- Radar-as-a-Service

- Posts

- RaaS #499: Revenue Vs. TVL: What Matters More?

RaaS #499: Revenue Vs. TVL: What Matters More?

Gnosis Tests Futarchy, EF Funds OIF Activation: GM Web3!

Solana Gets Solmate, Wintermute’s HyperEVM Dashboard, and Moar!

Want RaaS without digging through your inbox? Our Telegram channel gives you the same daily crypto roundup in a quick, scrollable format. Easy to read, easy to share. Join here → RaaS Telegram Group.

Quick Intro: Radarblock is a Web3-native growth agency that increases awareness, TVL, volume, and social metrics for its clients over a consistent time frame without uncertainty and confusion. All tweets are hyperlinked, so click to pull them up on Twitter!

Morpho now powers USDC on Coinbase. The DeFi Mullet is back in action with this integration with fintech user experience in the front and institutional-grade DeFi infrastructure in the back. Seems like DeFi apps now understand how to build the UX.

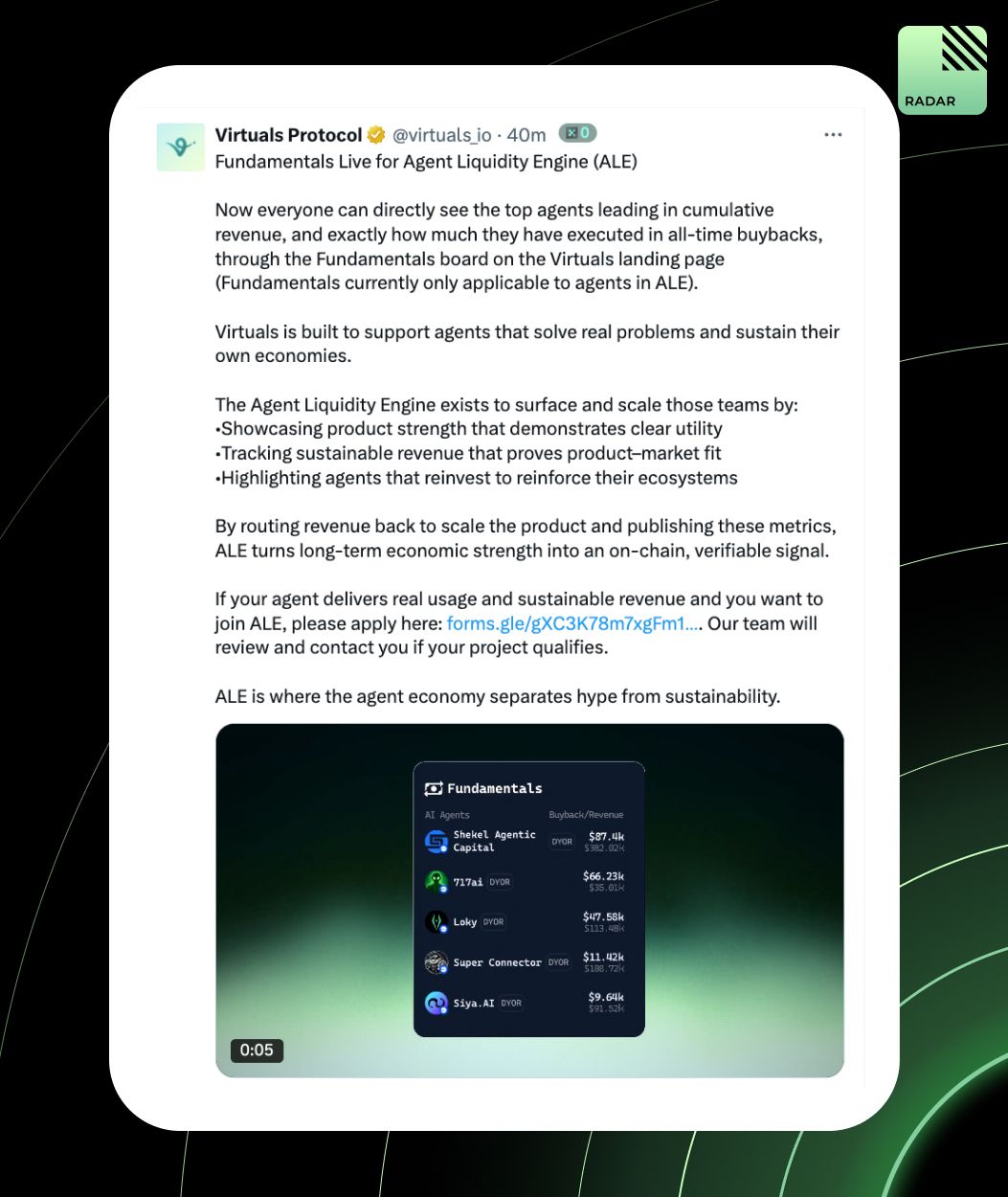

Virtuals just launched Fundamentals for its Agent Liquidity Engine (ALE), showing which agents are leading in revenue and buybacks. The ALE model routes revenue back into ecosystems, turning sustainable usage into on-chain signals of PMF. Fundamentals over hype.

Grvt raised $19M Series A co-led by zkSync, Further, EigenLayer, and 500 Global, bringing total funding to $34M. Backed as a Hyperliquid challenger, it’s building a privacy-first DEX to solve “position hunting” and unify fragmented on-chain markets.

