- Radar-as-a-Service

- Posts

- RaaS #527: 21Share Files For HYPE ETP!

RaaS #527: 21Share Files For HYPE ETP!

Grayscale Launches GSOL, Embodied AI's Big Moves: GM Web3!

MetaMask Rewards Season 1, Lighter Unveils LighterEVM, and Moar!

Quick Intro: Radarblock is a Web3-native growth agency that increases awareness, TVL, volume, and social metrics for its clients over a consistent time frame without uncertainty or confusion. All tweets are hyperlinked; click to view them on X.

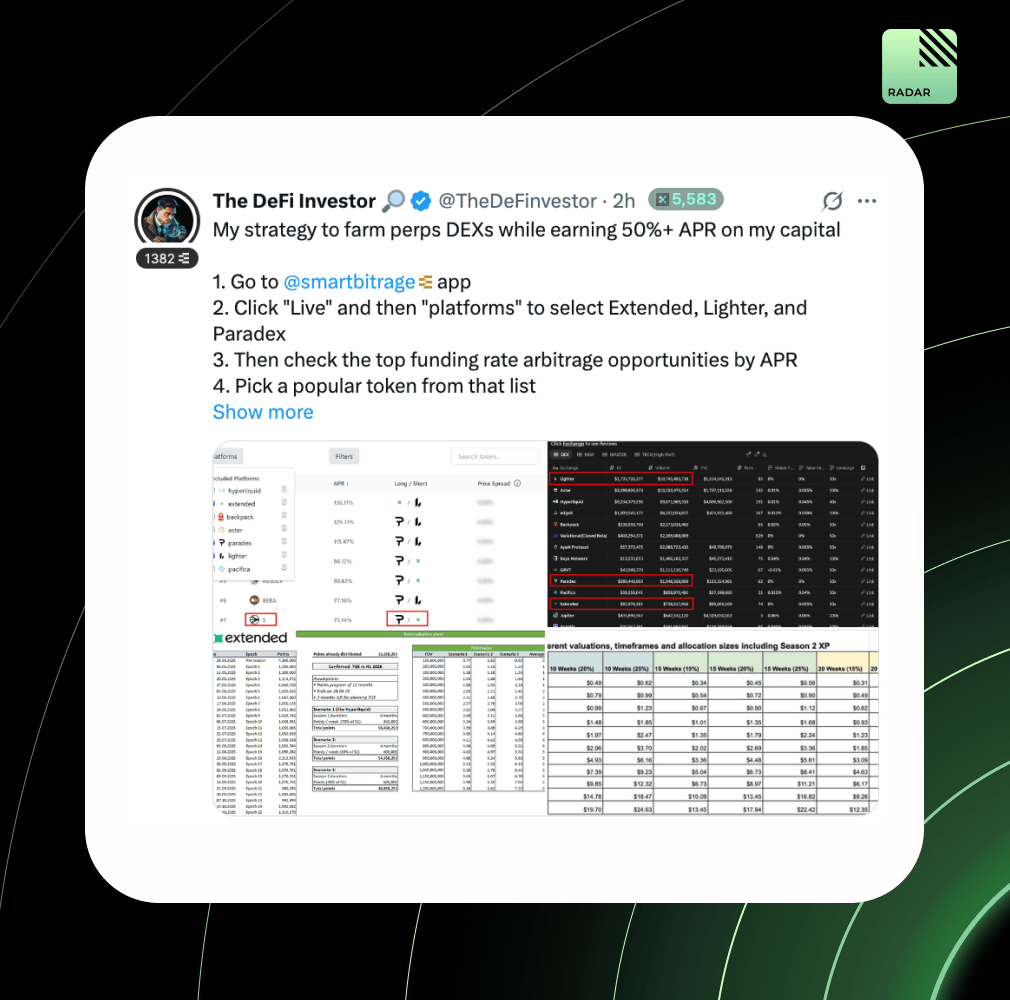

Delta-neutral airdrop farming is heating up. By finding arbitrage funding rates opportunities between Paradex, Extended, and Lighter, users are earning 50%+ APR while stacking points for upcoming 20–30% airdrops.

If you want to grow your brand, be consistently useful. That means diving deep into niche rabbit holes and sharing insights others haven’t surfaced yet. Mine replies under big accounts to find the questions everyone wants answered.

