- Radar-as-a-Service

- Posts

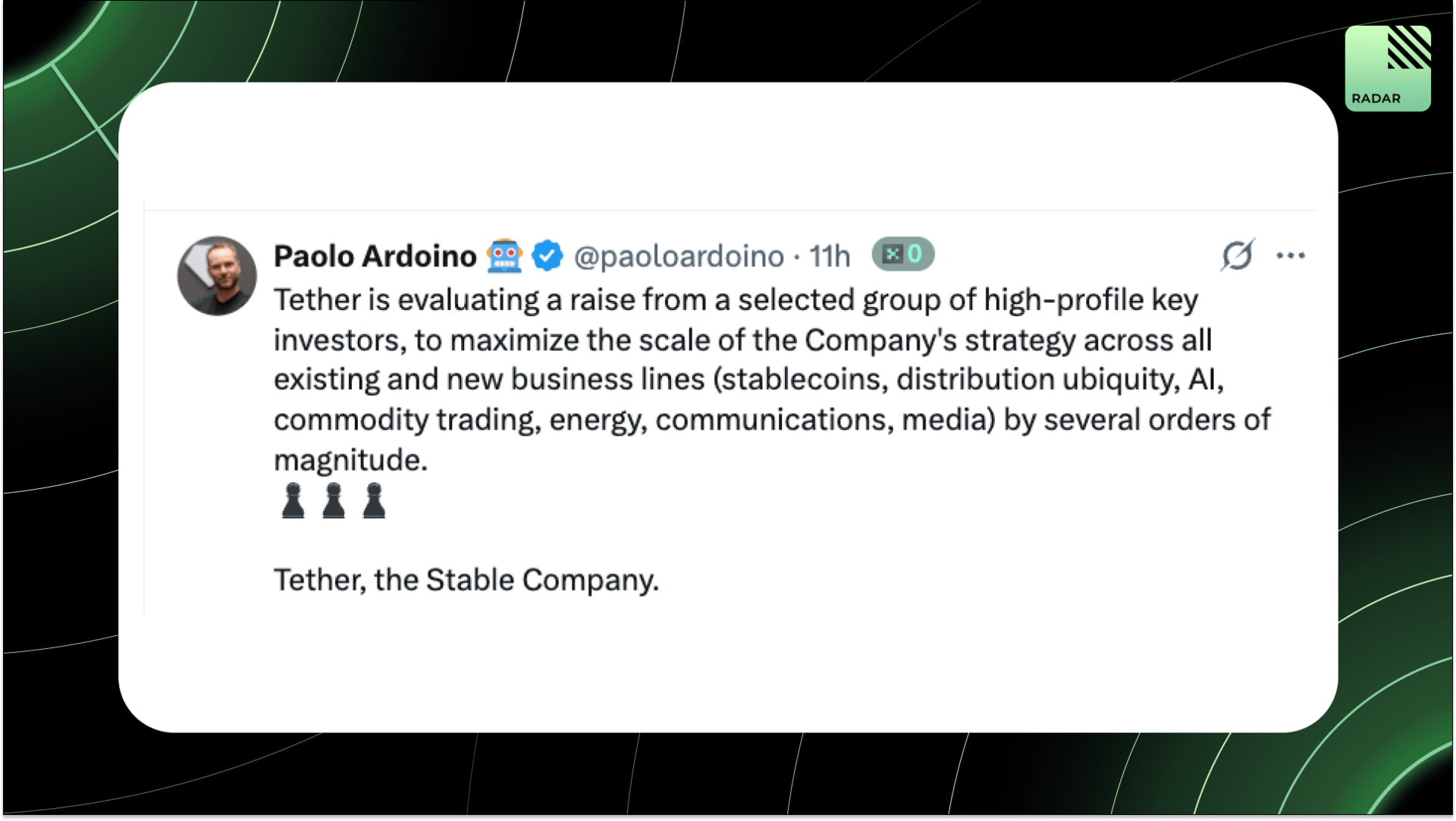

- RaaS #502: Tether Exploring a Raise!

RaaS #502: Tether Exploring a Raise!

