- Radar-as-a-Service

- Posts

- RaaS #511: Polymarket Raises $2B!

RaaS #511: Polymarket Raises $2B!

New Pendle Competitor, ZKsync's Atlas Upgrade:GM Web3!

Rug Radio Moving to MYRIAD, BNB Crosses $1,300, and Moar!

Want RaaS without digging through your inbox? Our Telegram channel gives you the same daily crypto roundup in a quick, scrollable format. Easy to read, easy to share. Join here → RaaS Telegram Group.

Quick Intro: Radarblock is a Web3-native growth agency that increases awareness, TVL, volume, and social metrics for its clients over a consistent time frame without uncertainty and confusion. All tweets are hyperlinked, so click to pull them up on X!

PancakeSwap burned 894k CAKE ($3.24M) this week, outpacing minting by 753k CAKE. While AMM v3 led with $2.32M in burns, all segments saw declines; AMM v2 dropped 37%, AMM Infinity 54%.

Celestia is building the AWS of modular blockchains, offering cheap, scalable blockspace as a core primitive. Like AWS, it bets infra demand will explode, and aims to capture a slice of every rollup’s growth through DA, light nodes, and shared security.

Polymarket just raised a $2B strategic investment from ICE (owner of NYSE), valuing it at $9B. ICE will distribute Polymarket data to financial institutions globally, marking the biggest prediction market validation to date.

The ultimate playbook quantified: extort top protocols, launch your own token, and call everyone else clowns.

ZachXBT’s roadmap to becoming an on-chain sleuth: start by tracing wallets and experimenting across chains. Rebuild real cases from court docs. Publish dashboards that fill industry gaps. Share findings with experts. Join a forensics or security firm early to gain hands-on experience.

Strata tranches yield-bearing tokens into senior and junior slices based on interest rate volatility. Unlike Pendle, which splits principal and yield, Strata offers differentiated risk profiles, starting with USDe and aiming to expand to HLP, LLP, and more.

ZKsync’s Atlas upgrade delivers 15K+ TPS, 1-second ZK finality, and less than $0.0001 proof costs via Airbender. It enables fast, private, multi-chain settlement without legacy bridge bottlenecks, positioning ZKsync as the backbone for a modular ZK economy.

Waiter, bring me whatever Kaito’s account manager is smoking.

Zeneca highlights 27 airdrops to watch, split across 7 categories. Each has a TGE on the horizon; clearly, the airdrop meta isn’t cooling off.

