- Radar-as-a-Service

- Posts

- RaaS #523: MegaETH Public Sale on Sonar!

RaaS #523: MegaETH Public Sale on Sonar!

a16z’s State of Crypto Live, Aster DEX Launches Rocket Launch: GM Web3!

KuCoin Launches KuPool, Polymarket is Raising Again, and Moar!

Quick Intro: Radarblock is a Web3-native growth agency that increases awareness, TVL, volume, and social metrics for its clients over a consistent time frame without uncertainty or confusion. All tweets are hyperlinked; click to view them on X.

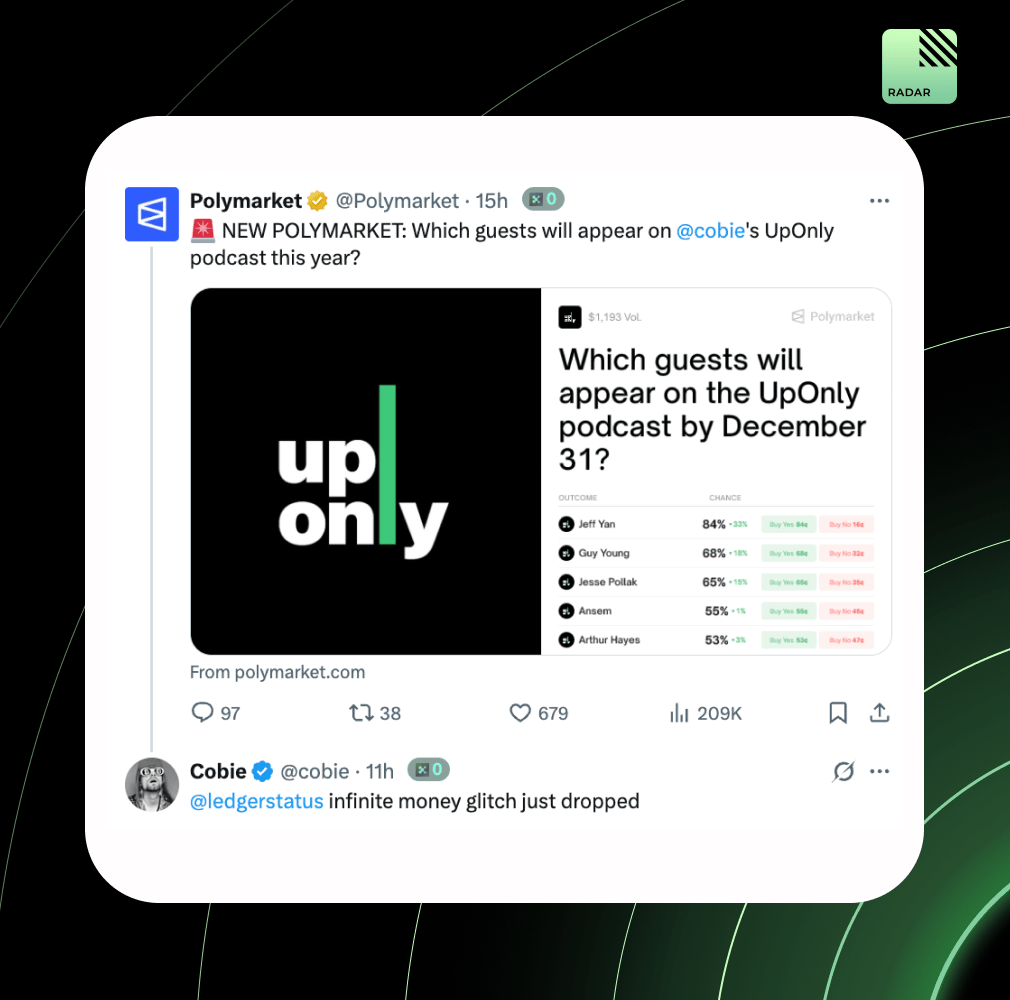

Polymarket launched a new market letting users bet on which guests will appear on Cobie’s UpOnly podcast in 2025. Infinite money for Cobie & Ledger Status.