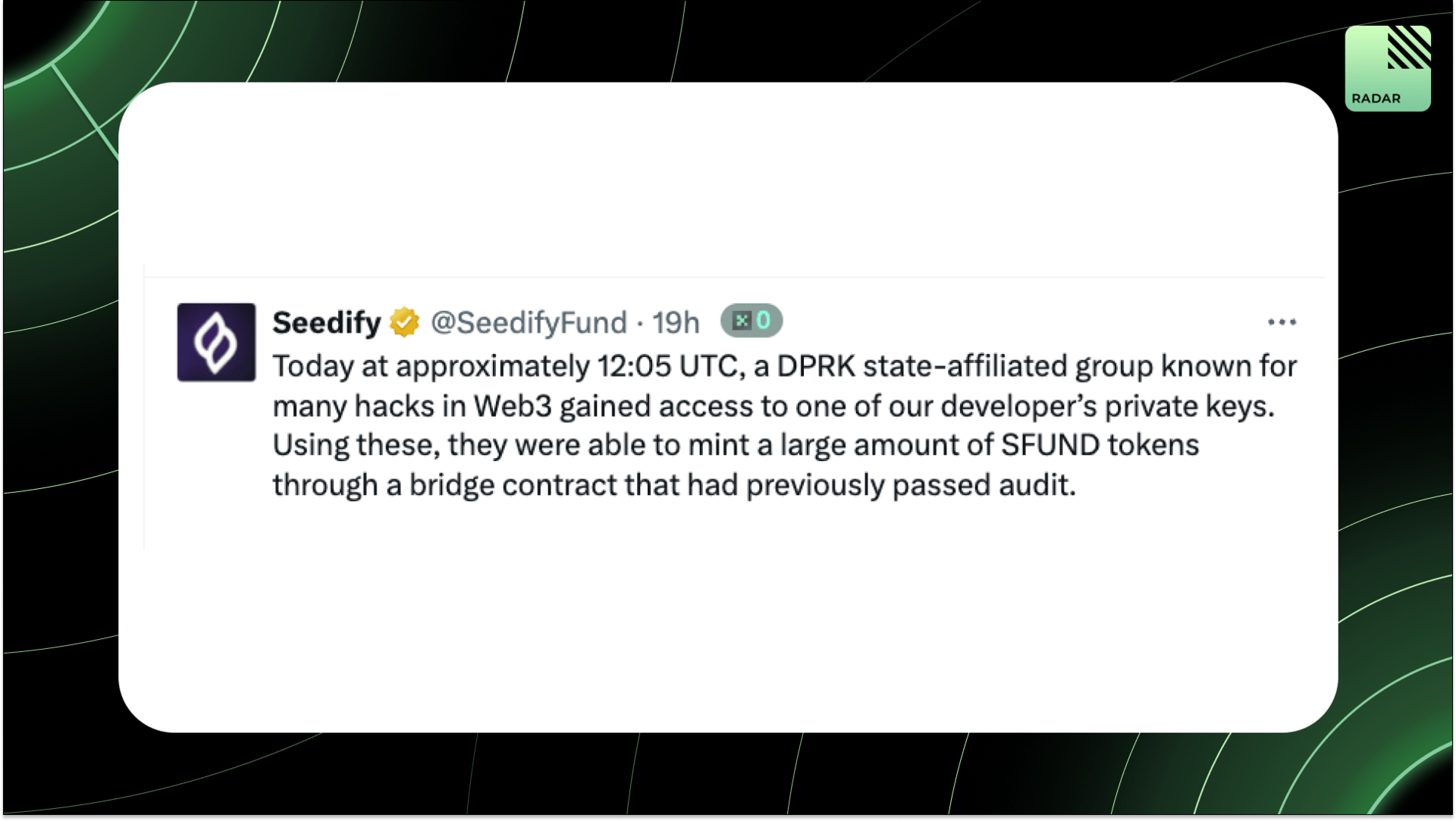

Seedify Exploited by DPRK, SBF Back on CT: GM Web3!

USDH Goes Live, Aster to Launch Privacy L1, and Moar!