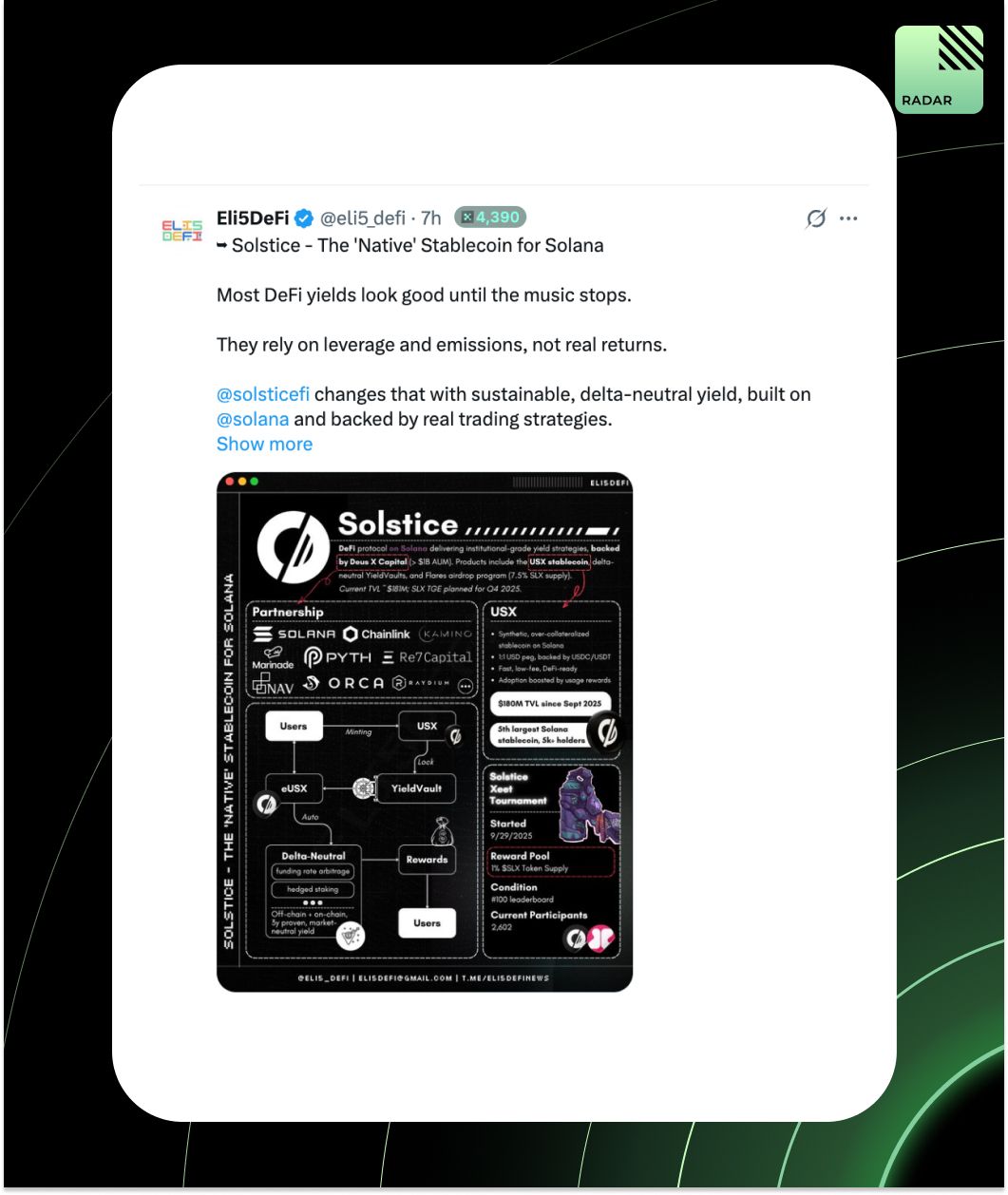

Solstice is emerging as Solana’s native stablecoin and yield layer. It’s backed by delta-neutral strategies (no emissions), already has $180M+ TVL, and is running a Flares airdrop, Xeet campaign with 1% SLX supply for early users and creators. SLX TGE expected Q4 2025.

Collector Crypt has tokenized 53K+ cards and seen $124M spent on gacha packs by ~7K wallets. Activity is rising, with normal packs driving ~64% of volume. CARDS launch spiked NFT trading to $848K, though volumes have since cooled.

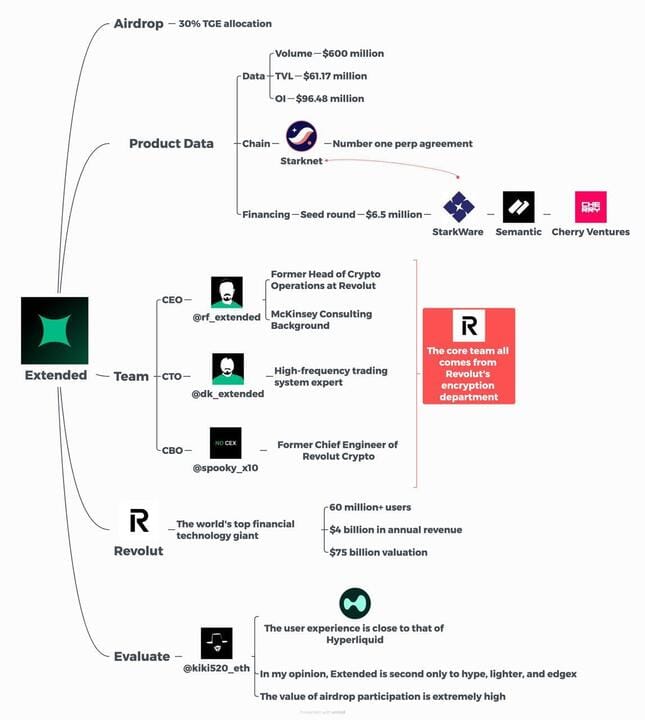

Extended is a perp DEX built by ex-Revolut execs that lets you trade using spot holdings as collateral, no need to liquidate assets for margin. Combined with tokenized vault shares, this offers a structural edge over competitors like Hyperliquid and Lighter.

