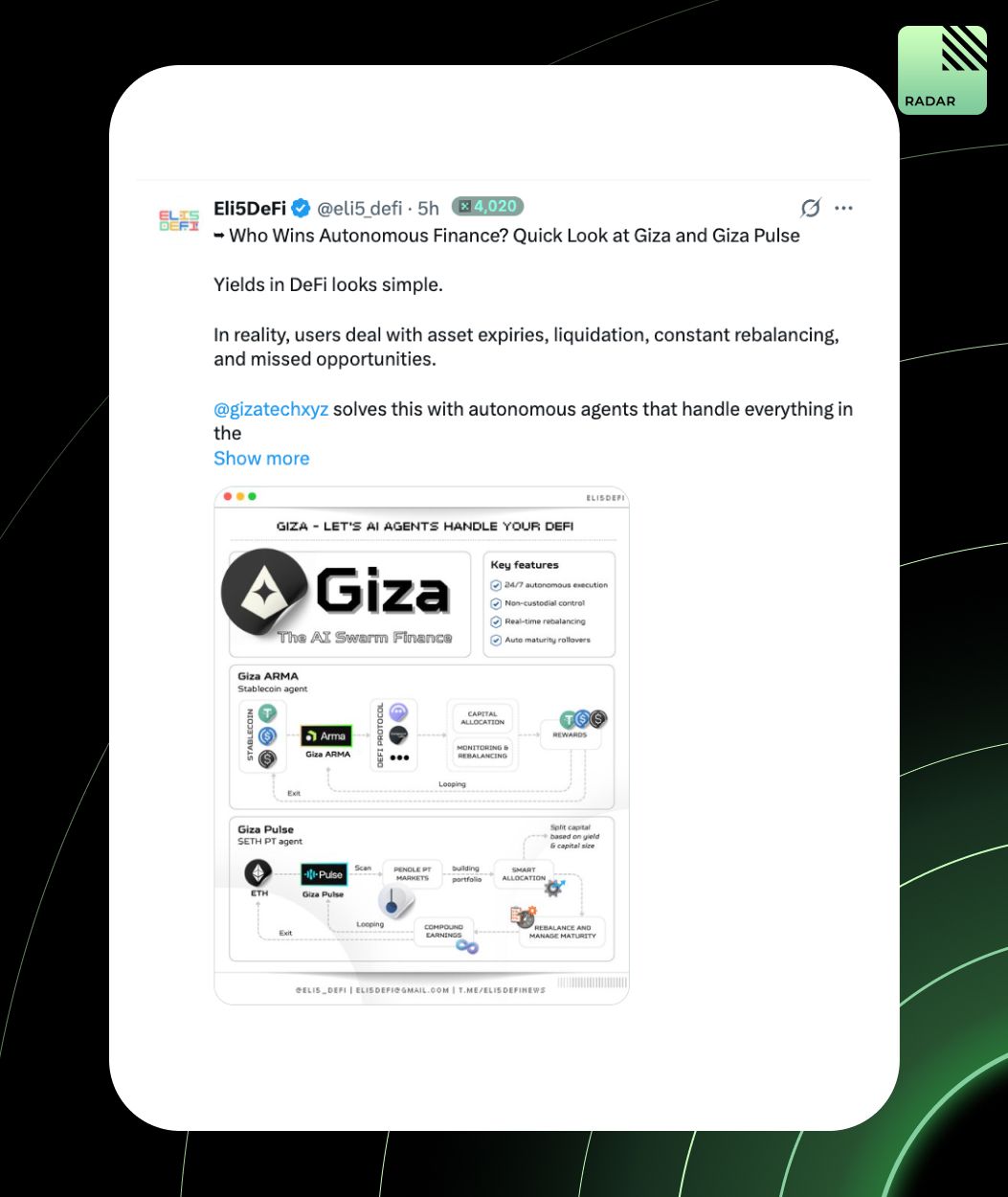

Giza has processed $1.9B+ in autonomous DeFi volume with agents like ARMA and Pulse, optimizing stablecoin and Pendle yields. By abstracting away expiries and rebalancing, it makes “autonomous finance” practical; users keep control while agents handle execution.

