- Radar-as-a-Service

- Posts

- RaaS #538: xStocks Crosses $10B as Tokenized Equities Accelerate!

RaaS #538: xStocks Crosses $10B as Tokenized Equities Accelerate!

Aave Adds Stablecoin Ramps, DeFiLlama Pro Shares Yield on Yearly Subscriptions: GM Web3!

sENA Holders Now Earn BasedOneX Points, UFC x Polymarket Partnership, and Moar!

Quick Intro: Radarblock is a Web3-native growth agency that increases awareness, TVL, volume, and social metrics for its clients over a consistent time frame without uncertainty or confusion. All tweets are hyperlinked; click to view them on X.

Trustless Manifesto by Weiss, Buterin, and Posner urges a commitment to math and consensus, warning against centralization in Ethereum. It defines trustlessness as self-sovereignty and protocol-based access, emphasizing design choices that maintain Ethereum's neutrality.

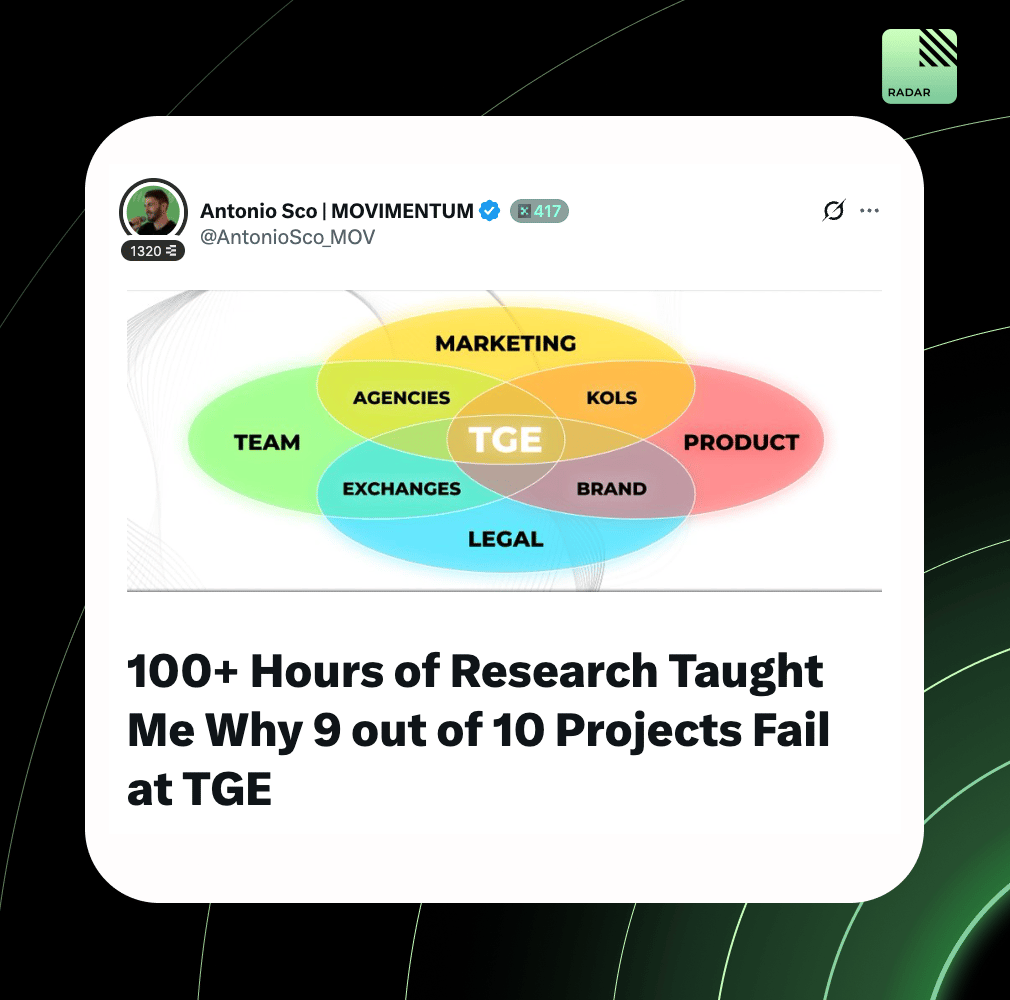

9 out of 10 token launches fail due to mismanagement of market makers, tokenomics, and exchange listings. Founders should vet market makers, test tokenomics against demand, and negotiate exchange listings using internal insights to avoid post-launch failures.