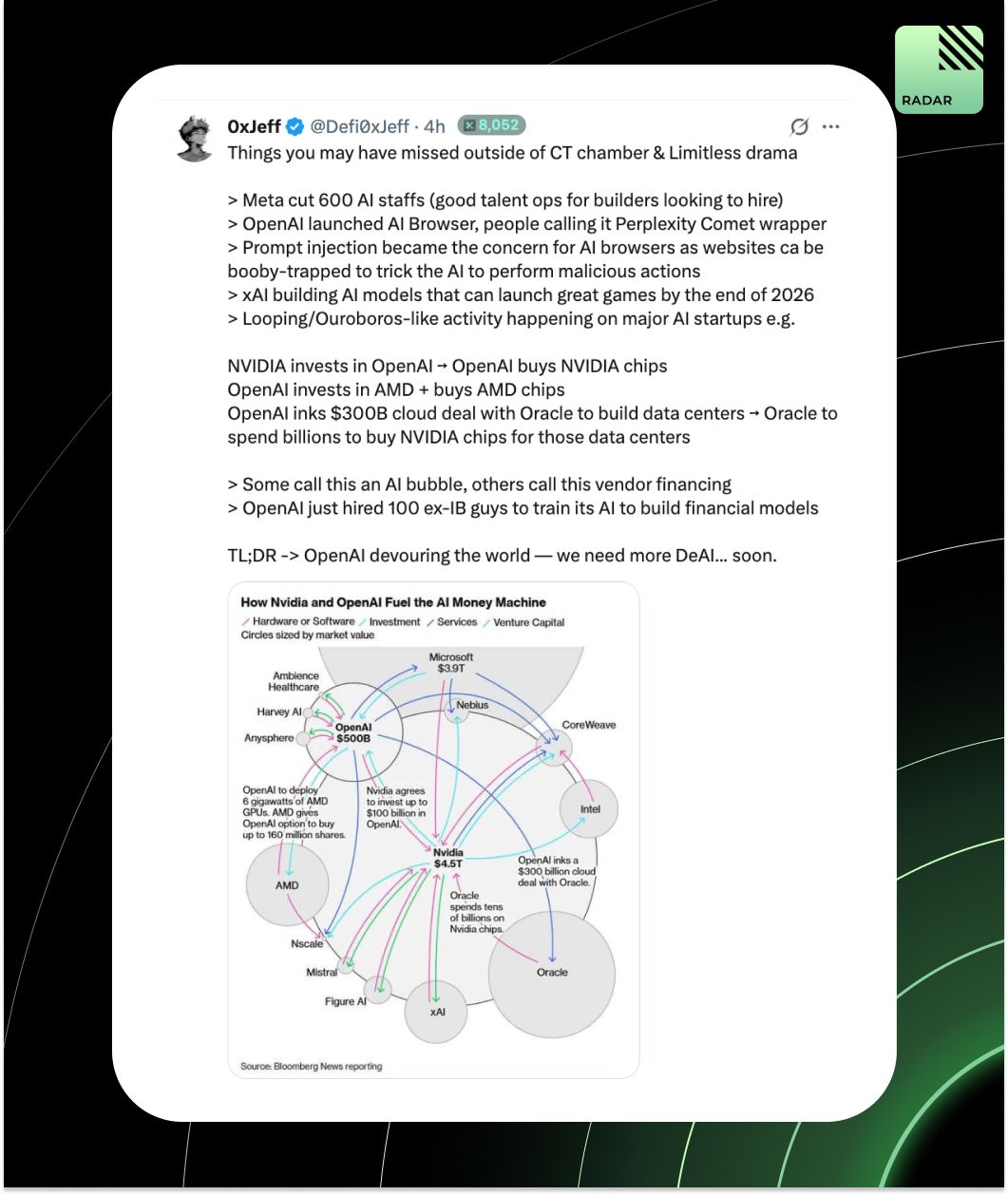

Things you might have missed in the broader context: OpenAI buys Nvidia chips. OpenAI follows up by signing a $300B Oracle deal—another major buyer of Nvidia chips. xAI is building AI models aimed at launching high-quality games by 2026.

Butler V2 rolls out across Virtuals Protocol and X, resetting all legacy chats. The upgrade brings enhanced tools and broader orchestration logic. All new chats now default to Butler V2.

Is there a “Limit” to Higherliquid?

a16z’s 2025 State of Crypto report highlights 100x TPS growth in 5 years, bipartisan policy support, and real-world usage surging. Blockchains now rival TradFi systems in throughput. With the GENIUS and CLARITY Acts gaining traction, U.S. policy shifts from blocking to supporting crypto innovation.