Korea’s KRW stablecoin push is stalled in politics and risk aversion, with laws unlikely before 2027 and regulators favoring private chains. The core dilemma: would it bring net inflows or capital flight?

AI agents are hitting a wall with human-centric infra, no verifiable IDs, clunky payments, broken auth. KiteAI offers agent-first rails: cryptographic passports, micropayments, governance, and audit trails. With 1B+ testnet interactions, it’s a betting on the iPhone moment for agents.

Arielle Pennington is joining Ava Labs as SVP of Growth to drive Avalanche’s next phase. With Scaramucci’s fund, tokenized equities via Dinari, 42M car titles on-chain with CA DMV, and FIFA’s Avalanche chain, she’ll focus on unifying institutional and consumer growth stories.

Pump Fun promised creator-led capital markets, but turned fans into investors chasing price charts. Tokens collapsed 60–99%, hype spirals pushed extreme content, and fees fueled rugs. Creators cashed out, traders held losses. Instead of new economies, it’s now a failed, fee-farming experiment.

Coinbase urged the DOJ to back broad federal preemption in crypto regulation, arguing that state blue-sky laws, licensing regimes, and staking bans undermine national markets and federal policy. It called on Congress to pass pending market-structure bills and for the SEC to issue clear rules.

Market makers keep markets liquid, profiting from spreads, funding, and stop runs. Perps are their goldmine, while prediction markets face tougher liquidity risks. Protocols like RubiFi now aim to open MM vaults to retail, sharing a game once dominated by whales.

Stablecoins now move trillions yearly and anchor payments, remittances, and DeFi. Plasma enters with zero-fee transfers, $2B+ TVL, and P2P wallet rails, aiming to capture Tron’s retail flows, non-US B2B settlement, and USDT-first DeFi.

Unbelievable, the amount of optimism this industry has.

Tomorrow at 1:30 PM UTC, Yugi will sit down with xodotmarket’s co-founder, Ali, to unpack XO’s approach, what sets them apart, and where the space is headed. Don’t forget to tune in!

GLC argues HYPE trades at a steep discount compared to Robinhood, Coinbase, and Nasdaq because tokens carry higher risk premiums and limited access. But Hyperliquid’s efficient model, direct revenue claims, and fast-growing L1 mean the market may be underpricing its real upside.

Profitable trading comes from solving constraints in order: learn basics, build a simple strategy, make execution consistent, improve with feedback loops, and refine into profitability. Consistency is more important than perfection early on.

0G opens airdrop registration, rewarding early supporters through Discord roles, NFTs, and social quests. Eligible users must complete KYC by Sept 21. With the mainnet ahead, the drop marks 0G’s first step in shaping its DeAI ecosystem.

