- Radar-as-a-Service

- Posts

- RaaS #503: Aster Flips Hype!

RaaS #503: Aster Flips Hype!

Plasma Mainnet Live, Radar After Dark at Eth Delhi: GM Web3!

ETH Reclaims USDT Lead, Rex Osprey Launches ETH Staking ETF, and Moar!

Want RaaS without digging through your inbox? Our Telegram channel gives you the same daily crypto roundup in a quick, scrollable format. Easy to read, easy to share. Join here → RaaS Telegram Group.

Quick Intro: Radarblock is a Web3-native growth agency that increases awareness, TVL, volume, and social metrics for its clients over a consistent time frame without uncertainty and confusion. All tweets are hyperlinked, so click to pull them up on Twitter!

DeAI is shifting from theory to reality. Bittensor shows recovery with DeFi layers, prediction subnets, and Q4 catalysts. The Internet commoditized info, blockchains commoditize value, and DeAI will commoditize intelligence.

Virtuals launched Butler, a trading desk embedded in X. Users get agent insights in DMs and can set TP/SL or swap instantly without a browser. It links info and execution on-chain, scaling ACP toward a trillion-dollar agent economy. Didn’t Solana already do this?

Ultra is joining Kalshi to scale prediction markets into the mainstream financial sector. He argues they’re a new asset class, praises Kalshi’s regulated model and ambition, and plans to expand social experiments while staying involved in MegaETH and Hunch.

I wonder when Jeremy Allaire will address ZachXBT’s feedback.

Introducing Ethereum’s hyperscale co-processor, TOOL. Built on L1 with no protocol changes, it enables 1s soft finality, fair blockspace access, and privacy. Backed by EF, Lido, Obol, and more, with SigP auditing.

