- Radar-as-a-Service

- Posts

- RaaS #516: Monad Claim Live!

RaaS #516: Monad Claim Live!

Elon Bullish on BTC, Circle Names Safe as Premier Institutional Partner: GM Web3!

Solana Foundation Partners with Wavebridge, Flipr Improves Token Discovery on Base, and Moar!

Quick Intro: Radarblock is a Web3-native growth agency that increases awareness, TVL, volume, and social metrics for its clients over a consistent time frame without uncertainty and confusion. All tweets are hyperlinked, so click to pull them up on X!

Get 10% off and earn Extended points by using our Code. Extended is a next-gen perp DEX built by former Revolut execs, letting traders use spot assets directly as margin. Trade smarter, earn yield, and farm an early airdrop, all in one platform. Start now on Extended.

Your daily dose of bite-sized news to stay updated.

BTC drops below $112K as ETF outflows and weak risk appetites weigh down prices.

Yield Basis TGE goes live on Oct 15, with token distribution at 10 AM UTC and spot trading starting 11 AM UTC on Binance, Kraken, and more.

Mo Shaikh launches MFV, $50M to fix capital without context. Just builders helping builders go the distance.

Fetch AI launches FetchCoder, a coding agent that reasons, maps, and deploys live agents across ASI.

Flipr improved token discovery on Base with live feeds, smart filters, and less spam.

Tria raised $12M to build a neobank for humans and AI agents. Programmable payments, self-custody, and infra that abstracts gas.

Elon says fiat is fake and Bitcoin is energy that’s impossible to fake.

High-signal reads are worth your time with the source in one place.

Robots are the next major frontier for crypto integration. This article breaks down how blockchains power robot finance, coordination, and infrastructure, and profiles five standout projects: peaq, Auki, Geodnet, CodecFlow, and Silencio.

LAB is launching on October 14 with listings on Binance Alpha, KuCoin, and Gate. Backed by $3.5M in real revenue and 30K traders, LAB’s upside comes from a deflationary model that burns 80% of fees. But only 3% float at TGE makes it a high-risk, high-reward play.

HyperBloom is relaunching its auto-compounding vaults and converting old points into non-reissuable diamonds. “Flowering Hyperliquid” marks a 5-phase roadmap to unify DeFi on HyperEVM—starting with vaults and evolving toward a full-stack aggregator.

Crypto doesn’t need more speed; it needs belief. Brother Bing argues the “last mile” is infra so fast and seamless that it turns interactions into products. Real-time chains = crypto’s YouTube moment.

Prediction market agents are automated systems that place bets based on user preferences and market signals. This piece outlines how they’ll evolve into tokenized vaults, why they’re aligned with Gen Z behavior, and what comes next.

This deep dive reveals how market makers accelerated the $19B Oct 10–11 crash by exiting en masse. Their withdrawal triggered a liquidity vacuum, ADL spirals, and forced deleveraging, turning volatility into structural failure.

Catch Blingoh, sharing his insights on Strategy & Operations. A must-listen episode for anyone navigating startup strategy.

Prediction markets mimic options: the closer to expiry, the more ‘No’ trades benefit from time decay. While systematic shorting strategies can generate steady returns, they rely heavily on risk frameworks like VaR to avoid exposure to rare but extreme events.

Solana Foundation signs MOU with Korea’s Wavebridge to build a compliant KRW stablecoin engine, tokenize money market funds (MMFs), support bank-grade on-chain settlement, and expand regulated Web3 infra. Real-world finance is getting a Solana-scale upgrade.

Monad airdrop claims are live. Connect wallets and socials before Nov 3, 13:00 UTC. Set your preferred wallet, check your power level, and wait for the mainnet.

This industry never ceases to amaze.

