- Radar-as-a-Service

- Posts

- RaaS #508: Lighter Goes to Mainnet!

RaaS #508: Lighter Goes to Mainnet!

Plasma Denies Token Sale, Polymarket Back in US: GM Web3!

Manta Focuses on Apps, VC Rounds Reduced in September, and Moar!

Want RaaS without digging through your inbox? Our Telegram channel gives you the same daily crypto roundup in a quick, scrollable format. Easy to read, easy to share. Join here → RaaS Telegram Group.

Quick Intro: Radarblock is a Web3-native growth agency that increases awareness, TVL, volume, and social metrics for its clients over a consistent time frame without uncertainty and confusion. All tweets are hyperlinked, so click to pull them up on Twitter!

RISC Zero patched a critical vulnerability that let malicious hosts write to arbitrary guest memory. The issue affected risc0-zkvm-platform; a full security disclosure is now live after giving partners time to update.

You’re not trading, you’re following, and the market punishes followers. Real alpha comes from independent thinking, not borrowed theses. That means reading deeply, writing clearly, understanding data, trading widely, and building social capital.

Thena is shutting down liveTHE, locking 34.61M THE into veTHE for two years. Users can pivot to eTHENA, a liquid veTHE alternative with 31.93% APR in BNB or other LP options.

What hypothesis is Phantom following?

Brazil’s ETH stack is quietly blooming. From Drex pilots to PIX-native fintechs, the country blends infra, adoption, and grassroots devs, making it one of the few regions scaling both policy and product on-chain.

Lighter’s public mainnet is live after 8 months of testing. Users can now trade perps on an Ethereum L2 built with custom ZK circuits for verifiable matching and liquidation. Points Season 2 has also begun.

Crypto isn’t about intrinsic value; it’s about recursive belief. xbt2025 argues hyperfinancialization turned markets into meta-games, where value emerges from coordination, not fundamentals.

I stand with Luki.

Our Chief Betting Officer has been running a daily Polymarket betting stream for over two months, weekly livestreams, and a strict “only bet YES” policy. That alone should earn him a Polymarket badge.