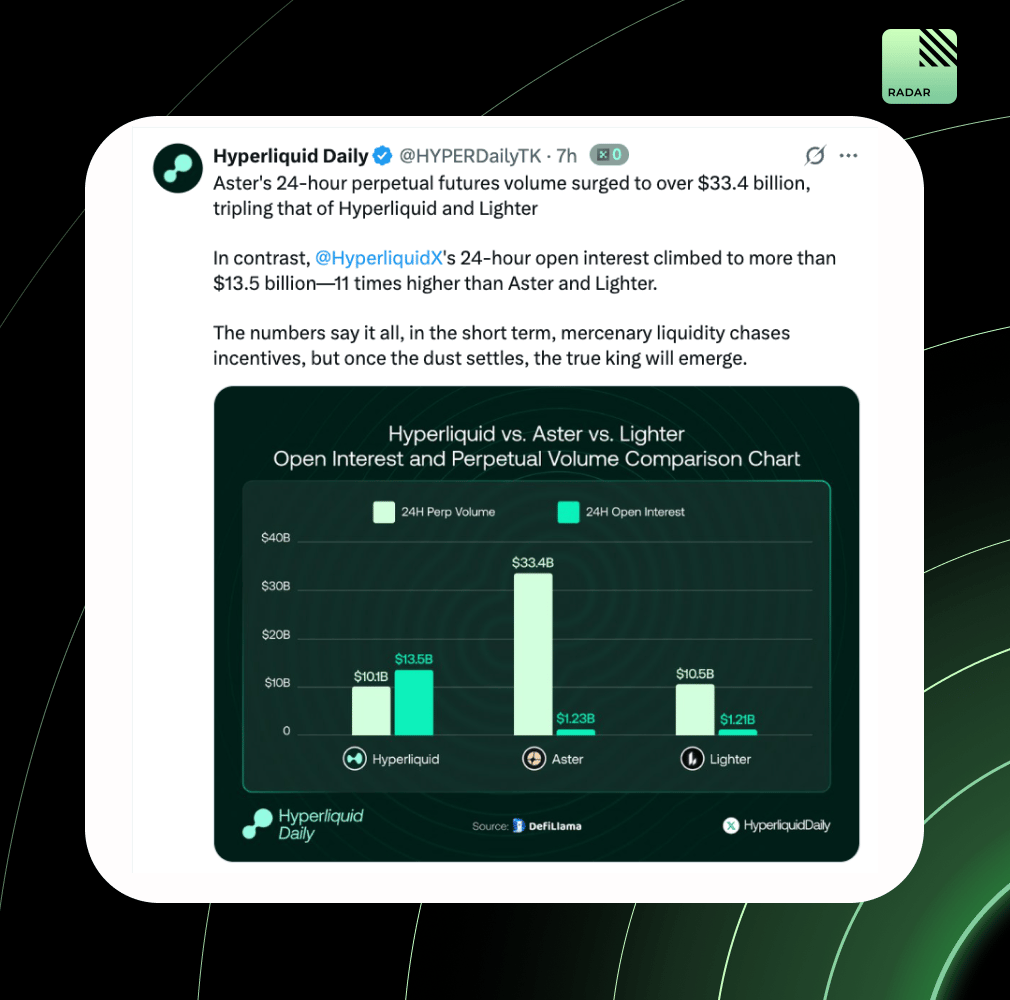

Aster hit $33.4B in daily perp volume, three times the volume of Hyperliquid and Lighter. However, Hyperliquid’s OI sits at $13.5B, 11 times that of its rivals. Incentives swing short-term flows, but depth will determine the real leader moving forward.

Plasma mainnet goes live with $2B stablecoin TVL, 100+ DeFi integrations, and zero-fee USDT transfers via PlasmaBFT. Its XPL token launched at an $8B FDV as the chain pushes a stablecoin-native neobank strategy with Plasma One.

A well-oiled machine!

Radarblock is hosting a Friday fiesta at ETH Delhi with Wormhole India and Manta Network, starting 5 pm IST. The venue is secret and revealed only after getting approved via Luma.

Binance upgraded its Plasma USDT product to the Aave-Plasma USDT Locked Product, offering up to 7% APR on-chain yields. Existing users are auto-subscribed to 60-day terms, while new users can join with flexible lockups from 15–90 days.

Ethereum has overtaken Tron in USDT supply with $80B, signaling a shift toward its DeFi depth and institutional rails. Daily transfers near 1M show active usage, reinforcing Ethereum as the preferred settlement layer for stablecoin adoption.