Bantr's update favors loyalty, originality, and authenticity. It penalizes multi-tagging, boosts reputation for loyalty, and lowers trust for incentivized posts. Genuine experiences, thoughtful content, and engagement with aligned creators are rewarded.

Ethereum is transitioning validators to zk-proof verification in under 12 seconds. Combined with EIP-7594 and EIP-4844, this achieves 10k+ TPS, enhancing scalability and decentralization without datacenter reliance.

Crypto business development focuses on rapid learning, clear outreach, and ecosystem engagement. Key strategies include fast learning, concise communication, selective sourcing, many-to-many partnerships, and personal branding to build trust and effectiveness.

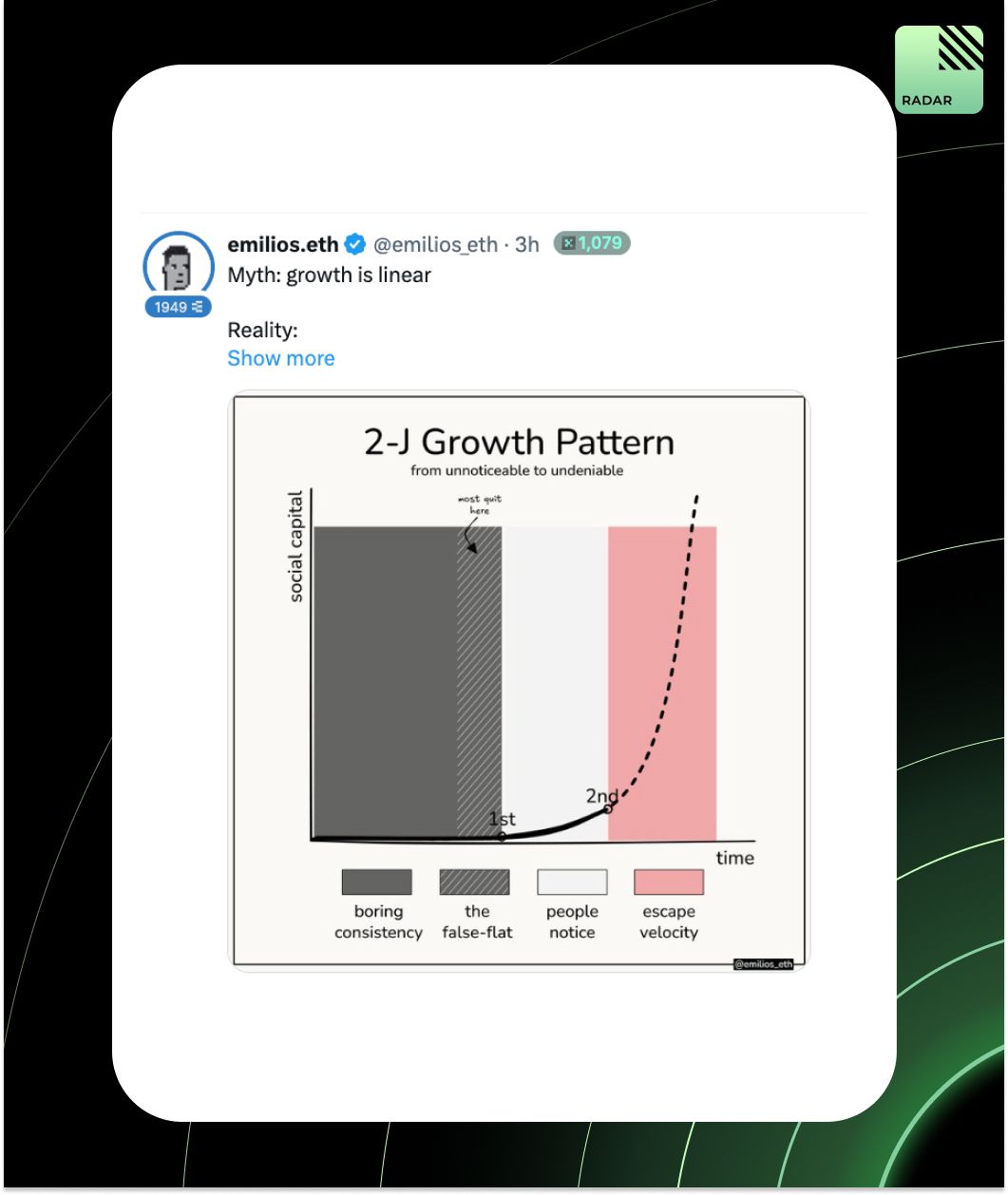

Clout farming is very necessary!

Bluefin launches a gated stablecoin vault offering 50%+ APY for users with 200K+ eBLUE, transforming eBLUE from a staking receipt to an access token with exclusive utility and high-yield opportunities. All previous positions continue to earn.

EigenCloud introduces EigenZero with LayerZero, a $5M slashing-enabled DVN. Apps choose verifiers on economic guarantees. Failed verifications lead to slashed stakes and user compensation, shifting cross-chain security to active accountability.

Your daily dose of bite-sized crypto news.

UFC x Polymarket just opened a new arena: the future of sports betting is on-chain.

sENA holders now earn BasedOneX points, linking Ethena to the largest builder on HyperCore with mid-eight-figure annualized revenue.

Aave launches no-fee stablecoin ramps. GHO and other stablecoins can now be on-/off-ramped in Europe with zero fees across Aave products.

Uniswap unveils Continuous Clearing Auctions. CCA brings transparent, token launches to v4 pools.

NFTfi’s new Cross-Protocol ReFi lets borrowers shift loans from other platforms without repayment or fees, solving fragmentation.

