- Radar-as-a-Service

- Posts

- RaaS #556: Paradigm Backs Crown With $13.5M!

RaaS #556: Paradigm Backs Crown With $13.5M!

MetaMask Gets 2x Faster, Circle Partners With Bybit: GM Web3!

Gensyn Teases Major Announcement, Oobit Enters U.S. With Bakkt, and Moar!

Quick Intro: Radarblock is a Web3-native growth agency that increases awareness, TVL, volume, and social metrics for its clients over a consistent timeframe without uncertainty or confusion. All tweets are hyperlinked; click to view them on X.

Paradigm invested $13.5M in a Series A in stablecoin startup Crown, valuing the company at $90M. With Brazil’s massive fintech penetration and growing stablecoin usage, Paradigm seems to be betting that LatAm is the next battleground for stablecoin dominance.

MetaMask rolled out its biggest UX upgrade in years. Swaps and bridge quotes are now delivered 2x faster, sourced from 18 providers, and no longer require native gas tokens across eight networks. The fox wallet is finally catching up to 2025 standards.

Circle is teaming up with Bybit, expanding USDC’s footprint deeper into derivatives trading and improving settlement flexibility across Bybit’s ecosystem.

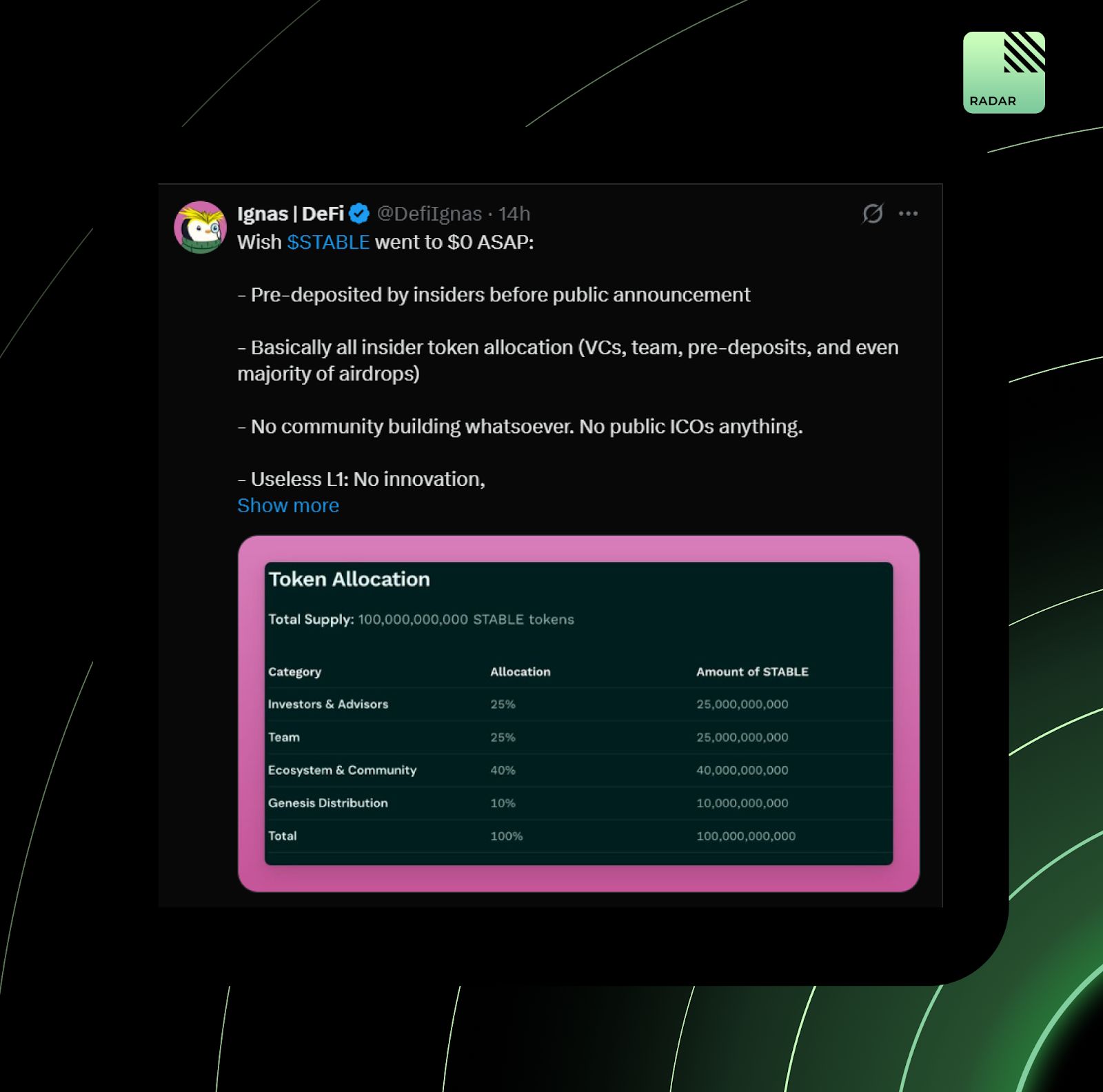

Stable’s long-awaited chain launch has gone completely off the rails. Despite raising $30M in VC funding and pulling in billions in deposits, users can’t withdraw their iUSDT after bridging into Stable’s chain. Ignas also openly wishes STABLE would go to zero so the exit can end.

The best revenge on your greatest enemy is to teach them crypto.

A new Gensyn Foundation account appeared today, with a website mini-game revealing a secret message hinting at their first teaser announcement. Earlier, they announced the launch of their Delphi AI Model Prediction Market, an open market for machine intelligence. TGE speculation is at an all-time high.

Oobit is entering the U.S. with Bakkt, enabling tap-to-pay crypto directly from non-custodial wallets like MetaMask, Phantom, Trust Wallet, and Base wallets. Merchants still get fiat instantly via Visa rails. The UX finally feels Web2-level smooth.

Your daily dose of bite-sized crypto news.

AllScale raised $5M in funding, led by Yzi Labs, to scale infrastructure through Easy Residency Season 2.

MoreMarket’s Earn program is shutting down as the team reallocates resources.

SEC updates on privacy & surveillance roundtable highlighted evolving priorities around privacy tech and compliance.

OKX’s layer 2, X Layer, has been migrated to OP Stack for a modular, high-performance framework.

MetaComp just closed a $22M round as a stablecoin-based fund management and cross-border payments firm.

Ondo just got a massive regulatory win: the SEC closed its confidential investigation into ONDO with no charges, clearing one of the biggest compliance clouds hanging over the tokenized Treasury sector.

