- Radar-as-a-Service

- Posts

- RaaS #521: Coinbase Acquires Echo!

RaaS #521: Coinbase Acquires Echo!

Brian Armstrong Burns UpOnly NFT, SharpLink Buys ETH: GM Web3!

Polymarket Launches 15 Minute Market, Gemini Launches Solana Credit Card, and Moar!

Quick Intro: Radarblock is a Web3-native growth agency that increases awareness, TVL, volume, and social metrics for its clients over a consistent time frame without uncertainty or confusion. All tweets are hyperlinked, so click to pull them up on X!

This post is like a 7-year diary distilled into pure signal. Minty’s 50 lessons walk the line between trader wisdom and life advice: no fluff, just hard-won truths on risk, mindset, execution, and CT illusions.

Coinbase has acquired Echo, an on-chain capital raising platform. The goal is to match builders with capital, expand investor access, and further Coinbase’s long-term bet on democratizing capital formation on-chain.

Backroom has launched a new ICM incubator called ‘Backroom Deals’ on Base, powered by AerodromeFi. Builders get full-stack acceleration (design, GTM, liquidity, distribution), while ROOM stakers access curated deal flow.

Is $400M enough to retire?

CoinGecko highlighted that with MetaMask’s upcoming token and the rumored launch from Base, the 2025 airdrop season is shaping up to be one of the largest yet, underscoring the importance of early usage and point‑driven eligibility systems.

Over 15K users are sprinting to the finish line for Buidlpad’s MMT UGC Squad challenge. Today is the final chance to join and claim $150 worth of MMT allocation on priority.

Your daily dose of bite-sized news to stay updated.

Brian Armstrong confirms the acquisition & burning of the UpOnlyTV NFT, signaling the show’s return.

SharpLink adds 19,271 ETH to its stack, bringing total holdings to 859,853 ETH.

Turtle raised a $5.5M strategic round to expand its on-chain liquidity distribution protocol.

Polymarket launches a new 15-minute BTC market with real-time up/down resolution.

YZi Labs doubles down on Sign with a follow-on investment to expand national blockchain infrastructure built on BNB Chain.