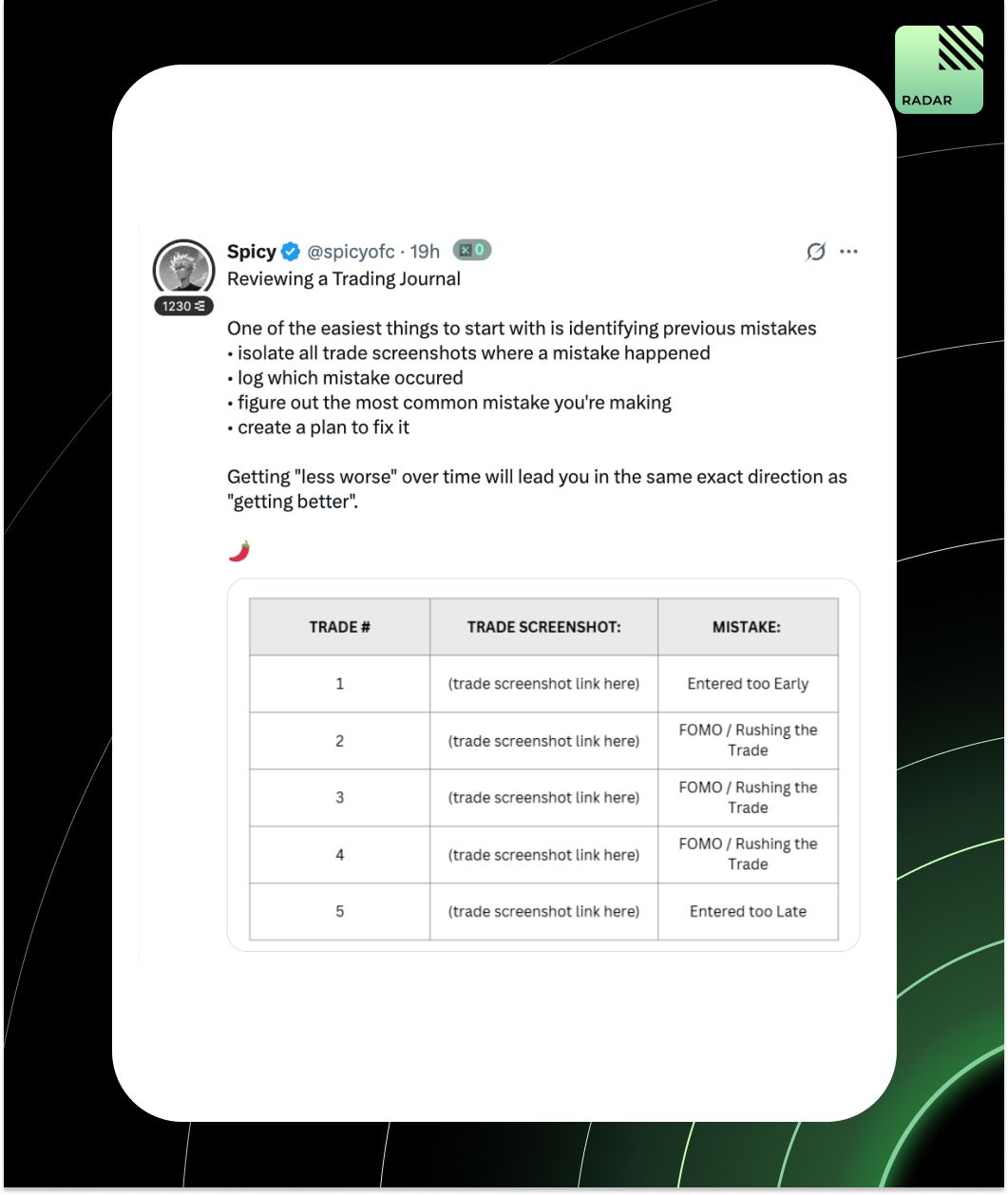

Spicy shares a trading journal tip: isolate losing trades, log the specific mistake (e.g., FOMO, early/late entry), identify patterns, and fix the root cause. Progress in trading isn’t about perfection; it’s about making fewer repeat mistakes over time.

Talking to a girl is more difficult than building your personal brand on CT! Not me, though, I am bad at both.

October’s NFT market stayed bearish with just $513M in volume and a $4.9B market cap, but a few bright spots emerged: Claynosaurz surged after product launches, Infinex Patrons rallied pre-TGE, and BAYC revealed major IP plays. Magic Eden’s $12M pack sales drew attention.

Binance Futures just listed the KITEUSDT perpetual with up to 5x leverage. Backed by Kite’s AI payment blockchain, this gives traders 24/7 exposure to KITE’s native token, settled in USDT.