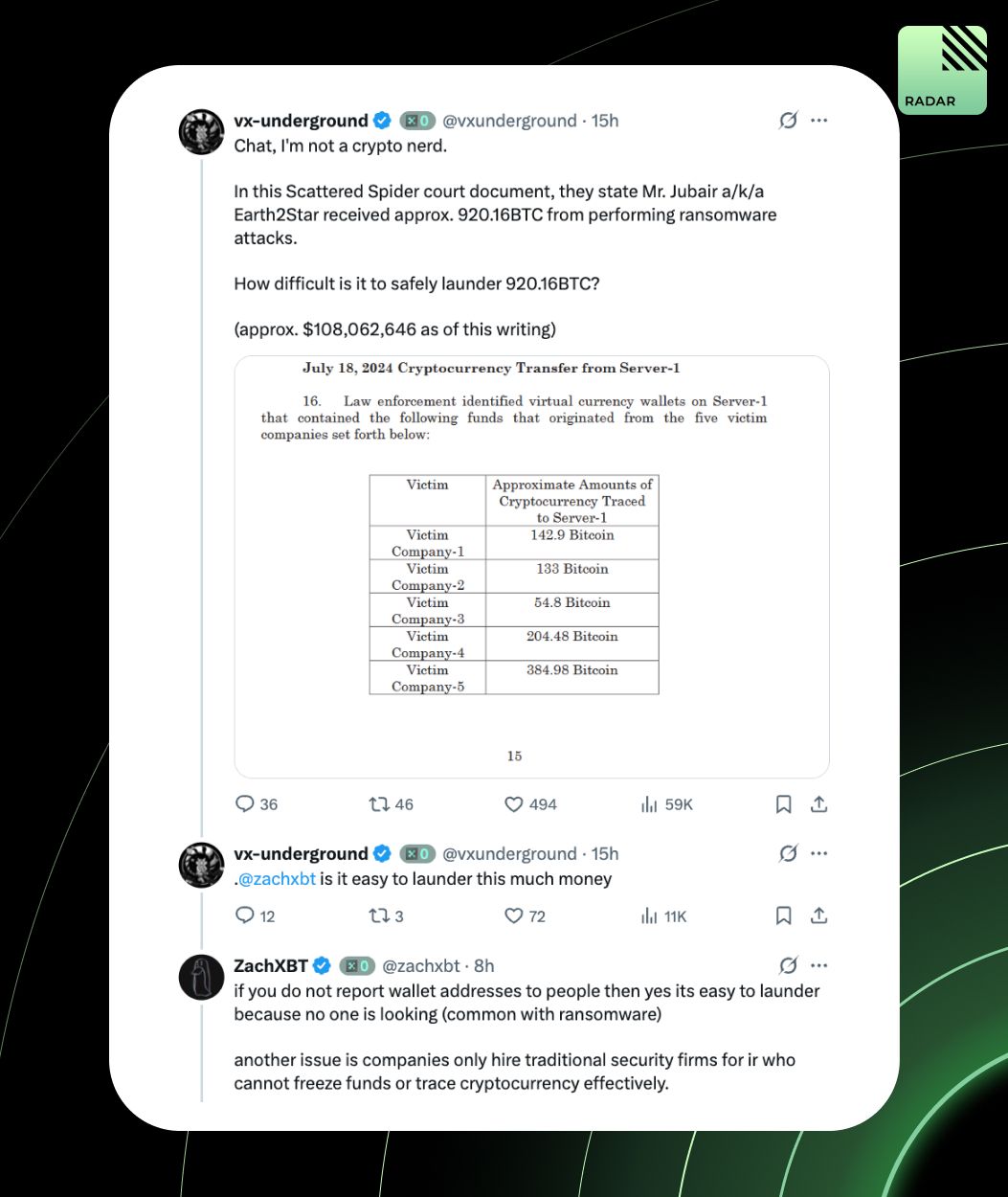

Seems like laundering $100M+ in BTC is pretty easy!

Columbia launched the Columbia-Ethereum Research Center, led by Tim Roughgarden, with EF backing. It’ll fund protocol research, postdocs, and events such as workshops and summer schools. Donations are matched up to $500K/year, and they’re hiring a Managing Director plus postdocs.

Monad launched Momentum, an incentive program to drive user growth for top apps on its mainnet. Wave 1 applications are now open and will close on September 28.

Marco Santori unveiled Solmate, a UAE-based Solana infrastructure venture backed by Ark Invest, Pulsar Group, and RockawayX. Solmate will run staking ops in Abu Dhabi, blending treasury strategy with sports assets under Brera (BREA).

Parimutuel betting, the first real market design for speculation, pooled all bets and split the winnings pro rata among those on the correct outcome. Simple and elegant, but rigid: no pre-resolution trading, no price discovery, dead liquidity, and poor scalability.

Results justify the means.

Kite AI expands its Agentic Network with CARV, APRO, Nubila, and BitMind, bringing gaming data, real-time oracles, environmental signals, and deepfake detection into its Agent App Store, the first agentic marketplace for verifiable, autonomous workflows.

Talus testnet is live, kicking off Agent vs Agent Gaming. Players can test Idol celebrity agents like Trump and Kim, compete for $125K+ in prizes, and join community quests. Powered by Nexus, AvA gaming makes AI agents autonomous actors in a new speculation market.

The EF will host an Open Intents Framework interop activation at Edge City Patagonia, Nov 11–15, ahead of Devconnect. The event invites builders to test OIF’s role in enabling seamless cross-chain UX, part of Ethereum’s broader interoperability roadmap.