Good brand socials don’t chase trends; they shape culture. Culture-shaping teams act like anthropologists, embedding in subcultures, speaking in shared truths, and optimizing for imprint, not impressions. The best brands co-create meaning, build rituals, and win group chats, not just timelines.

Your daily dose of bite-sized news to stay updated.

Blockworks has released a free Solana DEX aggregator dashboard, providing a consolidated view of Solana trading flows.

Aster DEX launched Rocket Launch, a liquidity boost platform for early-stage projects.

Bunni shuts down permanently after an $8.4M flash loan exploit and cites unaffordable relaunch costs.

KuCoin launches KuPool, a mining service for DOGE, LTC, and soon BTC, targeting retail and pro miners alike.

Polymarket is reportedly raising at a valuation of up to $15B, up from $1B in June.

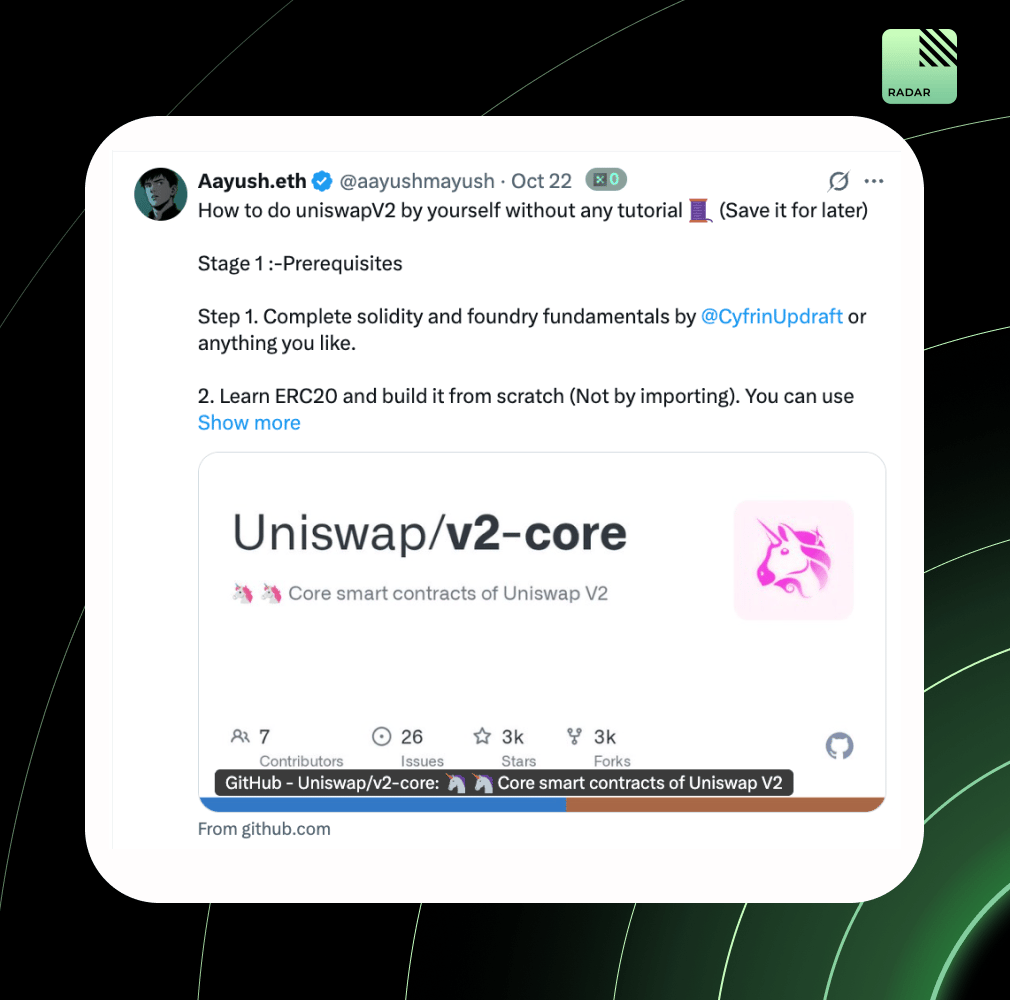

Build UniswapV2 from scratch without tutorials. Aayush breaks it into 3 stages: (1) Learn Solidity + ERC20 deeply, (2) Rebuild v2-core step by step (interfaces, Pair, Factory), and (3) Add Router02 from v2-periphery.