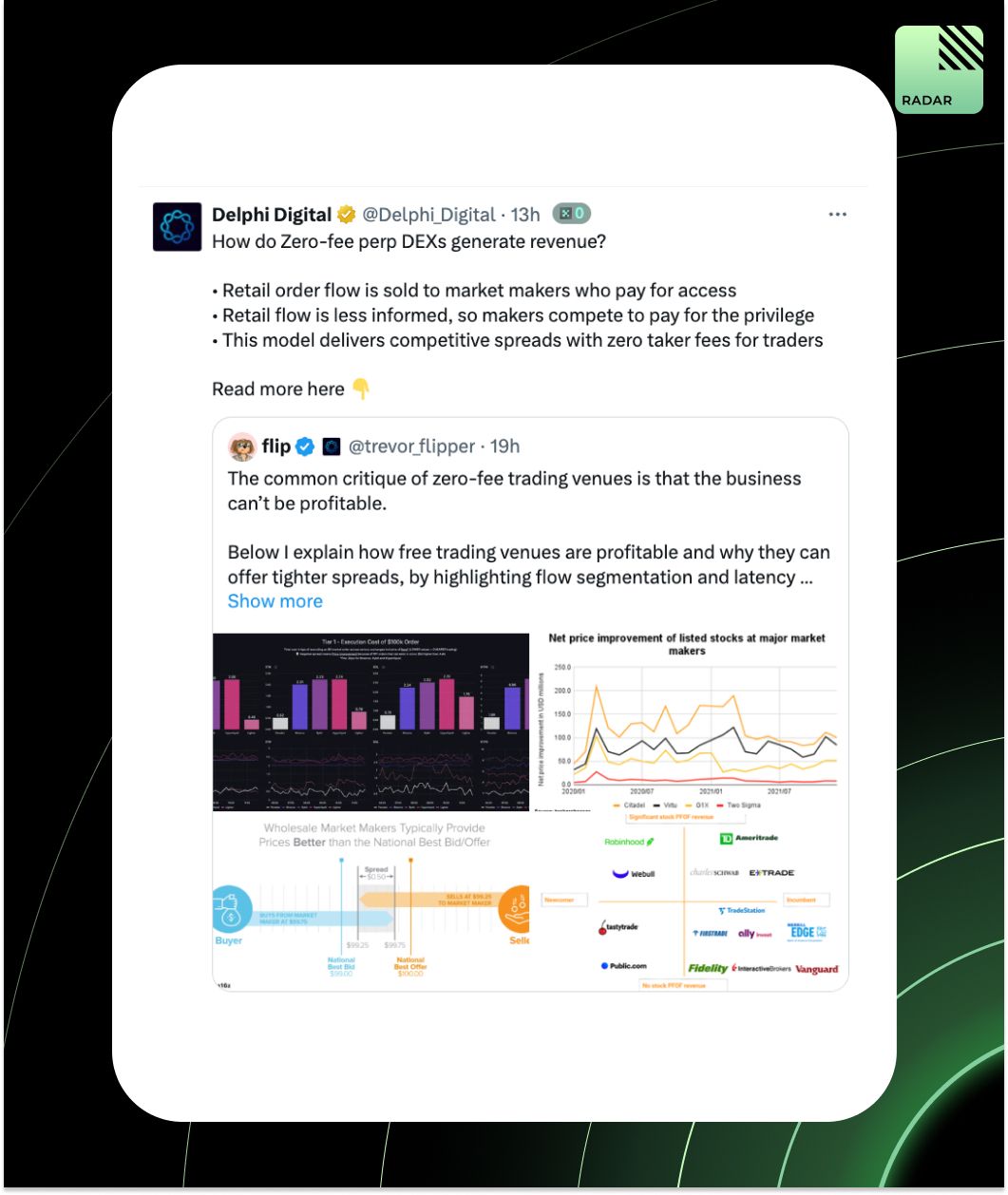

Zero-fee perp DEXs like Lighter & Paradex flip the model: makers effectively pay for order flow, rewarding clean fills. This unlocks Binance-tier spreads, beats CeFi on execution cost, and scales without taker fees or rebates.

DoubleZero replaces the public internet for validators with a private mesh network of fiber links, spam filters, and optimized routing. Backed by 300+ validators and live with 2Z on Solana, it offers faster block propagation and verifiable performance.

Plasma denied insider token sales, clarified that only 3 of 50 team members are ex-Blast, and stated they’ve never engaged Wintermute as a market maker. The team reaffirmed its focus on building and declined to comment further amid growing community backlash.

