- Radar-as-a-Service

- Posts

- RaaS #564: Pumpdotfun Dev Sentenced to 6 Years!

RaaS #564: Pumpdotfun Dev Sentenced to 6 Years!

Fuse Hits $5B Valuation, MegaETH Opens Frontier: GM Web3!

Uniswap’s Proposal Final Voting Live, Aptos Proposes AIP-137, and Moar!

Quick Intro: Radarblock is a Web3-native growth agency that increases awareness, TVL, volume, and social metrics for its clients over a consistent time frame without uncertainty or confusion. All tweets are hyperlinked; click to view them on X.

Former Pumpdotfun developer, Jarett Dunn, was sentenced to six years in prison for stealing roughly $2M worth of SOL by exploiting bonding curve contracts. The case serves as a reminder that “shipping fast” doesn’t mean skipping accountability.

DAWN raised $13M in Series B, led by Polychain, to expand its user-owned wireless network built on Solana. The project already reaches over 4M U.S. households and has launched internationally, positioning itself as a serious alternative to traditional broadband providers.

Fuse Energy also raised $70M at a $5B valuation, led by Lowercarbon and Balderton. The new capital will fund global solar expansion and a deeper push into the U.S. and Europe.

MegaETH has finally opened its Frontier mainnet beta to developers. The Ethereum L2 is already processing over 1M daily transactions, with sub-10ms block times and live infrastructure dashboards. Builders now get a month-long stress test before public access in early 2026.

The intern thinks he had a hot take.

The Terraform Labs Plan Administrator filed a $4B lawsuit against Jump Trading, accusing the firm of market manipulation and self-dealing tied to Terra’s collapse. The case aims to recover funds for creditors and re-litigate one of crypto’s most painful chapters.

Adam Back cooled the quantum FUD around Bitcoin. The Bitcoin pioneer said quantum risks only apply to early addresses with exposed public keys from 2009–2011, potentially affecting 2–4M BTC, including Satoshi’s coins. He added that Bitcoin can upgrade via soft forks, while mining remains largely quantum-resistant.

Your daily dose of bite-sized crypto news.

EthGas launched the EthGas Foundation to fund ecosystem development and drive long-term, sustainable value.

CZ weighed in on crypto payments, saying CEXs work short-term but sacrifice privacy, while long-term adoption needs proper privacy solutions.

PayPal partners with USDAI to integrate PYUSD as a settlement asset for AI infrastructure financing.

Nansen teased Joint Venture Protocols (JVPs), a new co-creation model for crypto infrastructure, expected to launch in 2026.

Crypto Czar David Sacks said the U.S. is closer than ever to passing a crypto market structure bill, claiming it could cut market manipulation by 70% or more.

The U.S. Senate confirmed Michael Selig as CFTC Chair, a pro-crypto and pro-Bitcoin pick that further signals a friendlier regulatory environment heading into 2026.

Uniswap’s UNIfication proposal entered final voting, which could trigger a 100M UNI burn, flip v2 and v3 fee switches on mainnet, and formalize governance alignment through a Wyoming DUNA structure. If it passes, supply dynamics change overnight.

Do you think the Hyperliquid maxis are regretting it?

Want RaaS without digging through your inbox? Our Telegram channel gives you the same daily crypto roundup in a quick, scrollable format. Easy to read, easy to share. Join here: RaaS Telegram Group.