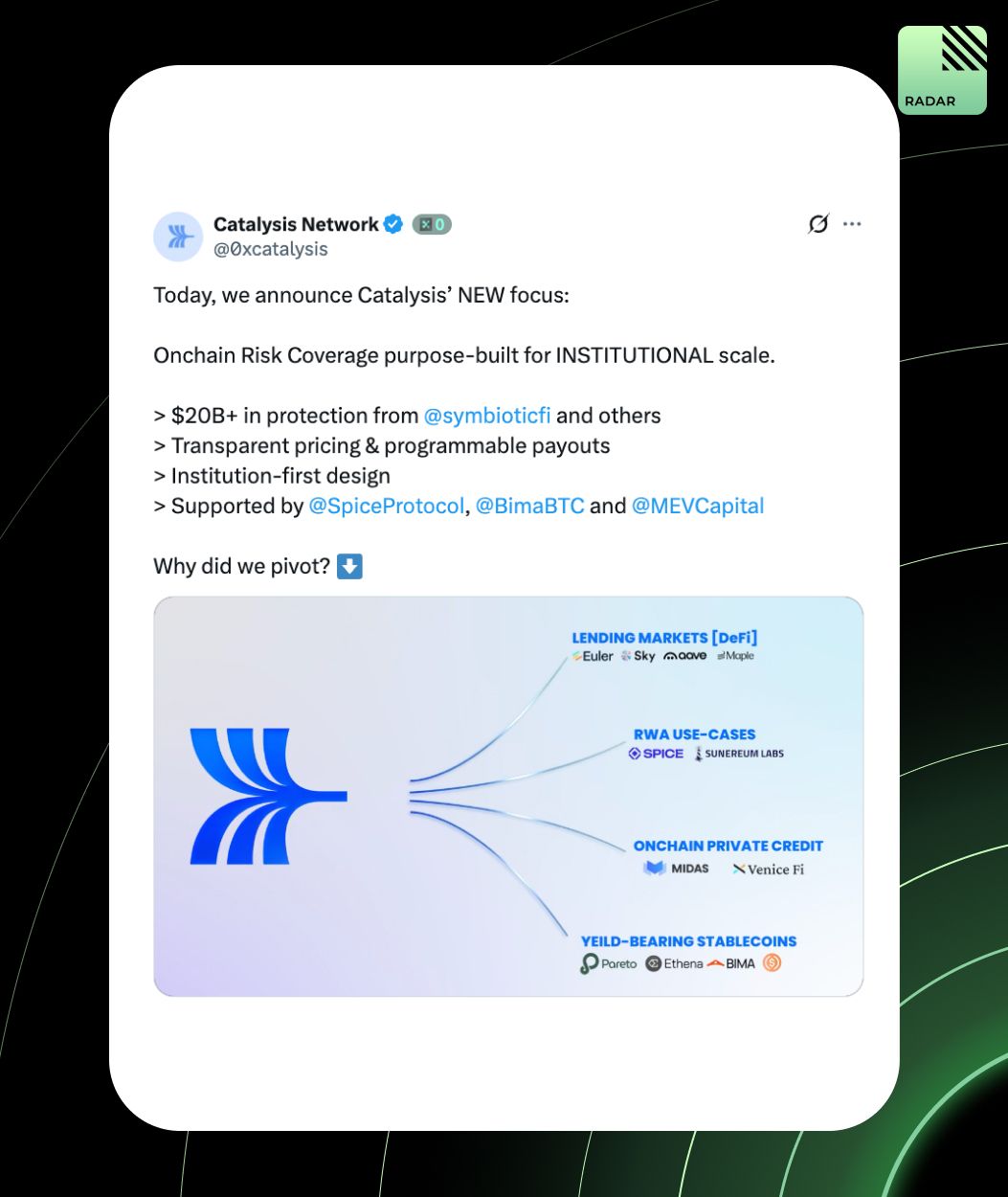

Catalysis pivots to institutional on-chain risk coverage, offering $20B+ in protection via restaked capital from Symbiotic and others. With transparent pricing, programmable payouts, and compliance-forward contracts, it targets lending, stablecoins, and yield products.