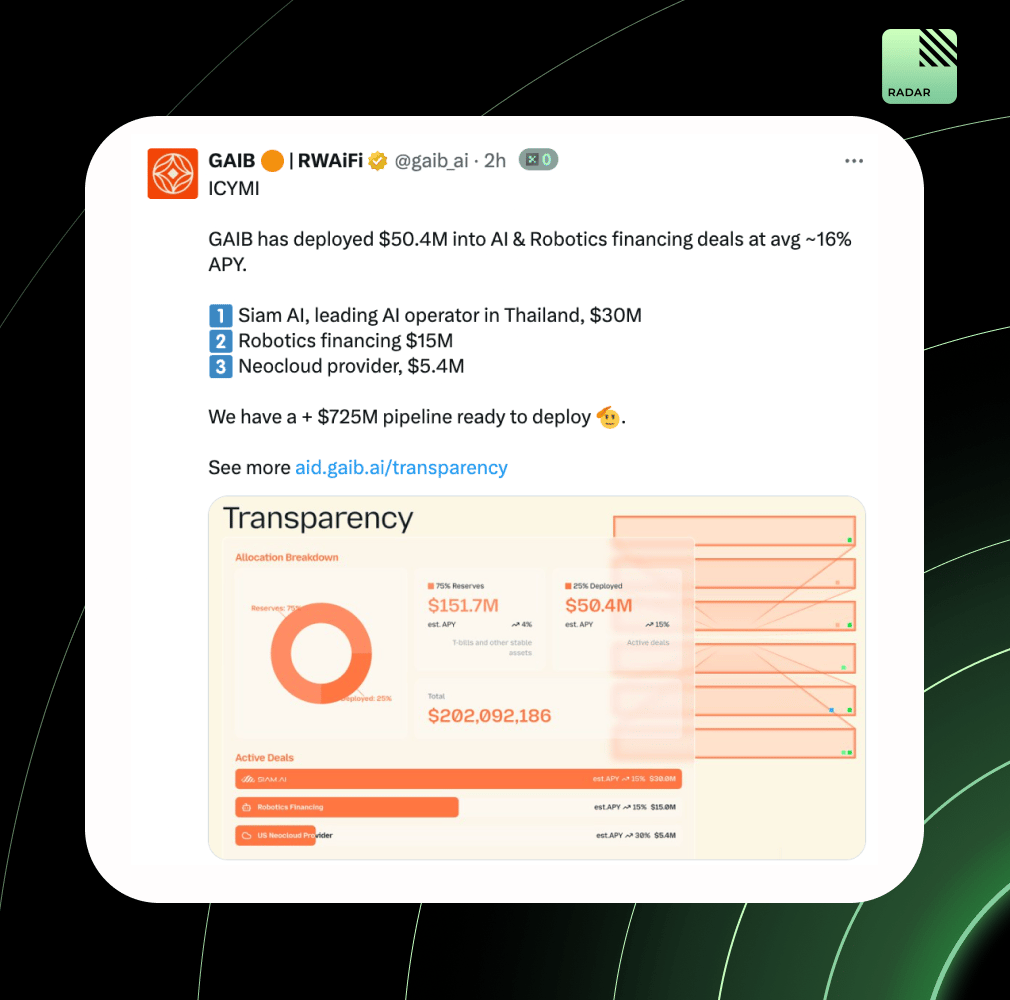

GAIB has deployed $50.4M into AI & robotics, earning ~16% APY, backing Siam AI ($30M), robotics infra ($15M), and a neocloud provider ($5.4M). With a $725M+ pipeline in tow, the RWAiFi thesis is scaling fast.

Bull run back?

Want RaaS without digging through your inbox? Our Telegram channel gives you the same daily crypto roundup in a quick, scrollable format. Easy to read, easy to share. Join here → RaaS Telegram Group.

