- Radar-as-a-Service

- Posts

- RaaS #507: Fusaka Hits Holesky!

RaaS #507: Fusaka Hits Holesky!

Flying Tulip Public Sale in Q4, Bridge Unveils Open Issuance: GM Web3!

BNB Halves Gas Fees, Drift Unveils V3, and Moar!

Want RaaS without digging through your inbox? Our Telegram channel gives you the same daily crypto roundup in a quick, scrollable format. Easy to read, easy to share. Join here → RaaS Telegram Group.

Quick Intro: Radarblock is a Web3-native growth agency that increases awareness, TVL, volume, and social metrics for its clients over a consistent time frame without uncertainty and confusion. All tweets are hyperlinked, so click to pull them up on Twitter!

Aggregation is the holy grail across search, UX, execution, and indices. Most volume is still trapped in fragmented frontends, with no unified way to discover, price, or bet on markets. Retail often gravitates to niche/local plays, while institutions prioritise hedging and structured exposure.

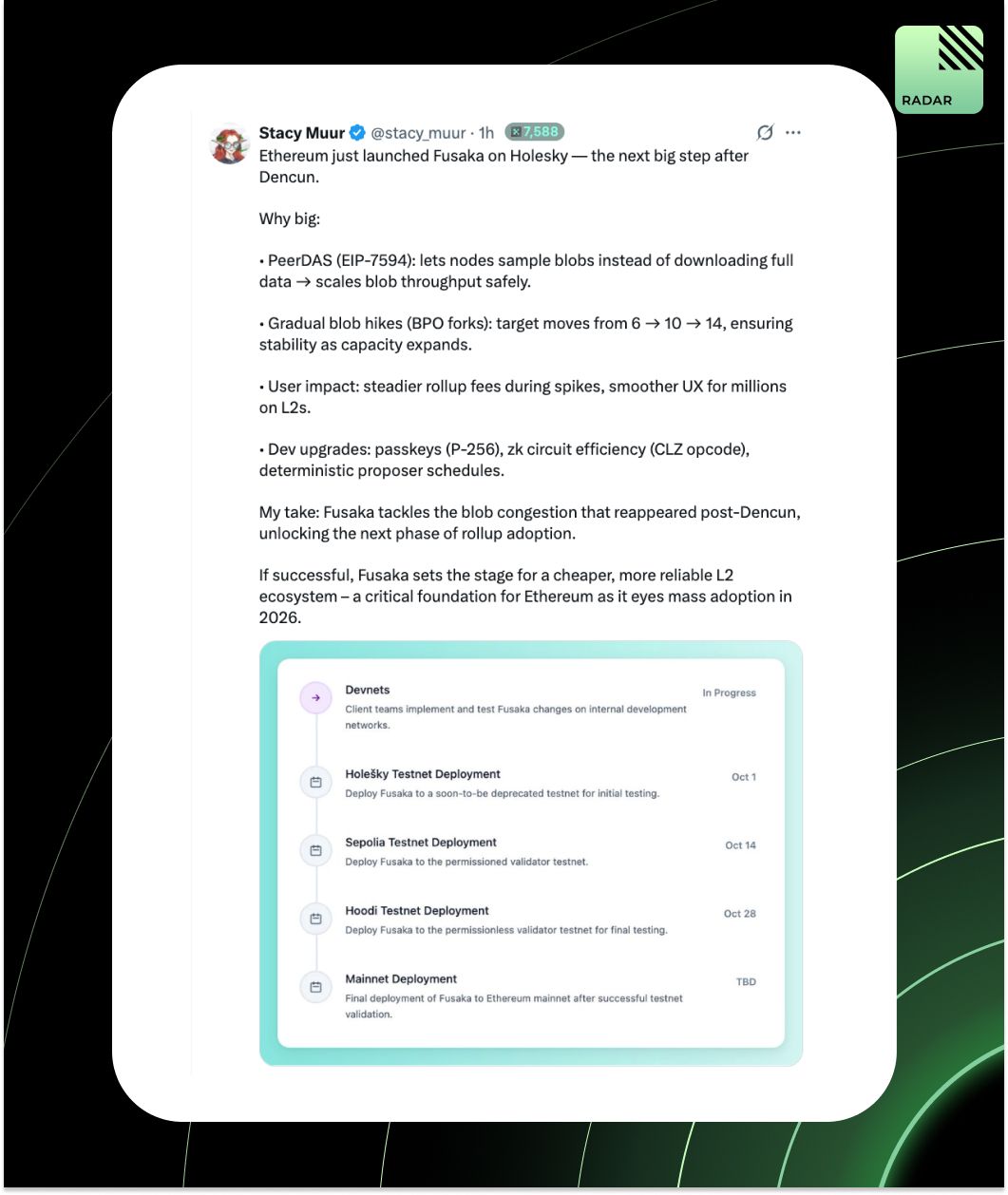

Fusaka just hit Holesky, marking one of Ethereum’s first testnet implementations post-Dencun. It brings PeerDAS (EIP-7594) for scalable blob sampling, gradual blob hikes (6 to 10 to 14), and smoother rollup fees. This will lay the groundwork for a cheaper, more reliable L2 UX.

Flying Tulip’s public sale is set for Q4, potentially this month, pending two final audits. But there’s a twist: buyers must pass an FT investor test to qualify. This time, you’ll have to read before you ape.