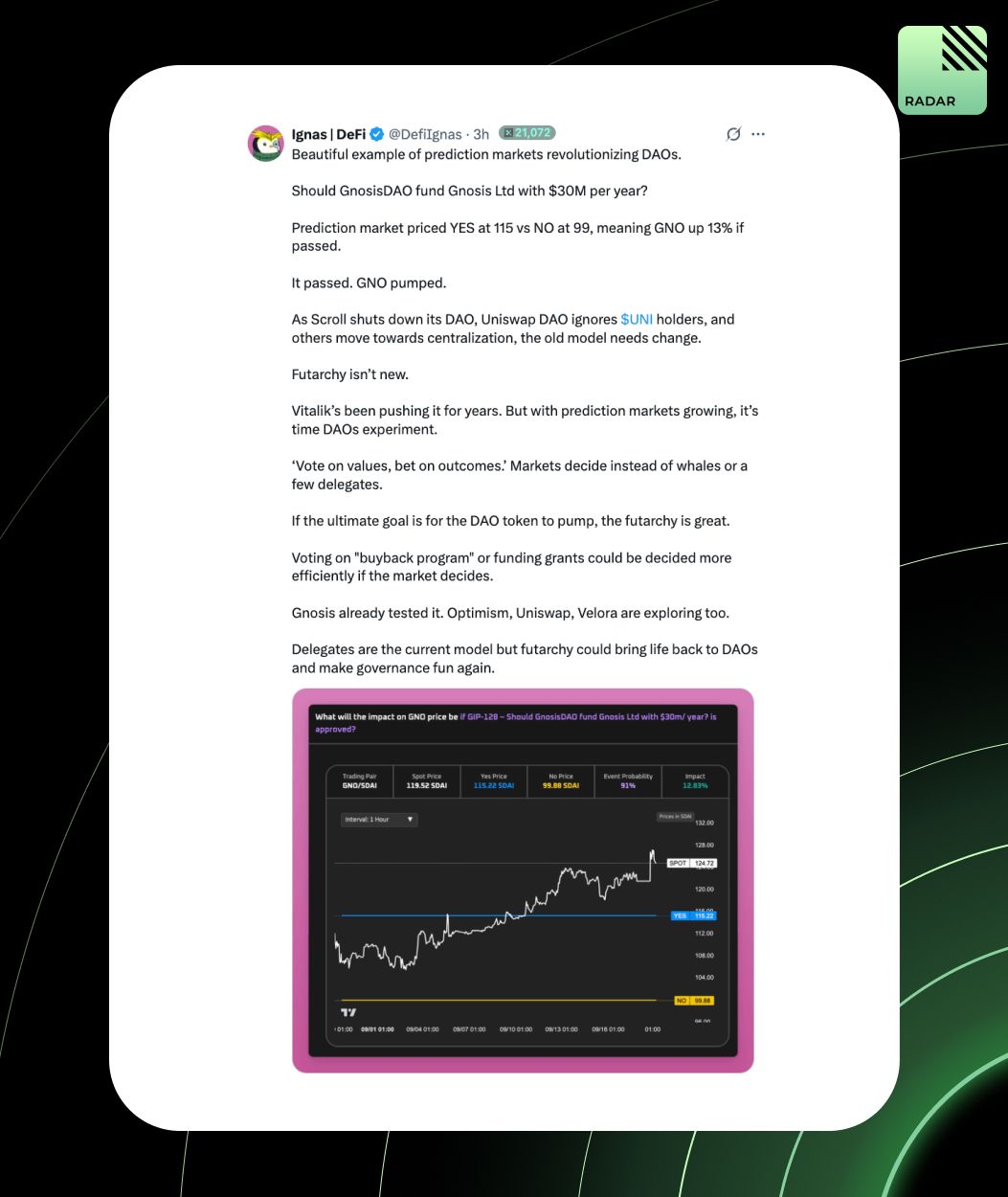

GnosisDAO just tested futarchy: a $30M/year funding vote priced via prediction markets. YES traded at 115 vs NO at 99, and after it passed, GNO pumped. With Scroll shutting down and Uniswap sidelining holders, futarchy offers a market-driven alternative to stale DAO governance.

DeFi doesn’t need to cling to TVL anymore; revenue is the true North Star. With Solana apps hitting $193M in August, the metric shift is already here: revenue >>> TVL.

YZi Labs has deepened its stake in Ethena Labs, backing the $13B+ USDe ecosystem, the fastest USD asset to $10B. Support will drive USDe adoption, BNB Chain expansion, USDtb (fiat-backed stablecoin), and Converge, an institutional RWA settlement layer.