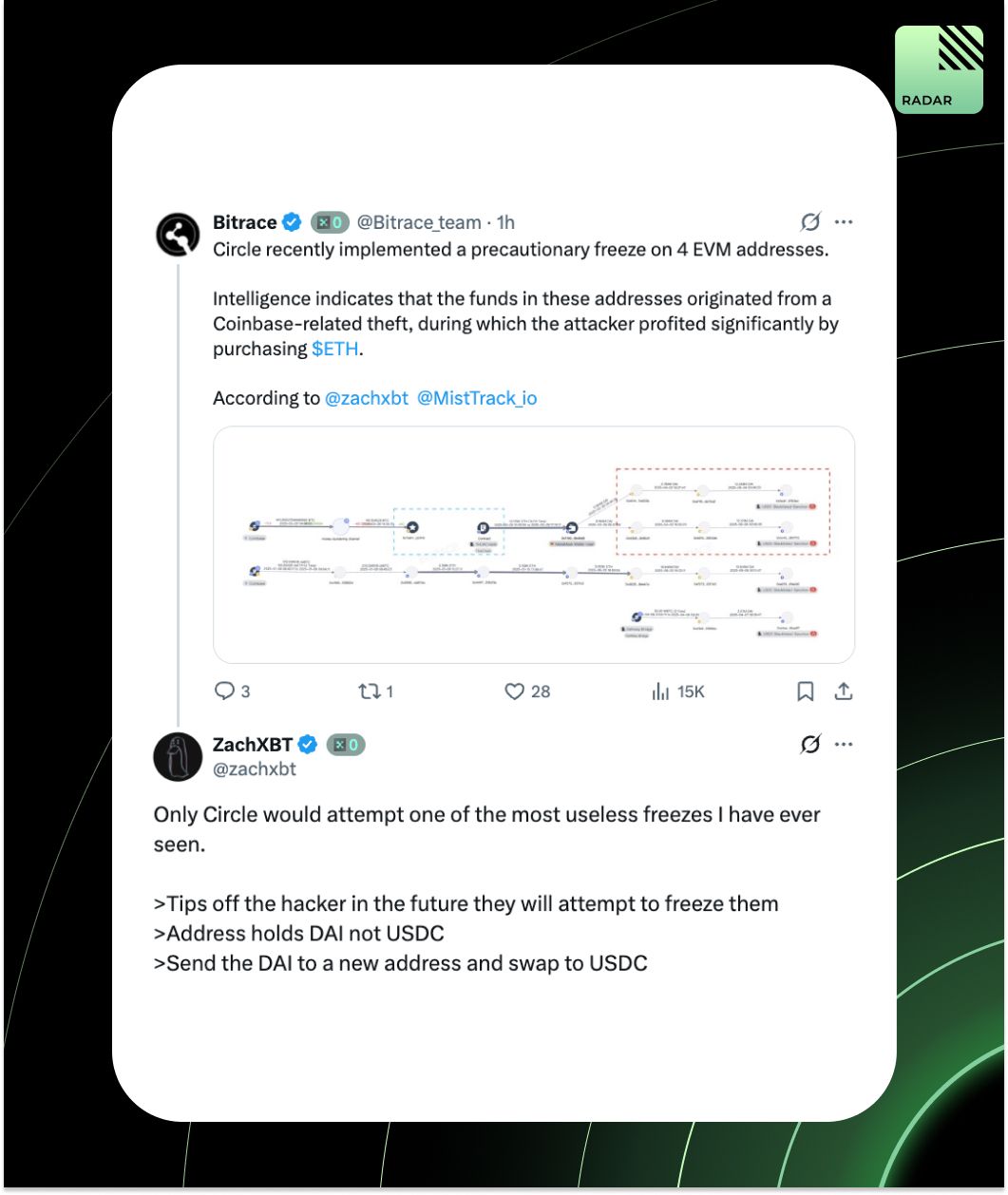

Circle froze 4 EVM addresses linked to a Coinbase theft, but critics like Zach call it ineffective, pointing out the hacker was tipped off, held DAI (not USDC), and could easily bypass the freeze by swapping assets.

Points work when users feel like they belong. When users feel like they’re building something real, they stick around even after the rewards dry up. The best systems create roots through skill, story, and shared wins.

Privy helped launch the Agent Payments Protocol with Google Cloud, Amex, Coinbase, and more, standardizing how AI agents process payments across chains. They will be upgrading chain IDs to CAIP-2 for smoother, secure agentic transactions.

Some tech.

Neura Vaults started as a Hyperliquid hackathon idea and is now building 7,540+ self-custodial, AI-managed liquidity vaults on HyperEVM. A full intelligent liquidity stack where agents, not humans, optimize capital across Hyper’s lending markets.

