- Radar-as-a-Service

- Posts

- RaaS #561: Visa Launches a Stablecoin Advisory!

RaaS #561: Visa Launches a Stablecoin Advisory!

JPMorgan Tokenizes Money Markets, Coinbase Fights California Staking Ban: GM Web3!

MetaMask Adds Bitcoin, Solana Shrugs Off DDoS, and Moar!

Quick Intro: Radarblock is a Web3-native growth agency that increases awareness, TVL, volume, and social metrics for its clients over a consistent timeframe without uncertainty or confusion. All tweets are hyperlinked; click to view them on X.

Visa isn’t flirting with stablecoins anymore; it’s committing. The payments giant just launched a full-on Stablecoins Advisory Practice, helping banks and fintechs figure out how to actually use stablecoins for payments.

California still won’t let you stake? Coinbase is over it. The exchange is calling on California users to email their state commissioner and demand that the staking lawsuit be dropped. Coinbase wants the lawsuit gone, not another year of regulatory limbo.

The first Legion sale using USD1 is coming soon via Footballdotfun, with USD1 set as the exclusive transaction asset. No ETH, no USDC, just one stablecoin, one sale.

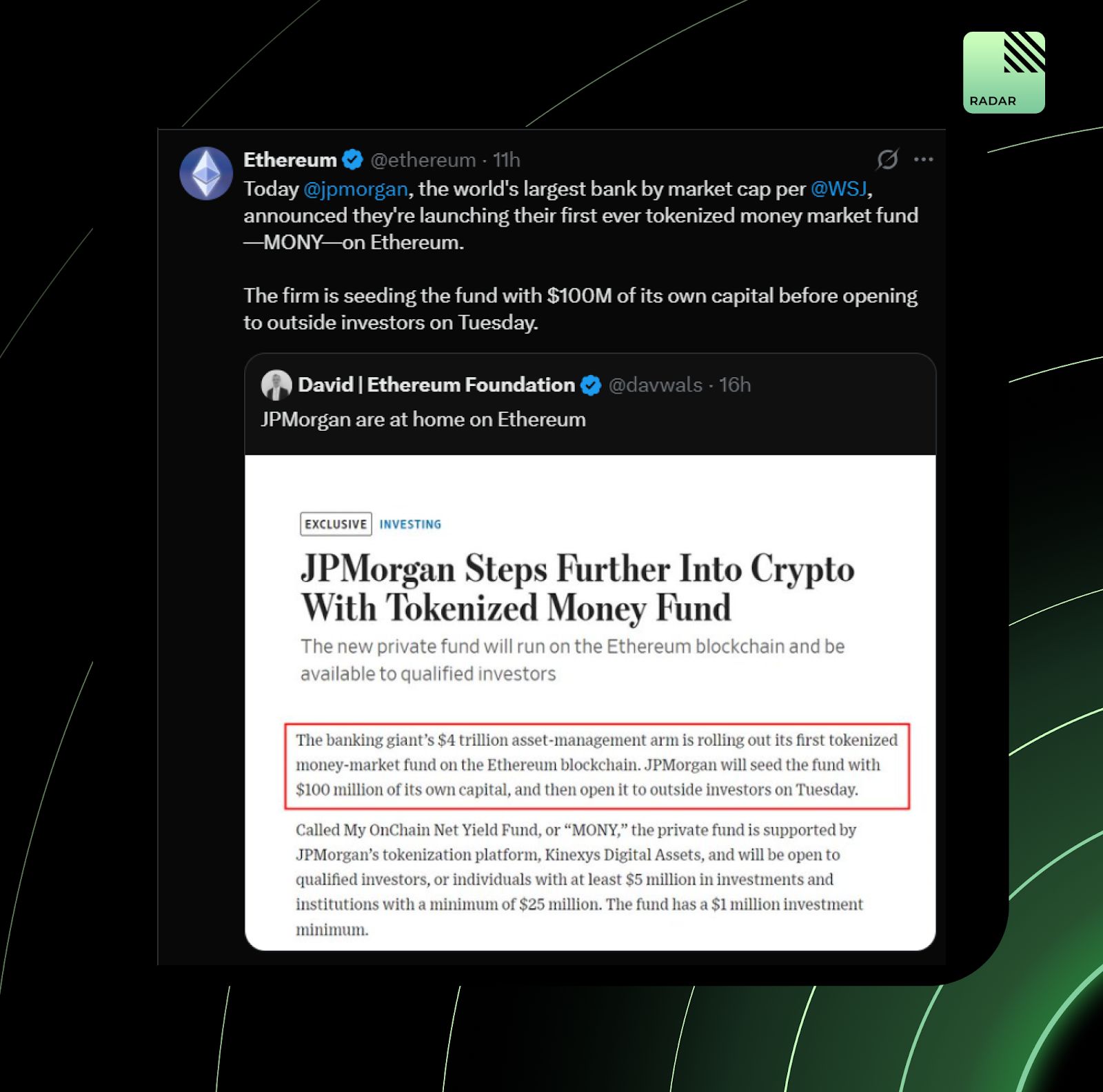

JPMorgan really went there. The world’s largest bank just launched its first tokenized money market fund on Ethereum, seeding it with $100M of its own capital. This isn’t a testnet experiment; this is Wall Street putting real money on-chain.

I’m so broke it’s not even funny.

Prediction markets are heating up with leverage. Space raised $3M to build leveraged prediction markets on Solana, aiming to offer up to 10x leverage with fast settlements and low fees. Degens get opinions and leverage now.

MetaMask finally rolled out native BTC support for its 30M users, letting them buy, swap, and send Bitcoin without wrapped assets or extra wallets. The update uses SegWit addresses initially, with Taproot coming soon, and even rewards swaps through their points program.

Your daily dose of bite-sized crypto news.

Matrixport says stablecoin growth is slowing, signaling weaker liquidity across crypto markets.

Aster DEX launched Shield Mode, enabling protected high-leverage perp trading with up to 1001x leverage.

The US Senate Banking Committee pushed crypto market structure markup to early 2026, skipping 2025 entirely.

