- Radar-as-a-Service

- Posts

- RaaS #498: First Crypto Project to Win an Emmy!

RaaS #498: First Crypto Project to Win an Emmy!

BNB Hits ATH, Grayscale's Multi-Token ETF Approved: GM Web3!

Plasma Mainnet & Token Next Week, Movement Pivoting to an L1, and Moar!

Want RaaS without digging through your inbox? Our Telegram channel gives you the same daily crypto roundup in a quick, scrollable format. Easy to read, easy to share. Join here → RaaS Telegram Group.

Quick Intro: Radarblock is a Web3-native growth agency that increases awareness, TVL, volume, and social metrics for its clients over a consistent time frame without uncertainty and confusion. All tweets are hyperlinked, so click to pull them up on Twitter!

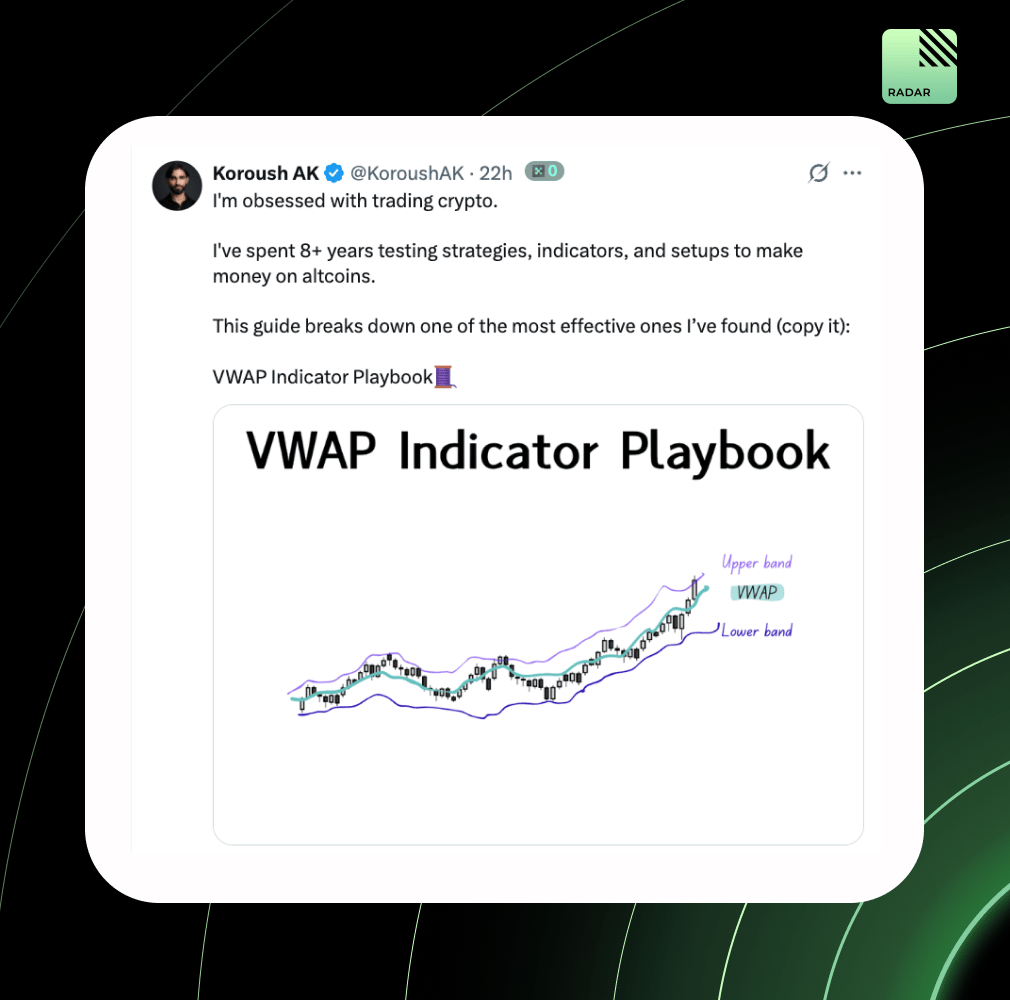

Koroush AK shares a VWAP trading playbook after 8+ years in crypto. VWAP filters noise by weighting price with volume, showing true market value. He explains slope and band signals for trends vs. chop, plus TradingView settings. A full PDF guide is included for altcoin setups.