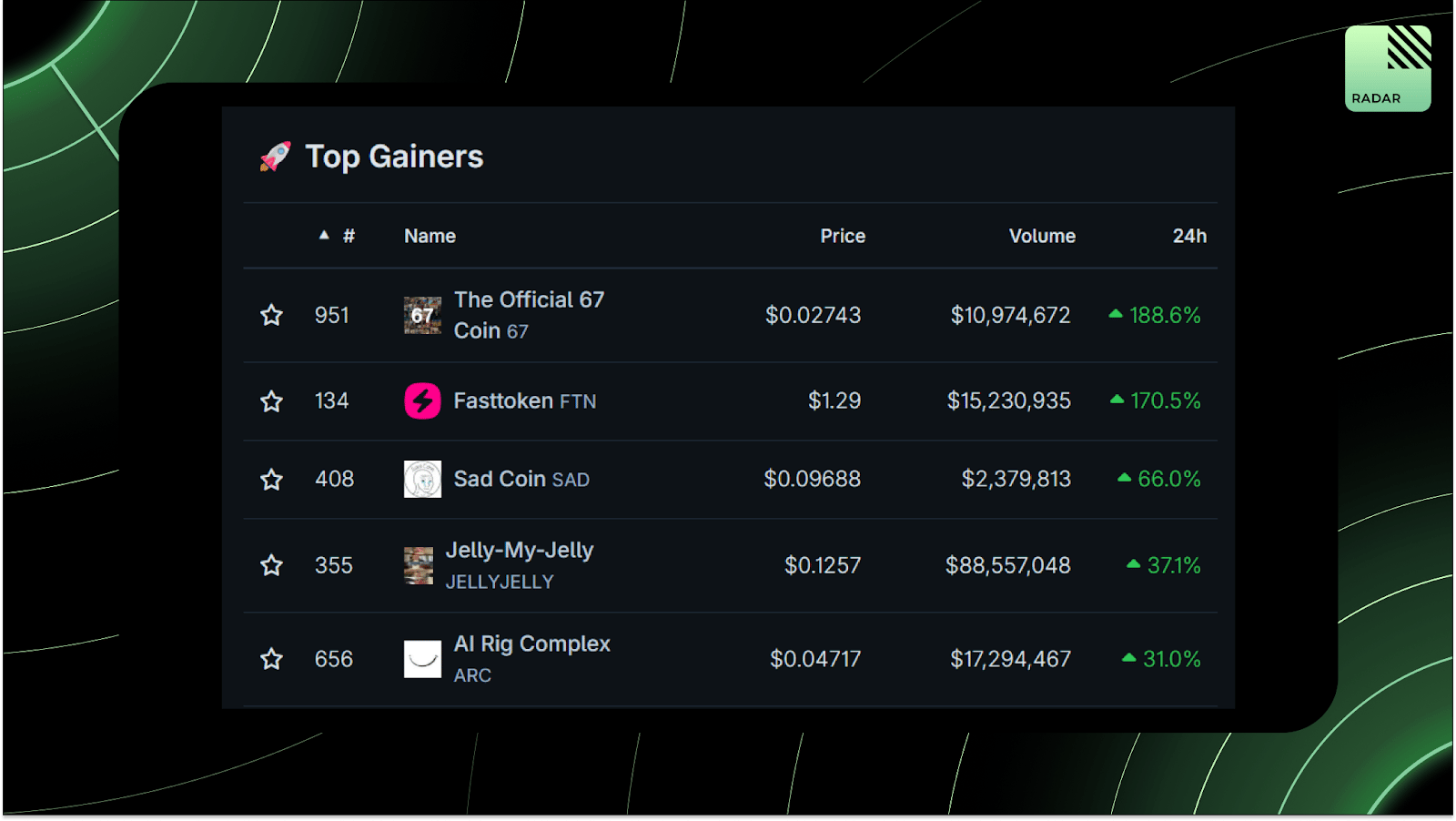

Top Gainers: 67, FTN, SAD, JELLYJELLY, ARC.

High-signal reads are worth your time, all in one place.

Messari lays out its Theses for 2026, mapping where crypto is headed next, from TradFi and crypto convergence to DePIN, decentralized AI, and the long-overdue push into consumer crypto.

Jeff reflects on 2025’s brutal market, arguing it was less a bull run and more an industry reset, with BTC dominance rising, alts collapsing, and crypto quietly maturing ahead of 2026 for those still standing.

Blendino breaks down why ICOs are back, explaining how projects that launch at reasonable FDVs avoid backlash, while inflated valuations continue to kill momentum before tokens even hit the market.

Edgar Pavlovsky shares post-Breakpoint takeaways, arguing that crypto has fully converged into finance, institutions are no longer “experimenting,” and the next wave belongs to teams that can build on crypto rails for mainstream users.

Luckshuryy distills seven years of trading lessons, emphasizing focus over diversification, strict risk management, collaboration over isolation, and process-driven discipline as the key to surviving and avoiding burnout.

Cryptodotcom expanded fiat rails in Singapore, partnering with DBS Bank to enable seamless SGD and USD deposits and withdrawals. Regulated infrastructure keeps winning where clarity exists.

Stablecoins keep quietly eating fintech. Intuit partnered with Circle to integrate USDC across TurboTax, QuickBooks, and Credit Karma, unlocking faster payments, remittances, and savings flows inside mainstream financial apps.

That’s all for today!