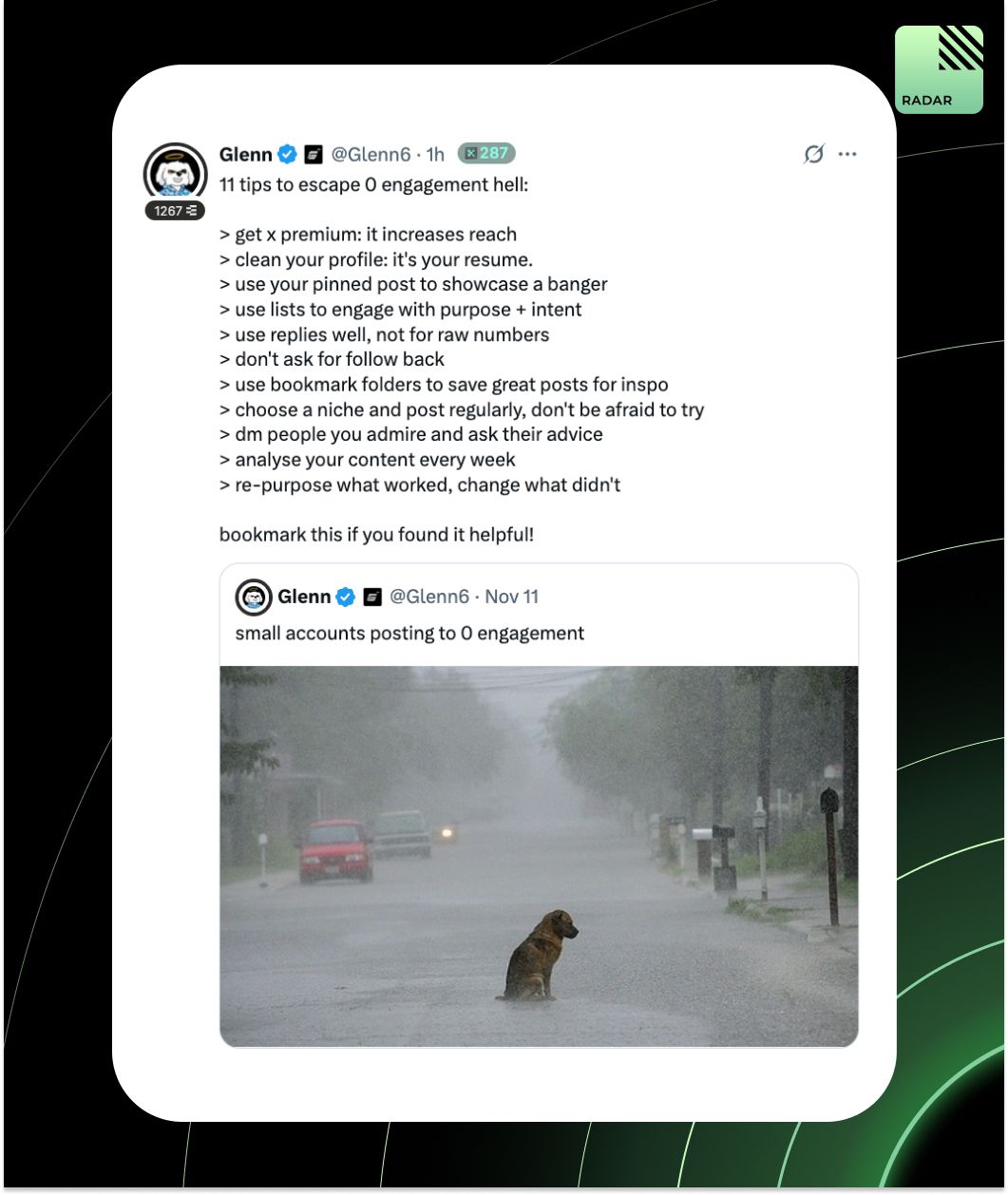

Glenn provides 11 tips to boost engagement on X, focusing on profile optimization, reply strategy, niche focus, content iteration, and direct outreach. Emphasizes intentionality and analytics, showing that structured and clear efforts lead to growth.

