- Radar-as-a-Service

- Posts

- RaaS #500: HYPE Supply Slashed in Half?

RaaS #500: HYPE Supply Slashed in Half?

mXRP to Unlock Liquidity, Hylo Deposits Skyrocket: GM Web3!

PayPal Invests in Stable, Giggle Raises $1M in Donations, and Moar!

Want RaaS without digging through your inbox? Our Telegram channel gives you the same daily crypto roundup in a quick, scrollable format. Easy to read, easy to share. Join here → RaaS Telegram Group.

Quick Intro: Radarblock is a Web3-native growth agency that increases awareness, TVL, volume, and social metrics for its clients over a consistent time frame without uncertainty and confusion. All tweets are hyperlinked, so click to pull them up on Twitter!

Axelar and MidasRWA have launched mXRP, a liquid-staked XRP token targeting up to a 10% APY. Backed by delta-neutral strategies and full DeFi composability, it aims to unlock idle XRP liquidity and make XRPL’s $180B market a yield-bearing backbone for DeFi.

A proposal from Jon Charbonneau and Hasu would have the HYPE supply cut by 45% by burning FECR allocations and Assistance Fund tokens, while removing the 1B cap. The aim is to fix FDV optics, reduce allocation bias, and align economics with strategy, without diluting holders.

Rebirth is a purpose-built L1 for trading, engineered for sub-50ms latency, gasless UX, and a revenue & buyback flywheel that rewards users, positioning itself as the decentralized Nasdaq.

Cryptodotcom’s CEO Kris Marszalek denied claims of an undisclosed data leak, saying a 2023 phishing incident was contained, reported to regulators, and did not endanger funds, while ZachXBT pressed for proof of public disclosure.

Mars DeFi has collated looping strategies on Aptos. Amnis x Meso lets you mint amAPT, stake into stAPT, then loop borrowing to reach ~15.5% APR. Kofi x Echelon offers a similar flow with kAPT into stkAPT, earning ~8% APY by supplying into Echelon.

Fluid is stacking: $1.2B TVL on Jupiter Lend in 21 days, buybacks starting Oct 1 with ~$1.5M first-month pressure, number one in loan growth and stables, $700M daily DEX vol, with Fluid V2 and Plasma launch ahead.

Hyperliquid faces its biggest test as 237.8M HYPE ($11.9B) unlocks start Nov 29, adding $500M supply monthly while buybacks cover just 17%. DATs like Sonnet help but fall short, leaving a massive overhang as rivals circle.

Marketing doesn’t need a strategy.

We will be attending Token2049 Singapore, the biggest crypto event of the year, and are super excited to meet builders and innovators.

Hylo deposits jumped from $2.2M to $37.4M in 2 months, with $21.4M stablecoin borrows. hyUSD is 174% collateralized, xSOL offers 235% SOL exposure, 67% of hyUSD is staked, and yields reached ~15% APY on a 30-day basis.