Figure partners with Brookfield ($1T AUM, 100k residential units) to scale Helix, its humanoid AI model. The deal unlocks real-world environments for data capture, compute for training, and pathways for robot deployment across Brookfield’s portfolio.

Prediction markets are expanding beyond elections, creating second-order opportunities. New products could include parlay-style wagers via a third-party, copy-trading pools for top-ranked users, and AI agent-powered strategies. Liquidity and fragmentation make this space ripe for builders.

Derivatives Monke called ZachXBT the most underappreciated figure in crypto, suggesting a PumpFun stream to support him. ZachXBT shot back, reminding Monke of the $30M Zkasino embezzlement case and seized assets.

South Korea’s BDACS has launched KRW1, the first won-pegged stablecoin, on the Avalanche blockchain. Backed by reserves at Woori Bank with real-time proof via APIs, KRW1 is still in the PoC stage amid unclear rules. BDACS aims for global use in remittances, payments, and public-sector settlement systems.

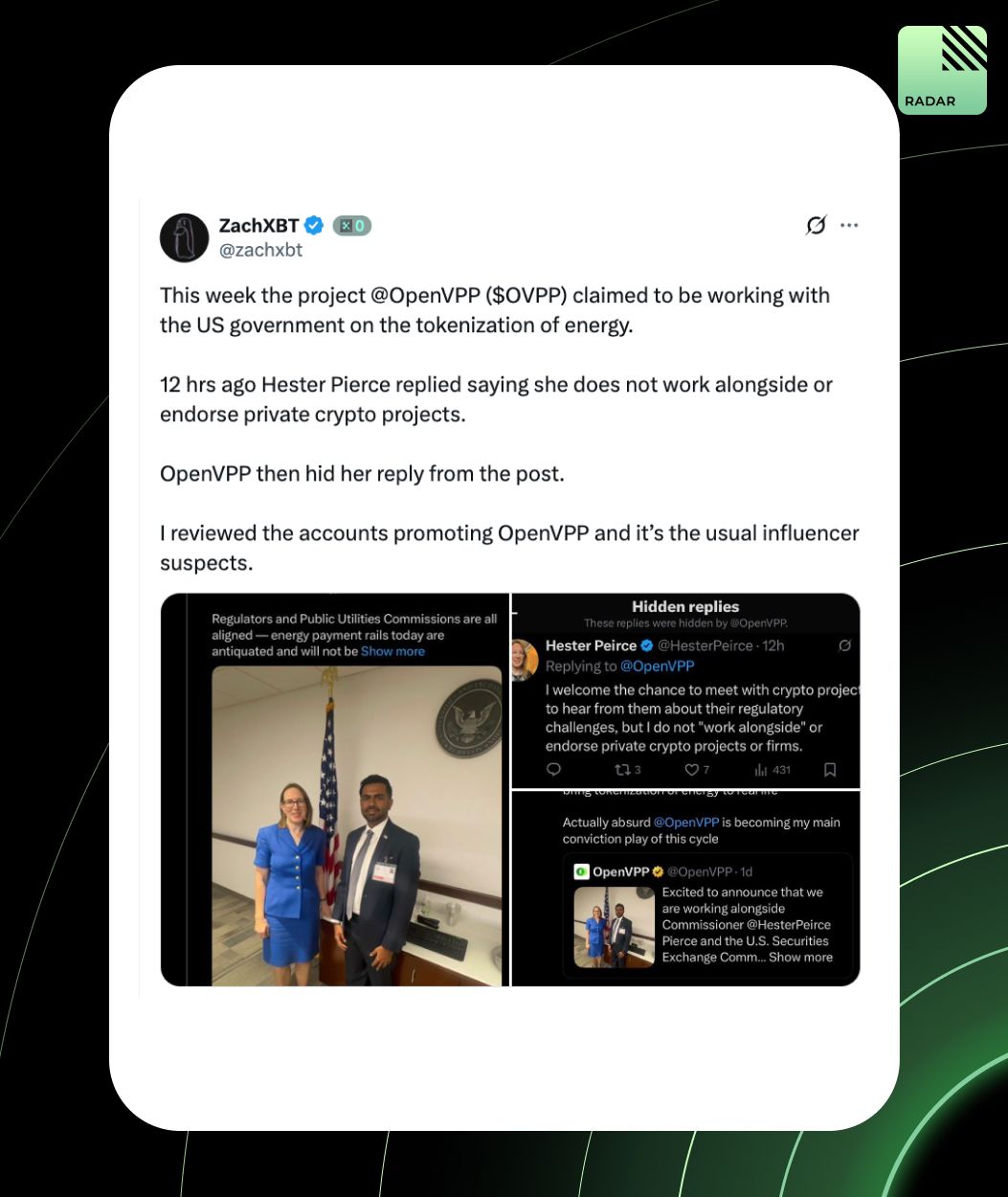

This week, Open VPP (OVPP) claimed they were “working alongside” the SEC on energy tokenization. 12 hours later, SEC Commissioner Hester Peirce clarified she does not endorse or work with private crypto projects. Open VPP then hid her reply before blaming an “intern.” The promo push is coming from the usual influencer circle.

Crypto M&A is heating up: LayerZero folded Stargate, Kraken acquired Breakout, Avail bought Arcana, Coinbase took Sensible, and Ripple scooped Rail. Miners, oracles, and asset managers are consolidating too, reshaping the industry while the market watches prices.

BNB crossed $1,000. CZ marked the moment by resurfacing his article written exactly 3,000 days ago, right after Binance’s ICO in 2017. From raising $15M and 20k seed users in 16 days to a 10,000x run, a story of speed, stamina, and relentless execution.

Print season soon?!