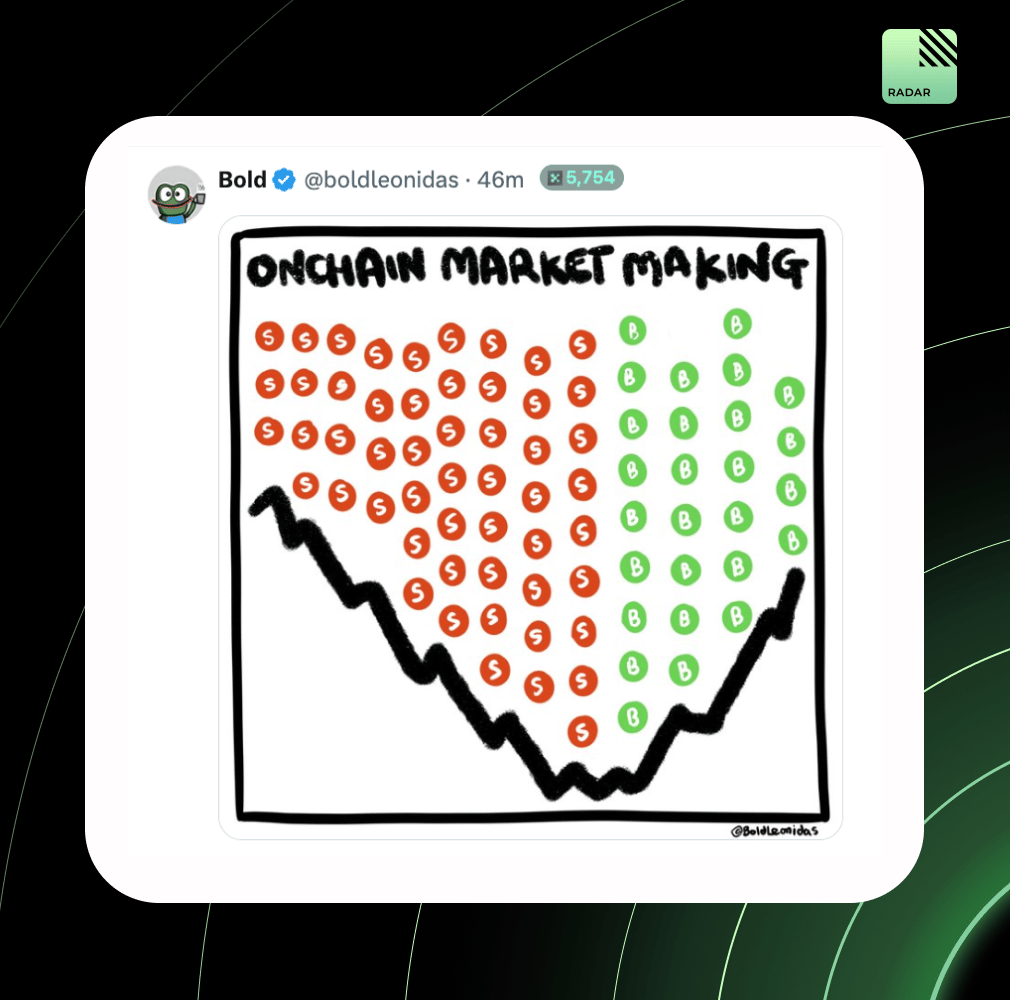

It’s an art.

Want RaaS without digging through your inbox? Our Telegram channel gives you the same daily crypto roundup in a quick, scrollable format. Easy to read, easy to share. Join here: RaaS Telegram Group.

