- Radar-as-a-Service

- Posts

- RaaS #558: Xiaomi Integrates Stablecoin Payments!

RaaS #558: Xiaomi Integrates Stablecoin Payments!

Surf Raises $15M, Gemini Secures Prediction Market License: GM Web3!

Injective Lands a $10B Migration Deal, Jupiter Hires KKR’s Digital Asset Lead, and Moar!

Quick Intro: Radarblock is a Web3-native growth agency that increases awareness, TVL, volume, and social metrics for its clients over a consistent timeframe without uncertainty or confusion. All tweets are hyperlinked; click to view them on X.

Xiaomi, the Chinese tech giant, is integrating a Sei-powered stablecoin payments app directly into its global smartphone ecosystem. Billions of devices, instant stablecoin transfers… imagine explaining this to yourself in 2020.

Surf raised $15M to build the AI model crypto actually needs, not another ChatGPT cosplay. After powering over 1M research reports for 80K users, Surf is building Surf 2.0 with Pantera, Coinbase Ventures, and DCG backing the mission. Generic LLMs are out. Crypto-native AI is in.

Meteora just bought back $10.6M worth of MET (2.3% of supply) and launched Comet Points. Stake, use the product, earn points, and spend them however you want. The team also hinted that more discretionary buybacks are coming. Someone’s clearly feeling bullish.

Gemini finally got its CFTC Designated Contract Market license after five years! Its prediction market is coming to the U.S., opening the door for futures, options, and perps later. Huge win for prediction markets!

The best stuff is built when nobody is watching.

Cascade raised $15M to build a 24/7 “neo-brokerage” for everything, crypto, stocks, even private companies like OpenAI and SpaceX. It got Polychain, Variant, Coinbase Ventures, and Archetype all in on it. TradFi but unhinged.

Jupiter made a huge hire: Kohlberg Kravis Roberts & Co’s Head of Digital Asset Strategy is now its President. $1T in annualized volume, $3B TVL, and now Wall Street talent joining the Solana super-app. Jupiter wants to become the on-chain gateway for the entire world, and they’re staffing up as they mean it.

Your daily dose of bite-sized crypto news.

Wallchain slashed multiple engagement-farming groups in its new Anti-Slop initiative.

Aster dropped all fees on all stock perpetual contracts (NVDA, TSLA, AMZN, AAPL, etc.).

Avalanche Foundation announced a new distributed-ledger tech fund with Abu Dhabi Global Markets.

NEAR hit 1 million TPS in a publicly verified benchmark, a major scalability milestone.

Vitalik says Ethereum and Fileverse have reached a security level that can be maintained with routine patches and contain no critical vulnerabilities.

Injective just onboarded a $10B mortgage portfolio! Pineapple Financial is moving 29,000 mortgages on-chain for real-time audits, automated checks, and an upcoming marketplace for anonymized loan data.

a16z crypto is expanding into Asia with a Seoul office and a new APAC lead from Monad and Polygon. They’re going after founders, enterprises, and governments across the region. Asia season is heating up.

And fyi, it never gets better.

Want RaaS without digging through your inbox? Our Telegram channel gives you the same daily crypto roundup in a quick, scrollable format. Easy to read, easy to share. Join here: RaaS Telegram Group.

