- Radar-as-a-Service

- Posts

- RaaS #517: MegaETH ICO on Sonar!

RaaS #517: MegaETH ICO on Sonar!

New Perp DEX on BNB, Almanak Extends Season 1 Timelines: GM Web3!

Ark Invest Takes a Stake in Solmate, EF Deposits in Morpho, and Moar!

Quick Intro: Radarblock is a Web3-native growth agency that increases awareness, TVL, volume, and social metrics for its clients over a consistent time frame without uncertainty and confusion. All tweets are hyperlinked, so click to pull them up on X!

Get 10% off and earn Extended points by using our Code. Extended is a next-gen perp DEX built by former Revolut execs, letting traders use spot assets directly as margin. Trade smarter, earn yield, and farm an early airdrop, all in one platform. Start now on Extended.

MegaETH’s ICO is going live today on Sonar. You can pay in USDT on mainnet, and choose a 1-year lockup for 10% off (required for US users). Allocation depends on social activity, builder activity, and on-chain activity; registration doesn’t guarantee tokens.

DeFi Dad shares 5 stablecoin yield plays: Kamino’s syrupUSDC/USDG loop (22.6%), Solstice’s eUSX (7.66%), InfiniFi’s siUSD/PT strategies (8.56–15.5%), cUSD staking on Cap (up to 14.33%), and Fluid lending (esp. GHO and USDG, up to 13.6%).

Radarblock is back with a new prediction market livestream. Our Chief Betting Officer, Yugi, sits down with Akshay and Kid Buu from Fireplace to talk about their mobile-first prediction market. Catch it live tomorrow at 1:30 PM UTC.

Kyle breaks down how to spot potential insider trades on Polymarket using Polymarket Sights: track new wallets (less than 1d old), few total trades, high radar score, and recent big bets. It’s not a foolproof alpha, but it’s a playbook for finding a sharper signal.

“Be CZ” posts from Andy hit different.

MetaMask’s upcoming Polymarket integration brings on-chain prediction markets, sports, crypto, and politics directly into the wallet. Trade, earn, speculate, and stay in custody. It’s self-sovereign finance, leveled up.

Aptos unveils a major rebrand, promising 10x performance to back its new vision: powering payments, trading, and data for billions. Aptos is positioning itself as the backbone for high-speed, high-scale value transfer.

Your daily dose of bite-sized news to stay updated.

Meteora introduces a Liquidity Distributor & Launch Pool model for MET’s TGE, letting users earn fees or claim airdrops based on how they opt in.

Reducto raises $75M in Series B, led by a16z, taking the overall funding to $108M.

Inference has raised $11.8M led by Multicoin and a16z to build task-specific Small Language Models while staying scalable and cost-efficient.

Coinbase backs CoinDCX at a $2.45B post-money. CoinDCX is now the standard-bearer for compliant crypto infra out of India.

Yield Basis is airdropping tokens to Curve voters and LPs.

CEXs saw major outflows this week, with Binance alone losing $21.75B in assets over seven days, per CoinGlass.

Superstate partners with Backpack to bring SEC-registered equities on-chain.

LiquidBNB brings MEV-resistant perps to BNB Chain using randomized sequencing and off-chain batching. Another competitor to challenge Hype.

ERC-S proposes a standard for scenario-based smart contract simulations. Scenario S#01 explores agent-led liquidity flows, enabling structured testing for AI-managed vaults like Neura on HyperEVM. Aimed at standardizing agentic DeFi behavior.

IYKYK

Want RaaS without digging through your inbox? Our Telegram channel gives you the same daily crypto roundup in a quick, scrollable format. Easy to read, easy to share. Join here → RaaS Telegram Group.