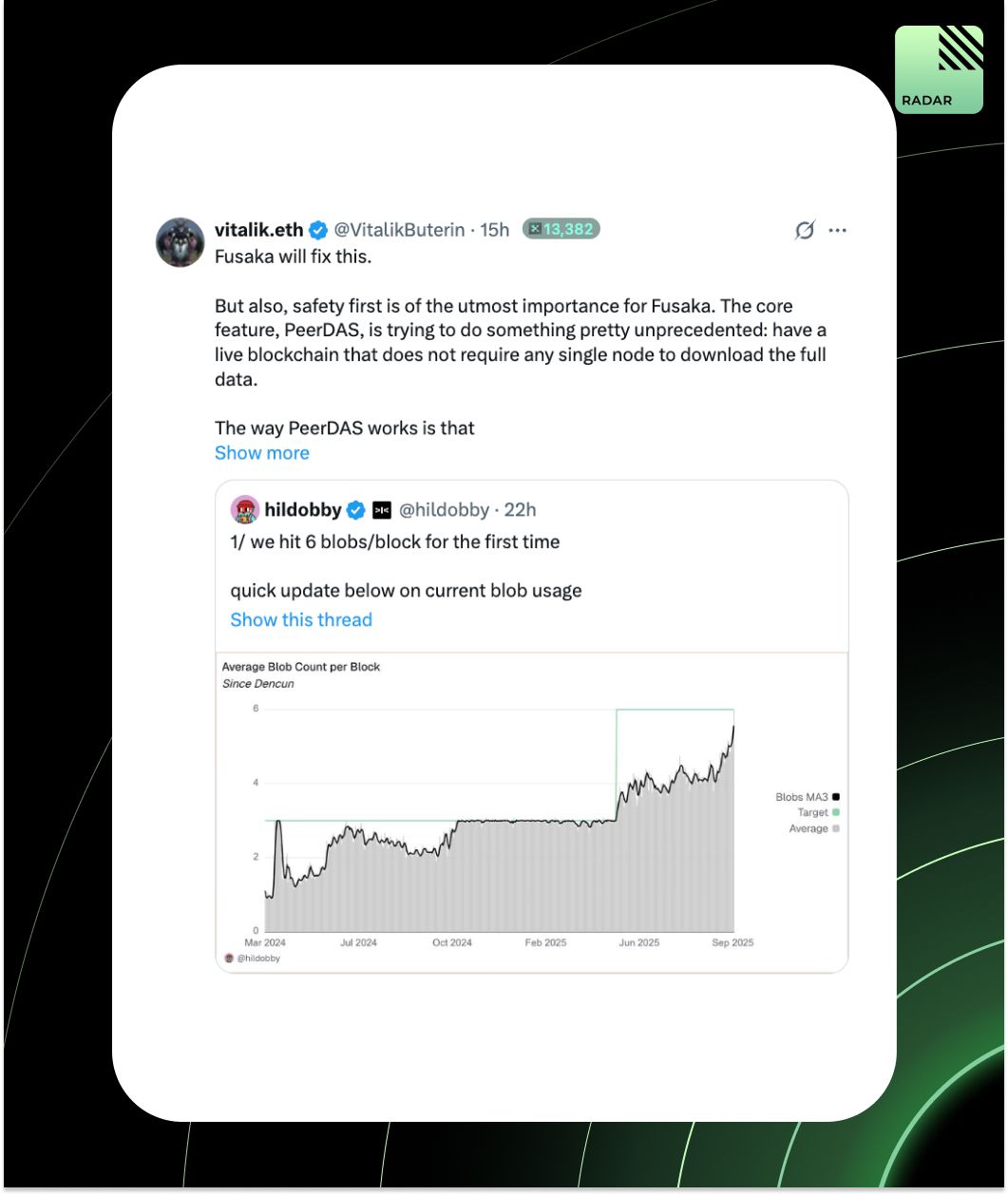

Vitalik explains Fusaka’s PeerDAS: nodes only sample small data chunks to probabilistically verify availability, using erasure coding for recovery. Early versions require one honest broadcaster, but future upgrades aim for full distribution, which is key to scaling Ethereum L2s and beyond.

Prediction markets aren’t a passing CT meta; they’re an industry shaped by the obsession to win. Unlike the chaotic odds of memecoins, prediction markets offer binary conviction bets that tap into the same dopamine loop of being right, making them cycle-agnostic and here to stay.

Ethereum’s strength isn’t in control, but in letting it go. The MegaETH team’s first EF call showed how little gatekeeping matters. Beyond ideology, Ethereum is the safest long-term layer; its story evolves as new builders and narratives flow into it.

Nansen launches Nansen AI, an on-chain-first research agent built for traders and investors. Powered by 500M+ labeled addresses, it delivers real-time portfolio intelligence, Smart Money tracking, and alpha discovery.