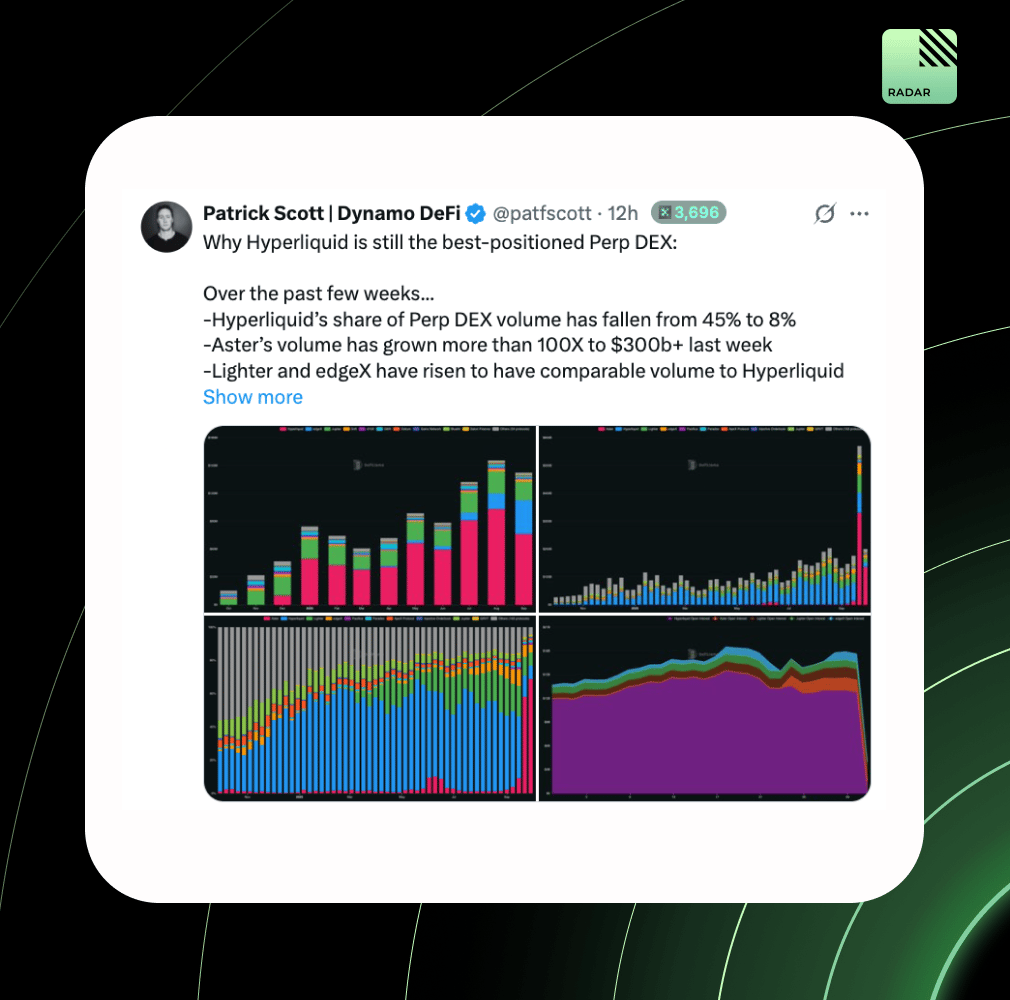

Despite Aster’s explosive 100x volume growth and market share dominance, Hype remains strongest on fundamentals, leading in Open Interest (62%), growing revenue steadily, and expanding into DeFi infra (USDH, HyperEVM, HIP-3) with sticky usage beyond incentives.

