- Radar-as-a-Service

- Posts

- RaaS #504: It's Raining Plasma!

RaaS #504: It's Raining Plasma!

Aster Wash Trading Concerns, Cloudflare Announces Stablecoin: GM Web3!

Level Getting Acquired, 0G & Bitget in Hot Water, and Moar!

Want RaaS without digging through your inbox? Our Telegram channel gives you the same daily crypto roundup in a quick, scrollable format. Easy to read, easy to share. Join here → RaaS Telegram Group.

Quick Intro: Radarblock is a Web3-native growth agency that increases awareness, TVL, volume, and social metrics for its clients over a consistent time frame without uncertainty and confusion. All tweets are hyperlinked, so click to pull them up on Twitter!

Top crypto projects don’t just ship tech, they engineer cult-like communities. Slogans, colors, and symbols build identity. Rituals and leaders sustain culture. Contrarian views attract loyalty. The winners launch tribes, not tokens, and tribes outlast markets.

Hypervault has allegedly rug-pulled after $3.6M was drained, bridged to Ethereum, and funneled into Tornado Cash. With its X account deleted and website offline, the DeFi vault project appears to have abruptly vanished.

Futuredotfun is live with Scouter, tracking Polymarket wallets and ranking traders via an Edge Score across profit, risk, consistency, scale, and experience. Users get gamified tiers, making prediction markets competitive and addictive.