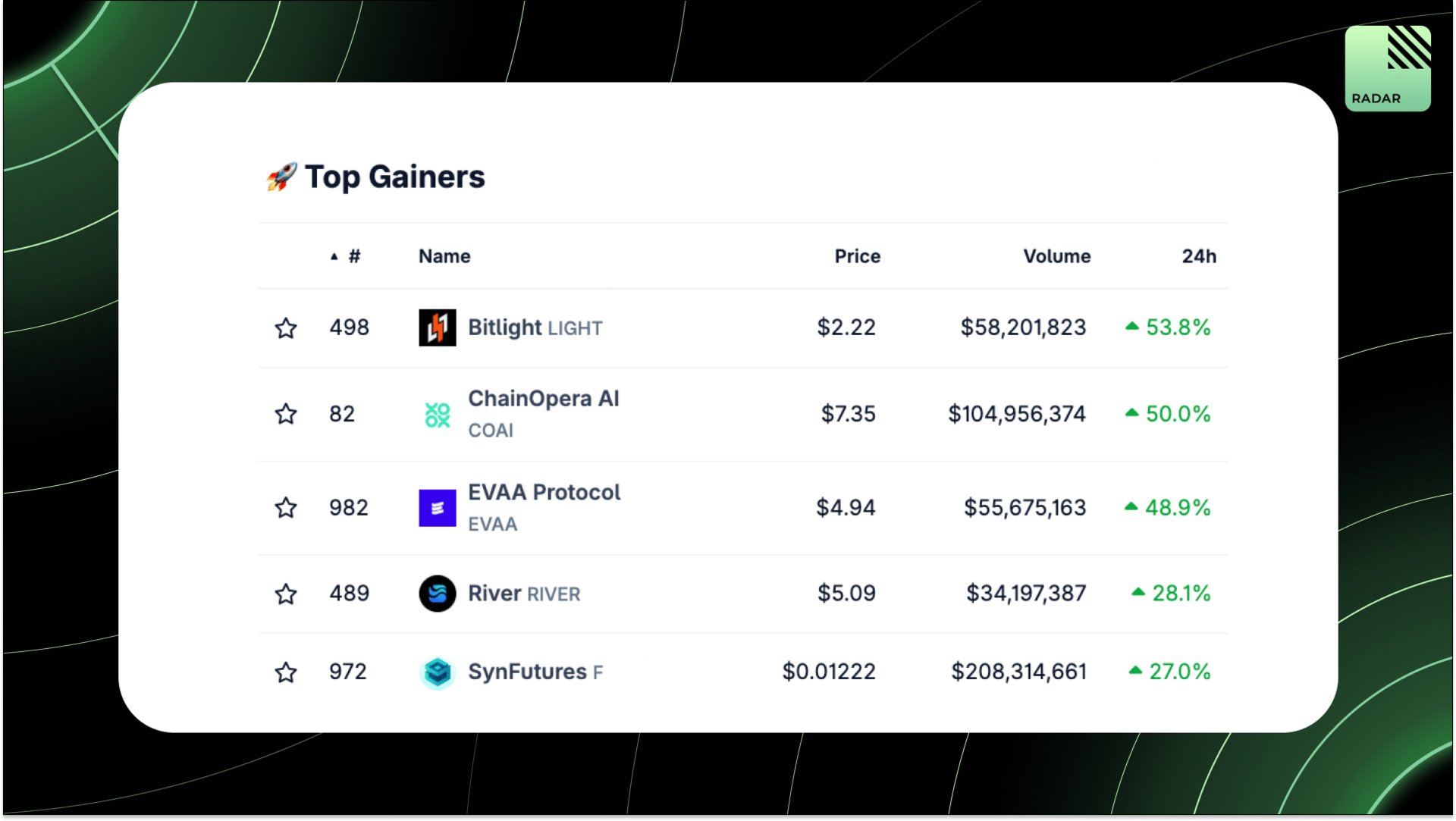

Top Gainers: LIGHT, COAI, EVAA, RIVER, F.

ZachXBT tested Zashi’s Near Intents integration by bridging SOL to ZEC to ETH via Crosspay. He found that refund transactions sent to static t-addresses leak linkability, breaking ZEC privacy. Zashi confirmed fixes are coming, but current users are at risk of deanonymization.

High-signal reads are worth your time, all in one place.

Crypto pessimism is rising, but it is misplaced. Like dot-coms, failure is noise in early tech cycles. Despite scams, crypto has built global infrastructure, new assets, and real use cases. The upside remains exponential.

Parlays could be the killer app for prediction markets. Like in sports betting, bundling bets across crypto, politics, or war could unlock $6.7B in volume and $400M in revenue, if infra and liquidity gaps are solved.

In these markets, a single wrong click can wipe you out. In crypto, losses hit hard, financially and existentially. Everyone loses: money, peace, or both. Winners lose slower and keep clicking.

Mention Markets are growing fast on Kalshi, offering unique profit paths. By betting on whether a word will be said in real-time events, traders blend transcript analysis with intuition (“vibes”) to price likelihoods.

Peter Szilágyi revealed a letter accusing the Ethereum Foundation of centralization. He claims 5–10 insiders and 1–3 VCs form a Vitalik-centric group, influencing project success. Raises questions about Ethereum’s governance optics.

Privacy will scale crypto next. Blockchains collapsed the observability gradient; everything’s public, always. ZKPs and TEEs reintroduce selective privacy, enabling more diverse, autonomous markets.

Gemini launched a Solana Credit Card that lets users earn and auto-stake SOL on every fiat spend. The card is metal, limited edition, and tied to Solana’s branding.