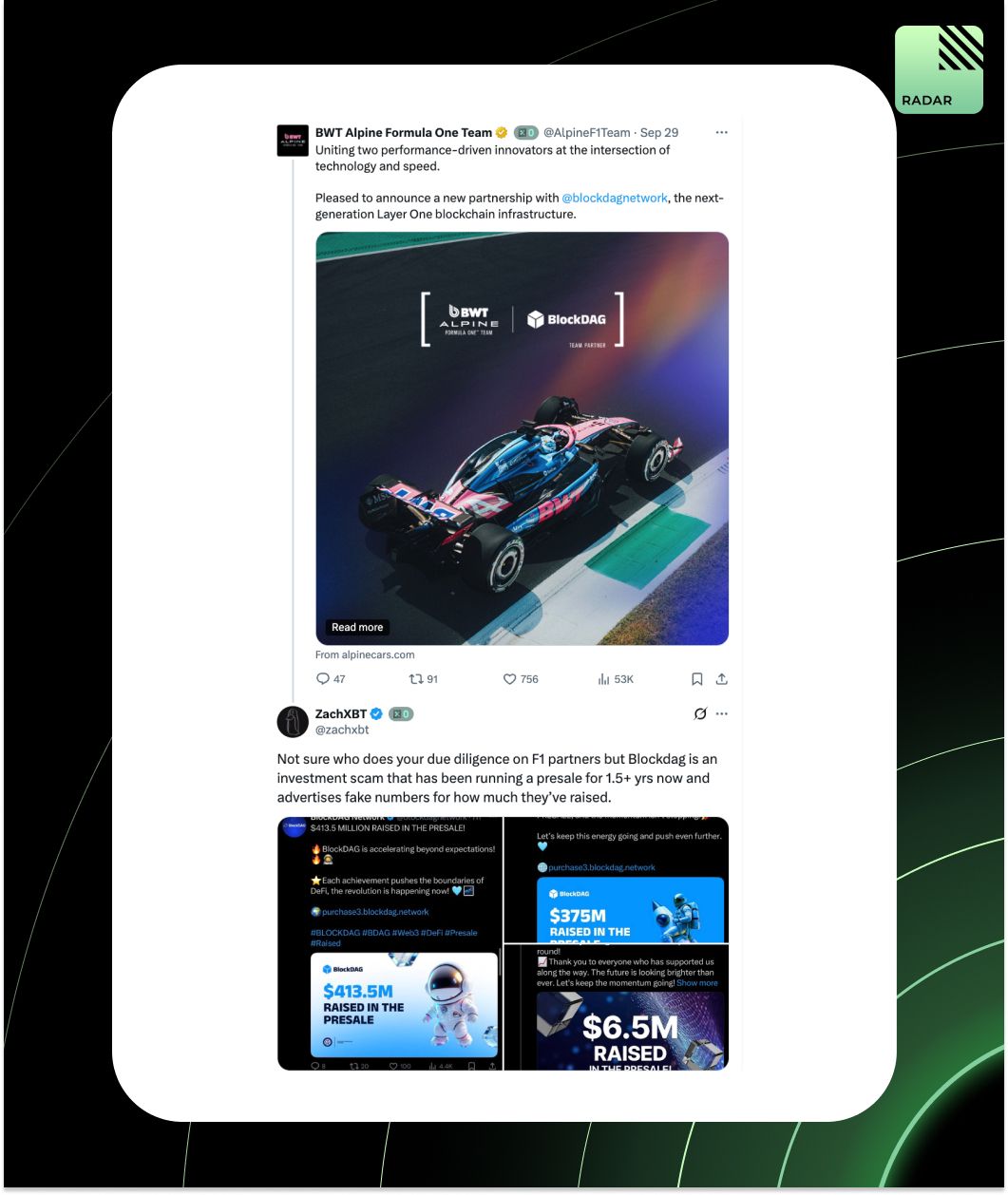

BlockDAG went from $6.5M to $413M in “presale” raises over 1.5 years, now partnering with Alpine F1. ZachXBT has raised concerns, alleging inflated numbers and potential investor deception. Endless presale, zero transparency, and partners not doing basic due diligence.

MI4 is Mantle’s tokenized fund holding BTC, ETH, SOL, and stables via yield-bearing assets like mETH and sUSDe. It’s audited, KYC-gated, and backed by $400M from the Treasury. An index fund built for institutions.

BNB’s X account was compromised, resulting in ~10 phishing links being posted and $8K in total user losses, $6.5K of which came from a single victim. The attacker also deployed a phishing contract, netting ~$4K in profit. BNB Chain has committed to reimbursing victims, with an investigation underway