PrismaX is heading to Seoul next week for the RWAiFi Summit with GAIB. They’ll be diving into how teleoperation turns robotics data into a financial asset class.

White Rabbit just made history as the first crypto project to win an Emmy. Ethereum literally got a shoutout on stage, something 2021 CT would’ve laughed off as a cope. Now it’s reality, and producers backed by crypto are taking home mainstream trophies.

The SEC just approved generic listing standards for crypto ETFs, allowing faster launches if they trade on ISG exchanges, have six-month futures history, or overlap 40% with existing ETFs. With Coinbase futures as a base, BTC, ETH, SOL, and more could see ETFs roll out far quicker.

Wormhole unveiled W Token 2.0: a Wormhole Reserve to capture protocol value, a 4% target base yield for stakers, and smoother bi-weekly unlocks replacing annual cliffs. With a capped supply intact, W aims to align growth, stability, and governance as it powers the multichain internet economy.

Movement is pivoting from a sidechain to a standalone L1, targeting 10K TPS and sub-second latency. The upgrade brings Move 2.0 language features and native staking, with testnet soon and mainnet by the end of 2025. TVL hit $200M as the project rebuilds after its 66M MOVE token scandal.

SEC cleared Grayscale’s Digital Large Cap Fund (GDLC) for trading, giving investors regulated exposure to BTC, ETH, XRP, SOL, and ADA. Another nod toward mainstreaming diversified crypto baskets inside U.S. capital markets.

STBL, cofounded by Tether’s Reeve Collins and Avtar Sehra, lets users lock tokenized RWAs like BENJI or BUIDL, splitting them into a dollar-pegged stablecoin (USST) and a yield NFT (YLD). Minters keep the yield, not issuers, pushing “Stablecoin 2.0” aligned with the GENIUS Act.

Plasma, backed by Bitfinex, launches mainnet beta and XPL on Sept 25 with $2B stablecoin TVL and 100+ DeFi integrations. Positioned as a “stablechain,” it offers zero-fee USDT transfers, the lowest borrow rates, and aims to rival Tron and Ethereum in global stablecoin rails.

