- Radar-as-a-Service

- Posts

- RaaS #512: YZi Labs Announces $1B Builder Fund!

RaaS #512: YZi Labs Announces $1B Builder Fund!

Limitless Public Sale 200x Oversubscribed, Flying Tulip Docs Live:GM Web3!

BNB Meme Season Here, Base Token is Near, and Moar!

Want RaaS without digging through your inbox? Our Telegram channel gives you the same daily crypto roundup in a quick, scrollable format. Easy to read, easy to share. Join here → RaaS Telegram Group.

Quick Intro: Radarblock is a Web3-native growth agency that increases awareness, TVL, volume, and social metrics for its clients over a consistent time frame without uncertainty and confusion. All tweets are hyperlinked, so click to pull them up on X!

Extended is a next-gen perp DEX built by former Revolut execs, letting traders use spot assets directly as margin. Trade smarter, earn yield, and farm early airdrop, all in one platform. Start now on Extended.

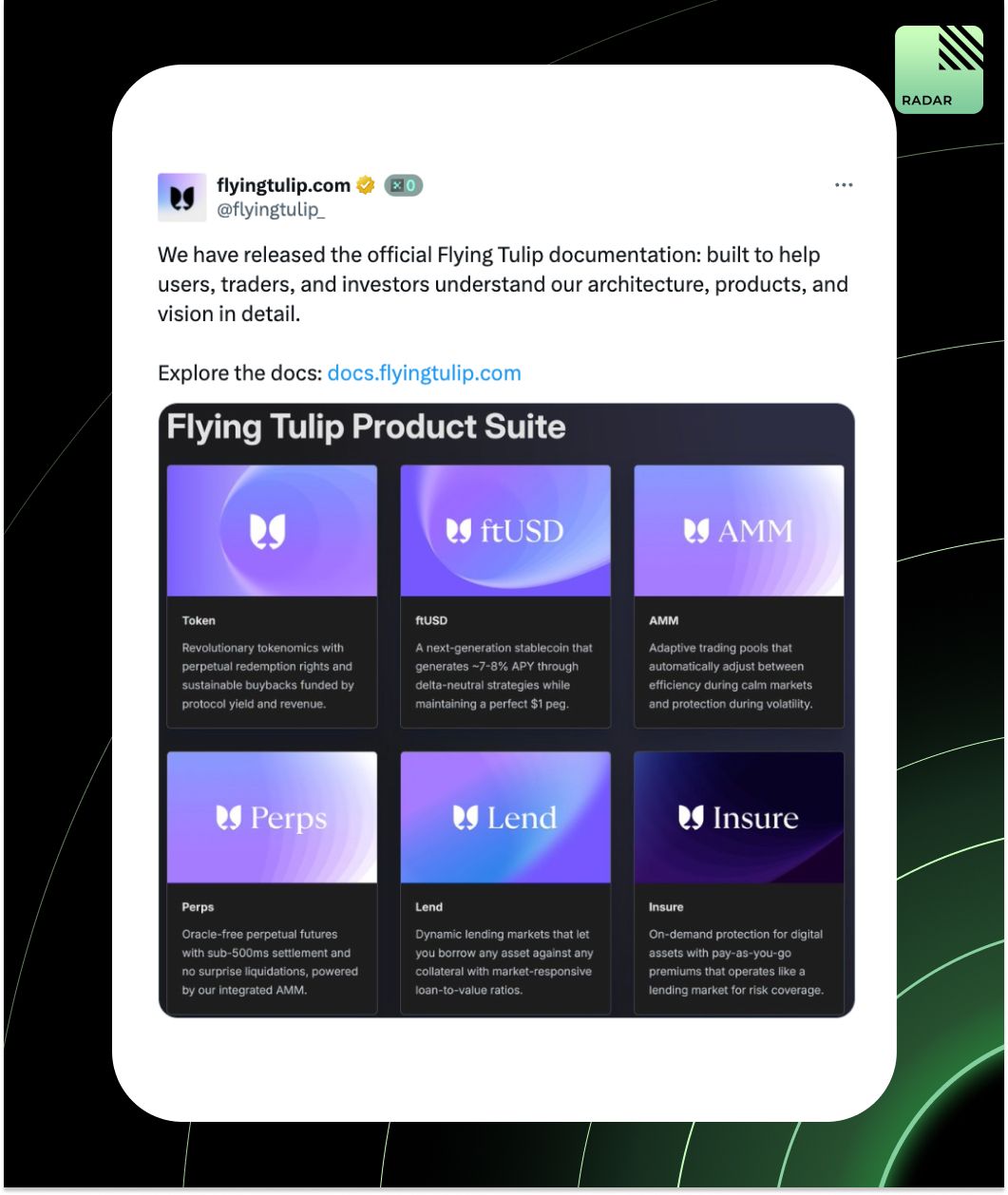

Flying Tulip releases official documentation. The team has published detailed docs outlining their architecture, product suite, and long-term roadmap.

DuneCon25 is shaping up to be a high-signal, builder-first event. With speakers from Polygon, Aave, Base, EigenLayer, Uniswap, MetaMask, Visa, Aztec, and more, it’s a who's who of on-chain infrastructure and data. Applications are now open.

Where black money once flowed beneath the surface of global economies, stablecoins are emerging as transparent liquidity backstops. In the ’80s, illicit trade made up over 5% of US consumer spending and quietly drove real estate growth. As fiat cracks under debt, gold and crypto are emerging as the new liquidity backstops.