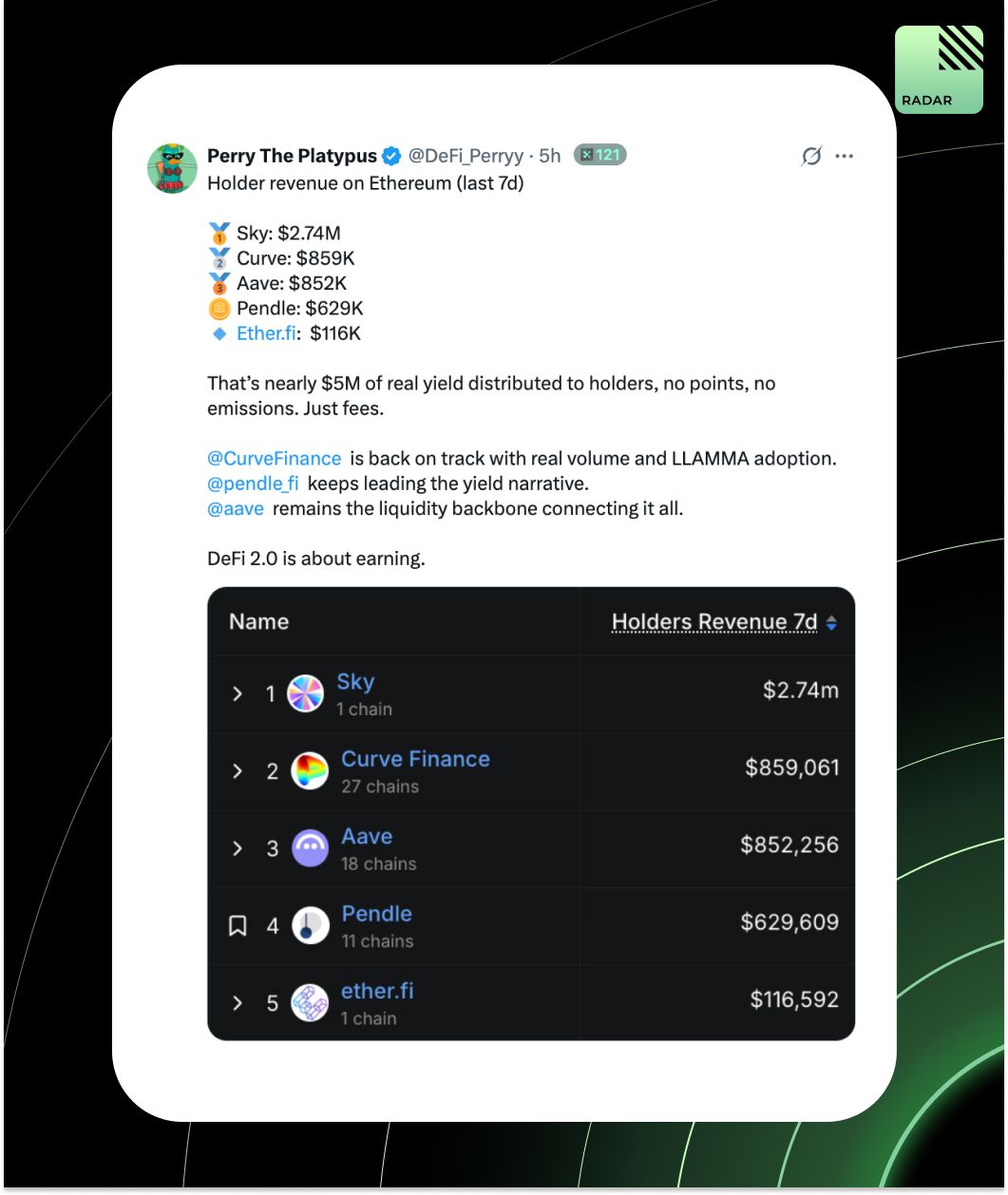

In the past week, Ethereum DeFi protocols distributed nearly $5M in fees, without incentives, emissions, or points. Sky led with $2.74M, followed by Curve ($859K), Aave ($852K), and Pendle ($629K). DeFi 2.0 is all about earning.

That’s all for today!