- Radar-as-a-Service

- Posts

- RaaS #562: Visa Picks Solana for USDC Settlements!

RaaS #562: Visa Picks Solana for USDC Settlements!

FDIC Opens the Stablecoin Door, SEC Drops Aave Case: GM Web3!

RedotPay Raises $107M, Securitize Announces Public Stocks On-chain, and Moar!

Quick Intro: Radarblock is a Web3-native growth agency that increases awareness, TVL, volume, and social metrics for its clients over a consistent timeframe without uncertainty or confusion. All tweets are hyperlinked; click to view them on X.

Visa, the payments giant, has launched USDC settlements on Solana for U.S. banks, allowing institutions like Cross River and Lead Bank to clear VisaNet obligations directly in stablecoins, even on weekends and holidays. Visa’s stablecoin volume is already running at a $3.5B annualized pace!

Right on cue, the FDIC opened the door for banks to issue stablecoins. Under the GENIUS Act, FDIC-supervised banks can now apply, via subsidiaries, to issue payment stablecoins backed 1:1 by dollars or high-quality assets. Translation: Stablecoins are officially entering the U.S. banking system, with regulators supervising rather than blocking.

Meanwhile, RedotPay, the Hong Kong-based stablecoin payments fintech, raised $107M in an oversubscribed Series B, led by Goodwater with Pantera, Blockchain Capital, Circle Ventures, and others. RedotPay now serves 6M users across 100+ markets and is already profitable.