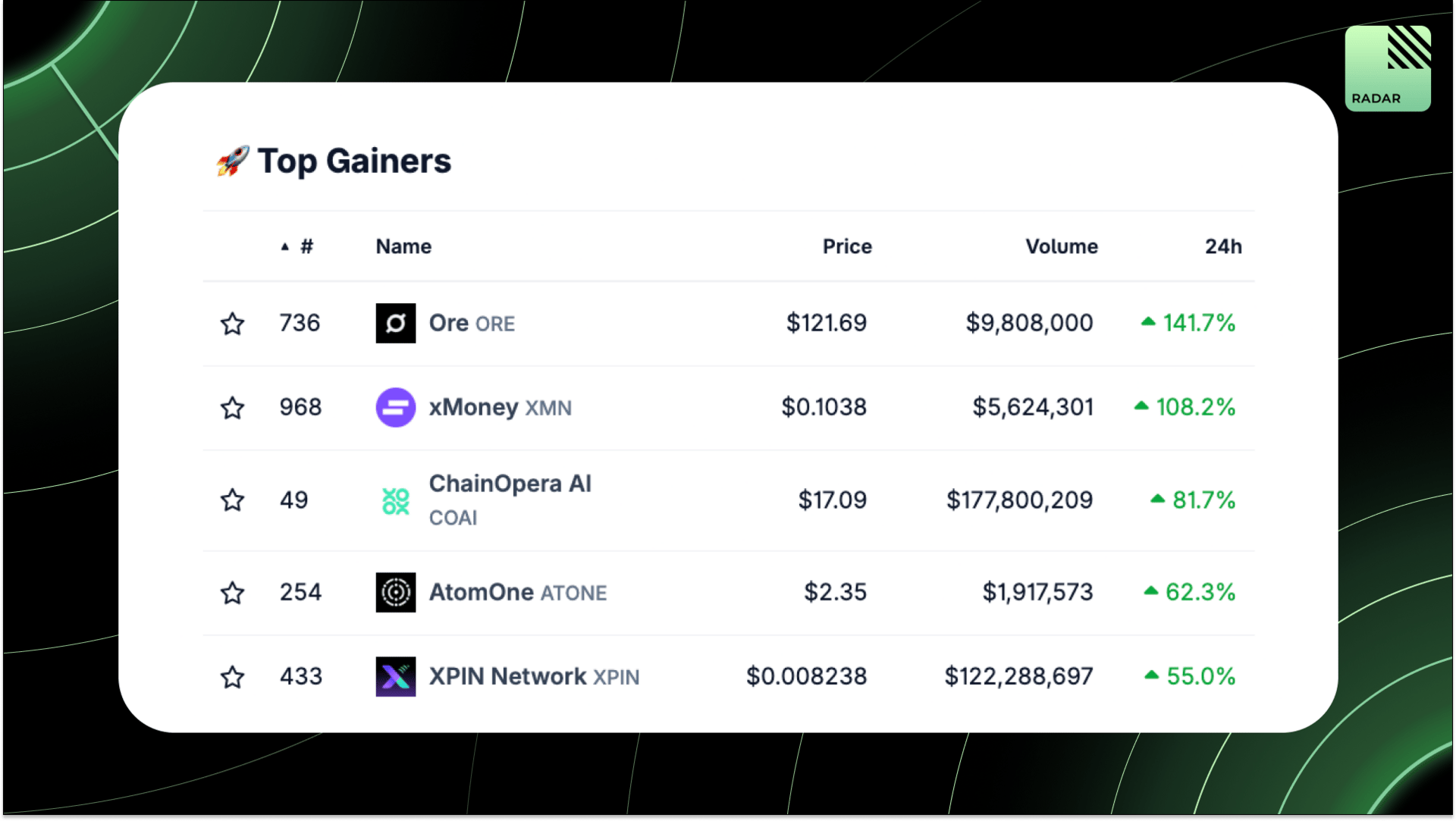

Top Gainers: ORE, XMN, COAI, ATONE, XPIN.