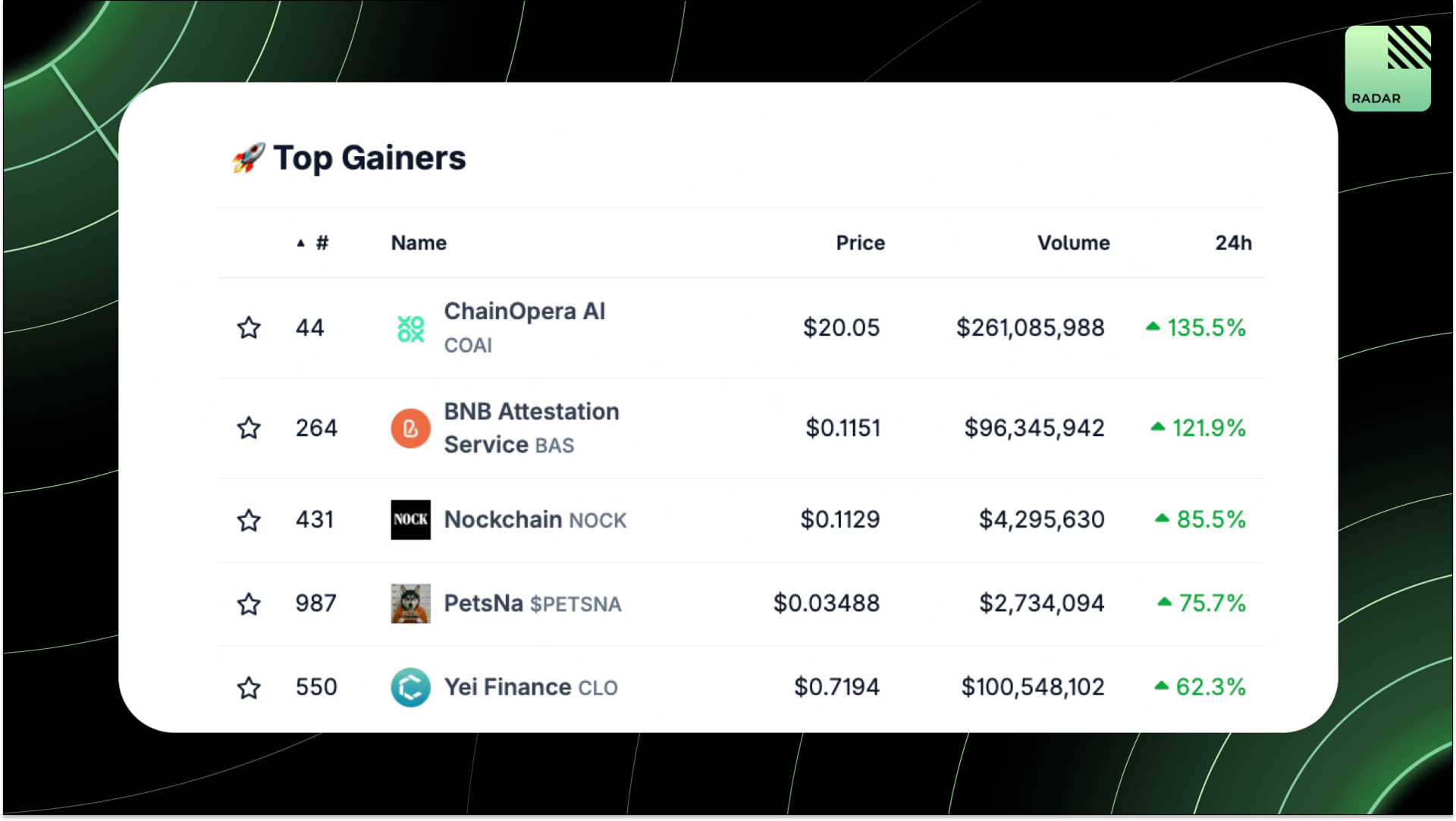

Top Gainers: COAI, BAS, NOCK, PETSNA, CLO.

Binance outlines its listing process: no listing fees, 100% token allocations go to users via campaigns; refundable deposits protect users; Alpha program offers GTM for early projects. Déjà vu much.

High-signal reads are worth your time, all in one place.

Binance’s two-minute liquidity disappearance triggered crypto’s largest-ever liquidation wave. This piece breaks down how the market collapsed before the USDe “depegged”, and why the real risk is a lack of postmortem.

Futarchy replaces voting with betting. This piece breaks down how prediction markets can govern DAOs through measurable outcomes, not opinions—and highlights early experiments by MetaDAO, Buttery, and Optimism.

Almanak is extending Points Season 1 with Stage 3 (Oct 23–Dec 11) to align with Pendle’s new alUSD pool. The goal: deepen TVL and partnerships while preserving low float ahead of TGE. Rewards increase by 1.67% of the supply.

Perps feed on volatility; prediction markets don’t. This article explains how Limitless offers liquidation-free trading with fixed outcomes and fees, and why conviction-based markets outperform leverage in black swan events.

ARK Invest has taken an 11.5% stake in Solmate (SLMT), which bought $50M worth of discounted SOL to build bare-metal validators in Abu Dhabi.

The EF deposited 2400 ETH & $6M stables into Morpho vaults, citing alignment with FLOSS values. Morpho’s GPL licensing ensures forkability and resilience, reinforcing EF’s defipunk-aligned treasury strategy focused on open, permissionless DeFi.

Stable integrates Morpho’s $12B lending layer to power its new “Earn” feature, bringing yield access directly into digital payments. This blends stablecoin utility with DeFi infrastructure, signaling a tighter merge between spendability and yield.

That’s all for today!