Want RaaS without digging through your inbox? Our Telegram channel gives you the same daily crypto roundup in a quick, scrollable format. Easy to read, easy to share. Join here → RaaS Telegram Group.

Top Gainers: CLO, H, NOCK, KGEN, META.

Circle has named Safe as its premier institutional storage partner for USDC. Safe, which already secures $2.5B+ in USDC and processes ~4% of Ethereum transactions, will now anchor USDC as the institutional default for DeFi treasuries.

October’s $20B crypto crash tested brands as much as infra. Binance calmed users, Solana/Hyperliquid flexed uptime, and Eclipse memed the pain. Silence was the default, but clarity, tone, and timing turned crisis into a narrative test for every protocol.

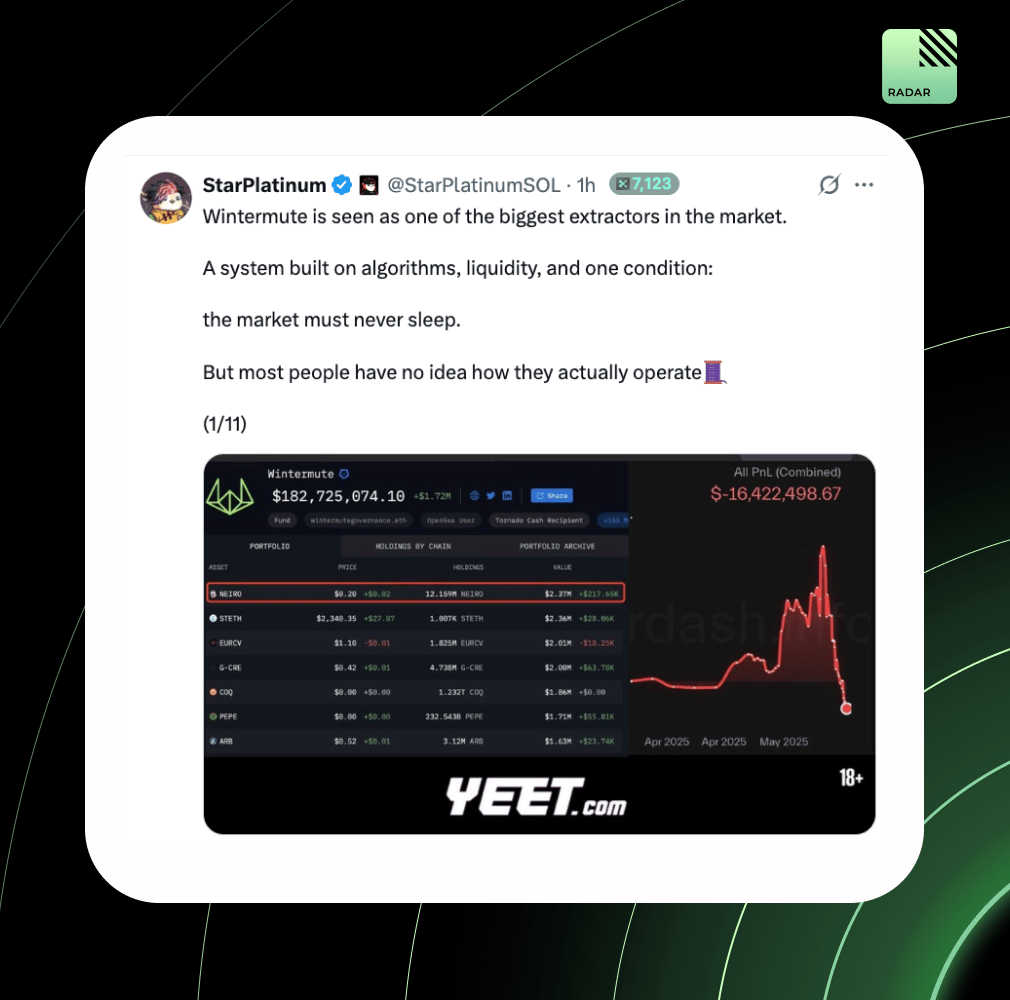

Wintermute moves fast and heavy: $546M+ across 16 chains, with top holdings in rSTETH, ETH, and stAAVE. But speed comes with shadows, $700M hit Binance hours before Oct’s crash. Still, few rival their grip on the game.

That’s all for today!