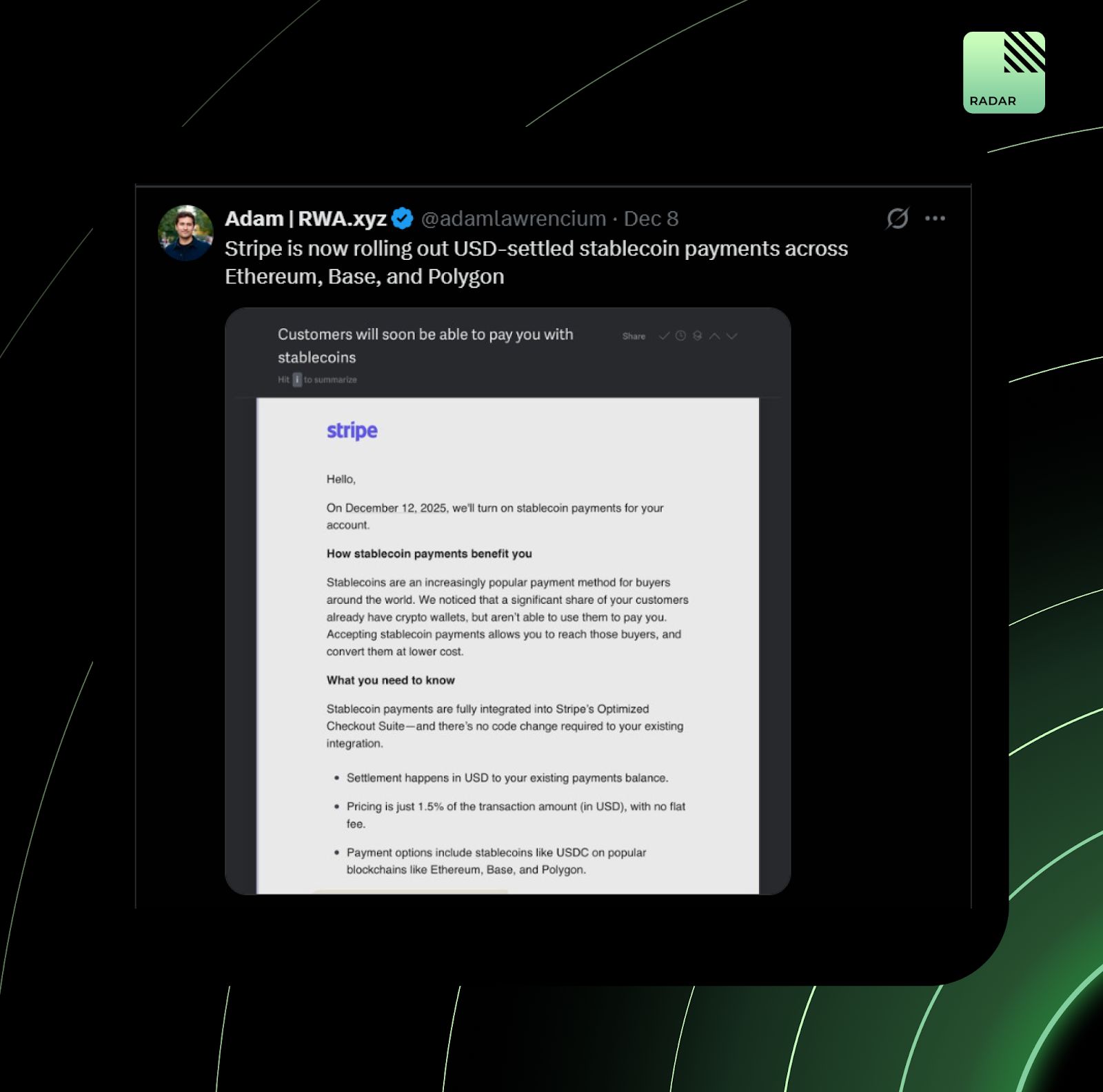

Stripe is rolling out USD-settled stablecoin payments across Ethereum, Base, and Polygon, pushing stablecoins directly into mainstream fintech infrastructure.

Ohhh (I still don’t get it).

You can now stake MON through Magma and earn up to 52% APY, split between staking rewards and points incentives. The points meta is officially alive on mainnet, and Magma is positioning itself as the place to squeeze the max yield out of MON!

Want RaaS without digging through your inbox? Our Telegram channel gives you the same daily crypto roundup in a quick, scrollable format. Easy to read, easy to share. Join here: RaaS Telegram Group.