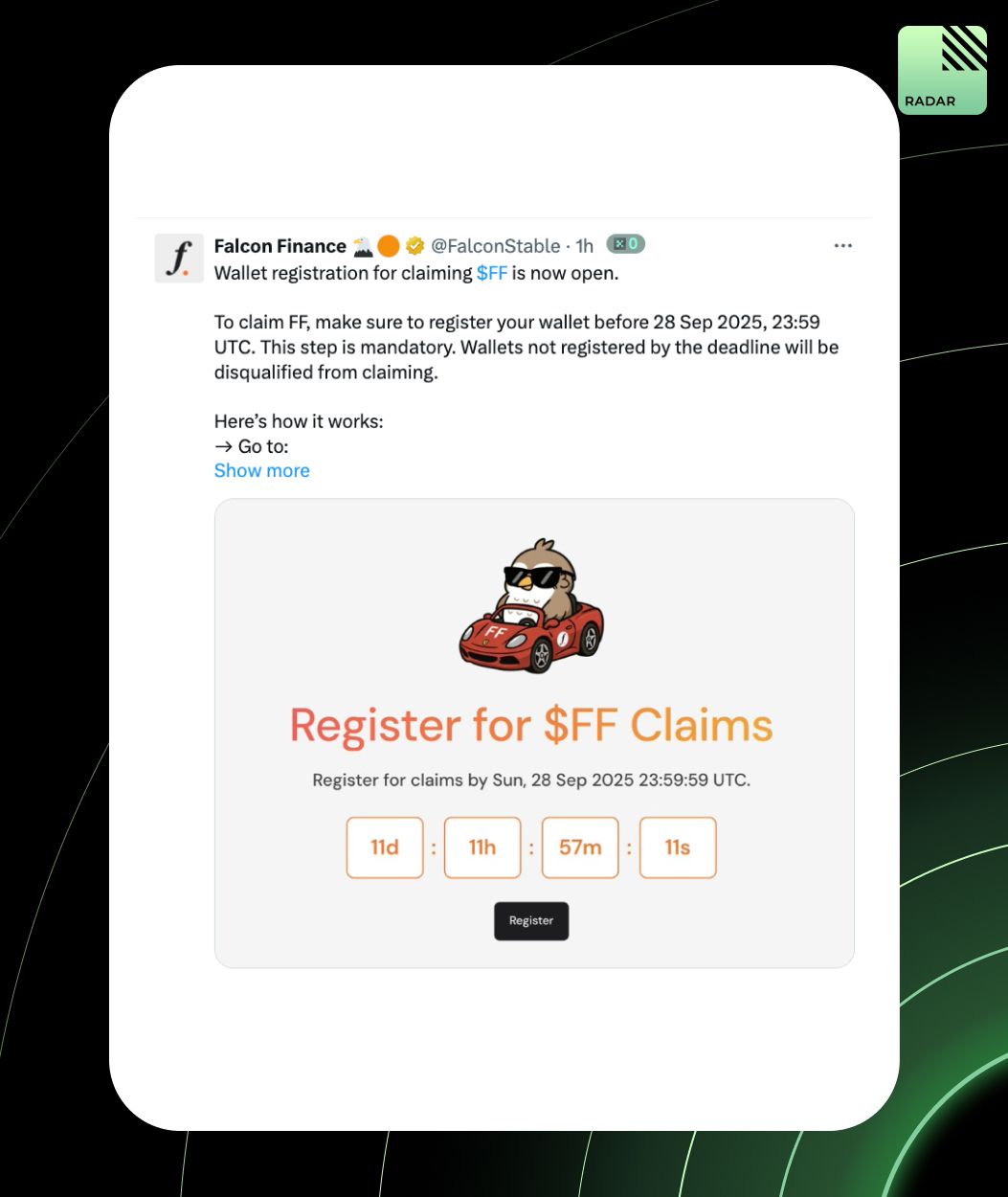

Wallet registration for claiming FF is live. Register by Sept 28, 23:59 UTC or lose eligibility. Single wallets claim directly, multiple wallets can claim separately, or consolidate if tied to one X account. Eligibility checks apply only to registered wallets.

Maple Finance has reached nearly $4B AUM, overtaking BlackRock’s BUIDL as the largest on-chain asset manager. Growth is fueled by syrupUSD, now over $1B, with rapid adoption on Plasma and Arbitrum. CEO Sid Powell targets $5B by year-end, driven by institutional credit demand and stable yields.

Kraken has partnered with Circle to expand USDC and EURC access, boosting liquidity, lowering conversion fees, and embedding stablecoin utility across Kraken’s apps. The move strengthens Kraken’s stablecoin markets and Circle’s push for wider adoption of onchain financial infrastructure.

Plasma is partnering with Rain to issue crypto cards powered by Plasma USD₮, which are usable at over 150 million merchants worldwide. With Rain’s global card stack and Plasma’s stablecoin rails, the partnership enables digital dollars to be spent anywhere Visa is accepted, driving stablecoins into daily commerce.