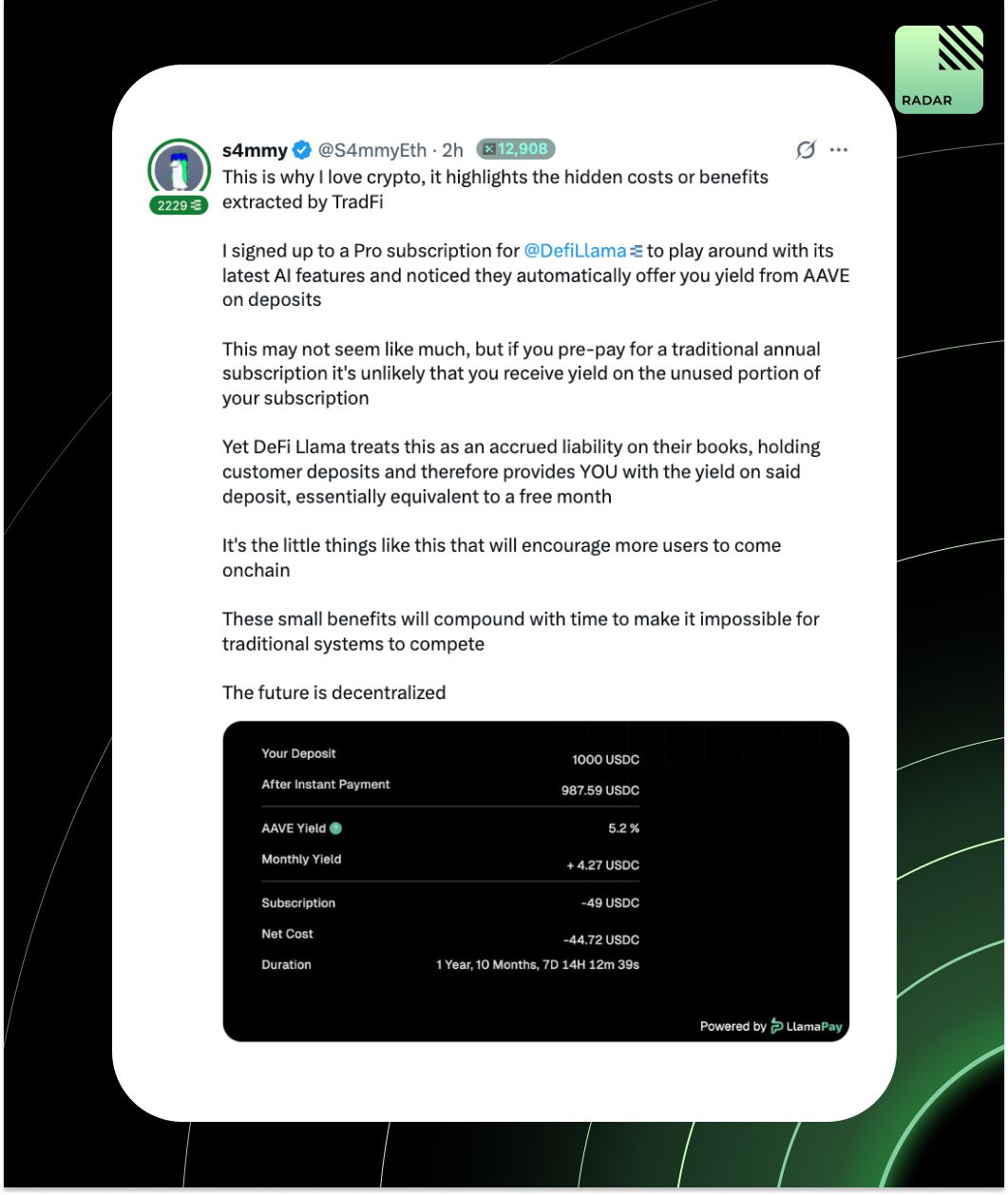

DeFiLlama Pro uses AAVE to earn yield on unused subscription deposits, offsetting costs for users. Unlike traditional models, it aligns incentives by accruing interest on prepayments, offering a fairer approach that TradFi can't easily replicate.

Algorithm is BaD!

Want RaaS without digging through your inbox? Our Telegram channel gives you the same daily crypto roundup in a quick, scrollable format. Easy to read, easy to share. Join here: RaaS Telegram Group.