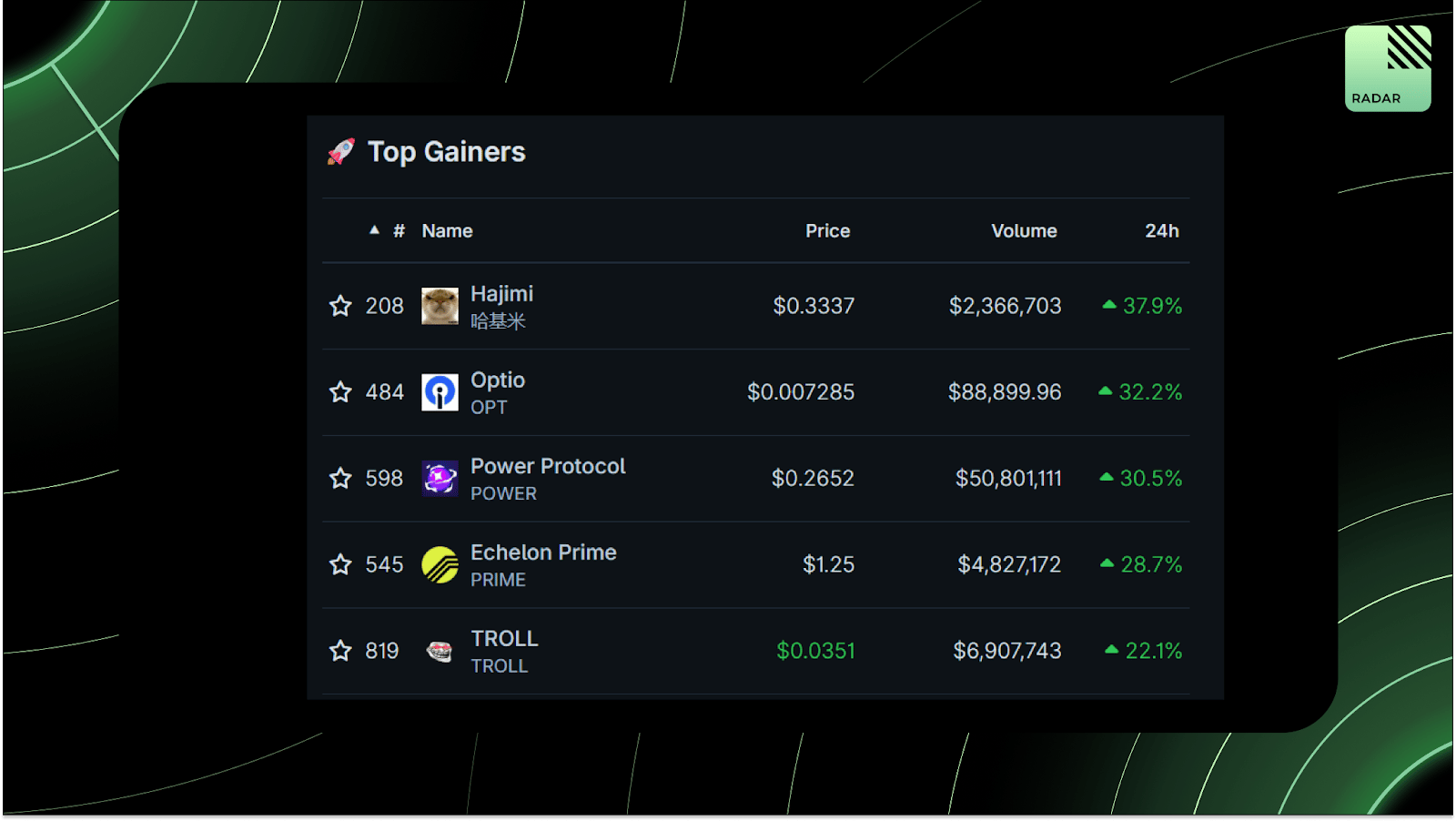

Top gainers: 哈基米, OPT, POWER, PRIME, TROLL

High-signal reads are worth your time, all in one place.

Variant’s annual report says Bitcoin and gold now act as dual safe havens. Hyperliquid becomes a full liquidity layer, RWAs accelerate, and prediction markets look like 2026’s breakout sector.

Aasha says crypto marketing shifted from memes to founder-led content, high-quality video, and team-led distribution. Platform-specific posts and clipping podcast moments are now the most efficient growth engines.

Avici’s co-founder, Ram, wraps up the project’s 2nd-month update, reporting that card spend is showing powerful traction, with named virtual accounts and business accounts seeing strong response from early access users.

Tochi argues retail quietly leveled up, sharper, more skeptical, and no longer easy exit liquidity. CT feels more efficient than it used to.

Radarblock’s Blingoh says CT’s not quiet, it’s simmering: ragebait drives attention, and everyone’s fighting to stay relevant. Memes aren’t enough; edgy takes are the new currency.

Acting Chairman Caroline Pham announced a new CFTC Digital Assets Pilot Program, allowing BTC, ETH, and USDC to be used as collateral in U.S. derivatives markets. A major institutional unlock!