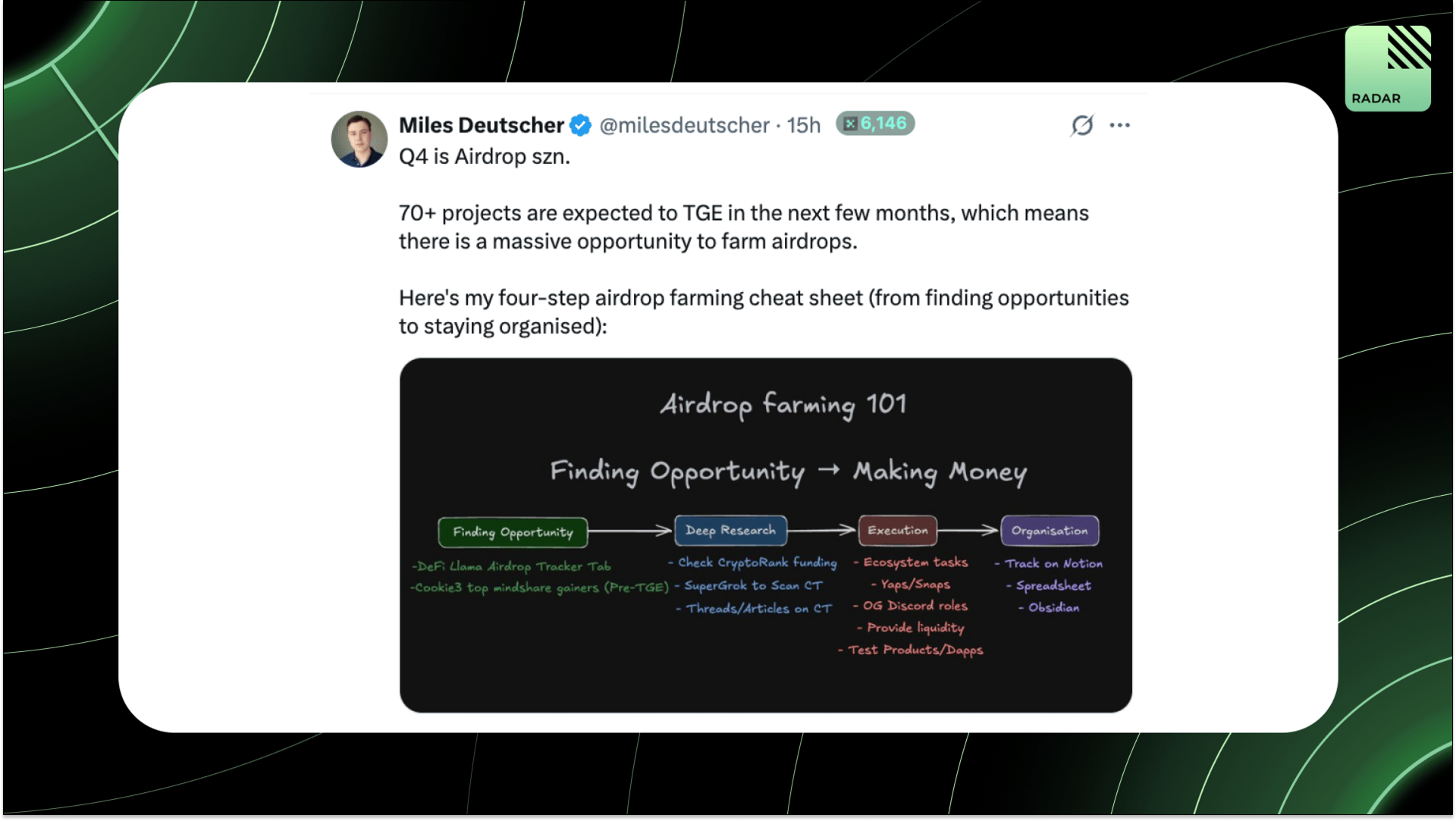

Miles Deutscher’s airdrop guide breaks it down: spot top projects (DeFiLlama, Cookie3), research (CryptoRank, CT), execute tasks (liquidity, roles, testing), and stay organized (Notion, Sheets). Q4 is for farmers.

High-signal reads are worth your time, all in one place.

Crypto neobanks could overtake fintech leaders by combining traditional finance with on-chain yield, access, and autonomy. The top neobank will seamlessly integrate on-chain essentials into familiar processes, safeguarding capital and enhancing crypto engagement.

Copy trading on Polymarket thrives on discipline, tools, and genuine signals. Most fail by chasing fake insiders. Success lies in reading behavior quickly and rationally than the crowd. Focus on creating a repeatable system, not relying on luck.

Flying Tulip merges trading, lending, perps, and a native stablecoin. It’s a capital-efficient, auto-adjusting DeFi stack that links protocol performance to token supply.

Treat content creation like a game: post daily for reps, track metrics like score, build skill trees, set quests over vague goals, collab for multipliers, and level up each quarter. Growth comes from systems, not motivation. Play long enough, you win.

MegaETH’s public sale flips the script: users-turned-investors now hold more $MEGA than insiders or VCs. With a U-shaped allocation and public signal filters, it’s a bet on belief, not bots. This time, the community buys in.

Hyperliquid isn’t just a DEX; it’s building finance’s backend. Jeff explains why origin matters, how Hyper draws from Satoshi, why it skipped VCs, and how HIP-3 unlocks a new asset class.

Stablecoins made money stable. Vaults will make it productive. If 2025 was about cementing stablecoins as digital cash, the next cycle is about turning savings into curated, programmable yield through vaults, led by Morpho’s institutional-grade infra.

That’s all for today!