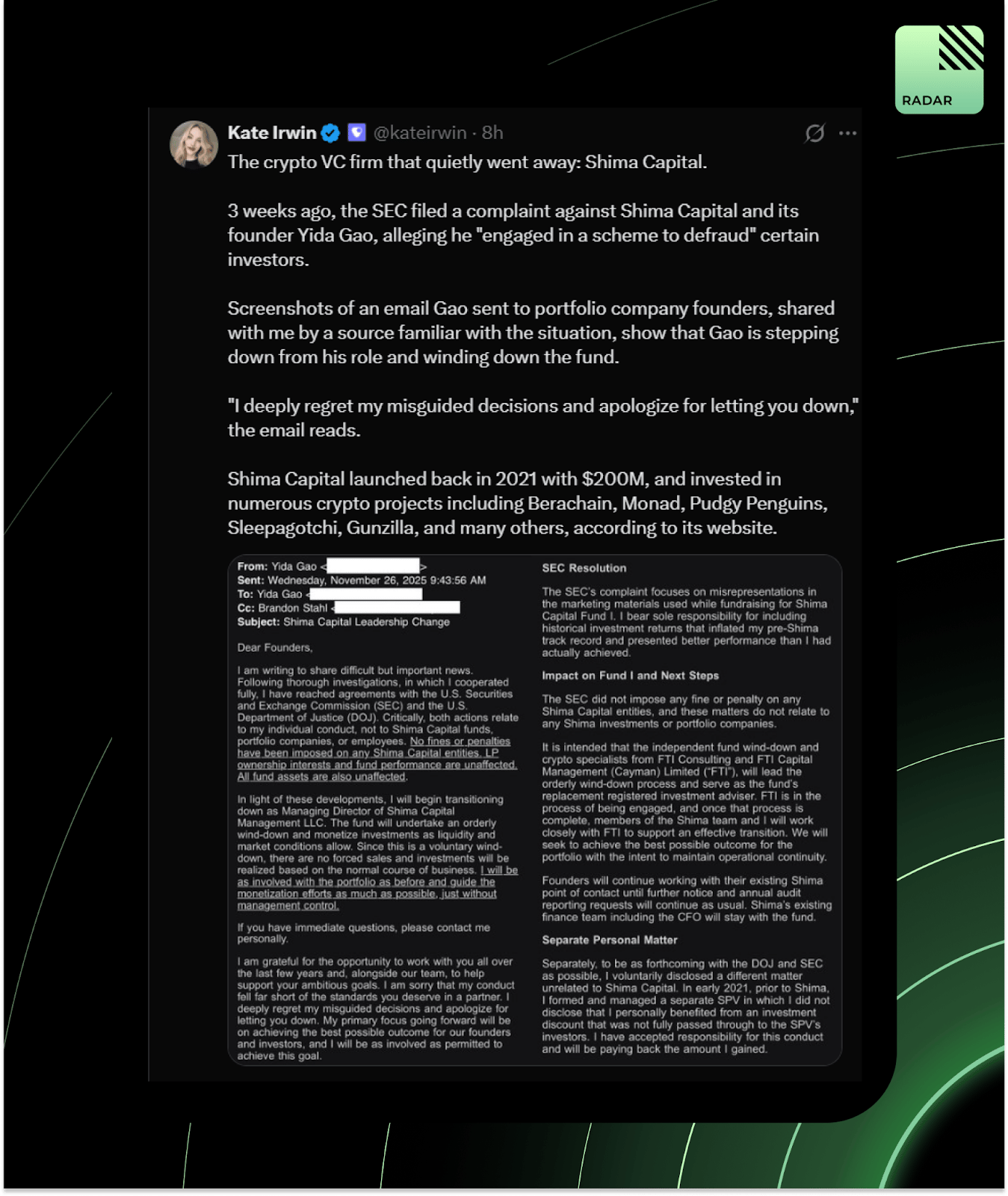

Shima Capital is winding down after founder Yida Gao settled SEC fraud charges tied to misleading fundraising claims. The firm, once managing $200M and backing names like Berachain and Monad, will undergo an orderly shutdown while Gao faces both civil penalties and a parallel criminal case.

In this economy? USDT or USDC.

On the infra side, prediction markets are multiplying. PancakeSwap and YZi Labs are co-incubating Probable, an on-chain prediction market on BNB Chain that lets users bet on sports, politics, crypto, and major events using any asset.