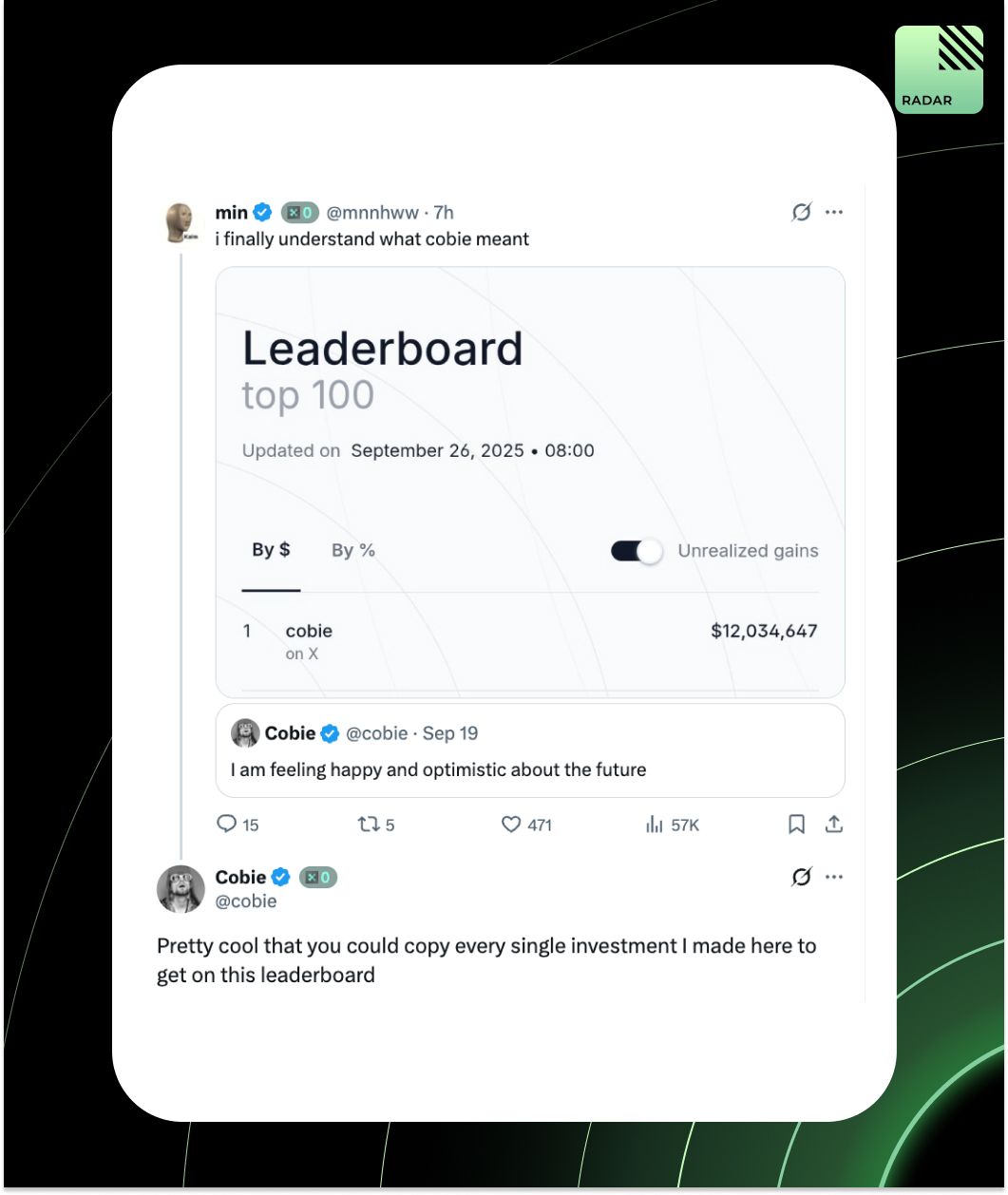

Just copy trade Cobie!

BasedPad’s first launch with Upheaval saw $80M in HYPE committed (110 times oversubscribed), showing strong demand for Hyperliquid TGEs. The live ticker is UPHL on Based, Hyperliquid Core, and HyperEVM.