Despite doing $8.5B in 30D volume and raising from top-tier backers (StarkWare, Tioga, Cherry, etc.), Extended only has ~8.4K users and $56M in TVL. And 30% of the token supply is set aside for community rewards.

If you’re looking for underfarmed airdrops with strong tech, real traction, and high upside, Extended is worth tracking.

Start farming: https://app.extended.exchange/join/RADAR

Full guide & breakdown: https://tinyurl.com/RadarExtendedThesis

NFA. DYOR. We highlight opportunities; you decide how to act.

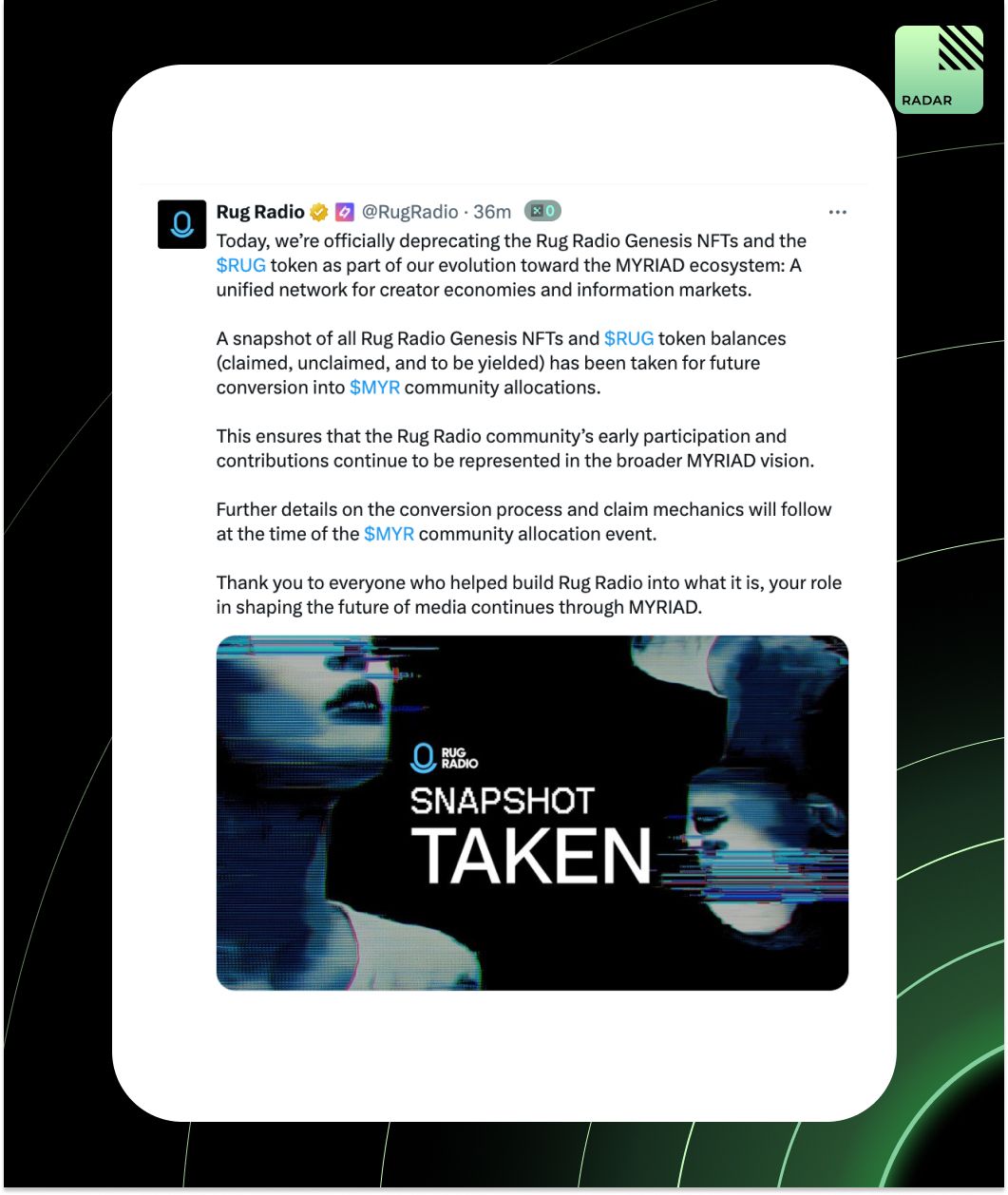

