- Radar-as-a-Service

- Posts

- RaaS #518: BlackRock to launch GENIUS Act-compliant MMF!

RaaS #518: BlackRock to launch GENIUS Act-compliant MMF!

Echo Participants Eligible for Monad Airdrop, Daylight Raises $75M: GM Web3!

Paxos Fat Fingered PYUSD Mint, Ink’s Native Trading Platform, and Moar!

Quick Intro: Radarblock is a Web3-native growth agency that increases awareness, TVL, volume, and social metrics for its clients over a consistent time frame without uncertainty and confusion. All tweets are hyperlinked, so click to pull them up on X!

MET TGE is now live. Backed by $12B+ in liquidity, MET powers tokenized asset markets with execution rails, native liquidity, and an on-chain coordination layer. It’s the infrastructure stack behind Meteora’s push toward a fully tokenized financial future.

Tydro, built on Aave v3, is now live as Ink’s native lending protocol. Users can supply, borrow, and earn on assets like USDT0, USDG, wETH, and more. It powers Ink’s on-chain liquidity and opens up credit rails for both users and developers.

We dive into Fireplace on Prediction Thursdays. Chief Betting Officer Yugi hosts co-founders Sumer & Akshay to explore their mobile-first prediction market and vision for betting on-chain. Missed it? Catch the recording. 👇️