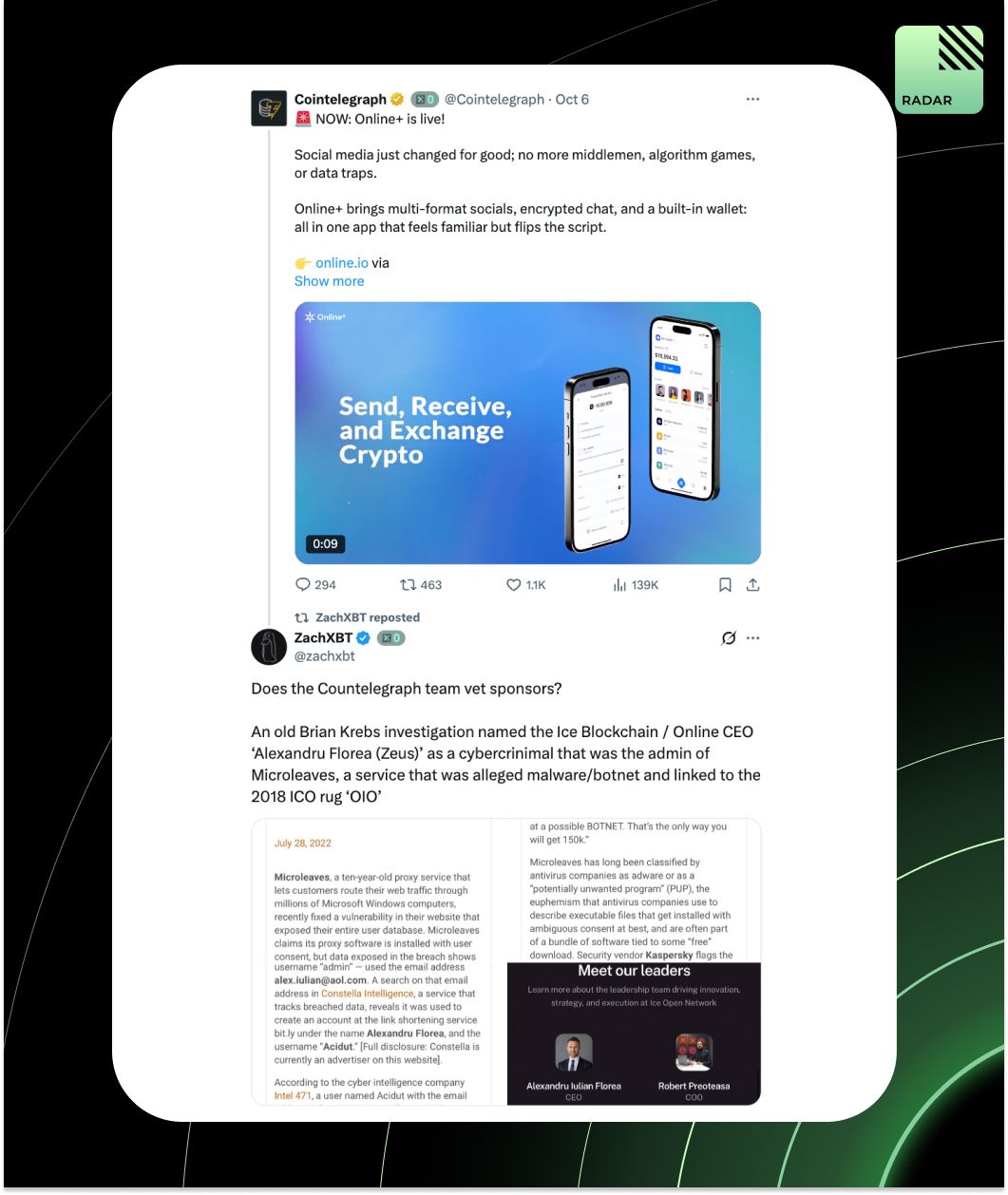

ICE Blockchain’s CEO ran Microleaves, a proxy botnet flagged by Kaspersky. He also allegedly rugged the 2018 OIO ICO. Now Cointelegraph is promoting his new app, Online, without public mention of the founder’s history.

Kaito’s Limitless sale hit $201M in pledges for just $1M in allocation, 201x oversubscribed. The average user got $31, and the median $10. Top backers, early pledgers, stakers, and Yapybaras scored higher allocations. Refunds coming in 24h. TGE later this month.

