- Radar-as-a-Service

- Posts

- RaaS #506: YieldBasis Pre-deposits Hit $150M!

RaaS #506: YieldBasis Pre-deposits Hit $150M!

Flying Tulip Raises $200M, SEC Green Lights DoubleZero’s 2Z: GM Web3!

Pyth Gears for Institutions, Ethereum’s Reputation Audit, and Moar!

Want RaaS without digging through your inbox? Our Telegram channel gives you the same daily crypto roundup in a quick, scrollable format. Easy to read, easy to share. Join here → RaaS Telegram Group.

Quick Intro: Radarblock is a Web3-native growth agency that increases awareness, TVL, volume, and social metrics for its clients over a consistent time frame without uncertainty and confusion. All tweets are hyperlinked, so click to pull them up on Twitter!

Circle and Deutsche Börse will integrate USDC and EURC into Europe’s financial infrastructure under MiCAR, enabling stablecoin trading, settlement, and custody via 360T, Crypto Finance, and Clearstream.

Ethereum’s reputation audit is out. Project Mirror interviewed 60+ builders, researchers & critics to map how Ethereum is perceived today. Key takeaways: strong values, but complex UX, fragmented messaging, and competition catching up.

Laura Shin’s Unchained podcast is now streaming on Pumpdotfun, making it the first major crypto media brand to launch a memecoin. Unchained will be utilising the streaming to generate revenue through fees, with no plans to sell or shill the coin.

Probably never going to consume Casu Martzu.

Hyperliquid’s crown is under fire. New DEXs like Aster, Lighter, and EdgeX are pulling volume with aggressive incentives, but Hyperliquid still leads in open interest and user loyalty. Its infra edge, sticky traders, and the broader HyperEVM playbook make it more than a momentary winner.

Kazakhstan has launched the Alem Crypto Fund to establish a sovereign crypto reserve. Its first buy: BNB, in partnership with Binance Kazakhstan.

Morpho launches Vaults V2, a noncustodial upgrade with role-based governance, in-kind redemptions, and future-proof infra. It allocates across Morpho versions (starting with V1), with tighter risk caps and institutional access controls.

Leg days build character (I don’t do leg days).

PRED is building the perp DEX for sports prediction, because sports sit at the intersection of emotion, scale, and objective resolution. With 92% of prediction market volume in “no one knows” markets, PRED is betting sports will be DeFi’s breakout vertical.