Want RaaS without digging through your inbox? Our Telegram channel gives you the same daily crypto roundup in a quick, scrollable format. Easy to read, easy to share. Join here → RaaS Telegram Group.

Quick Intro: Radarblock is a Web3-native growth agency that increases awareness, TVL, volume, and social metrics for its clients over a consistent time frame without uncertainty and confusion. All tweets are hyperlinked, so click to pull them up on Twitter!

Tether is exploring a raise from top investors to expand its strategy across stablecoins, AI, commodities, energy, media, and more, signaling ambitions to scale its business lines at a significantly larger scale.

Seedify confirmed a DPRK-linked attacker exploited a developer’s compromised key to mint SFUND via a bridge contract, draining liquidity across Avalanche, Ethereum, Arbitrum, Base, and BNB before containment. Bridges are paused, core contracts and user wallets remain secure.

Morgo, a top PVP trader on Hyperliquid, turned a $300K drawdown into $1.8M PnL in under a year by focusing on simplicity, instincts, and BTC/HYPE trades. He credits Hyperliquid’s design, PiP’s community, and his clan, Casa de Morgo, for shaping his journey.

Robert Leshner says crypto’s resilience comes from those who stayed after SBF’s fraud cratered the industry, while ZachXBT notes FTX creditors weren’t truly made whole since creditors received payouts based on 2022 valuations, not current market prices, leaving many far behind today’s market.

Perp DEXs rotate fast: dYdX to GMX to Hyperliquid. Unlike Aave, Uniswap, or Lido, market leaders rotate quickly. The question is whether HL can keep the crown longer than the rest.

Bless just launched: staking and trading are live, and early testers can now claim BLESS. The world’s first shared computer, pooling unused computing power into a global computing network.