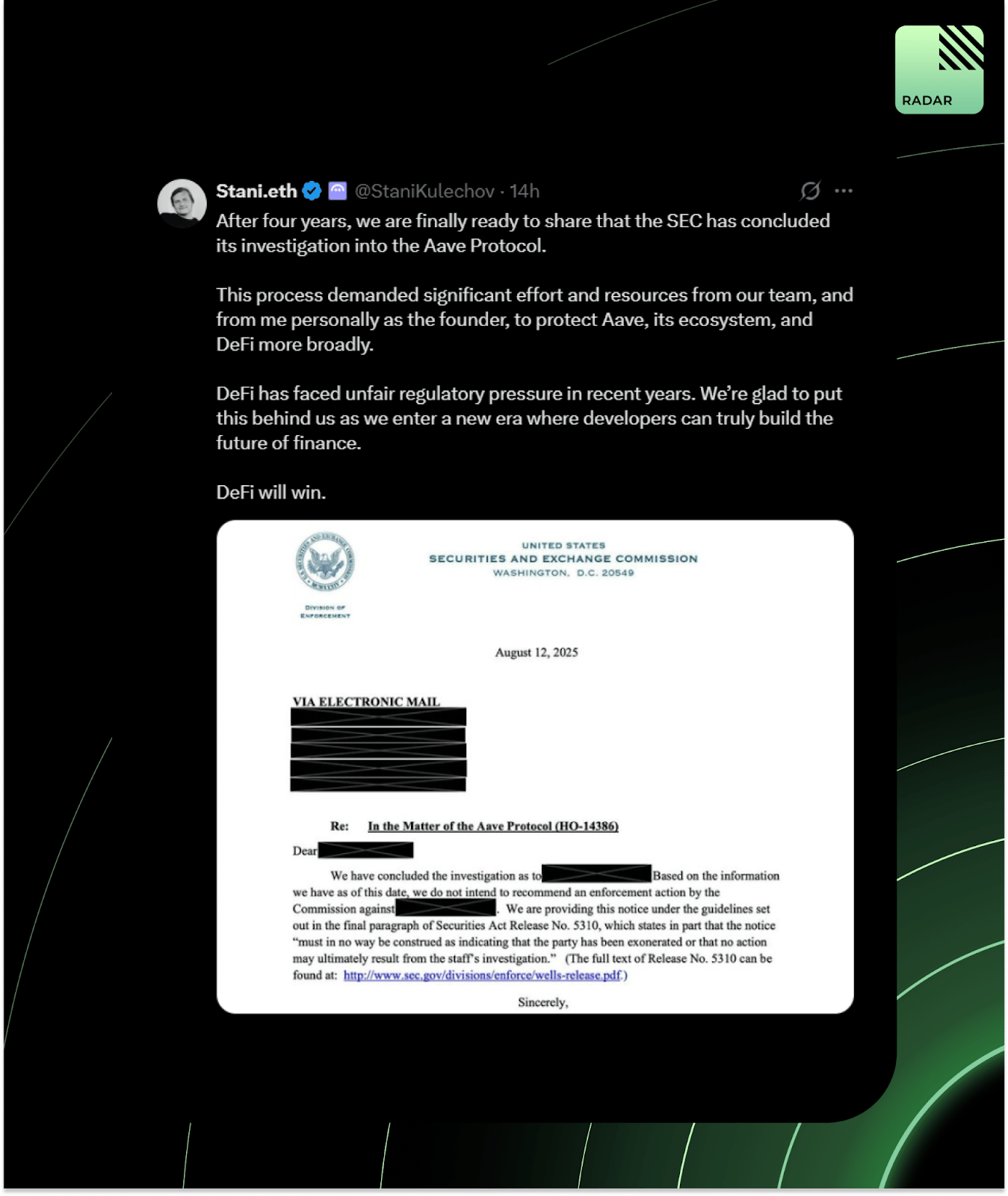

After four long years, Aave finally got the all-clear. The SEC has closed its investigation into the Aave Protocol without recommending any enforcement action. Founder Stani Kulechov called the pressure unfair, but says the closure frees builders to move forward.

Your daily dose of bite-sized crypto news.

Strata raised $3M led by Maven 11 to build the risk-tranching layer of DeFi.

KindlyMD risks Nasdaq delisting if it can’t reclaim a $1 share price for 10 consecutive days by June 2026.

Phantom launched Phantom Connect, a free SDK to make Phantom accounts detectable and easier to onboard across apps.

Moto raised $1.8M pre-seed to build the first true on-chain credit card on Solana, waitlist now live.

The Marshall Islands launched on-chain UBI, powered by Stellar, the first of its kind.

BNB Chain also teased U, a new unified, institution-ready stablecoin launching December 18, positioned as a liquidity layer across multiple on-chain use cases. Another chain, another stablecoin.

Securitize announced real public stocks on-chain, with full shareholder rights, self-custody, voting, and dividends, all recorded directly on issuer cap tables. Backed by BlackRock and Morgan Stanley, the full launch lands in early 2026.

Rip memecoins, 2024-2025. You will not be missed.

Want RaaS without digging through your inbox? Our Telegram channel gives you the same daily crypto roundup in a quick, scrollable format. Easy to read, easy to share. Join here: RaaS Telegram Group.