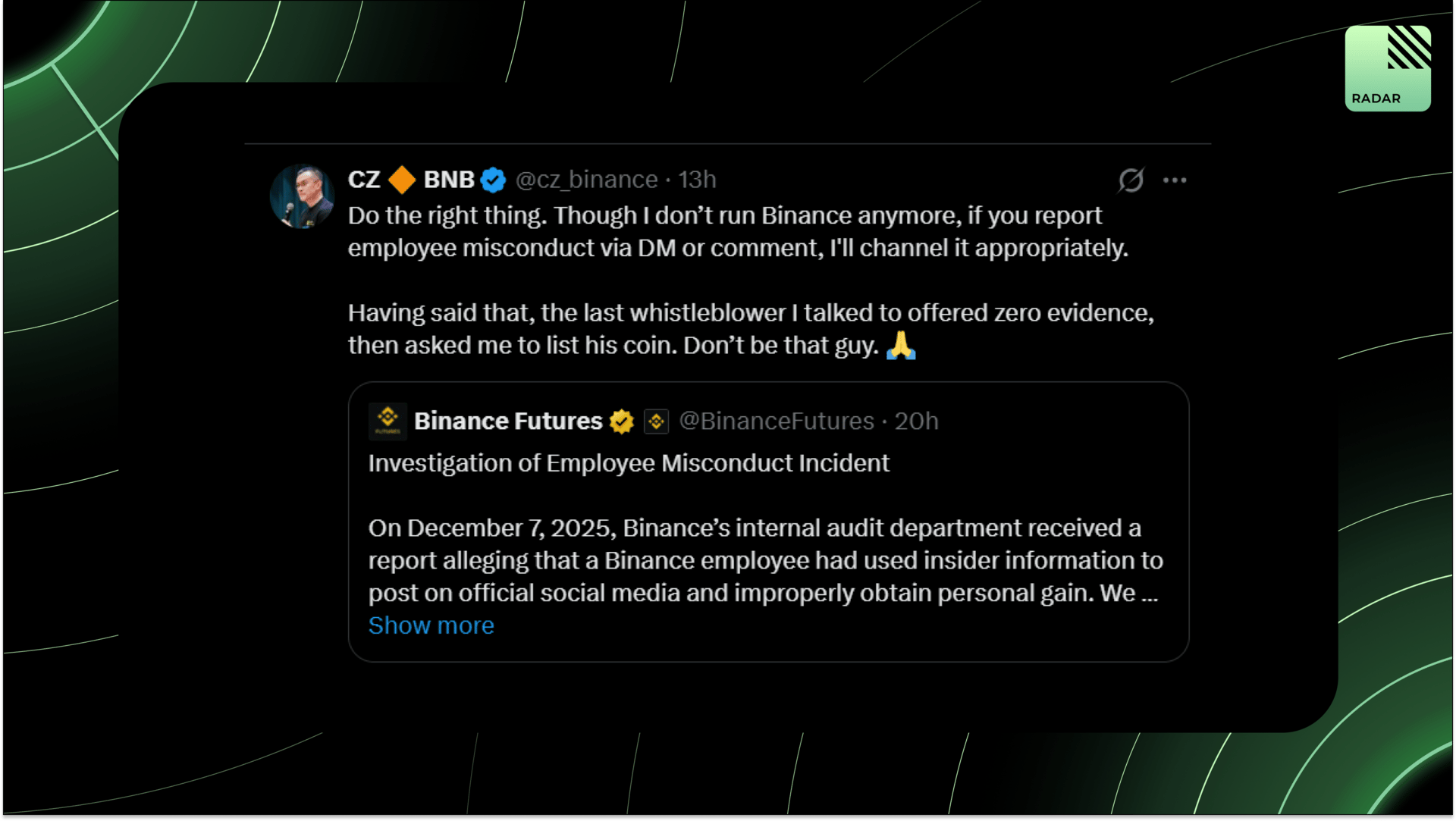

Binance caught another internal memecoin slip. Right after the “Year of the Yellow Fruit” token was deployed, the Binance Futures account tweeted it out, later traced to an employee abusing access. The token spiked to $5M market cap, then cratered, and Binance paid $100K to whistleblowers while suspending the staffer.

That’s all for today!