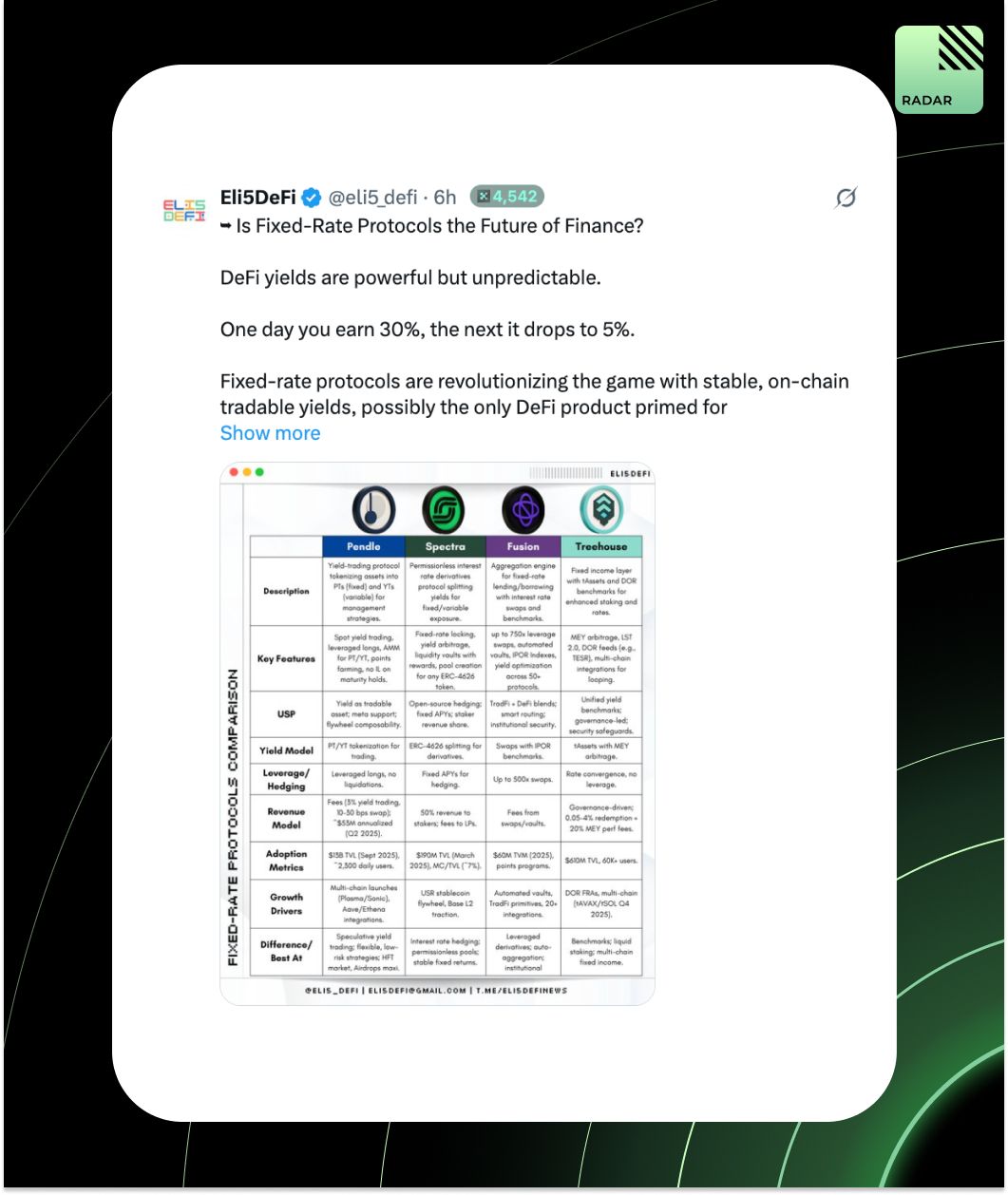

Fixed-yield DeFi is heating up. Pendle, Spectra, Fusion, and Treehouse each bring new approaches to predictable on-chain income, turning yield into a tradable, swappable, or benchmarked asset class built for composability.

How come SOL maxis haven’t pointed this out?

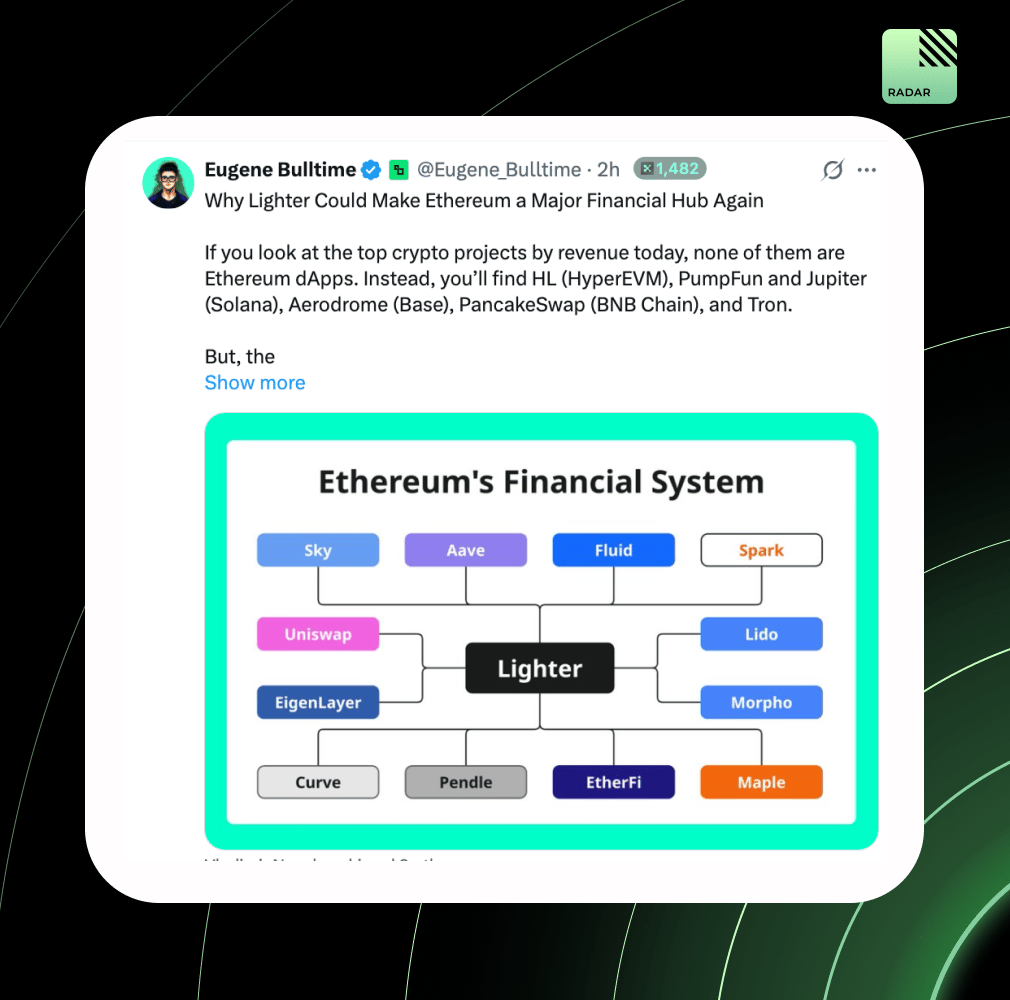

Ethereum’s DeFi stack is deep but underutilized. Lighter fixes this by becoming the central exchange layer, enabling spot/perp trading, cross-margin, and collateral reuse across tokens, LPs, and vaults, all without leaving Ethereum.