Rug Radio is sunsetting its Genesis NFTs and RUG token as it transitions to the MYRIAD ecosystem. A snapshot has been taken for future MYR allocations, ensuring early contributors are included in the next phase focused on creator economies and info markets.

BNB’s supply has shrunk by ~30% (60.8M burned), with quarterly auto-burns and per-block gas burns targeting a 100M cap. From $0.15 to $1,328 in 8 years, it’s up 7,800x.

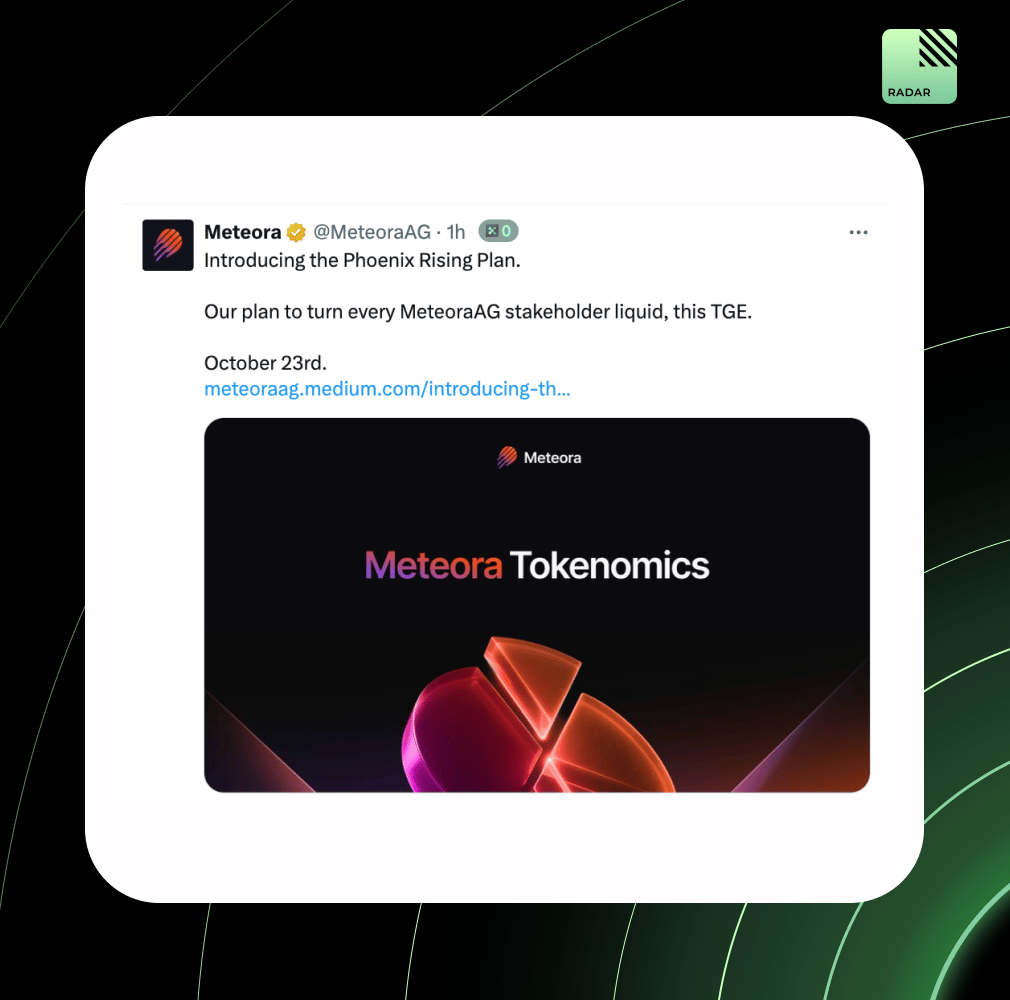

Meteora flips the script with 48% of MET’s supply liquid at TGE, no team sales, and zero vesting for early backers. Airdrops become LPs via its Liquidity Distributor, letting users earn fees instead of dumping.