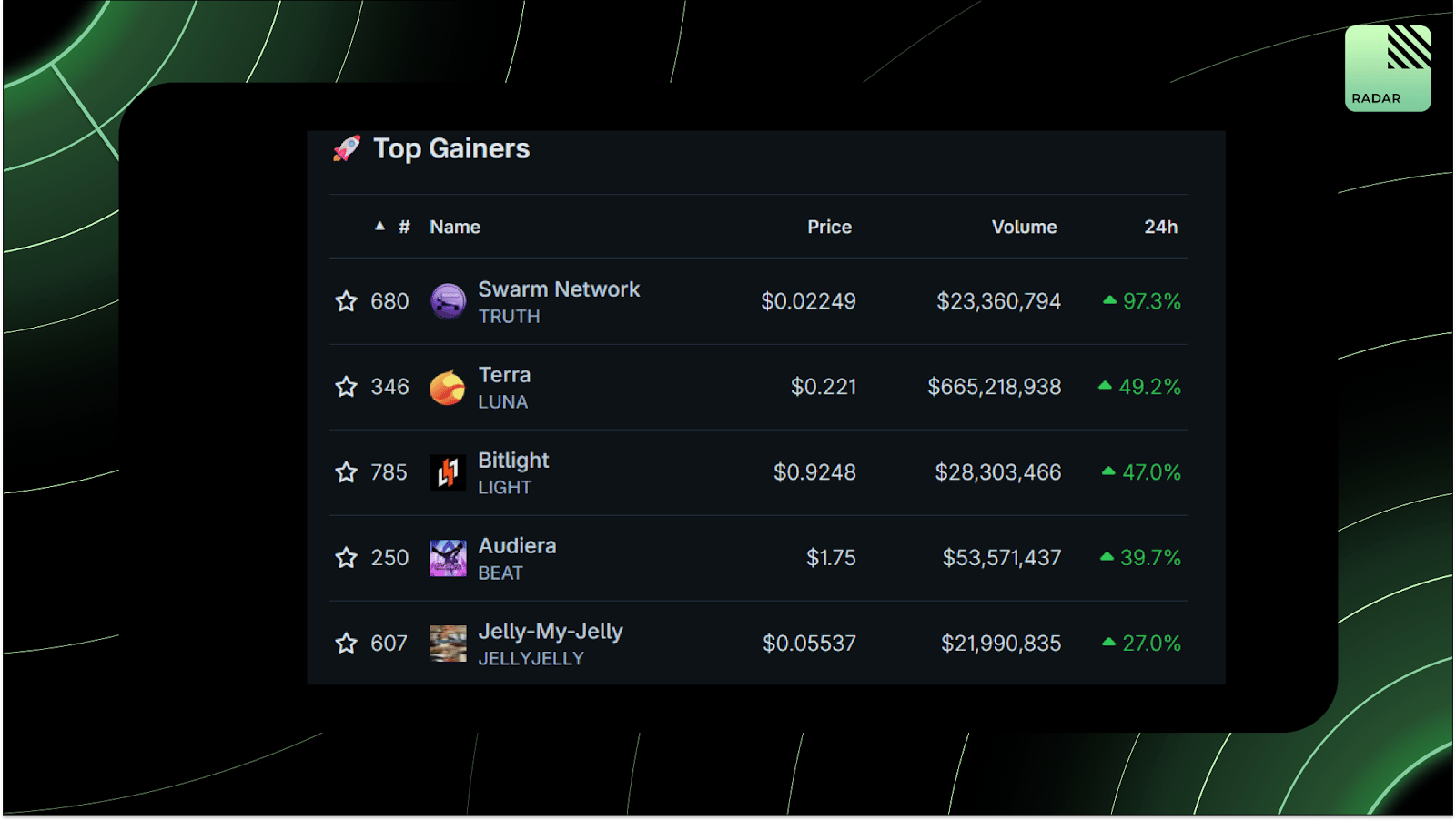

Top gainers: TRUTH, LUNA, LIGHT, BEAT, JELLYJELLY

High-signal reads are worth your time, all in one place.

CryptoDan breaks down how tokens die because companies capture the value, not the protocol. Hyperliquid avoided VC equity and routed fees to the protocol, proving token success is a product-design problem.

Crypto looks like a casino to some, but Carter maps five real teloi and urges pragmatic optimism: acknowledge the mess, keep building the useful stuff, and don’t confuse mania for the whole story.

Trendle highlighted how the prediction market narrative has changed from niche to media data source through recent Kalshi’s $1B raise, CNN/CNBC integrations, and wallet-native prediction markets.

Leon Abboud breaks down 5 mistakes creators make when trying to grow and monetize their brand.

KatexBT tells the life story of an “optimizooooor” in his 20s who over-optimizes everything, and is paralyzed by choices. The lesson is to do the good stuff now before “later” never comes.

Michael Saylor says Morgan Stanley Capital International (MSCI)’s plan to cut Digital Asset Treasury (DAT) companies is anti-progress and anti-America. In other news, water is wet.

Stripe acquired Valora to supercharge its global crypto operations. After buying Bridge and launching the Tempo blockchain, Stripe is clearly not playing. Valora keeps running under cLabs while Stripe pushes stablecoins into the mainstream.

That’s all for today!