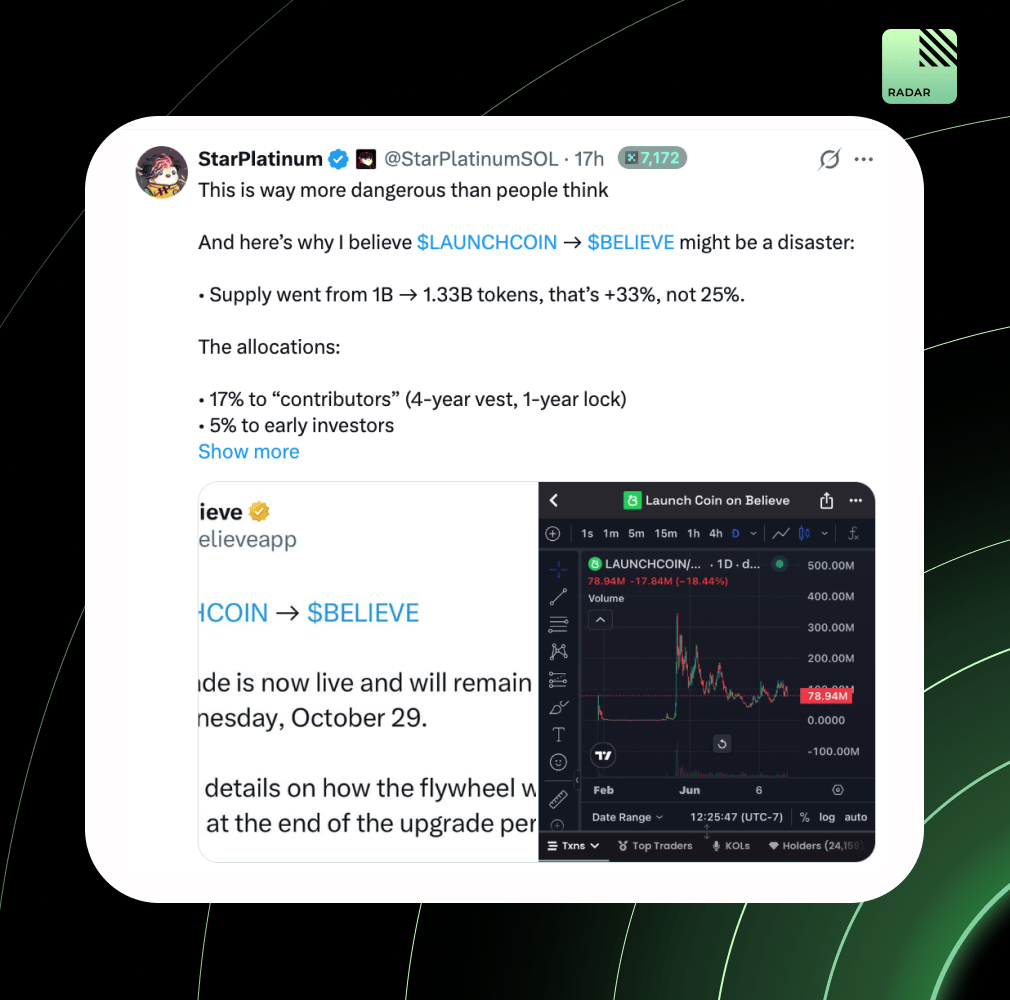

Believe (formerly LaunchCoin) claimed token supply increased by 25%, in reality, supply jumped 33%, revenue’s down 94%, and there’s no flywheel. The app’s empty, and token holders are still waiting on “details soon.”

Your daily dose of bite-sized news to stay updated.

Jito raises $50M from a16z crypto as BAM goes live and JitoSol ETFs gain traction.

Echo confirms that anyone who ever invested in a deal is eligible for the Monad airdrop.

Daylight raises $75M to turn electricity into an asset class.

Paxos fat-fingered extra PYUSD into existence.

Uniswap’s NFTStrategy by TokenWorks hits $230M+ in volume, letting users accumulate, exit, and burn NFTs via structured strategies.

BlackRock to launch GENIUS Act-compliant money market fund this Thursday, aiming to streamline reserves custody for stablecoin issuers.

Most creators treat InfoFi like a farm. The best treat it like a system. This thread maps the system, clear incentives, and predictable loops.

Kevin hurts me in unimaginable ways.