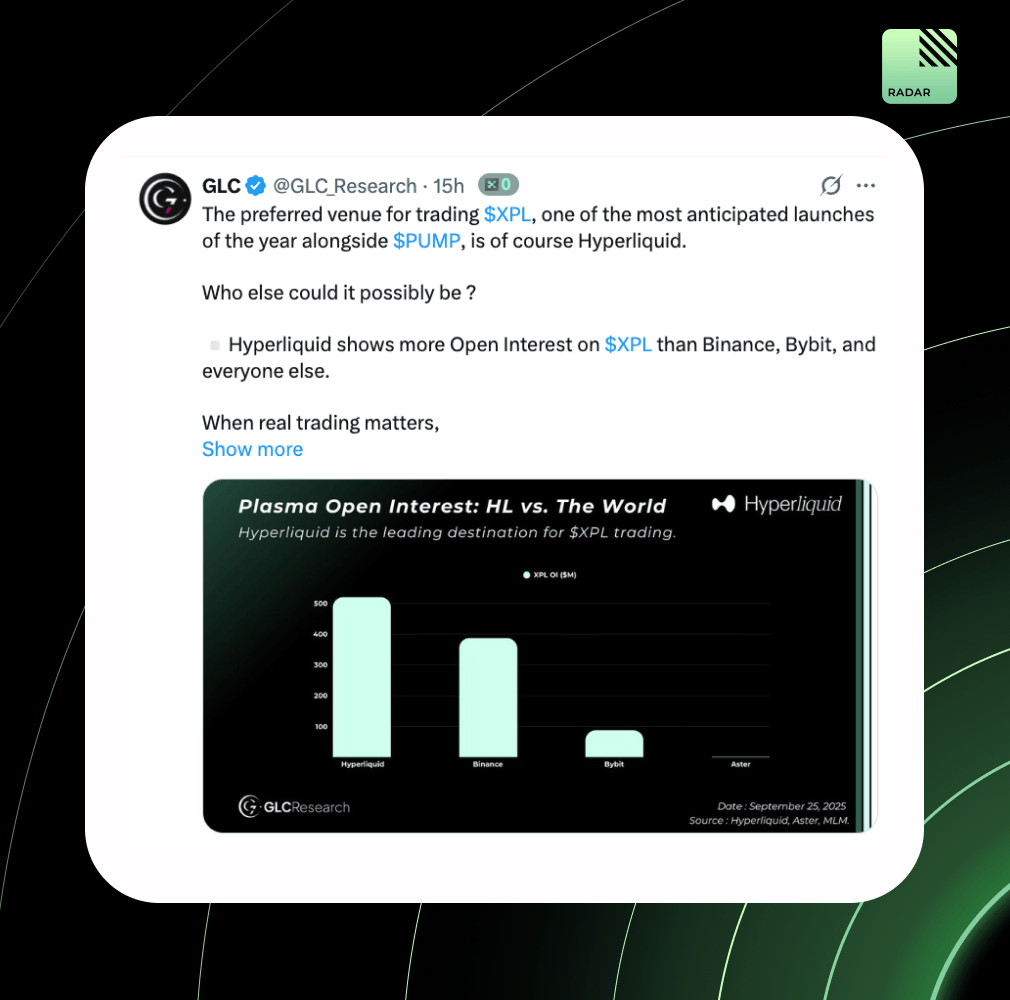

XPL launch showed Hyperliquid’s edge: more Open Interest than Binance, Bybit, and 250x Aster. Funding hit 500% APY, Liminal auto-built neutral plays, and traders piled in. More than a DEX, Hyperliquid is the ecosystem for major launches.

A cluster of around 114 wallets farmed Plasma’s airdrop, turning ~$570 into ~$1.1M (XPL) with 1,500x returns. They pooled base allocations, consolidated across addresses, and dumped to CEXs, showing how coordinated farming outperformed echo sale gains.

It’s time to lock in!

We are going live today at 1:30 PM UTC with Ganesh, founder of Covalent, alongside Luki and Yugi from Radarblock. Expect Covalent’s story plus coverage on Plasma’s mainnet, Aster flipping Hyperliquid, Tether’s raise, and more.

Ser Dave shares his Plasma journey: passion for stablecoins got him in early. He netted $9K, but realized a “game mindset” would’ve scaled his rewards. Now he’s applying that lesson to Makina, aiming for yield, points, and ICO access at a strong valuation.