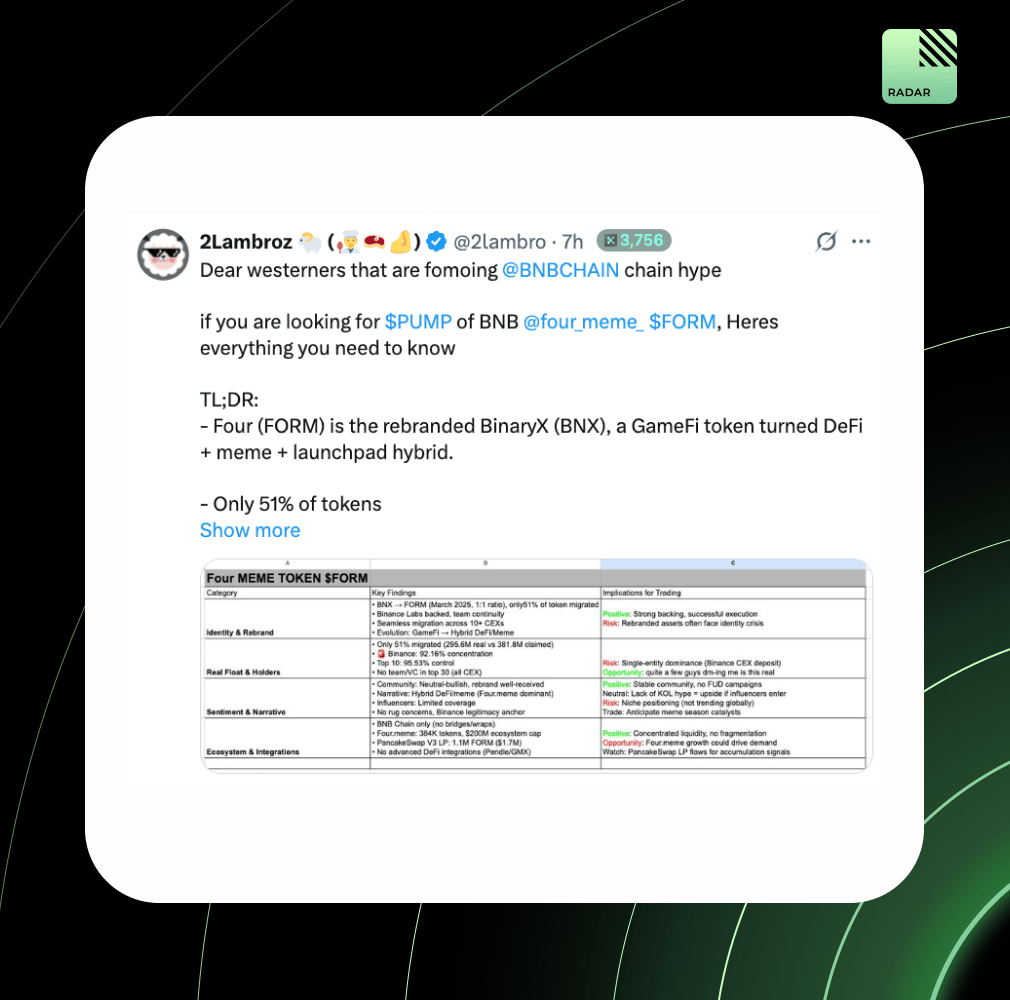

BNB Chain is trending again, and FORM is riding that wave. Born as BinaryX, FORM (Four Meme) is now a hybrid memecoin, DeFi, and launchpad backed by Binance Labs. With deep Binance liquidity, a growing ecosystem, and renewed community interest, it’s shaping up as a high-beta bet on BNB narratives.

The S&P Digital Markets 50 blends the top 15 tokens with 35 listed crypto-native companies. Rebalanced quarterly, capped at 5% per asset. BTC, ETH, XRP, & others made the list.

大表哥会救我们的!