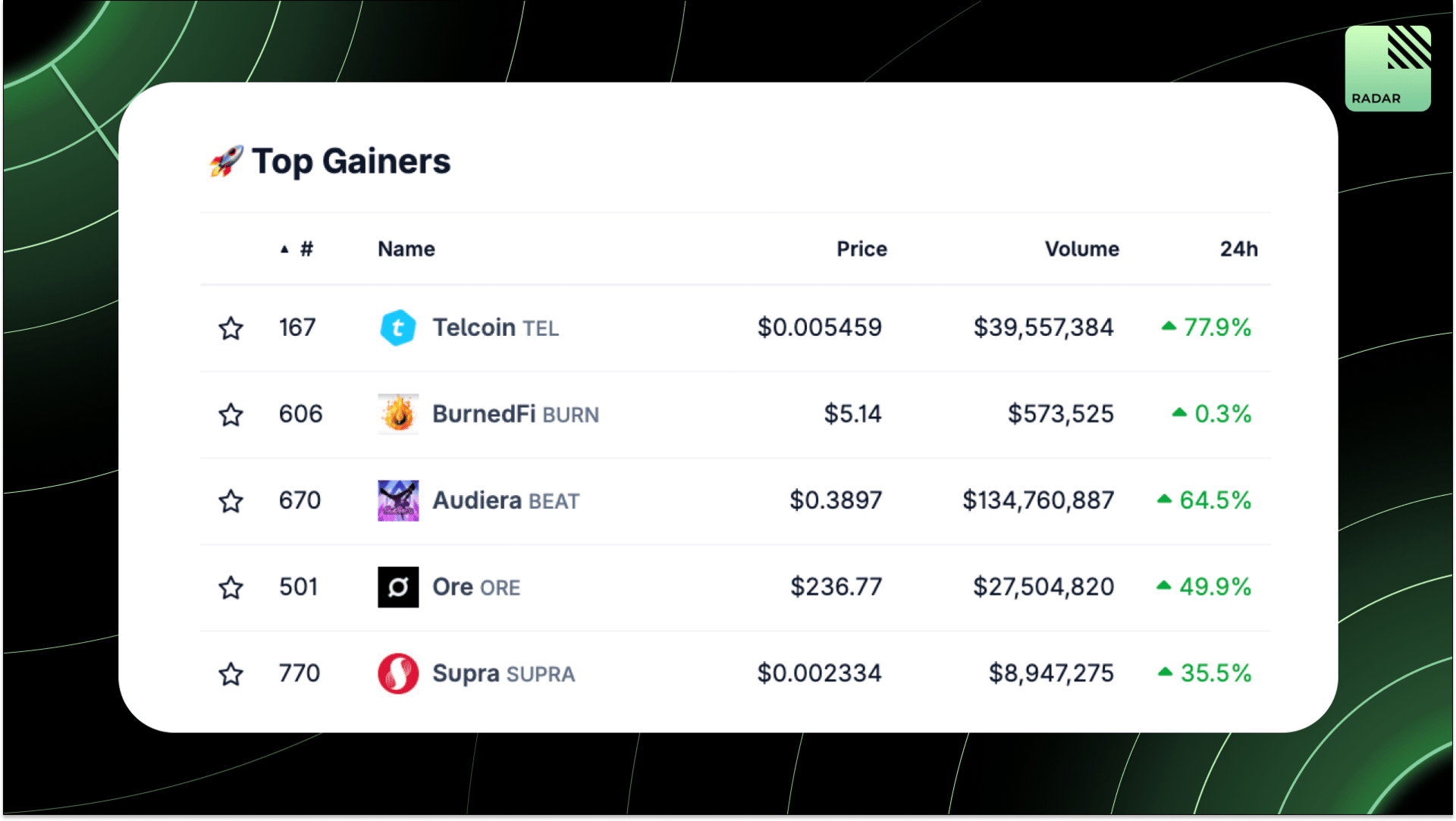

Top Gainers: TEL, BURN, BEAT, ORE, SUPRA.

High-signal reads are worth your time, all in one place.

Footprint charts offer detailed trade analysis and execution by revealing intra-candle order flow, helping detect absorption. Customizable with various cluster types, they enhance market insight, timing, and order-flow reading, benefiting traders significantly.

X's algorithm reduces crypto engagement; viral formats like drama and screenshots outperform technical posts. To thrive, adapt to these trends and reserve valuable insights for private channels until algorithm changes occur.

xStocks hit $10B in transactions, with $2B on-chain in 135 days. Created by Kraken and Backed, it offers tokenized equity on Solana and Ethereum, with 45K+ users and $135M AUM.

Circle introduces StableFX and Partner Stablecoins for 24/7 on-chain FX trading via Arc. Built with partners like Visa and Coinbase, it offers real-time stablecoin FX with no counterparty risk, aiming to make Arc a key FX settlement layer and expand USDC's reach.