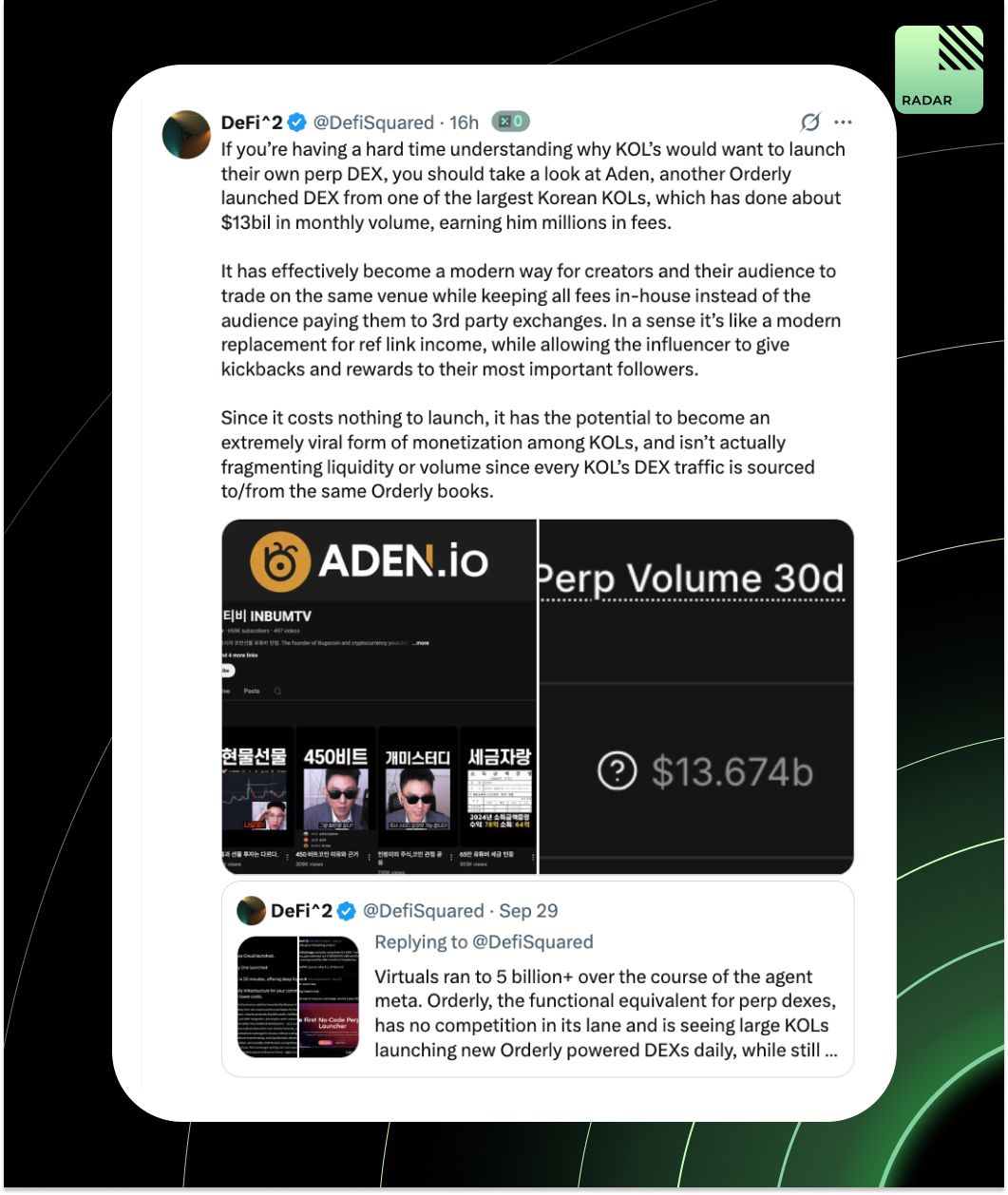

KOL perp DEXs are the new referral links. Aden, built on Orderly by top Korean KOLs, did $13B in volume last month, generated millions in fees, and ran with zero infra cost.

Stripe and OpenAI just dropped the Agentic Commerce stack. ChatGPT gets instant checkout (via Stripe), Agentic Commerce Protocol goes live, and Stripe now offers Shared Payment Tokens for AI-native payments.