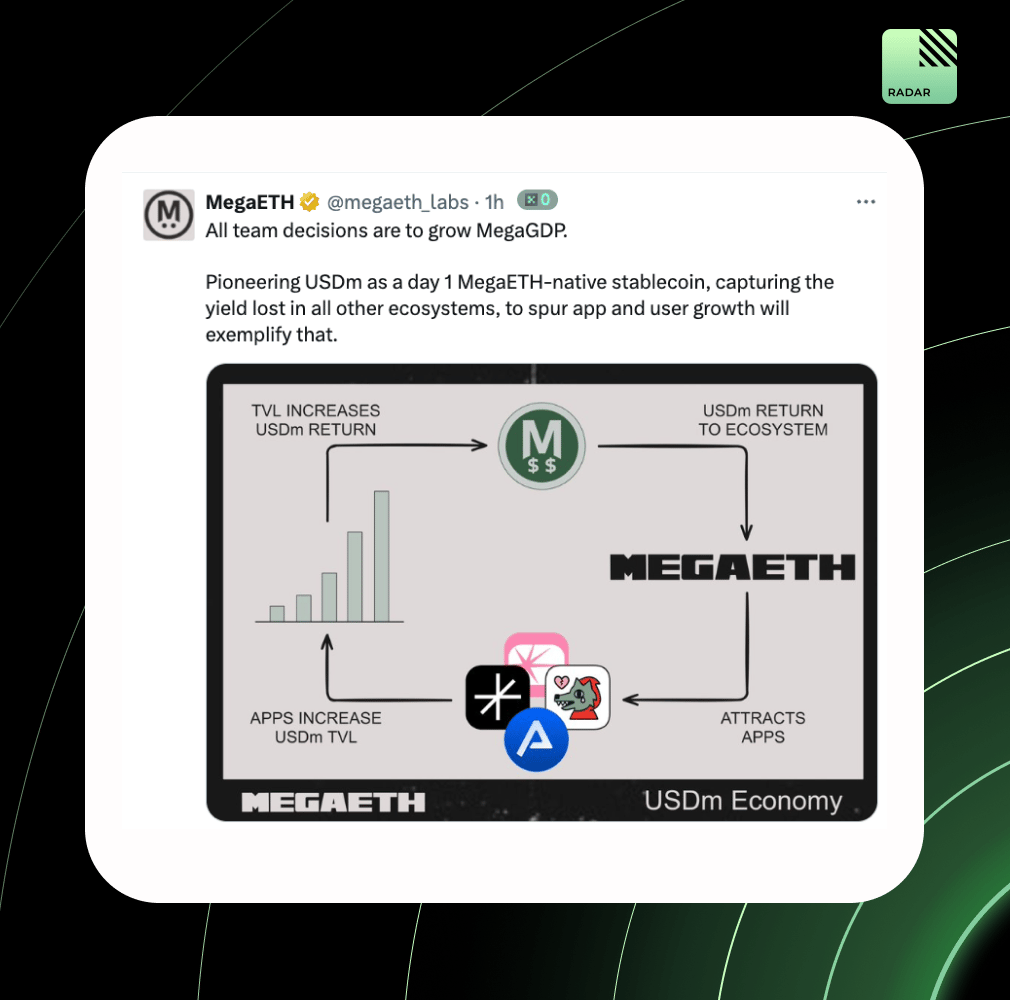

MegaETH’s strategy is to grow “MegaGDP” by making USDm the native yield-bearing stablecoin: returns from higher TVL flow back into the ecosystem, attract more apps, and those apps drive further USDm deposits, creating a self-reinforcing loop of growth and adoption.