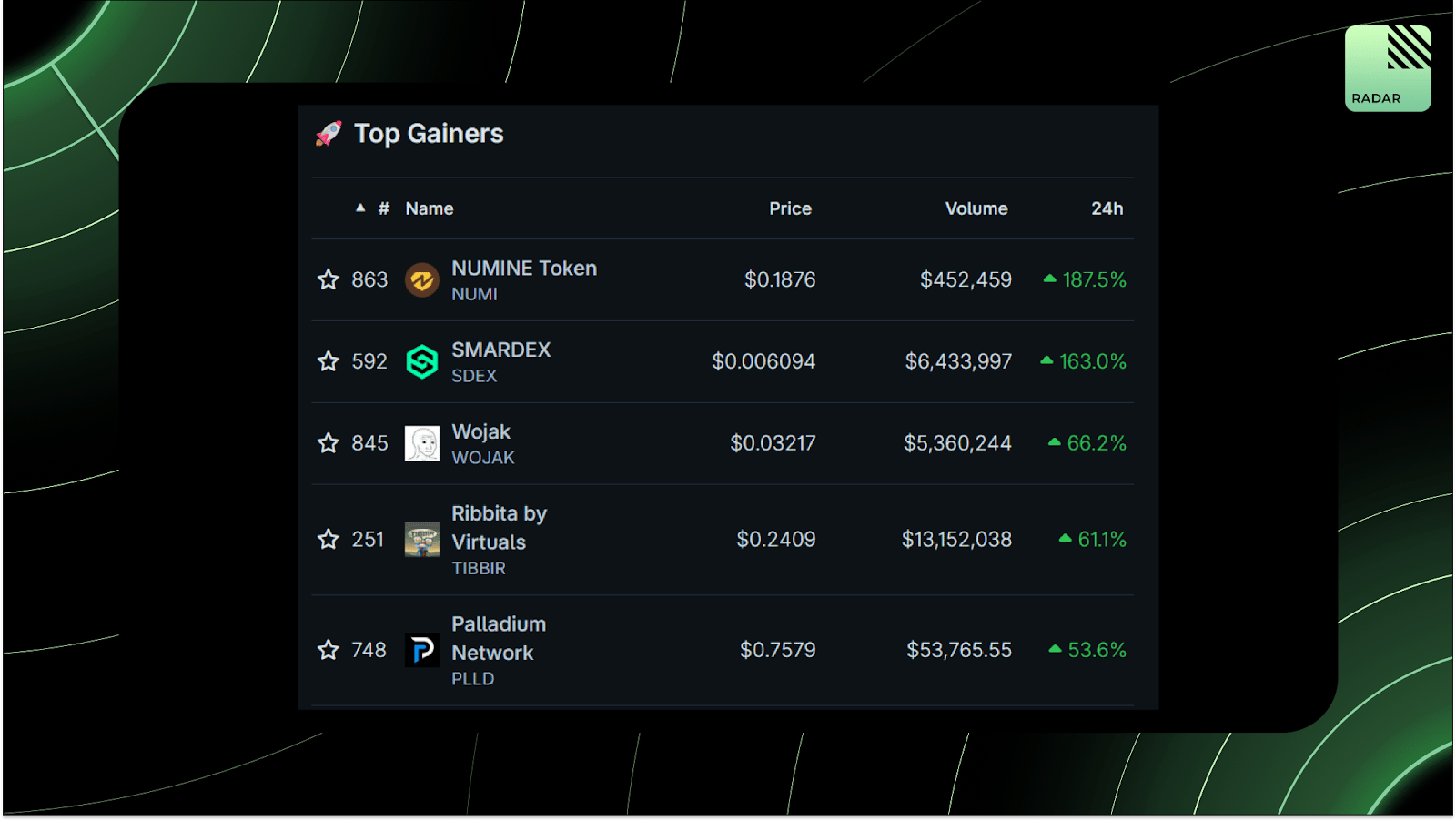

Top gainers: NUMI, SDEX, WOJAK, TIBBIR, PLLD

High-signal reads are worth your time, all in one place.

DeFi Explora recaps 2025 as a chaotic rollercoaster, from memecoin rugs and InfoFi dominance to hacks, liquidations, and prediction markets turning into casinos, then looks ahead to the narratives that could actually matter in 2026.

GTreasury explains why corporate treasury is finally evolving, breaking down how digital asset rails enable 24/7 settlement, slash cross-border costs by up to 90%, and unlock liquidity without legacy banking friction.

MINHxDYNASTY shares a raw story of going all-in five times, getting wiped twice, and still ending up financially free, arguing that risk isn’t reckless if you engineer the downside and align everything toward one north star.

Dougie DeLuca argues that “crypto” as a self-contained bubble is dying, not because the tech failed, but because it’s dissolving into everything else, marking the real beginning of mainstream adoption, not the end.

Shineeee breaks down why Monad is positioned to win where other high-FDV chains failed, claiming its success comes from prioritizing real product market fit and ecosystem engagement.

Tether led an $8M strategic investment in Speed Inc., a payments infrastructure platform that enables instant global settlements using the Bitcoin Lightning Network and stablecoins, processing over $1.5B in annual volume for 1.2M users and businesses via Speed Wallet and Speed Merchant.