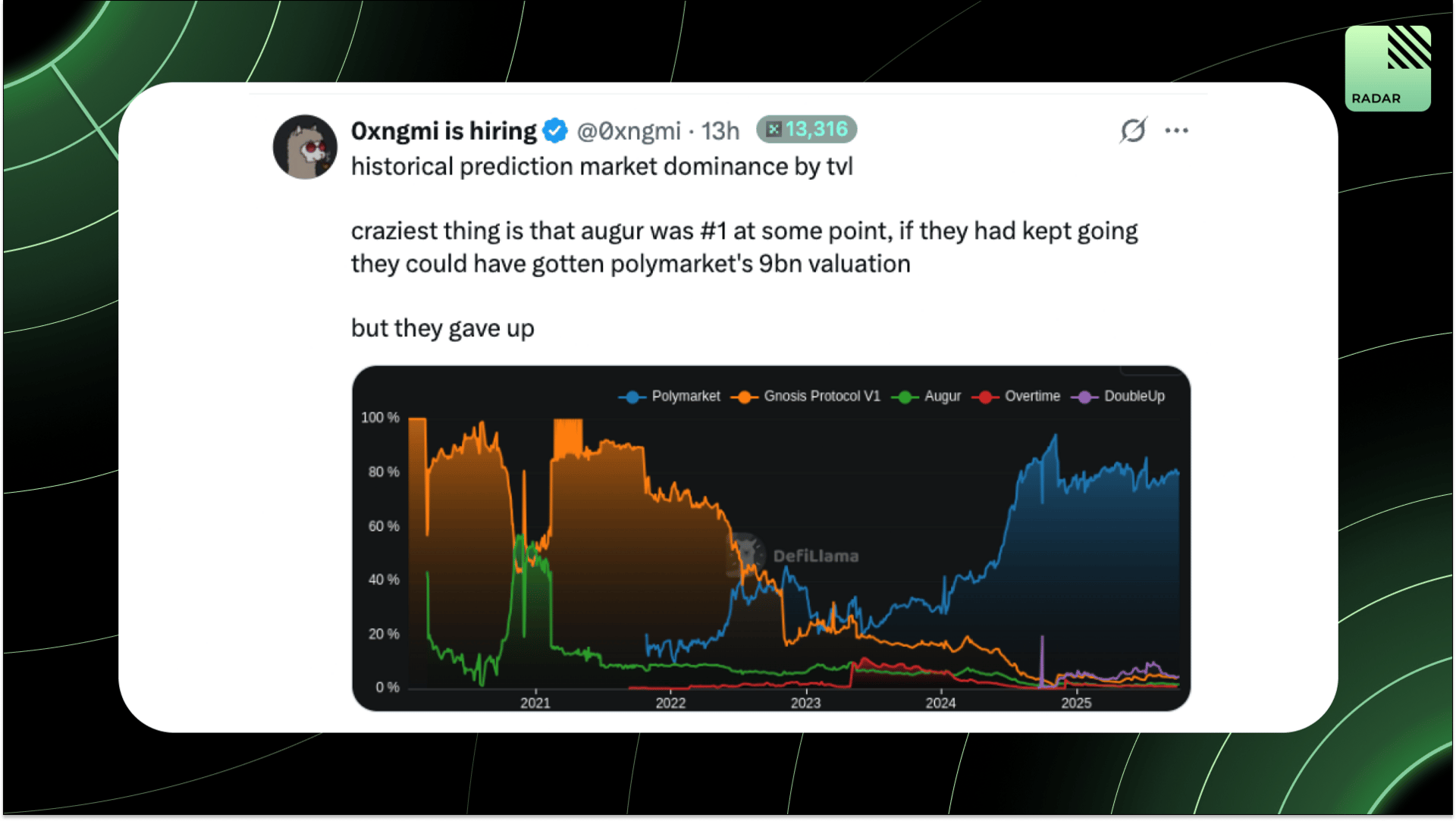

Polymarket now dominates more than 85% of prediction market TVL, but it wasn’t always this way. Augur once led the category. Their decline shows what happens when you stop shipping: others catch up, eat your market, and end up with a $9B valuation.

Base wrapped up its On-chain Summer Awards, selecting 20 standout apps from over 500 submissions across four categories: both Live & New, Mini Apps, and Consumer Apps. Winners split $200K in prizes, with a surprise $50K round dropping later this week.

MetaMask Mobile now supports perps trading, with rewards and a Polymarket integration on the horizon. It’s not just a wallet anymore, it’s turning into a full-stack trading hub for the next wave of onchain users.

BNB Chain is surging, with YZi Labs launching a $1B Builder Fund to fuel Trading, RWA, AI, DeFi, and DeSci innovation. Backed by 460M+ users, low fees, and fast infra, BNB’s MVB accelerator now runs via EASY Residency.

Big Tech no longer chases just profits but control of models, data, and minds. OpenAI’s burn rate isn’t a failure. Centralized AI creates one worldview, silencing diversity. The only escape: decentralize compute, models, and governance.

If NYSE is betting on Polymarket, it’s a bet on how markets might evolve. Polymarket turns belief into a tradable asset, merging attention with price. It gives NYSE event-driven data: real-time odds on reality itself, verifiable on Ethereum’s trustware.

Token fundraising distorts crypto. Many founders issue tokens for hype or investor exits. It splits focus, fuels speculation, and drains trust. Only tokens core to a product make sense; real builders should raise equity, not sell speculation.