News breaks, market lags. Gemchanger outlines how to exploit Polymarket’s 3–10 min reaction delay using fast Twitter feeds and automated alerts. It’s not a prediction, just positioning early before odds shift and late traders become exit liquidity.

Your daily dose of bite-sized news to stay updated.

Grayscale launches GSOL, a Solana ETF offering both spot exposure and staking rewards.

21Shares just filed an S-1 for a Hyperliquid ETF, bringing the first perp DEX into the U.S. spot ETF conversation.

Visa to accept stablecoin payments across 4 chains. Accelerates real-world stablecoin adoption via TradFi rails.

MetaMask Rewards Season 1 is live with $30M+ in rewards up for grabs.

Accountable, a crypto-native tax and accounting platform, raised $7.5 million in funding led by Pantera.

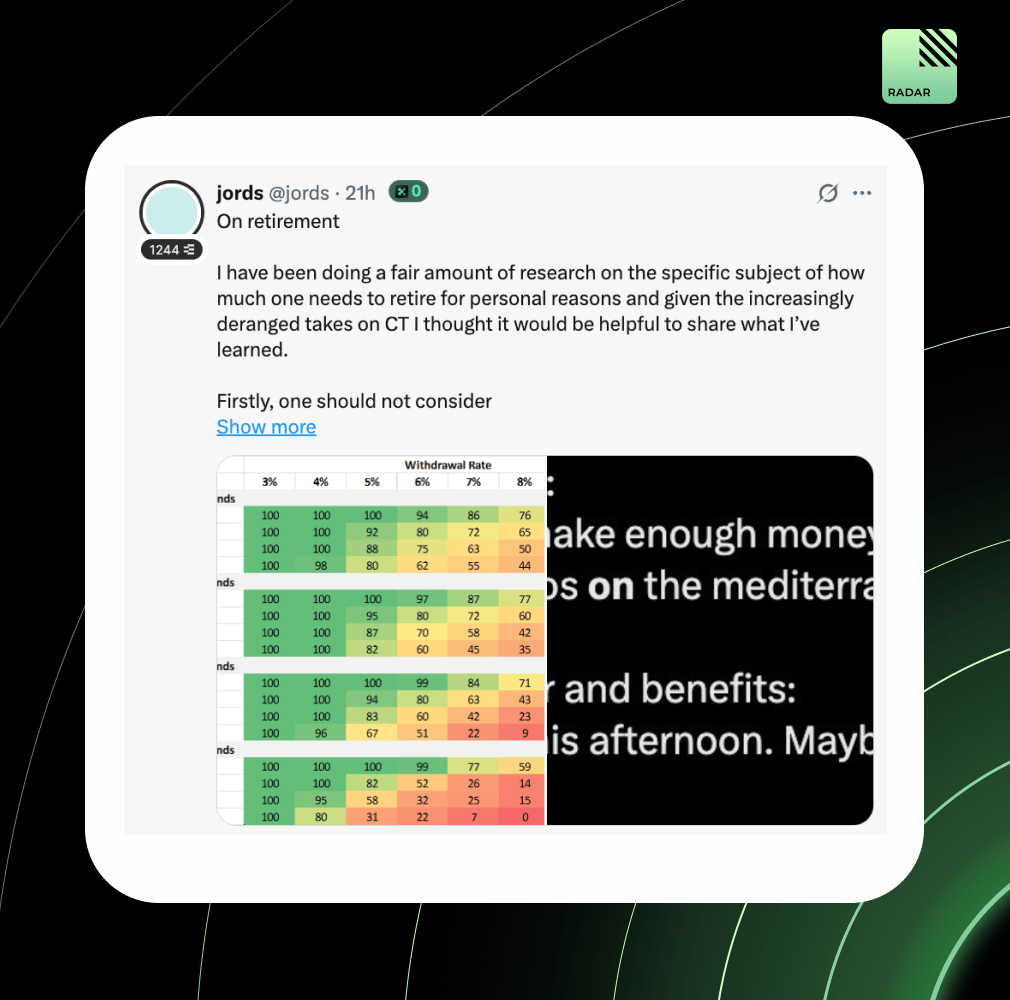

A 4% withdrawal rate from a conservatively invested portfolio has historically supported 30+ years of retirement with minimal risk. The goal isn’t to stop working, it’s to stop needing to. What you need depends on lifestyle, location, and flexibility.

Cobie’s robot wouldn’t say that.