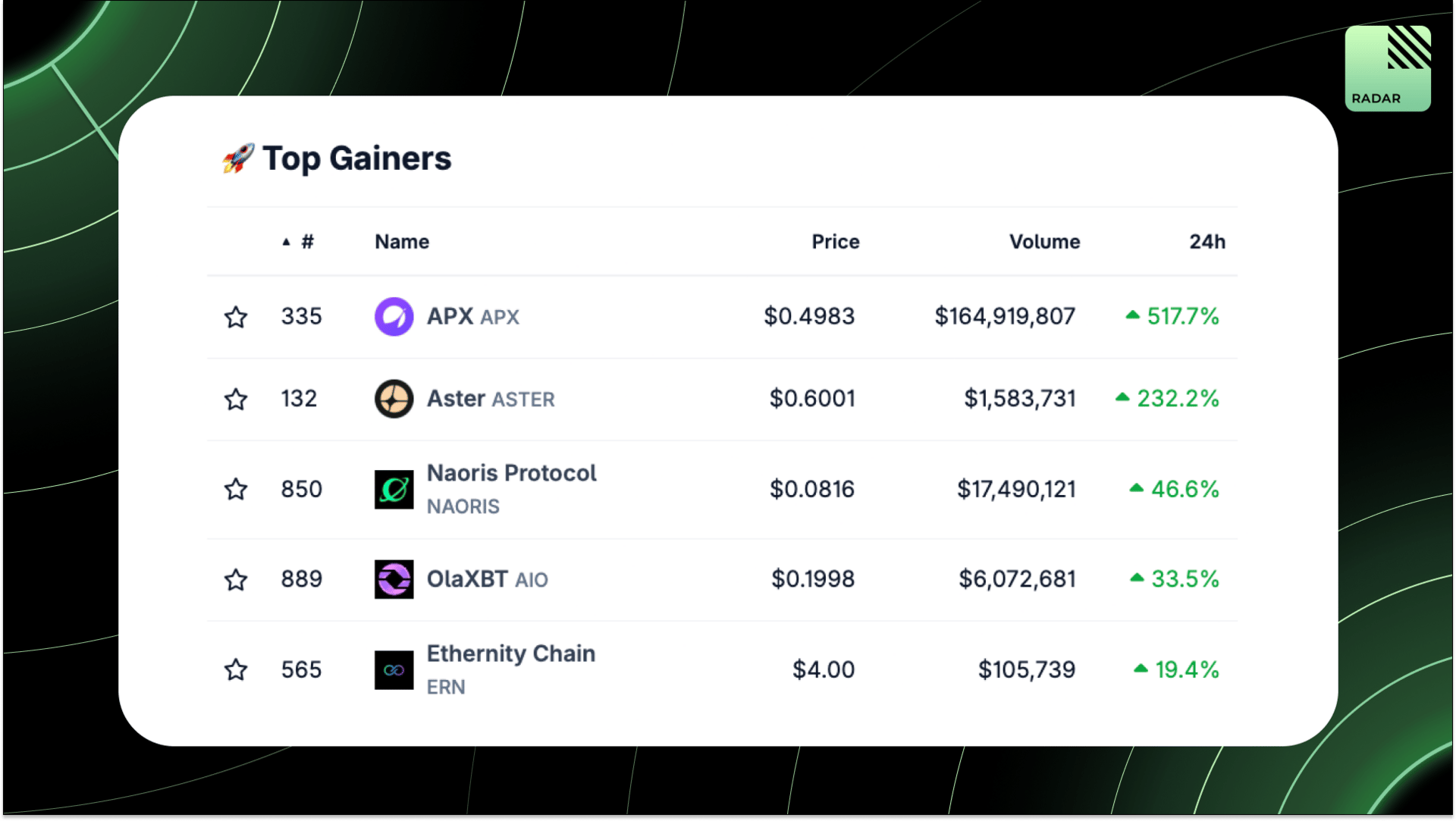

Top Gainers: APX, ASTER, NAORIS, AIO, ERN.

Ledger’s CTO found Tangem cards vulnerable to “tearing attacks” that bypass security delays, letting attackers brute-force PINs. A 4-digit PIN could be cracked in ~1h. Since cards can’t be updated, users are urged to set long, complex passwords.

Personal branding in crypto is about recognition. Lock in a PFP, colors, and visuals that people associate with you. Layer in consistency, human touch, and storytelling. Recognition and trust are the moat and signal in a sea of noise.