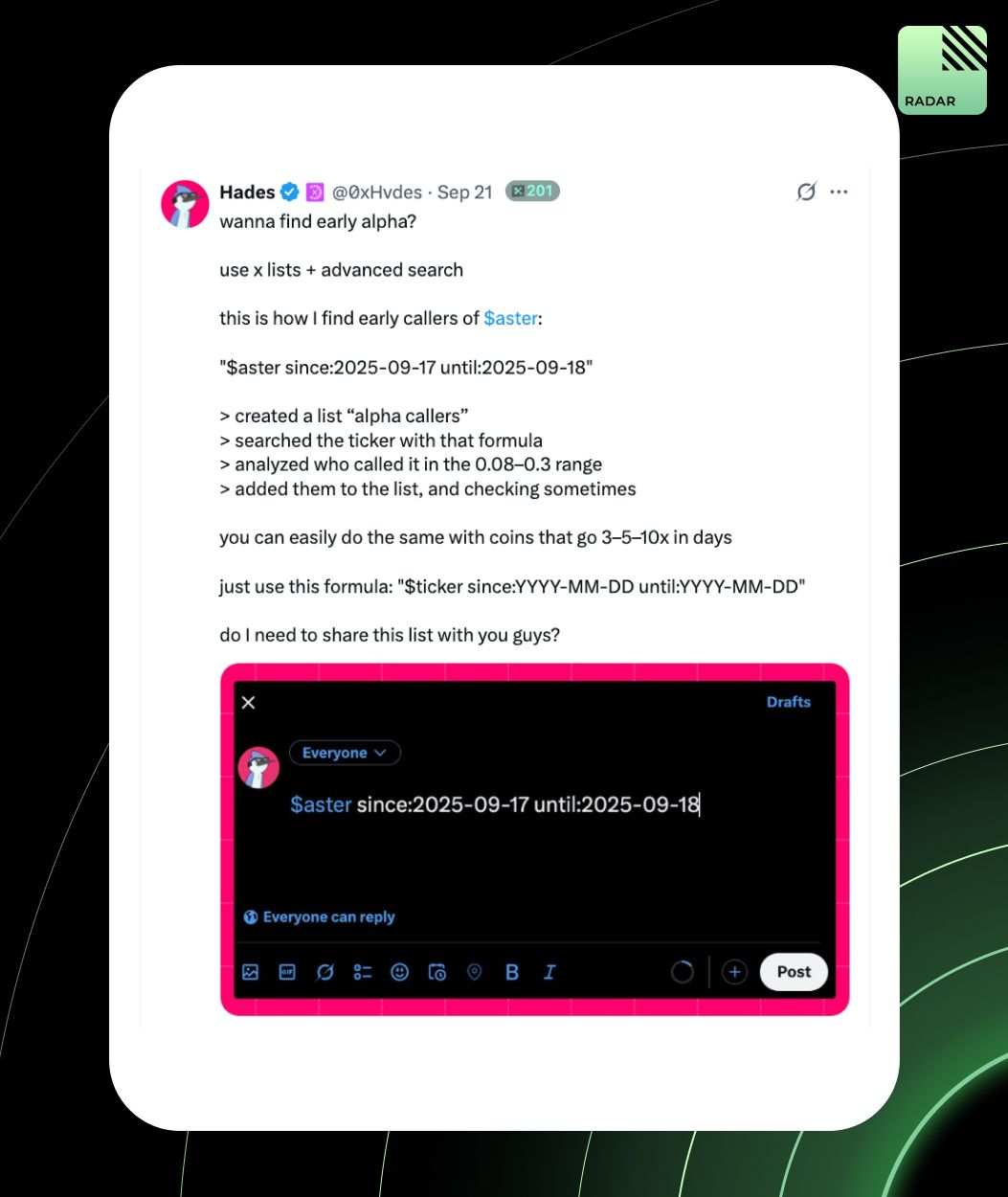

Hades explains how to catch early alpha by using X lists and advanced search with a ticker & date filter, then tracking early callers who spotted coins like ASTER in the $0.08–$0.3 range and adding them to an “alpha callers” list for future checks.

Prediction markets look explosive with $1.2B+ volume, Kalshi’s $2B surge, Polymarket’s $112M acquisition, and new entrants, but this is a local maximum capped by regulation, fragmented liquidity, and missing infrastructure. The global peak lies ahead with mainstream adoption.