Want RaaS without digging through your inbox? Our Telegram channel gives you the same daily crypto roundup in a quick, scrollable format. Easy to read, easy to share. Join here → RaaS Telegram Group.

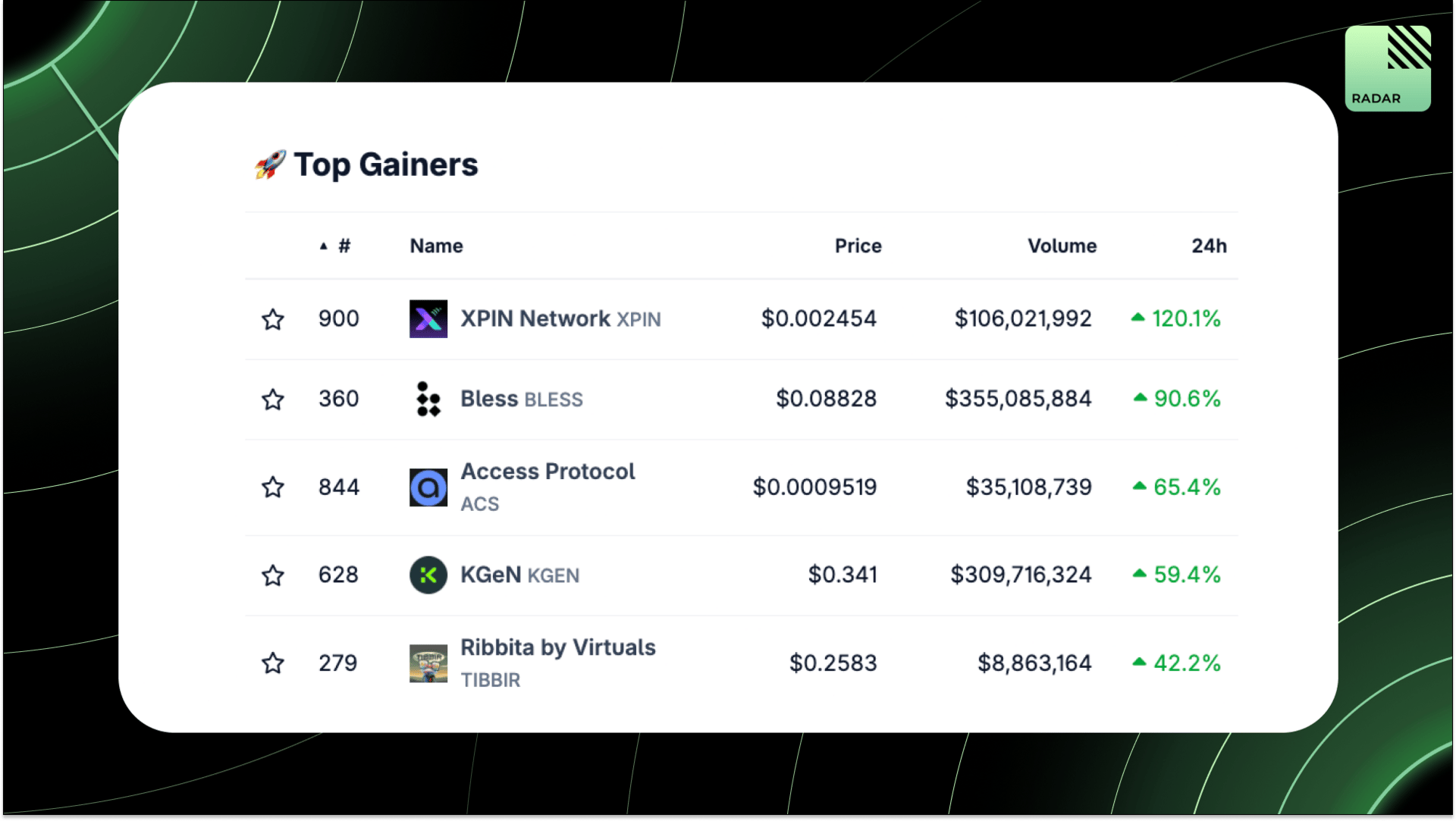

Top Gainers: XPIN, BLESS, ACS, KGEN, TIBBIR.

Turtle airdrop checker is live, and you can check your eligibility on the link below.

High-signal reads are worth your time, all in one place.

Kalshi is streaming regulated prediction data on-chain via Pyth, Stork, and Switchboard. This positions it as DeFi’s source of truth, bridging compliance-grade markets with Web3-native applications.