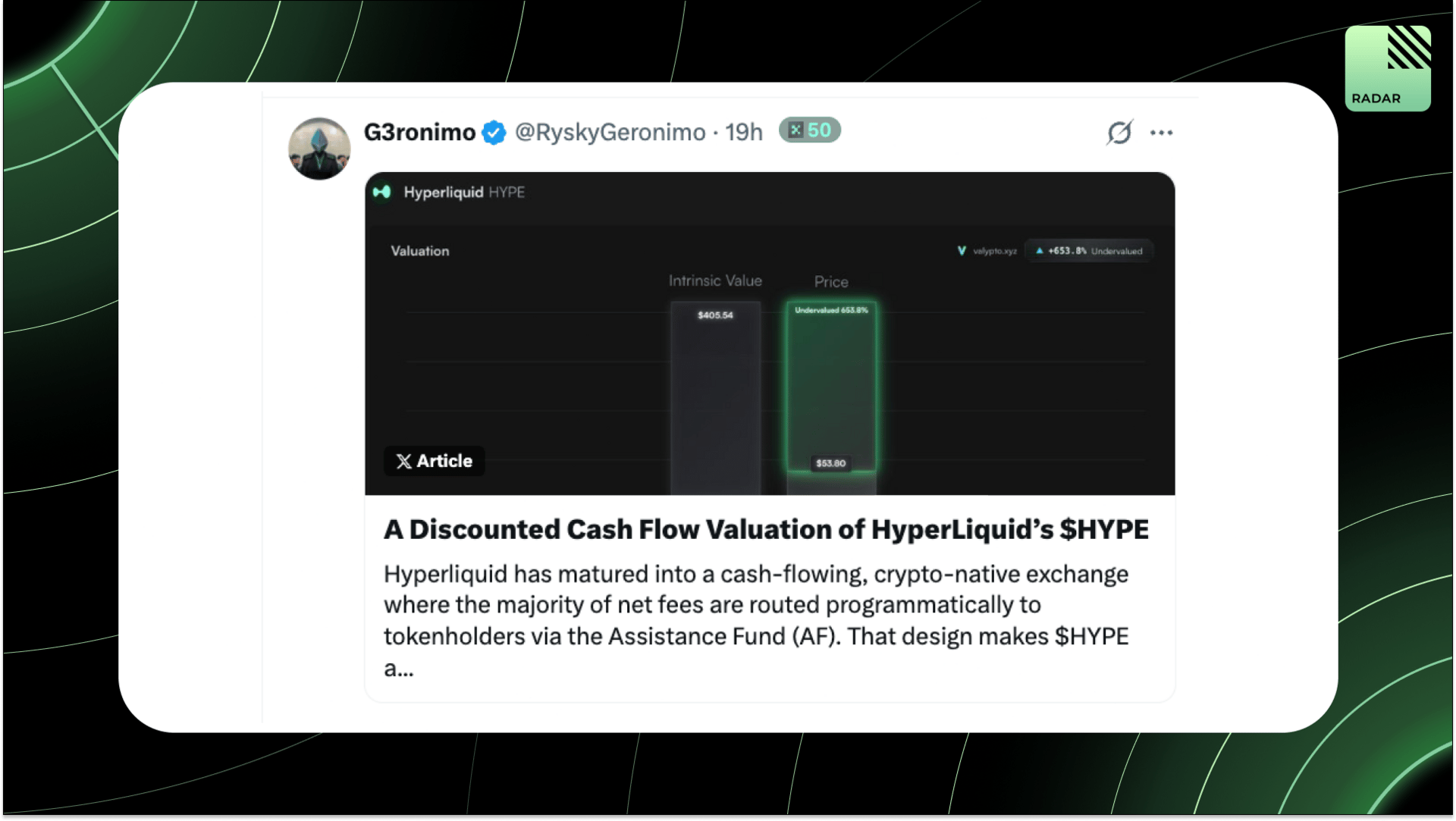

Hyperliquid’s HYPE is one of the few crypto tokens suited for DCF since 93% of trading fees flow to holders. At $54, the market prices in ~$700M earnings by 2025 and $1.4B by 2026. Bull cases project $128–$385 per token on fee growth and USDH upside, signaling deep undervaluation.

AI agents can’t rely on implicit trust like humans. They need blockchains: first for payments, then for identity, reputation, and contracts. Databases can replicate data, but only blockchains guarantee verifiable, neutral truth. The agentic internet runs on trustware.

Polyfactual is building the liquidity rails for prediction markets with FactLayer (event-linked insurance), Project Y (cross-venue arbitrage), and daily pump.fun streams (~$230K fees). At ~$4M mcap, POLYFACTS is a levered bet on the infrastructure monetizing PM growth.

That’s all for today!