CME Group launched spot-quoted XRP and SOL futures for institutional traders.

YZi Labs-backed Predictdotfun is launching its prediction market on BNB Chain tomorrow.

Circle just bought the brains behind Axelar. The USDC issuer acquired Interop Labs, the original Axelar devs, to boost its cross-chain ambitions. The network stays independent, but AXL dumped anyway. Classic case of equity wins, token holders cope.

Ondo announced plans to launch 100+ tokenized U.S. stocks and ETFs on Solana in early 2026, all backed 1:1 by regulated custodians. TradFi liquidity, crypto rails, and the RWA push keep accelerating.

Based on true events.

Want RaaS without digging through your inbox? Our Telegram channel gives you the same daily crypto roundup in a quick, scrollable format. Easy to read, easy to share. Join here: RaaS Telegram Group.

Top gainers: LUX, FHE, PIPPIN, ARC, KGEN

High-signal reads are worth your time, all in one place.

Mr.Beefman breaks down how 17 months of DLMM farming led to 7K SOL profit and 20K SOL in fees, showing there’s no “easy strat,” just long reps and experience compounding.

FipCrypto argues that most people fail in crypto by wasting time, not money, and that real winning comes from high-leverage actions instead of living in the trenches.

DeFi Cheetah explains why non-USD stablecoins aren’t failing on demand but on supply, as bank regulations kill liquidity and leave DeFi-native FX as the only real solution.

Miguel Rare connects vibecoding to the next Web3 app wave, drawing parallels to GOAT and showing how new infra is setting up the next narrative shift.

Abhitej reflects on Solana Breakpoint as a builder-first festival, arguing Solana’s real edge is culture, momentum, and execution, not noise.

Solana got hit and didn’t even blink. The network has been under a massive DDoS attack peaking near 6 Tbps, one of the largest ever recorded. Despite that, confirmations stayed fast, and latency stayed stable. Love it or hate it, this was a real stress test.

Ordinals are dead. Again. Magic Eden launched Ordinals buybacks, committing 15% of platform fees to scoop up Ordinals for a permanent collection. Whether this revives the market or just memes it harder… time will tell.

That’s all for today!