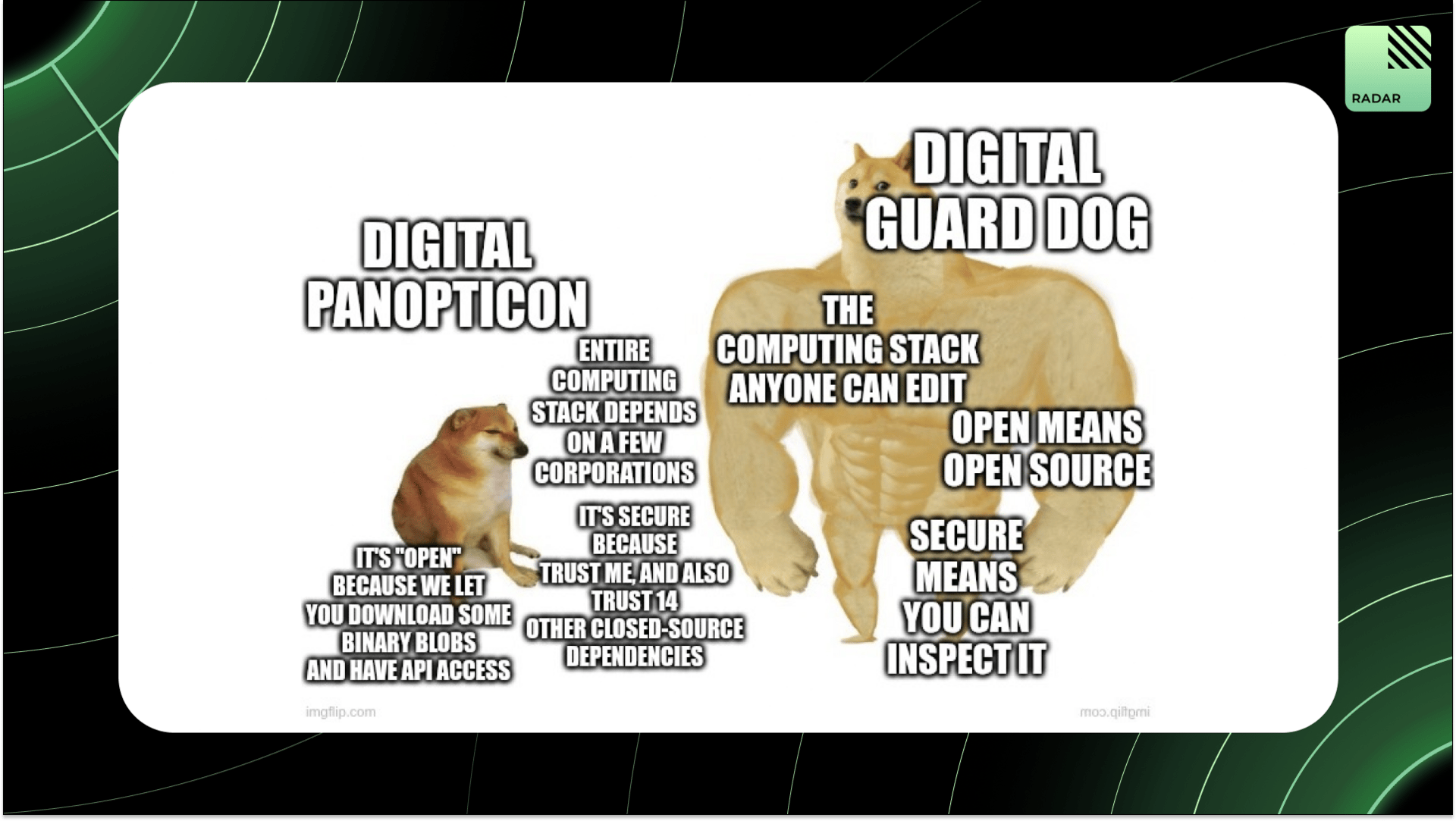

Vitalik’s latest post outlines why openness and verifiability must form the foundation of 21st-century tech. From vaccines to civic systems, the danger isn’t just hacks but concentrated control. He argues that secure, open, and verifiable stacks are a compelling way to balance.

Been waiting a long time for a Vitalik meme. Go read his article above.