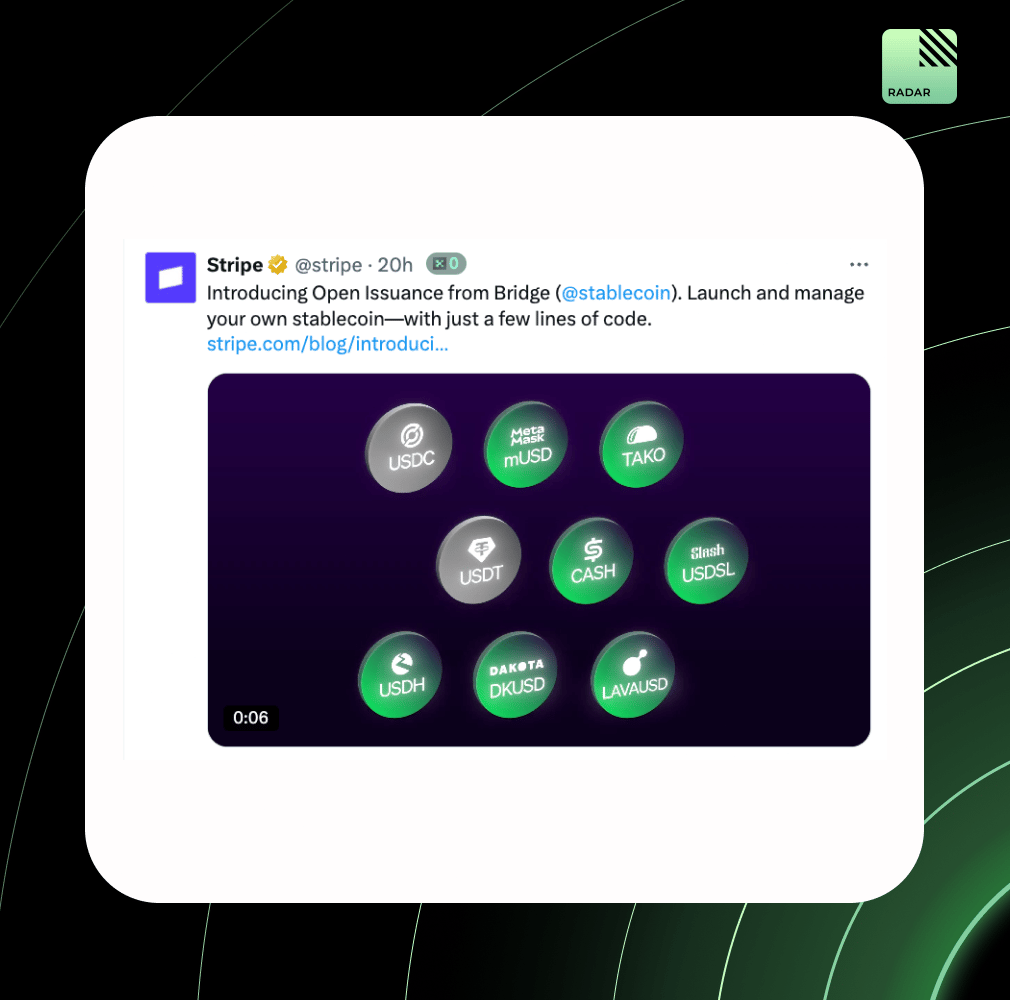

Bridge unveils Open Issuance, a platform for businesses to launch their own stablecoins without relying on dominant issuers. This gives companies full control over fees, reserves, and rewards, while plugging into a shared liquidity network. Phantom’s new stablecoin, CASH, is the first live deployment.

Heresy.

Radar After Dark wasn’t about panels or pitches; it was vibes, stories, and spontaneous connections. Radarblock, Manta, and Wormhole India brought the right people together.

From 500 to 8K+ followers in 7 months, Bigray breaks down the formula: show real results, master your niche, and post value daily. Branding, consistency, and verified engagement helped turn his X into a growth engine, supported by a clear niche and frequent posting.

Prediction markets aren’t just about being right. True success depends on accuracy, real-time efficiency, liquidity depth, transparent resolution, and user diversity. This piece breaks down the full stack of metrics that define sustainable, credible platforms.

2025 is the perp DEX breakout year, and Drift is positioning to lead. Drift v3 brings 10x upgrades in speed, liquidity, and UX, powered by Solana infra. And packed with new LP mechanics, full community revenue return, and a growth flywheel.

BNB Chain has lowered its minimum gas fee to 0.05 Gwei (~$0.005 per transaction), now adopted across all BSC validators. This will boost trading speed, lower costs, and strengthen BNB Chain’s position as one of the most user-friendly chains.

YieldBasis’ merit-based sale was 78x oversubscribed ($195M requested vs. $2.5M raised). Allocation emails are rolling out now. Despite heavy oversubscription, thousands were still able to secure allocations. Missed out? FCFS opens soon on Kraken Launch.

September saw some major moves. Stablecoin infra, AI x crypto, and compliance hires are heating up. From Uniswap’s CLO exit to new execs at Coinbase, Circle, Pantera, and 0G, firms are gearing up for the next wave.

Polygon and Immutable are launching a dedicated Polygon Hub on Immutable Play, kicking off with 5 AAA games, $100K in rewards, and platform-wide quests. Soon, Agglayer integration will unlock seamless cross-chain gaming across the Polygon ecosystem.