Want RaaS without digging through your inbox? Our Telegram channel gives you the same daily crypto roundup in a quick, scrollable format. Easy to read, easy to share. Join here: RaaS Telegram Group.

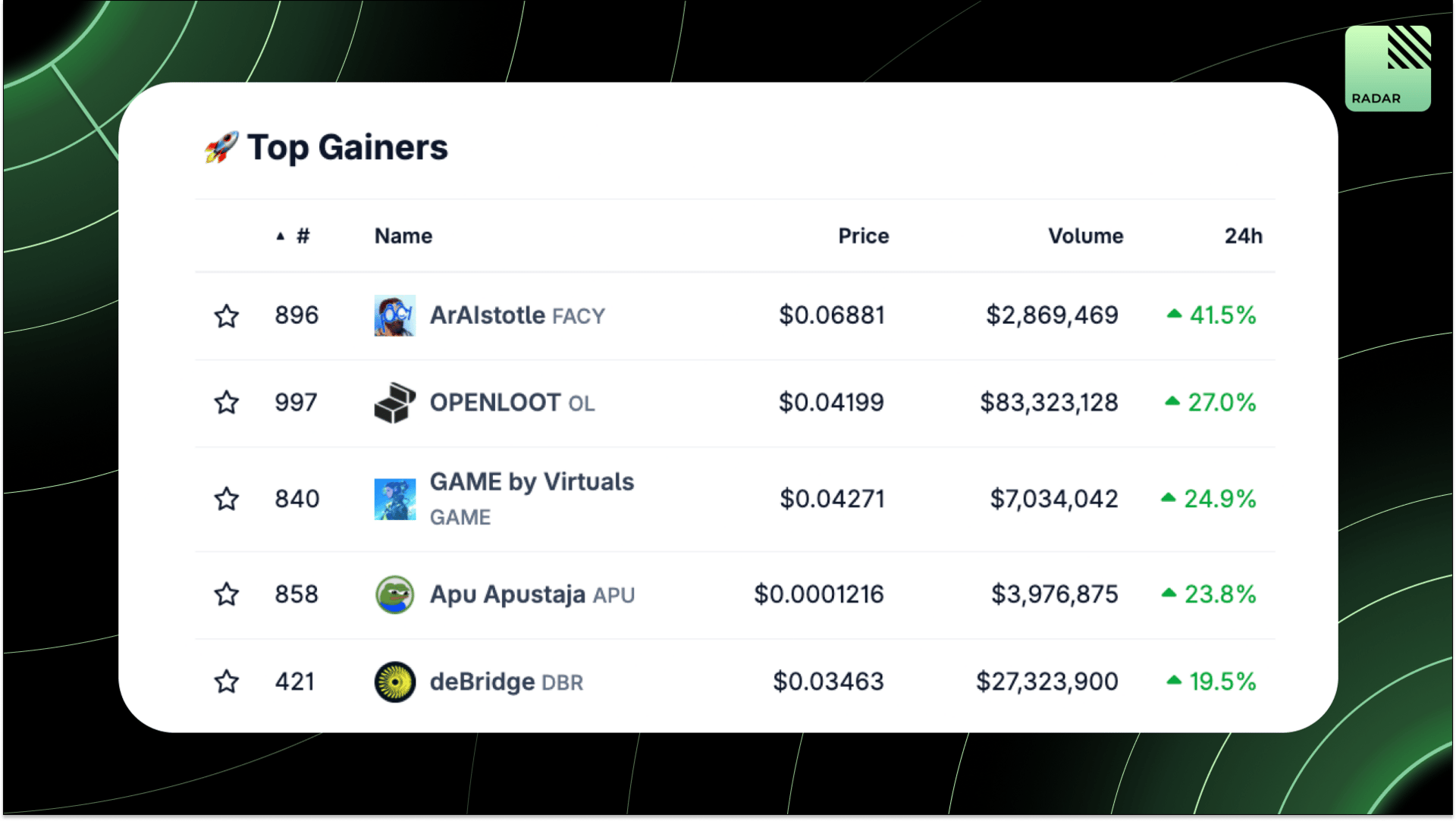

Top Gainers: FACY, OL, GAME, APU, DBR.

High-signal reads are worth your time, all in one place.

DeFi vaults echo 1980s hedge fund mania, high risk, no oversight. Crypto needs on-chain “funds of funds” to size, rebalance, and manage risk before inevitable blowups hit.