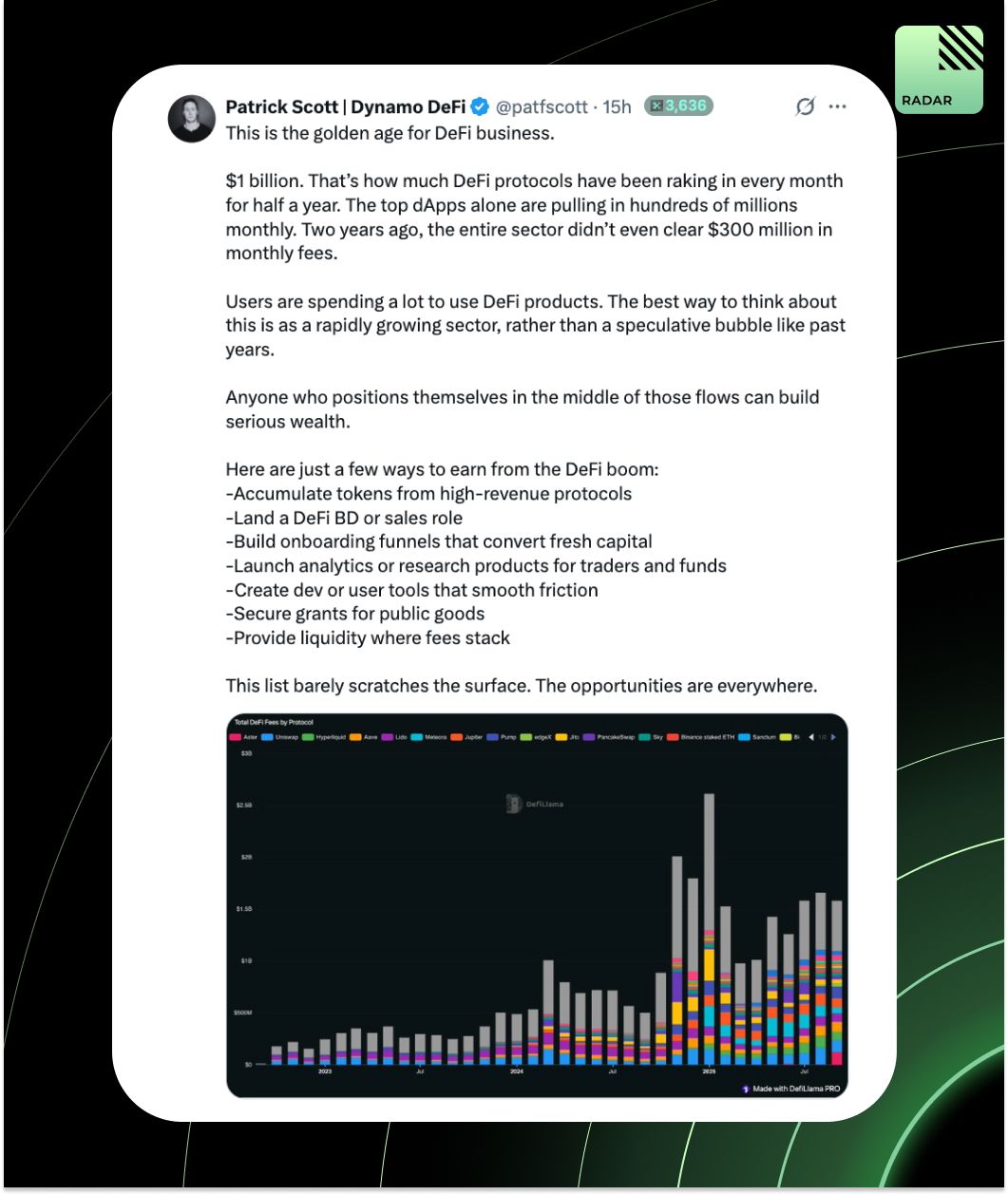

DeFi is printing $1B+ monthly, and it’s not slowing down. Top protocols now earn hundreds of millions in fees, up from less than $300M/month two years ago. Lots of opportunities for everyone to capitalize on.