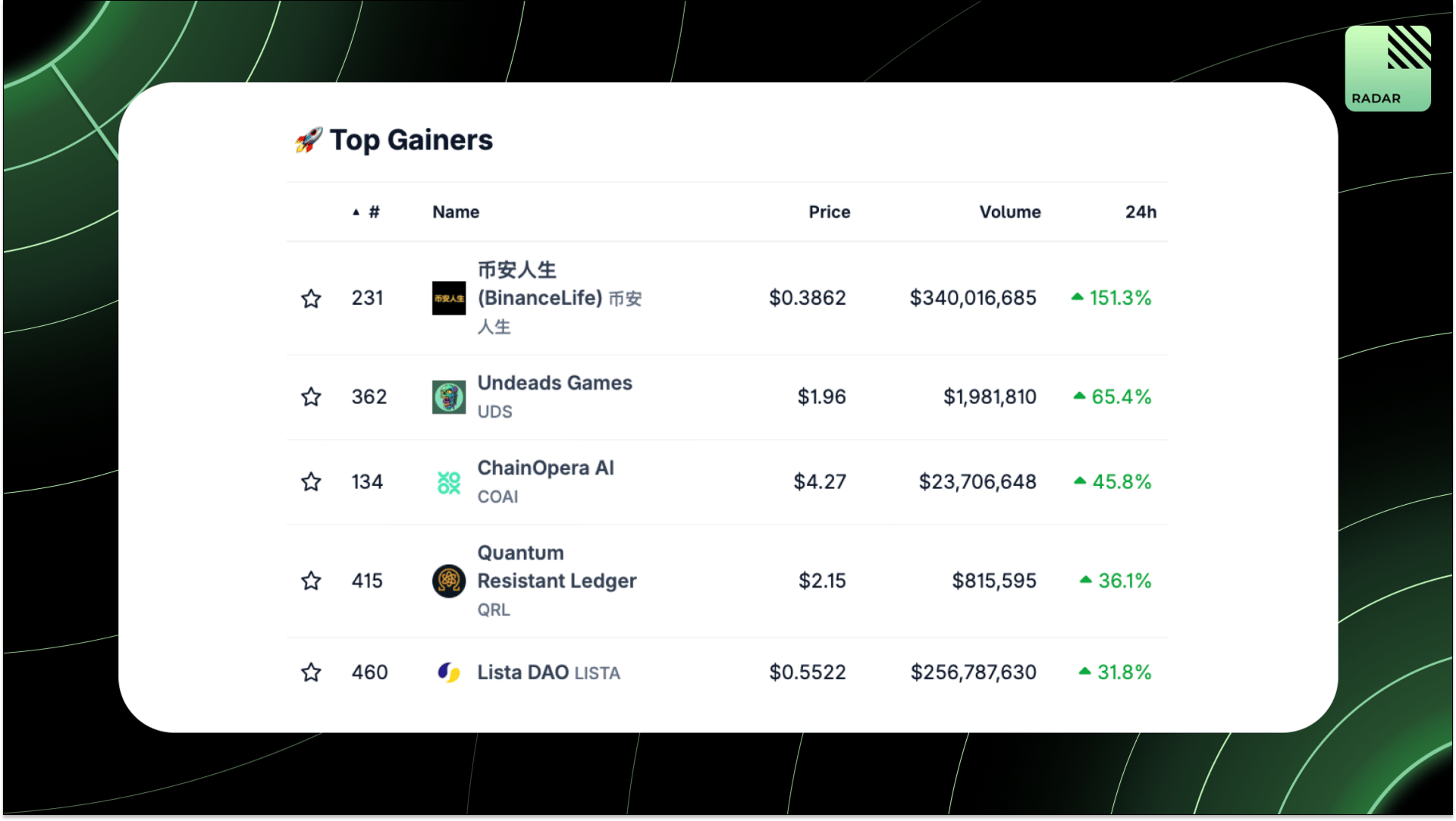

Top Gainers: 币安人生, UDS, COAI, QRL, LISTA.

BASE will be the first token launched by a public company, less about mercenary TVL, more about driving social engagement that lifts both the Base ecosystem and COIN stock. A new playbook for aligning tokens with shareholder value.

In 1944, dollars were backed by gold; in 2025, stablecoins may be backed by Bitcoin. BTC-backed stables replace banks with code, fiat reserves with on-chain collateral, and trust with math. They merge Bitcoin’s scarcity with stablecoin utility, a new, verifiable standard.

Stable redefines blockchain payments by guaranteeing predictable, congestion-free blockspace. Its reserved-capacity model ensures critical transactions settle on time and at stable costs, making stablecoins reliable for global-scale payments and enterprise-grade finance.

That’s all for today!