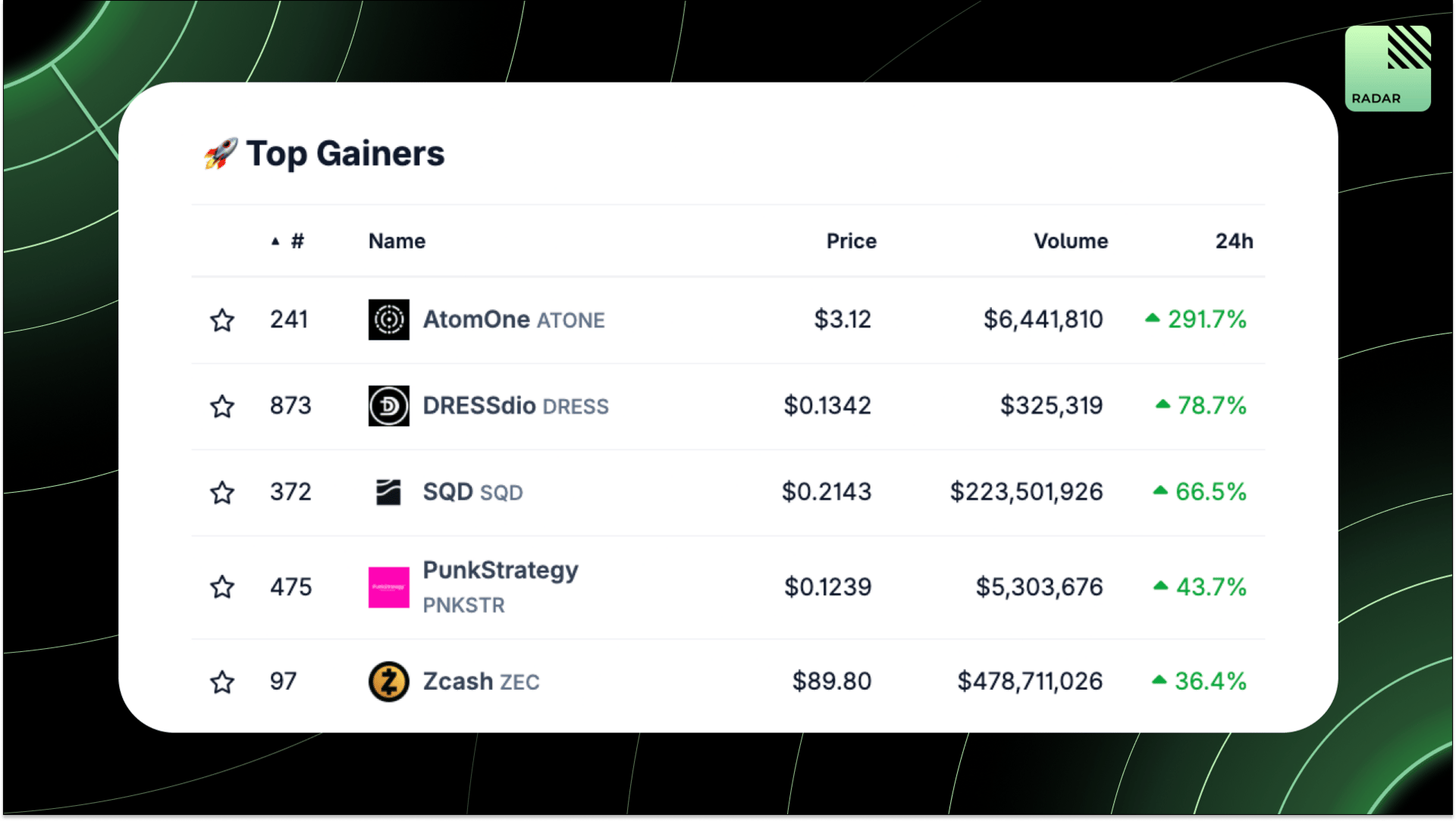

Top Gainers: ATONE, DRESS, SQD, PNKSTR, ZEC.

Bitcoin hashrate hit 1.085 ZH, up 53% since 2024, marking an all-time high. Meanwhile, public companies now hold over 1M BTC (~5% of supply), led by Strategy (632K BTC) and new entrant Twenty One (43.5K BTC). Adoption and infrastructure continue accelerating.

The wrong debt structure could be fatal for Ethereum treasury firms. Bit Digital CEO Sam Tabar warns that secured debt may “destroy” DATs in a bear market. His firm opts for unsecured convertible notes, raising $135M at 4% interest, betting big on ETH.

Binance’s new Industry Map breaks down the 2025 crypto stack into 7 verticals, from stablecoins and DATs to DeFi, RWAs, and gaming infra. Each segment spotlights top projects across functions like issuance, payments, privacy, and more.

That’s all for today!