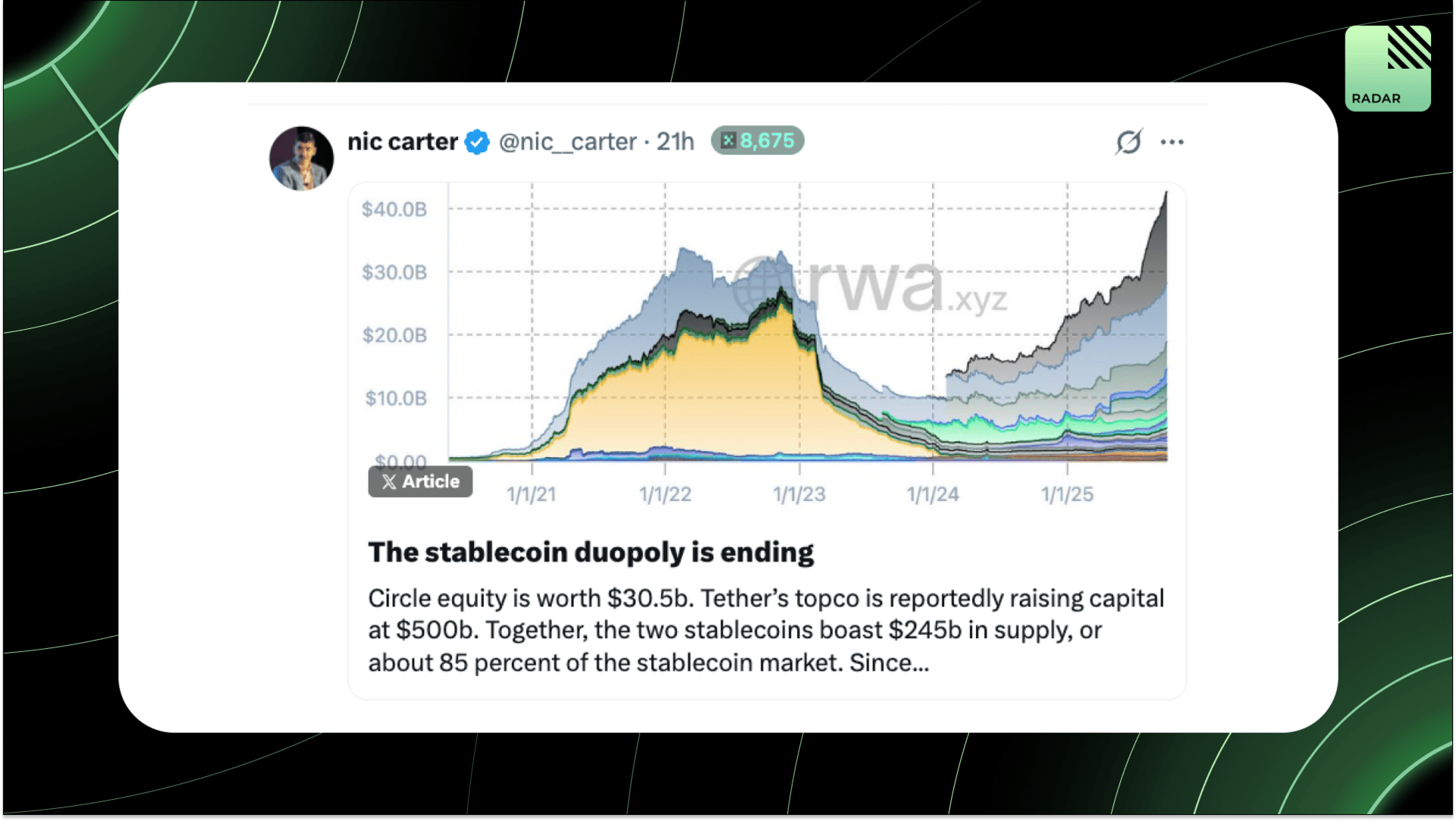

Tether & Circle’s dominance is slipping. Their market share fell from 91.6% to 86% as float-seeking apps and embedded stables (e.g., USDe, PYUSD, USDH) gain ground. Stablecoin wars now hinge on yield capture and distribution edge.

Polymarket reenters the U.S. legally. After acquiring a CFTC-regulated exchange for $112M, Polymarket has self-certified four event markets, three sports, and one election for relaunch. Trading resumes Oct 2, marking its return after a 4-year CFTC ban.

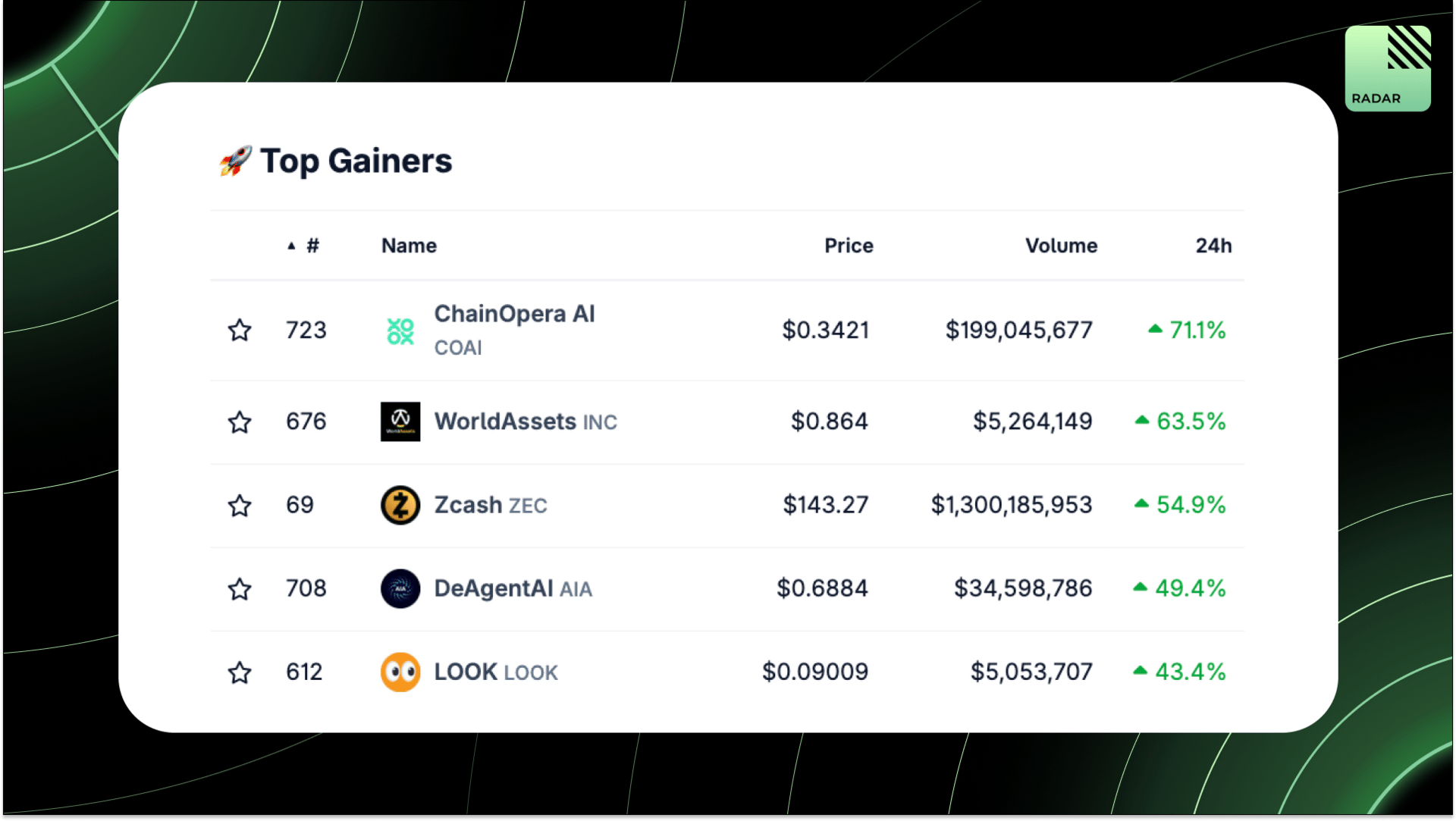

Top Gainers: COAI, INC, ZEC, AIA, LOOK.