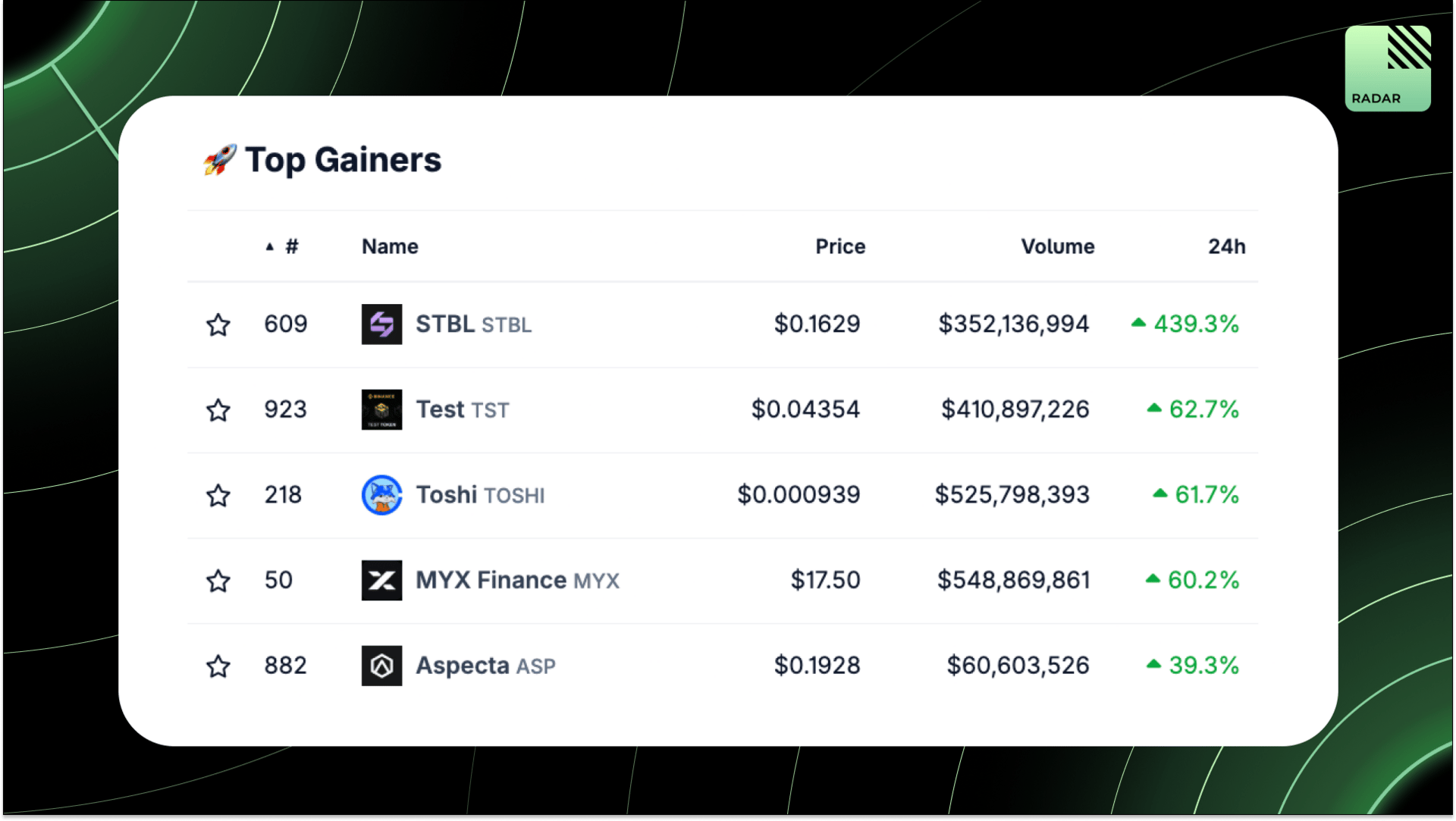

Top Gainers: STBL, TST, TOSHI, MYX, ASP.

Farming airdrops with Solana stables is low-risk and high-reward. Top plays: Onre via Exponent (14% APY + 4x points), Onre on Loopscale (12% APY + points), hyUSD on RateX (20% APY + multipliers), PT-PST looping (11–26% APY), and Lince’s automated strategies.

Kalshi just launched Kalshi Ecosystem, a hub for builders, traders, and creators in prediction markets. With grants, referral perks, and partnerships with Solana and Base, they’re spinning up a flywheel of projects, content, and liquidity.

CME’s crypto options market offers regulated Bitcoin and Ether exposure with deep liquidity, capital efficiency via margin offsets, and flexible expiries from weekly to micro contracts. SOL, Micro SOL, XRP, and others launch Oct 13.

That’s all for today!