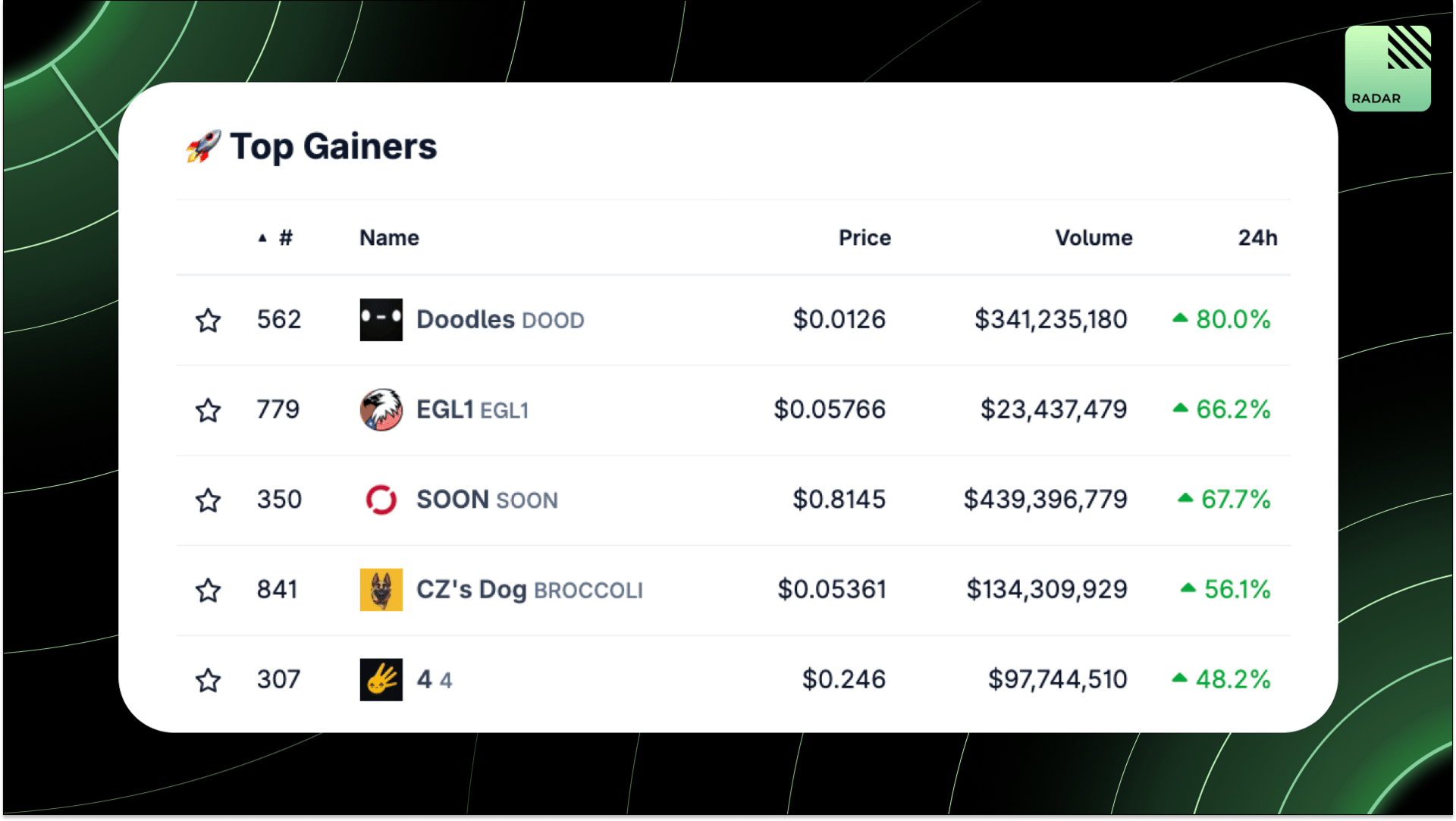

Top Gainers: DOOD, EGL1, SOON, BROCCOLI, 4.