Manta shifts focus from infra to apps. Kenny tells Laura Shin that “just being an L2” won’t cut it. Manta’s new bet is to build user-facing applications instead of competing in the overcrowded L2 race.

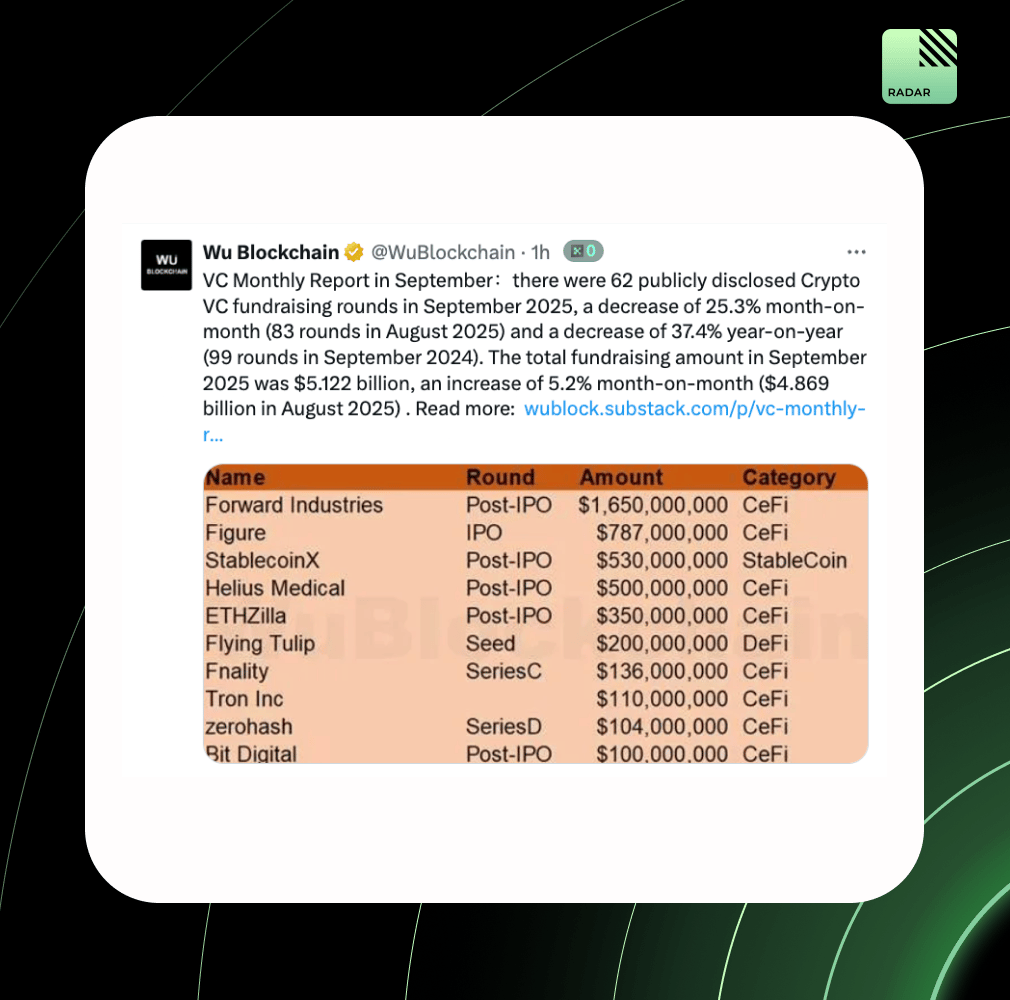

Crypto VCs slowed down in Sept: 62 rounds (–25% MoM), but $5.12B raised (+5% MoM, +739% YoY). Capital concentrated in mega PIPEs (Ford, Helius), ETH/SOL treasury plays, and RWA infra (Fnality, Zerohash). Despite fewer rounds, the bet is on scale.

Fixed risk per trade assumes all setups are equal, but they are not. Most trades won’t move your PnL, but rare high-expectancy trades will. Size down to stay sharp, but when the moment comes, size up. That’s how you compound edge over time.

That’s all for today!