ICOs are back, rebuilt with KYC, reputation scores, and liquidity mechanics. Platforms like Echo, Legion, and MetaDAO are turning token launches into structured, compliant raises.

Bittensor is evolving into a DeAI economy. This piece breaks down TAO emissions, alpha token dynamics, subnet strategy, and how dTAO aligns capital with useful AI, plus rising institutional tailwinds.

Chainlink integrates real-time oracles natively on MegaETH, enabling sub-ms data pulls for perps, stables, and predictions. A major unlock for CEX-speed DeFi with full on-chain composability.

Perps failed in the October dump. Oracles lagged, ADLs spiked, and MMs disappeared when volatility hit. Risk sizing and stop-losses outperformed fancy hedges.

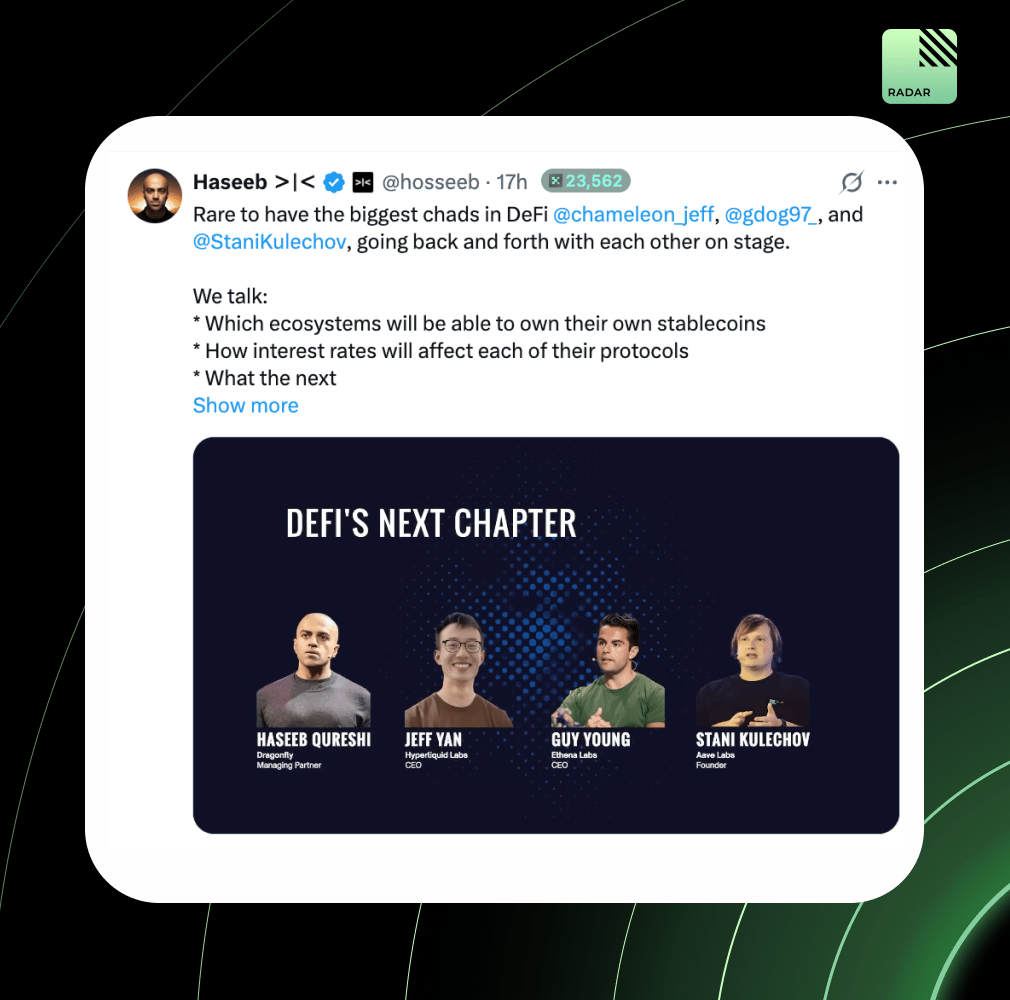

Three of DeFi’s most influential founders shared a stage. Stani, Guy, and Jeff clashed on stablecoin design, rate impact, and protocol survival. Worth the watch.

MegaETH is solving the scalability trilemma by separating execution and validation. With stateless verification & Pi Squared’s dual clients, it enables 10ms blocks without trust assumptions or a data center.

That’s all for today!