The Wind Runner SBT honors the thinkers, builders, and creators shaping the future of Kite AI through consistent, authentic work. This is a signal. If you’re helping shape the wind, they’ll find you.

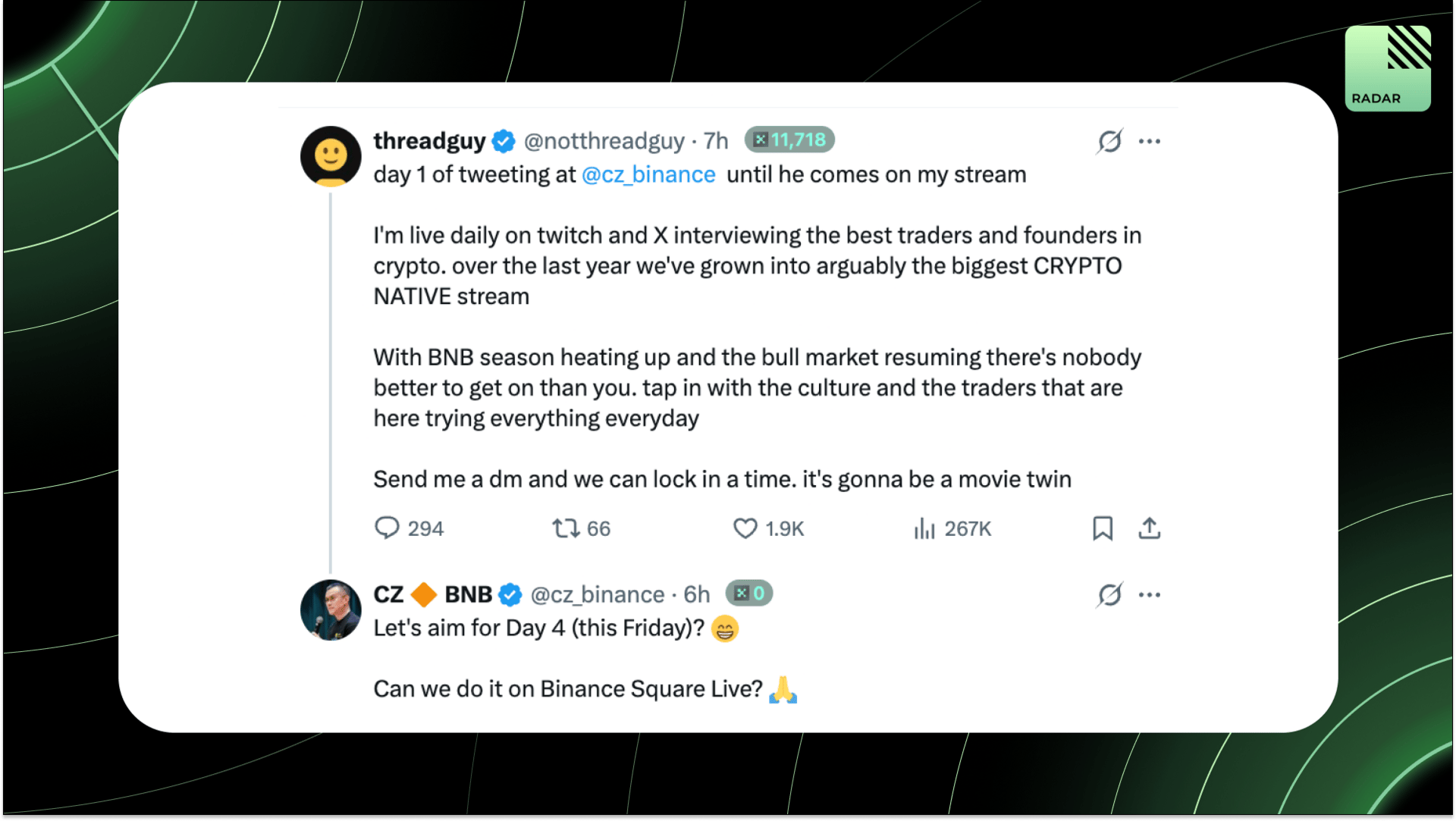

CZ agrees to join Threadguy on Binance Square Live on Friday.