Balancer recovered $4.1M from a V2 meta-stable pool exploit via a whitehat operation with Certora and SEAL Org, covering Ethereum, Optimism, and Arbitrum. V3 remains unaffected, underscoring the importance of whitehat and cross-organization responses.

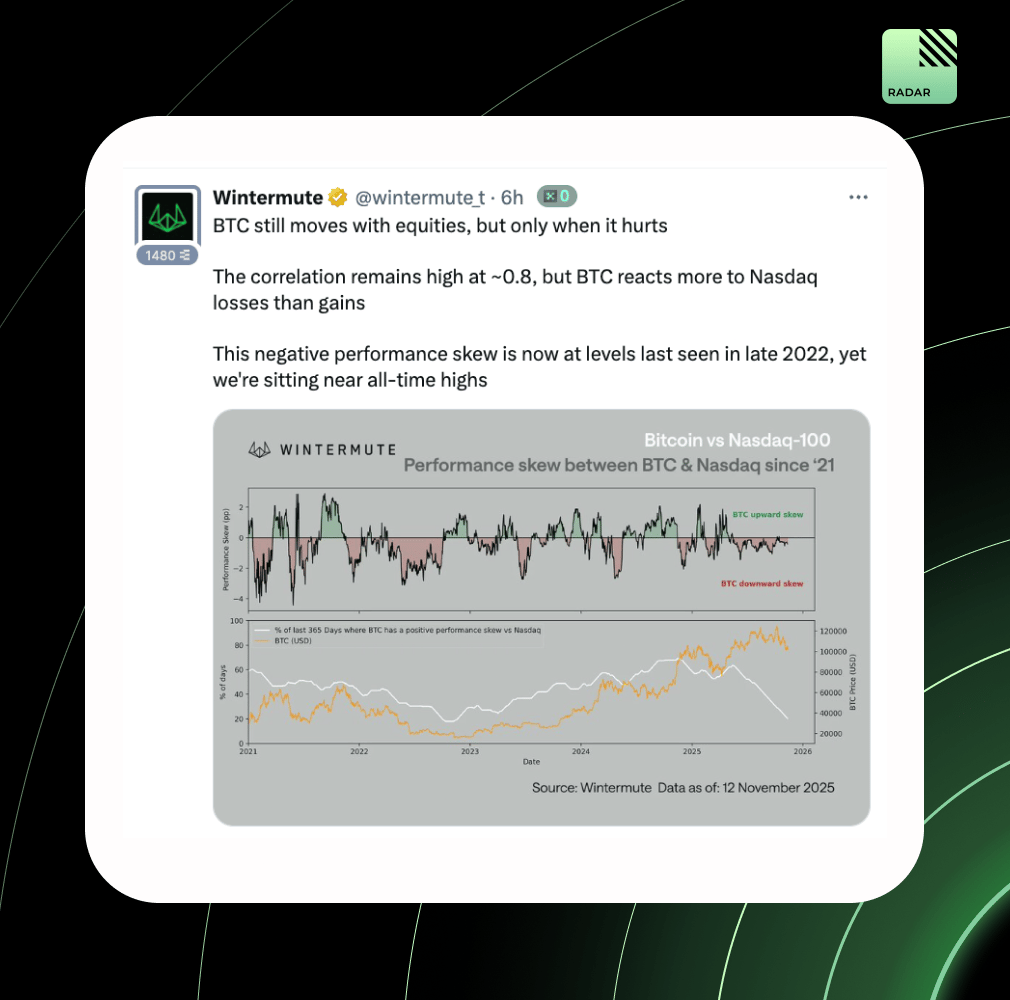

BTC's outperformance over the Nasdaq has decreased, with positive skew on fewer than 40% of days over the past year. Despite new highs in 2025, the skew turned negative, indicating crypto's momentum had weakened relative to traditional finance tech.

Organic growth on X follows a 2-J curve with phases: boring consistency, false-flat, first checkpoint (recognition), second checkpoint (breakout), and escape velocity. Many quit early. Success requires enduring until recognition improves distribution.

That’s all for today!