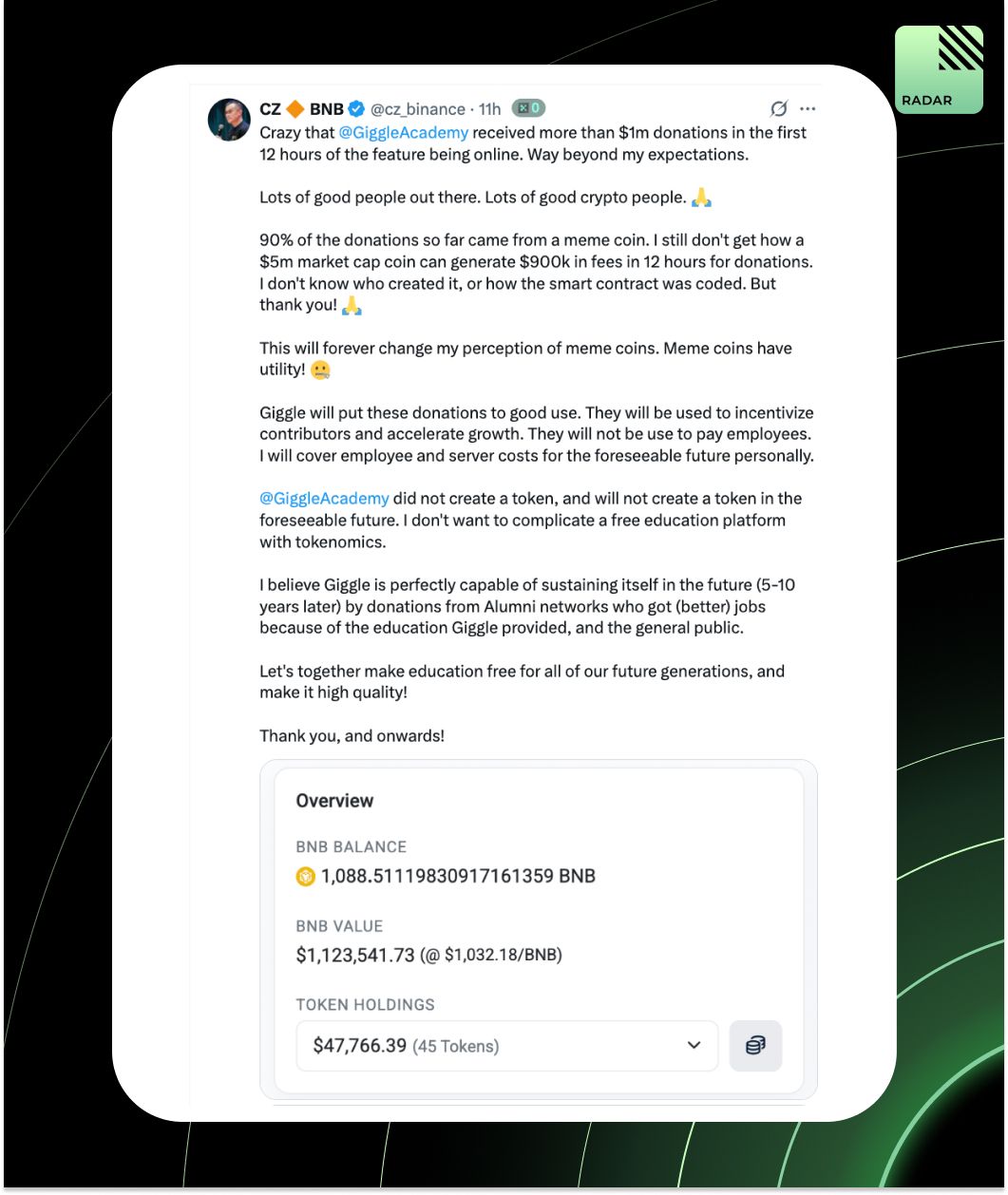

Giggle Academy raised over $1M in 12 hours, with 90% coming from a memecoin that generated $900K in fees, reshaping views on memecoin utility. Donations will fund contributors and growth, not salaries, as Giggle stays token-free and focused on free education.

PayPal has invested in Stable to advance stablecoin payments, bringing PYUSD to Stablechain and focusing on cross-chain compatibility, on/off-ramps, and new payment flows to make stablecoins faster, more reliable, and practical for global finance.

A comparison of InfoFi campaigns (by Bantr) shows Bantr outperformed Cookie3 and Kaito, driving 19% wallet growth and 1.2% average mindshare for Morph, while others declined. Bantr proved that sustained mindshare, not short-term hype, converts into lasting adoption.

Glider will let portfolio creators earn when others copy their portfolios, turning investing into a collective model where profits are shared between leaders and followers.