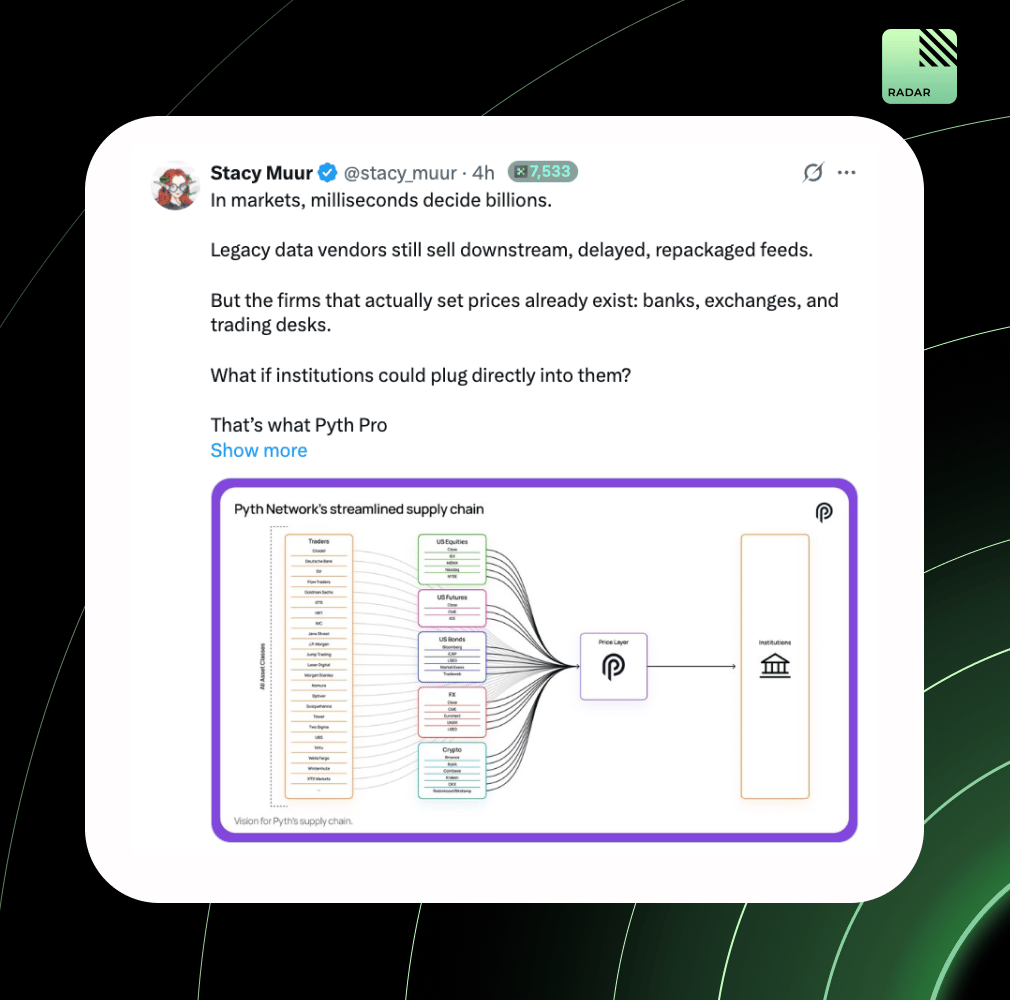

Pyth is coming for Bloomberg. With Pyth Pro, institutions can now subscribe to raw price data straight from trading desks, without middlemen and latencies. It’s DeFi’s #1 oracle, and gunning for a $50B institutional market dominated by legacy vendors.

SEC gives green light to DoubleZero’s 2Z token. The no-action relief signals a shift: utility tokens tied to real-world DePIN infra like fiber networks may not be treated as securities. This could set a precedent for compliant U.S. launches.

Flying Tulip raises $200M and rewires token fundraising from scratch. 100% of tokens go to investors, backed by a perpetual put. Treasury yield funds operations, while buybacks reduce supply. New mechanism for deflationary token launches in town.

YieldBasis has hit $150M pre-deposits in 24h. It offers up to 20% APR with full BTC exposure via an IL-neutral AMM, backed by Curve DAO and led by Egorov.