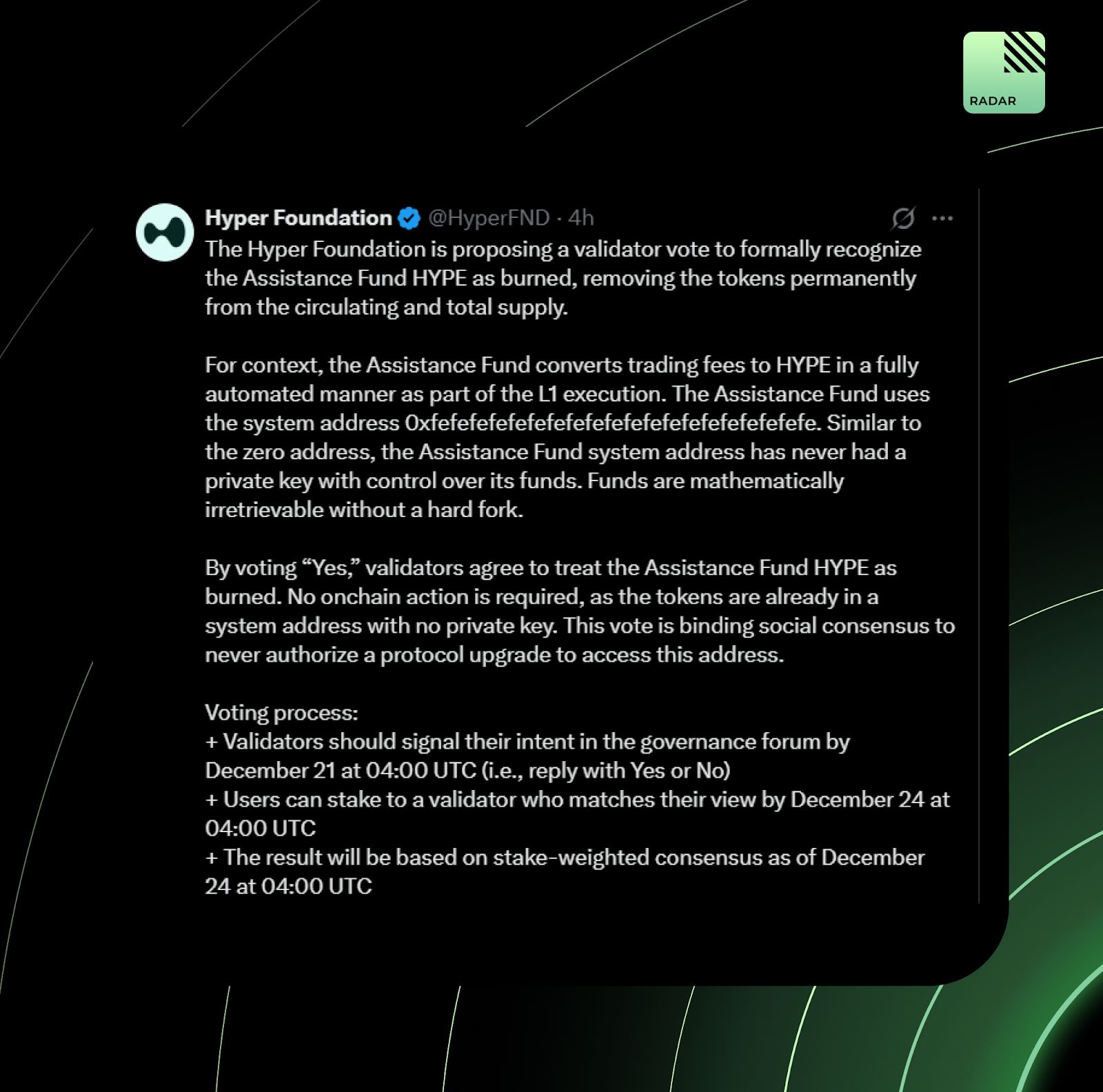

Finally, Hyperliquid may be about to burn $1B. The Hyper Foundation proposed formally recognizing 37M HYPE tokens in its Assistance Fund as permanently burned. If passed, it will cut Hyperliquid's fully diluted value by over $1 billion right away.

That’s all for today!