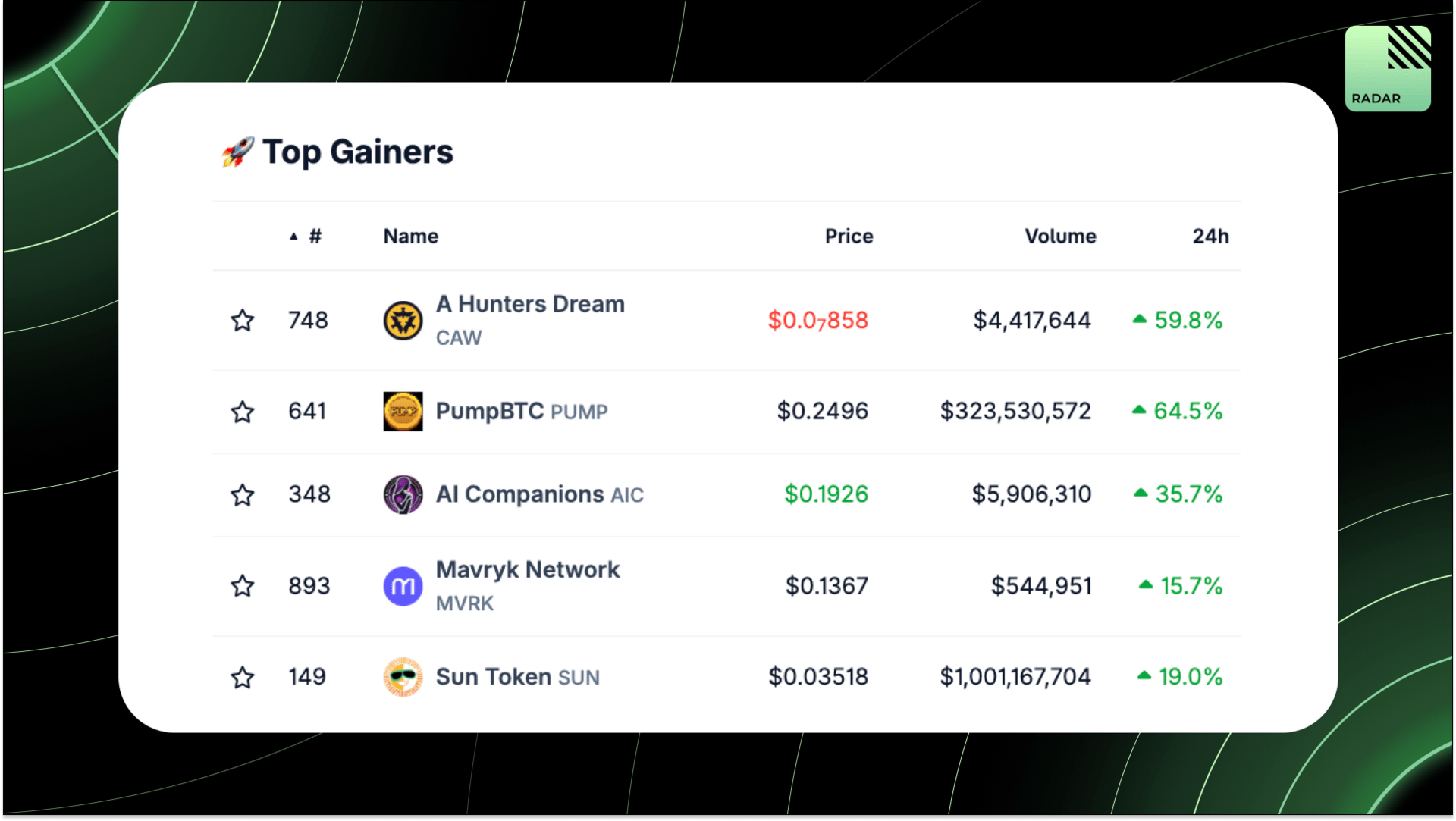

Top Gainers: CAW, PUMP, AIC, MVRK, SUN.