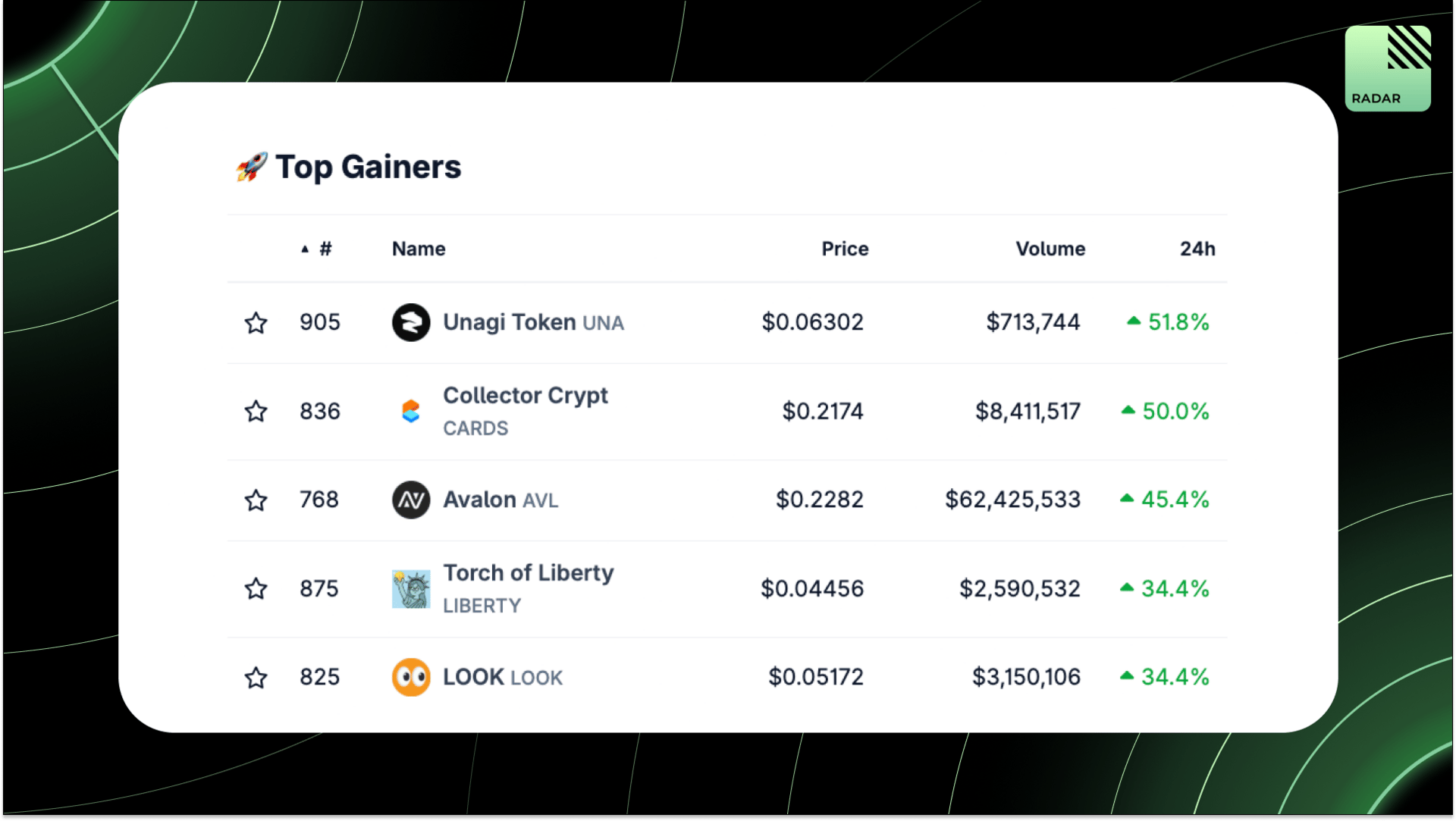

Top Gainers: UNA, CARDS, AVL, LIBERTY, LOOK.

Betting on high-margin subnets is how Bittensor escapes the incentive death spiral. Ridges shows the way: a $25 entry, open-source leaderboard, and $120K prize pool. Subnets that mine minds, not machines, will outlast the rest.

CMCC Global launches a $25M Resonance Fund to back Sonic’s DeFi and consumer app ecosystem. They will scale Fee Monetization (FeeM) as a revenue model and grow liquidity across early and liquid assets.

Pumpdotfun is reviving as the “TikTok of crypto,” with tokenized livestreams that let creators earn from trading fees. ARK sees this as more than memecoins; it’s a signal that crypto-native creator economies are maturing into investable verticals.

That’s all for today!