Enso API-fies on-chain actions like Stripe did for payments, $3.1B in a day proves PMF. Devs build modular Shortcuts, users get seamless UX, ENSO drives usage and rewards.

ERC‑8004 adds trust to agent payments by giving AI agents on-chain identity, verifiable rep, and optional proof-of-work checks.

Lighter unveils Universal Cross Margin and LighterEVM to enable L1 assets like stETH, LP tokens as L2 collateral, and verifiable smart contract logic.

A CT user made $50K+ via InfoFi airdrops, and others have landed top crypto jobs by posting smart, niche content. The key is to avoid low-effort KOL mimicry & focus on on-chain experience.

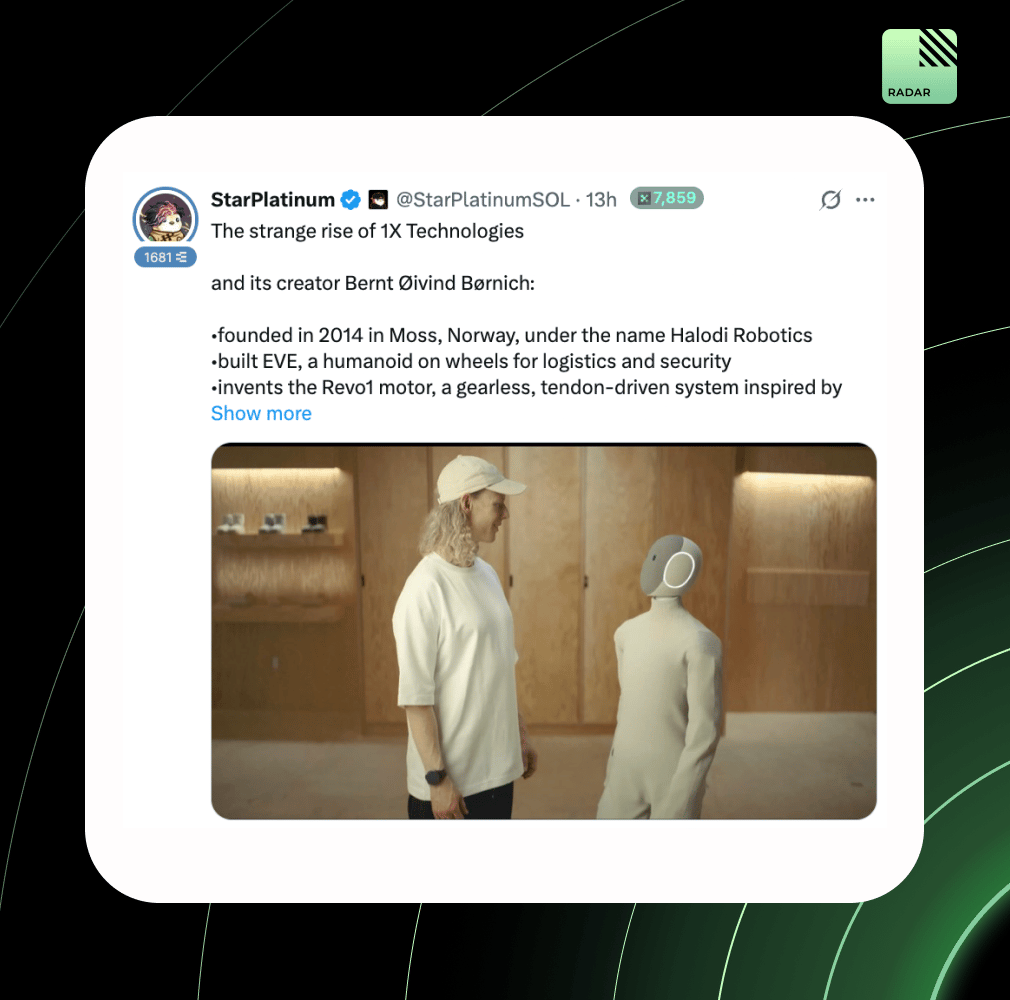

Norway-born 1X Technologies raised $123M+ to bring soft, safe humanoids into homes. Its new biped robot NEO, priced at $20K, can recognize owners, adapt behavior, and do chores. The founder is an ex-gamer chasing 1M humanoids by 2028.

Ondo expands tokenized U.S. equities to BNB Chain, unlocking 24/7 access for non-U.S. investors in Asia & LatAm. Already live on Ethereum with $1.8B TVL, this will boost global reach and cement BNB as an RWA hub amid growing tokenized securities momentum.

That’s all for today!