Aster has listed HYPE futures with up to 300x leverage, giving traders the ability to long or short the token, though the exchange cautions that the listing is not an endorsement and trading carries significant risk.

Plasma announced Plasma One, a neobank built for stablecoins with zero-fee USDT transfers, rewards cards, and fast onboarding. Launching ahead of its Sept. 25 mainnet beta and XPL TGE, Plasma targets $2B liquidity and 100+ DeFi integrations from day one.

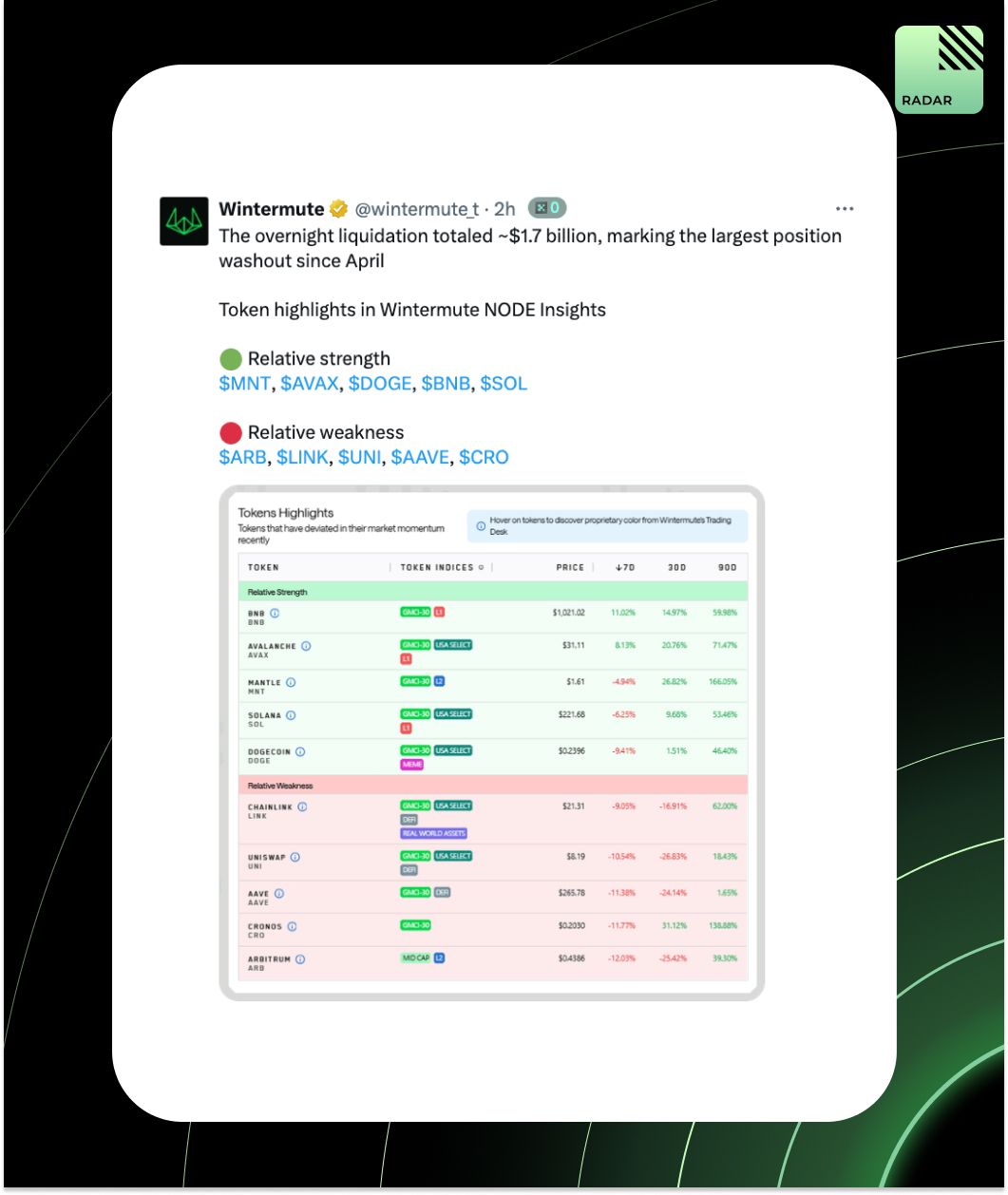

Wintermute reports that the industry saw a $1.7B overnight liquidation, the largest since April, with relative strength in MNT, AVAX, DOGE, BNB, SOL, and weakness in ARB, LINK, UNI, AAVE, and CRO.