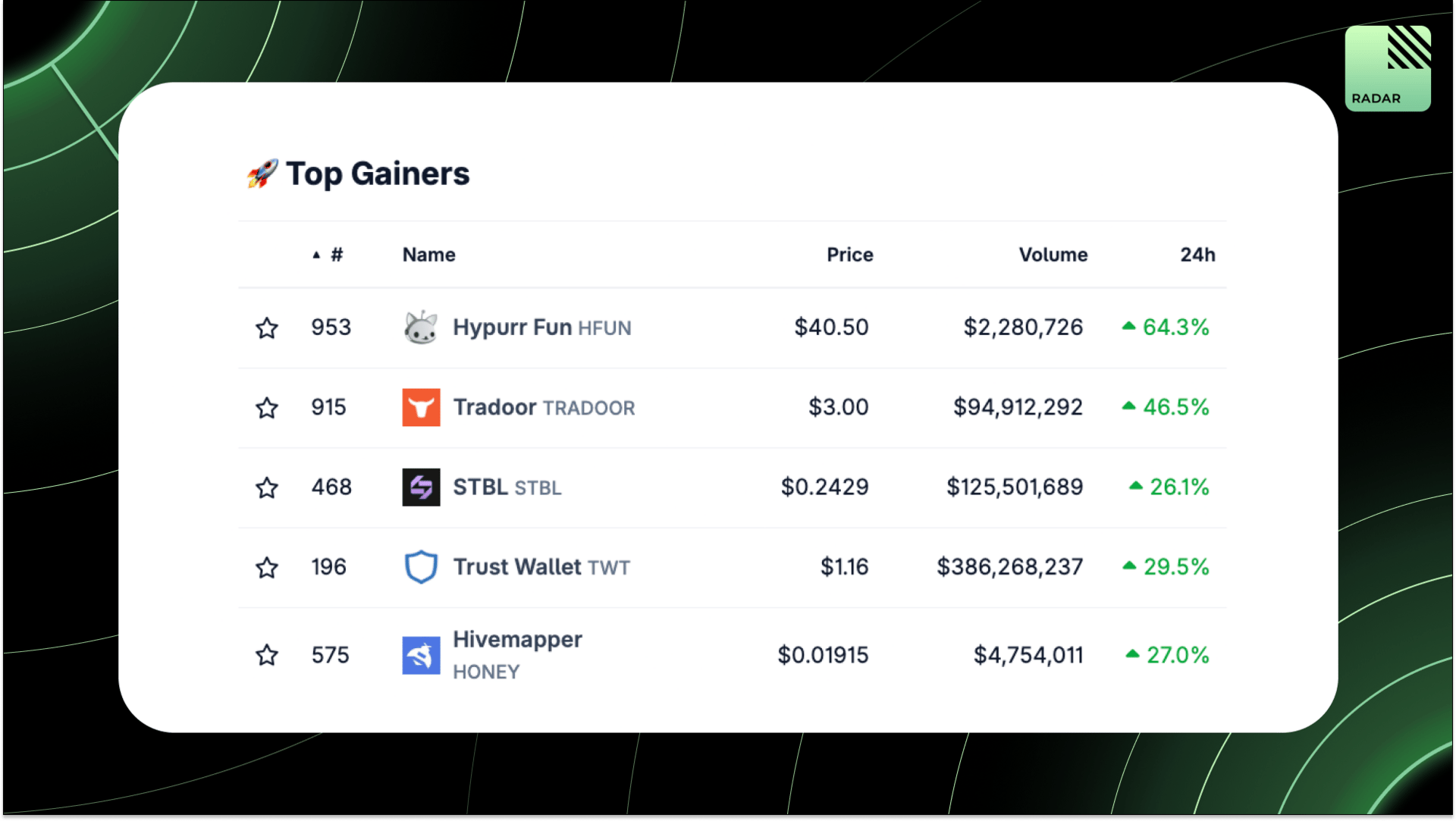

Top Gainers: HFUN, TRADOOR, STBL, TWT, HONEY.

Critics allege Hyperliquid’s stablecoin contest was skewed toward Native Markets, citing signs of a head start, insider ties, and validator bias. Hyperliquid has stayed silent, leaving its credibility under scrutiny.

Many protocols like OP Labs, Copper, FalconX, ZeroHash, Sardine, Hacken, Immutable, Fireblocks, Polygon, and Dune are hiring. Check out more roles below.