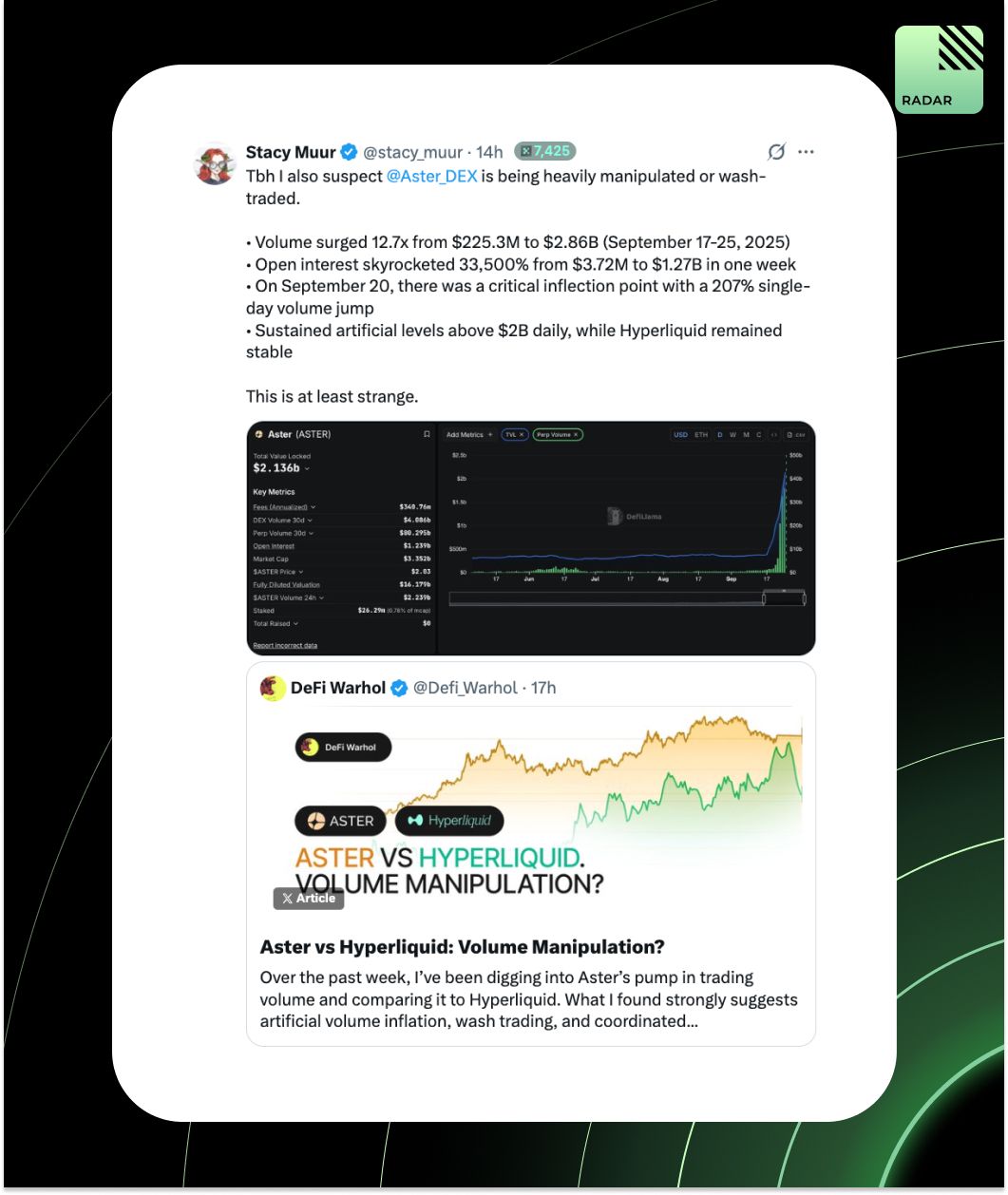

Stacy Muur flagged Aster’s explosive growth as likely wash trading: volume jumped 13 times to $2.86B, and OI 335 times to $1.27B, and fees outpaced revenue. Paired with whale transfers and a points system, the surge looks artificial compared to Hyperliquid’s stable metrics.

Almanak is training AI swarms to replace human quants, turning months of strategy development into minutes. With ERC-7540 vaults for secure, verifiable execution, it’s building tokenized AI strategies designed to scale into billions across DeFi and beyond.

Cloudflare is launching NET Dollar, a USD-backed stablecoin to power instant and secure payments for the AI-driven web. Framed as the next Internet business model, it supports microtransactions, agent-to-agent payments, and fair creator rewards.

Aster reimbursed traders liquidated after an XPL perp glitch that spiked prices to $4. The issue, tied to safeguard removal during Plasma’s token launch, was resolved within hours, with USDT payouts covering losses and fees.