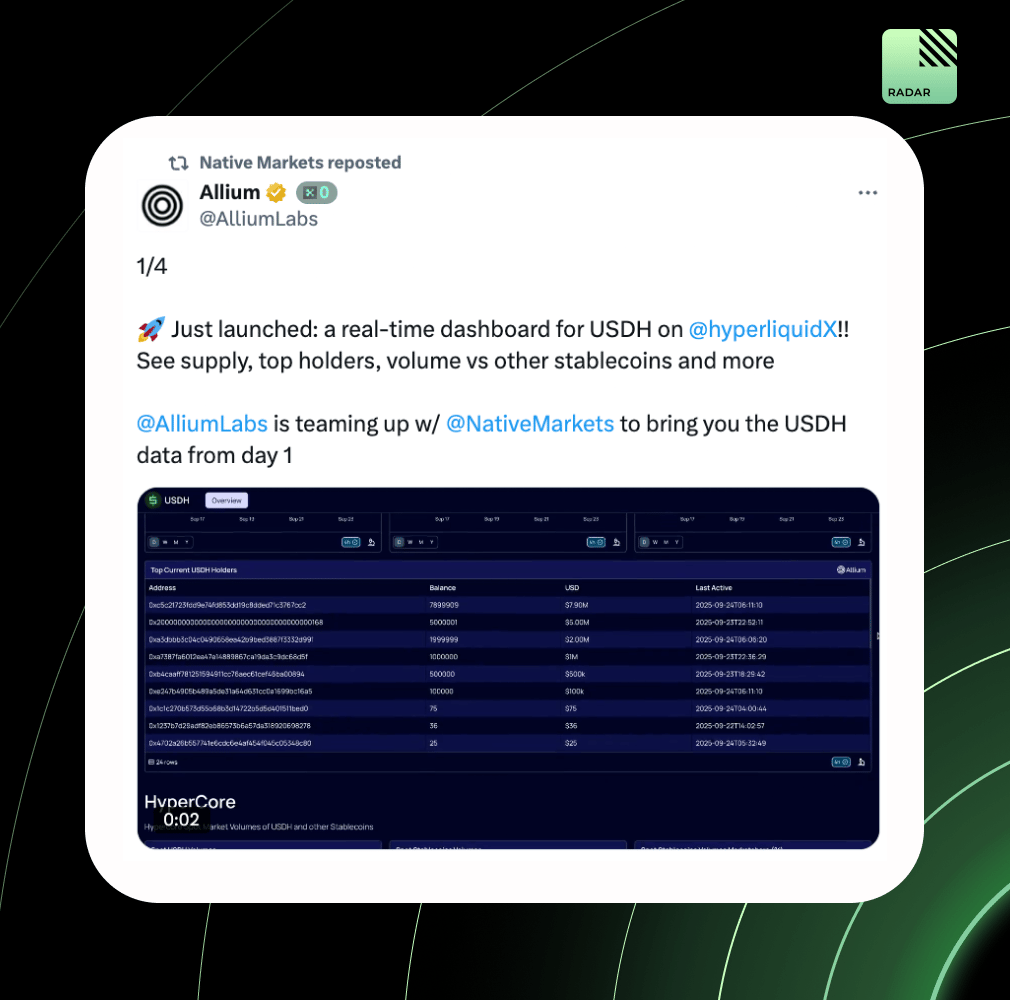

Hyperliquid’s new stablecoin USDH hit $24M supply within 9 hours, surpassing USDC’s share on HyperEVM. Backed by Native Markets, led by ex-Uniswap’s Lader, Max Fiege, and Anish Agnihotri, USDH is now HyperEVM’s 3rd largest stablecoin at 8.9%.

Top Gainers: CCD, APEX, DRV, BSU, RICE.

Kraken’s survey of 1,000 U.S. crypto users found 79% would pay higher fees for trusted exchanges, with trust (26%) and security (14%) outranking fees (16%) as priorities. Most users hold accounts on multiple platforms to manage risk and access.

REX Shares and Osprey Funds launched the first U.S. Ethereum staking ETF (ESK), offering spot ETH exposure plus staking rewards under the 1940 Act structure. The move precedes SEC decisions on BlackRock and Fidelity’s pending stake ETF applications.

Boundless CEO Shiv Shankar and RISC Zero’s Tina Liu outlined how Boundless turns ZK from research into production with ~12s Ethereum block proofs, PoVW incentives, and post-quantum defense. Positioned as a verifiable compute layer, it targets a trillion-dollar scale.

That’s all for today, later!