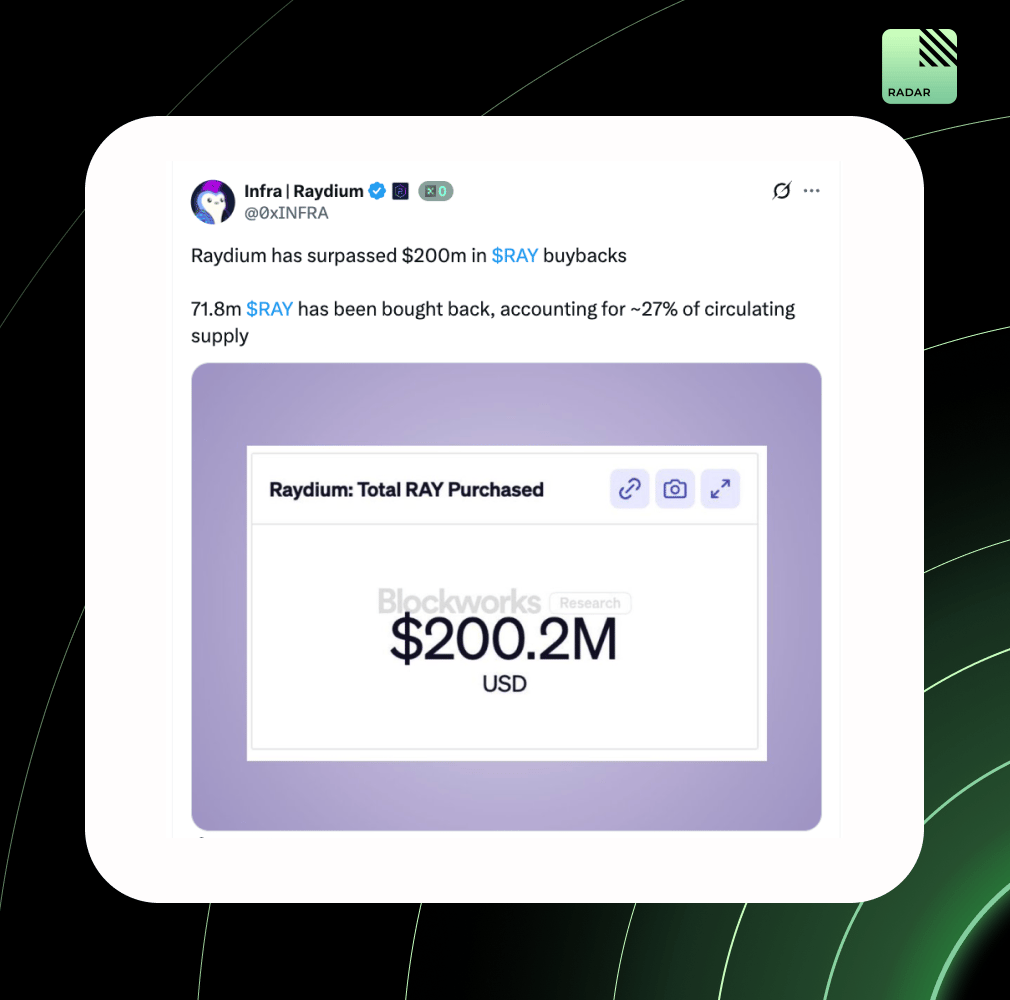

Raydium has completed over $200M in buybacks, retiring 71.8M RAY, or about 27% of the circulating supply.

That’s all for today. Thank you for sticking with us for the 500th edition of RaaS!