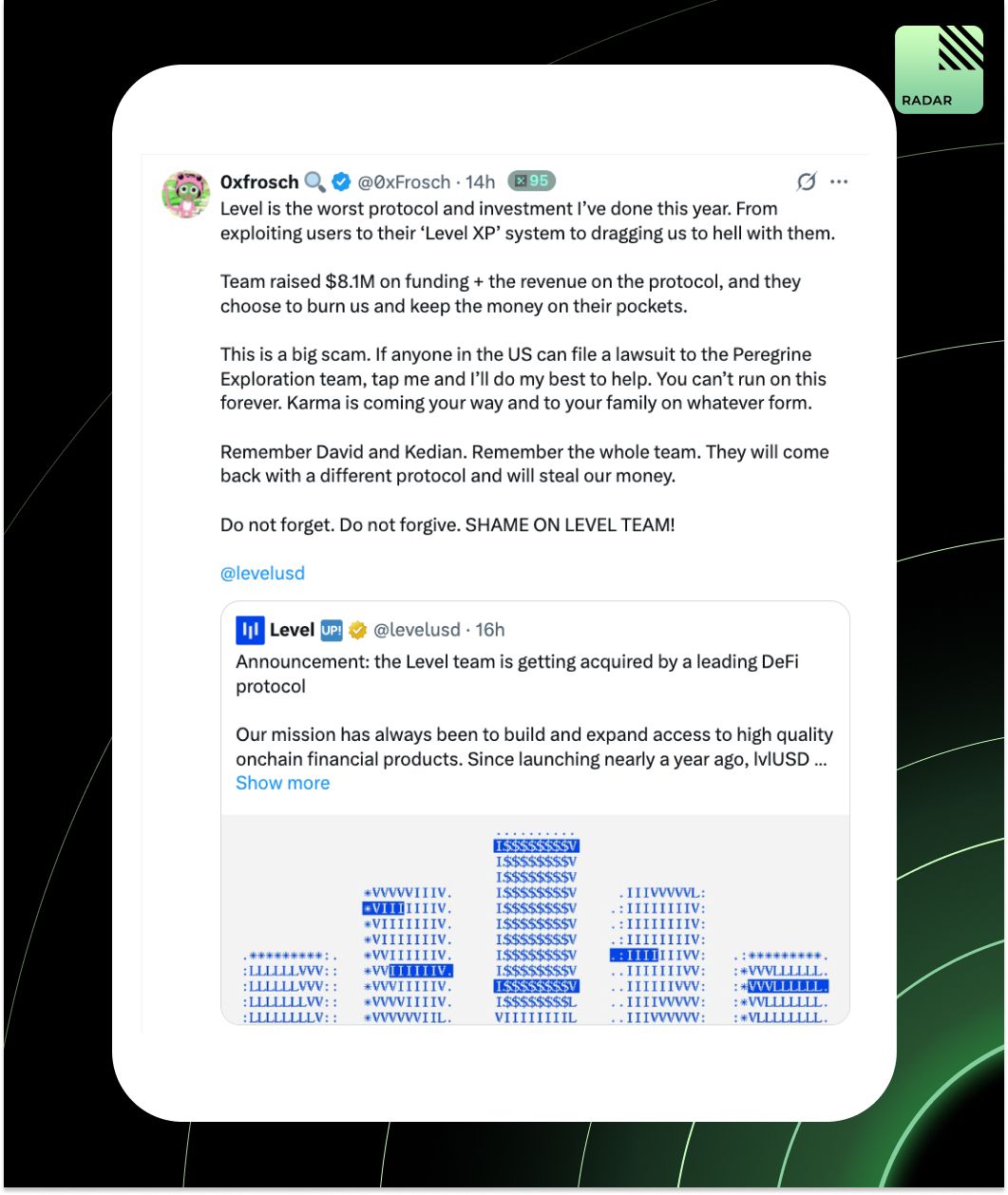

Level is shutting down after an acquisition, offering 1:1 redemptions and fast unstaking until December. Critics accuse the team of pocketing funding while abandoning users, calling it a scam and warning they’ll rebrand to strike again.

We expect life to reward effort, but reality never agrees. The gap between expectation and outcome breeds frustration. Sanity comes from calibrating: control what you can, accept what you can’t, and treat reality as a feedback loop, not a verdict.

Top Gainers: SQD, CCD, WXPL, DRV, DLC.

Best crypto cards in 2025 offer real rewards without sacrificing usability. EtherFi Cash leads for non-custodial users (3% back), Gemini Credit Card offers the best flat bonus (4%). Others, like Cryptodotcom or Gnosis Pay, push higher rates but require staking or token risk.

Humans have always chased foresight, once through livers, birds, and oracles, later through astrology and alchemy, then probability and statistics. Prediction markets are the next step. Millions of micro-oracles price uncertainty into tradable truth in real time.