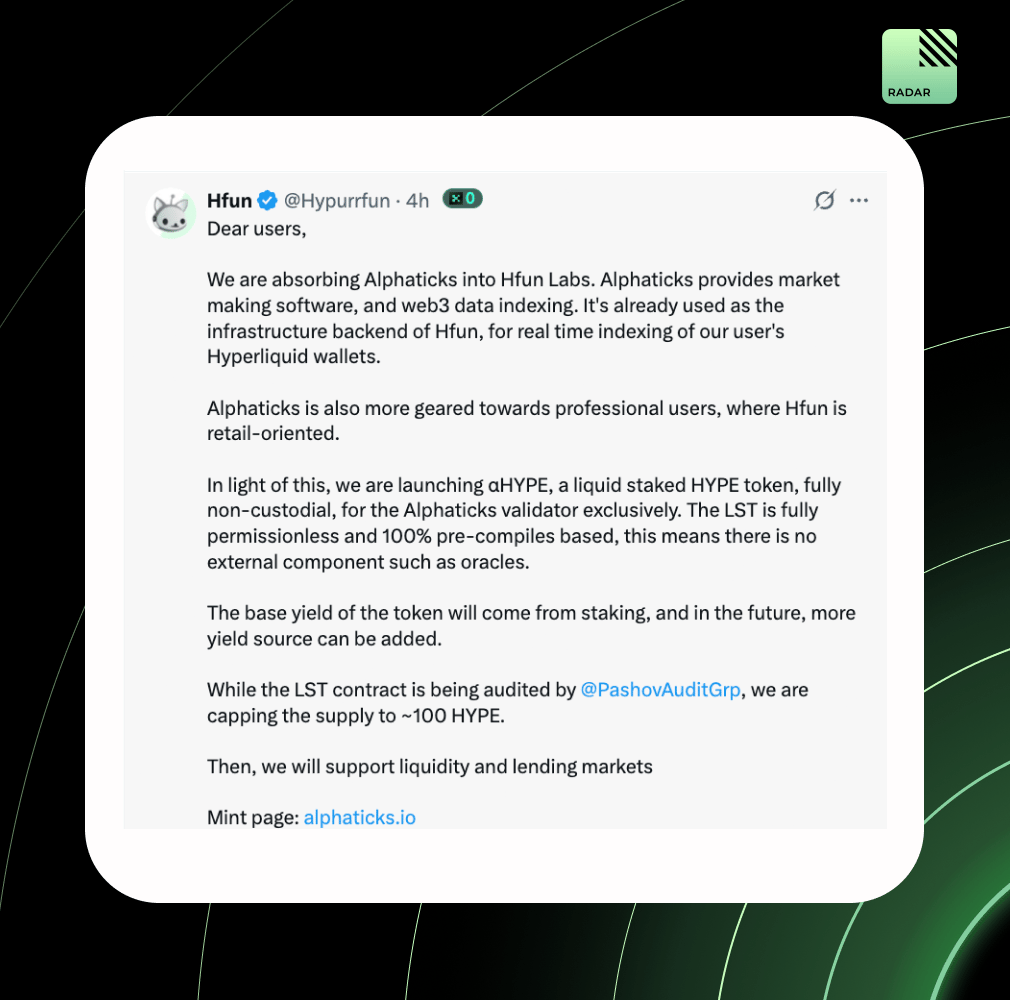

Hfun Labs is absorbing Alphaticks, the infra powering its Hyperliquid wallet indexing. To mark the move, it’s launching αHYPE, a non-custodial liquid staked HYPE token for the Alphaticks validator, capped at ~100 HYPE during audits, with staking yield and future liquidity support.

Fluid DEX dominates blue-chip pairs with deep, efficient liquidity via Smart Debt and low gas costs, while EulerSwap’s permissionless design makes it ideal for long-tail assets and DAO tokens. Fluid scales the majors; Euler enables niche market creation.

Wintermute has built the most detailed Hyperliquid’s HyperEVM dashboard yet, labeled contracts, precompile coverage, bridging flows, and LST/stablecoin tracking. One wallet alone moved $3.4B across HyperCore and HyperEVM.

That’s all for today, see ya next week!