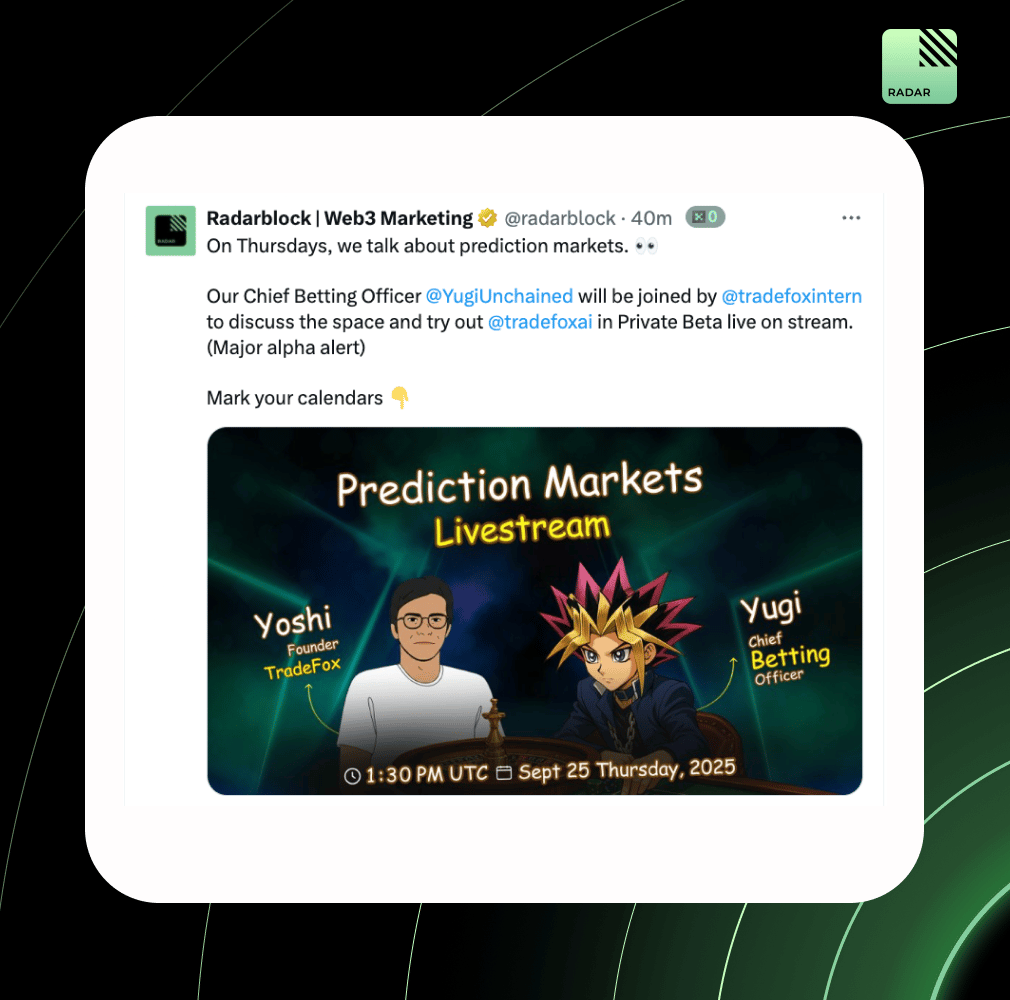

On Thursdays, we bet. Our Chief Betting Officer, Yugi, teams up with Yoshi from TradeFox, live on stream. Mark your calendar, anon.

Hyperliquid’s first native stablecoin, USDH, is live with $2.2M in early volume on the USDH/USDC market. Issued by Native Markets after winning the validator vote, USDH is fiat-backed with reserves in cash and Treasuries, and its earnings loop supports HYPE buybacks.

Uniswap & Oage just shipped The Compact, an open-source, composable system for cross-chain swaps. It uses reusable resource locks to solve counterparty risk and lets builders create credible commitments.

Aster is testing its own chain, a privacy-focused L1 built to power Aster DEX. With the CEO confirming rollout plans, the DEX is moving beyond app-layer infra to full-stack control.

Mira is building on Base, betting on sub-second blocks and low fees to scale verifiable AI. With MIRA in play and Coinbase ties, it’s positioning next to TAO, Vana, and 0G, but with the Base community as its moat.

Coinbase and Cloudflare are launching the x402 Foundation to make x402 the open standard for AI-driven payments. Built on HTTP’s 402 code, it enables real-time, stablecoin-based micropayments for agents, APIs, and apps, positioning x402 as the backbone of agentic commerce.

Based is rolling out the “Boosted Airdrop” for its 20k+ traders, a system that rewards loyalty with bigger allocations. Users can boost rewards by locking longer (up to 6 months), while unclaimed tokens get burned. The first test case: Upheaval’s UPHL airdrop.

Bubblemaps launched Intel Desk, rewarding scam-spotters with 30M BMT (~$2M) over the first year. Users can earn via seasonal airdrops, case indexing, and future bounties. It turns on-chain sleuthing into an intelligence marketplace, making BMT its first major utility.

Top Gainers: SVL, PNKSTR, FLUID, RIVER, SIGN.

BNB validators propose halving gas to 0.05 Gwei and cutting block time to 450ms, pushing fees near $0.005. Trading already makes up 67% of BSC activity, and past fee cuts boosted daily transactions 140%. The goal: keep APY >0.5% while driving BSC toward $0.001 fees and trader dominance.

Synthetix is bringing perps back to the Ethereum mainnet with a $1M top prize trading comp. One of the biggest contests the space has seen, aiming to test if on-chain liquidity and mainnet gas can support serious perp volume again.

Perp DEXs just logged a record $1.8T in Q3 volume, already surpassing all of 2024. Hyperliquid still leads with $2.7T lifetime volume, but Aster flipped it in daily activity, backed by Binance and a token up 2,000%. Lighter and EdgeX round out the race.

CZ’s BNB Chain AMA touched on RWA, DeSci, and on-chain assets. He sees MMF tokens and stablecoins as the first institutional bridges, with Hong Kong policy as a catalyst. Tokenizing equities is facing delays due to compliance constraints.

That’s all for today, later!