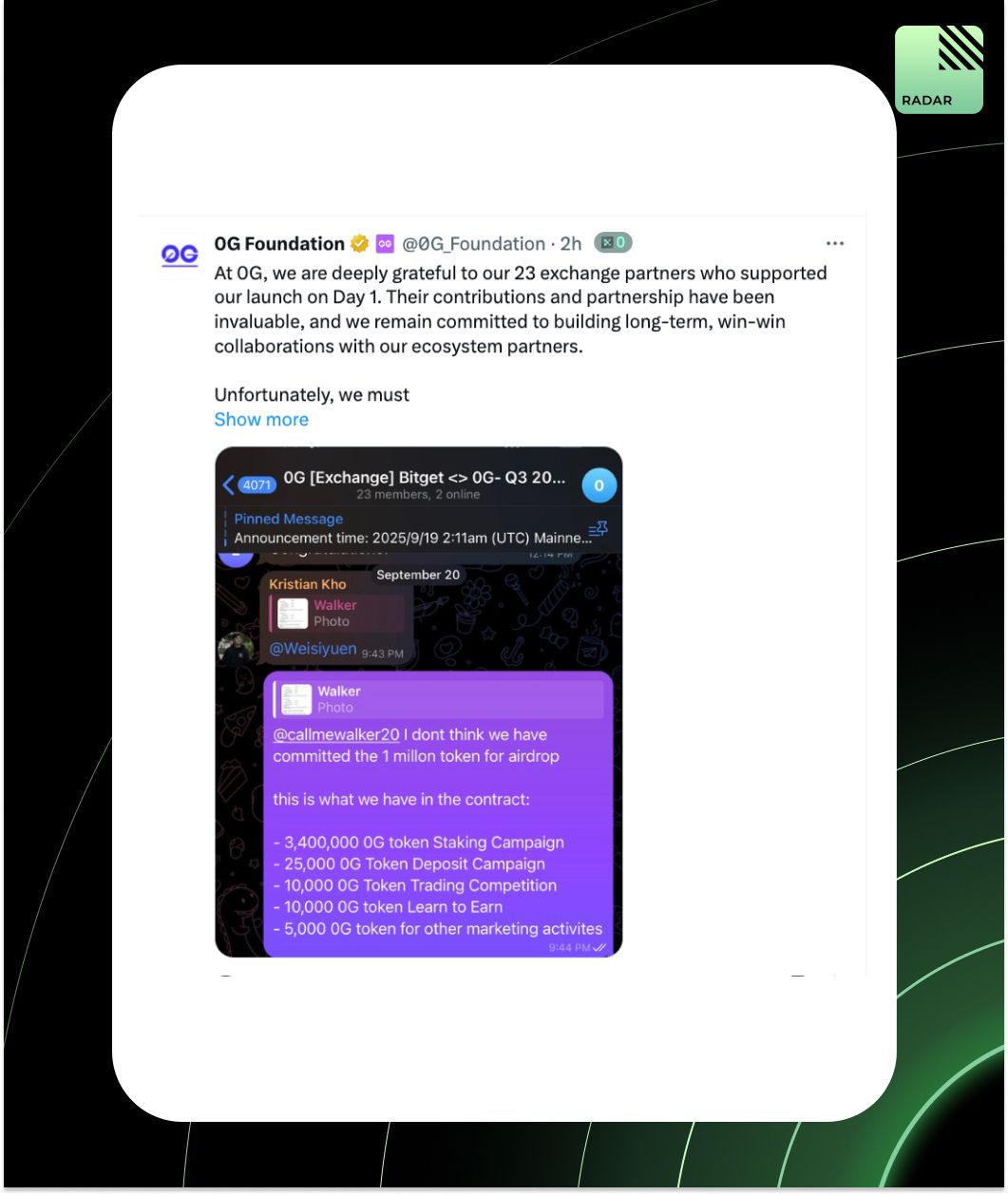

0G accused Bitget of breaking their agreement by replacing a 90-day staking campaign with an unauthorized 3-day Launchpool/airdrop. 0G has sent a legal demand, urged partners to halt deals with Bitget, and requested either token buybacks or financial compensation to rebuild trust.

That’s all for today, see ya on Monday!