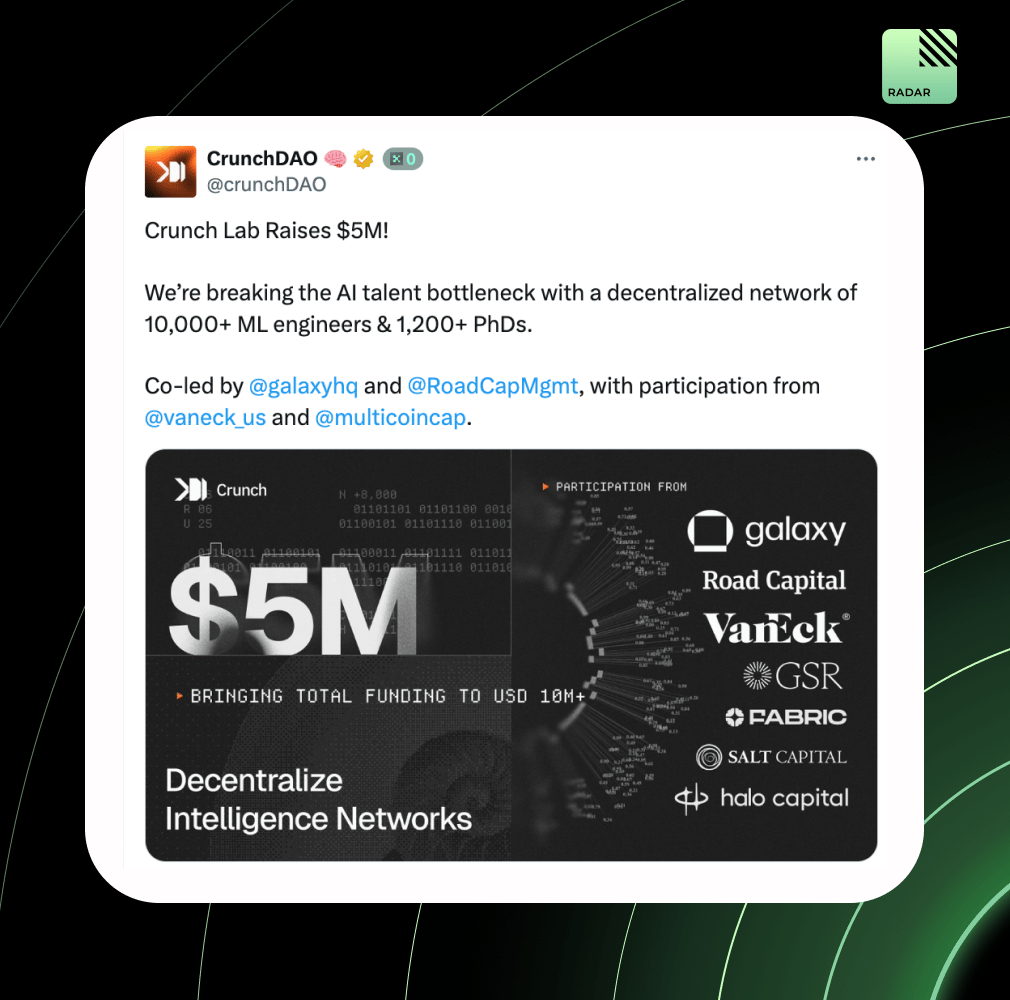

CrunchDAO raised $5M to scale Crunch Lab, a decentralized network of 10K+ ML engineers and 1.2K+ PhDs. Backed by Galaxy, Road Capital, Multicoin, and VanEck, they’re betting crowdsourced models will outcompete Big Tech’s $100M silos.

Perp DEXs are booming, and Hyperliquid’s $46.2B FDV dwarfs the rest. Aster, MYX, and APX trail far behind, while OGs like dYdX now sit under $600M. New players are commanding outsized valuations in the on-chain derivatives race.

That’s all for today!