- Radar-as-a-Service

- Posts

- RaaS #565: Coinbase Sues Over Prediction Markets!

RaaS #565: Coinbase Sues Over Prediction Markets!

Buidlpad Vaults Fill Instantly, Tether Builds an AI Wallet: GM Web3!

Lighter Airdrop Speculation Heats Up, Klarna Taps USDC Funding, and Moar!

Quick Intro: Radarblock is a Web3-native growth agency that increases awareness, TVL, volume, and social metrics for its clients over a consistent time frame without uncertainty or confusion. All tweets are hyperlinked; click to view them on X.

Coinbase has filed lawsuits against Michigan, Illinois, and Connecticut, arguing that prediction markets fall under federal CFTC jurisdiction, not state gaming regulators. The exchange says state-by-state enforcement threatens innovation and creates a fragmented regulatory mess.

Buidlpad launched its fixed-term DeFi Vaults offering an institutional-style 8% APY, and Phase 1 filled almost immediately. Roughly $20M was locked across four vaults, with deposits now earning until maturity in January 2026. Fixed yield is officially back on the menu.

Arthur Hayes dropped another macro nuke, arguing that Reserve Management Purchases (RMP) are simply Quantitative Easing (QE) with a new label. His take: once markets price this in, Bitcoin could reclaim $124K and move quickly toward $200K. Hayes also flagged ENA as his favorite alt tied to synthetic dollar demand.

The Blockchain Association and over 125 crypto firms sent a letter urging U.S. lawmakers to block efforts to restrict stablecoin rewards on third-party platforms. The group warned that expanding these limits would hurt adoption, liquidity, and U.S. competitiveness in digital finance.

It’s easy peasy lemon squeezy.

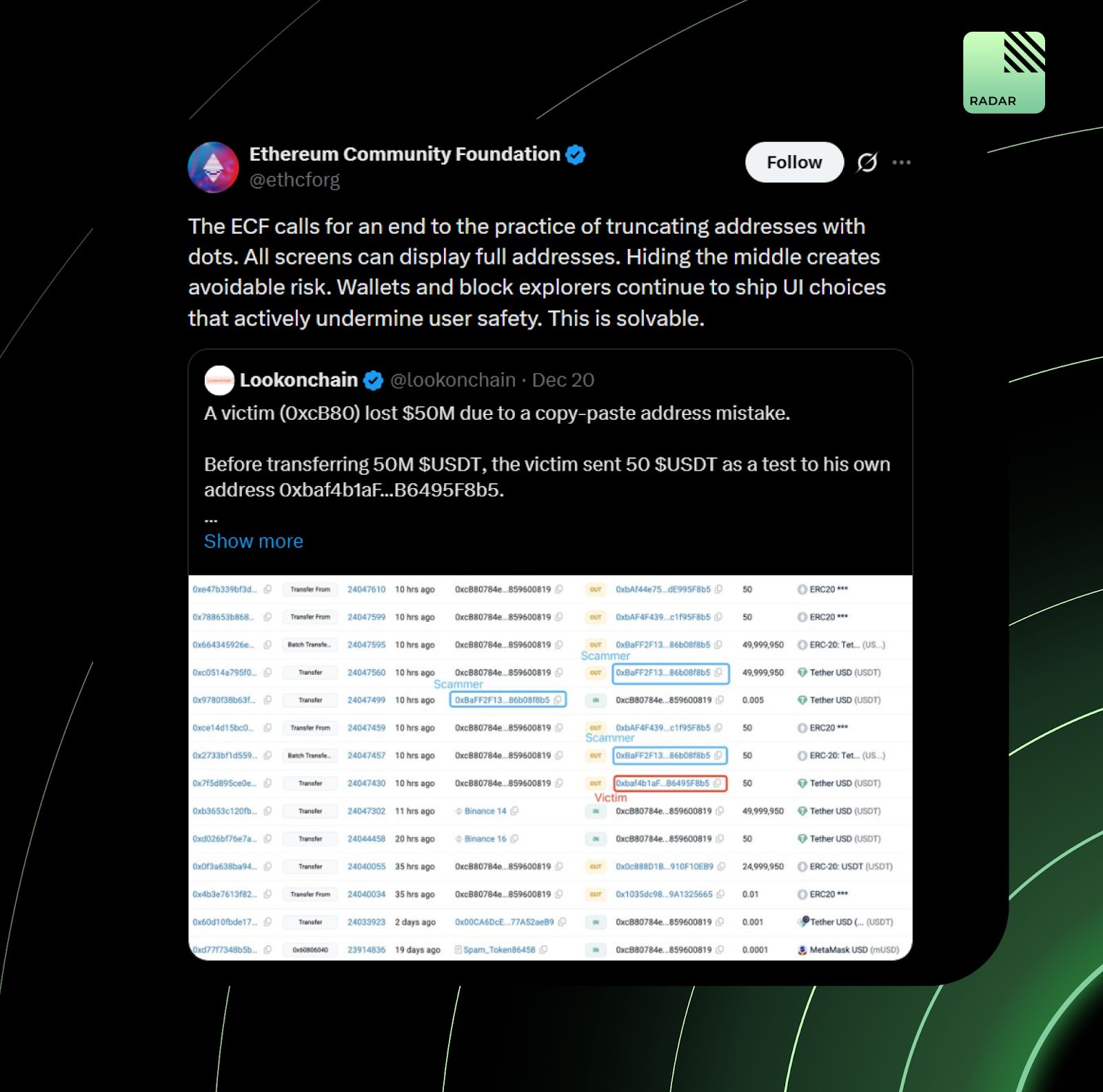

The Ethereum Community Foundation is urging wallets and block explorers to stop truncating wallet addresses with “…”. The push comes after a $50M loss caused by a copy-paste address spoofing attack. The message is simple: full addresses reduce risk, and bad UX is costing users real money.

LeverUp (LV) just made history as the first-ever Monad-native project to launch on CAKE.PAD, PancakeSwap’s new launchpad. Participants committed CAKE during the sale and will claim LV once it concludes. The launch was 678X oversubscribed with $61M committed. Monad meets PancakeSwap, and the appetite is loud and clear.

Your daily dose of bite-sized crypto news.

RUSSELL on Base popped after Elon Musk replied with a fire emoji, briefly pushing the token to a ~$10M market cap.

Binance earned ISO/IEC 42001 certification, setting a new bar for responsible AI governance in crypto.

Hedera-native DePIN Neuron was selected for NATO’s DIANA 2026 Challenge Programme.

Litecoin pushed back on rumors, saying claims that Charlie Lee “regrets creating LTC” were based on a misleading, clipped video.

Aave governance heats up as the community prepares to vote on transferring brand asset control to token holders.

Tether CEO Paolo Ardoino has revealed plans for a mobile wallet that supports BTC (including Lightning), USDT, XAUT, and USAT, with local private AI integration. If shipped, it would mark Tether’s biggest move yet into consumer-facing infrastructure.

BitRobot Network has opened limited private beta access for its robotic AI platform. The project focuses on embodied AI, enabling users to remotely control robotic arms for training machines and earning rewards. It previously raised $8M from investors, including Solana Ventures and Anatoly Yakovenko.

Crypto early 2025 vs late 2025.

Want RaaS without digging through your inbox? Our Telegram channel gives you the same daily crypto roundup in a quick, scrollable format. Easy to read, easy to share. Join here: RaaS Telegram Group.

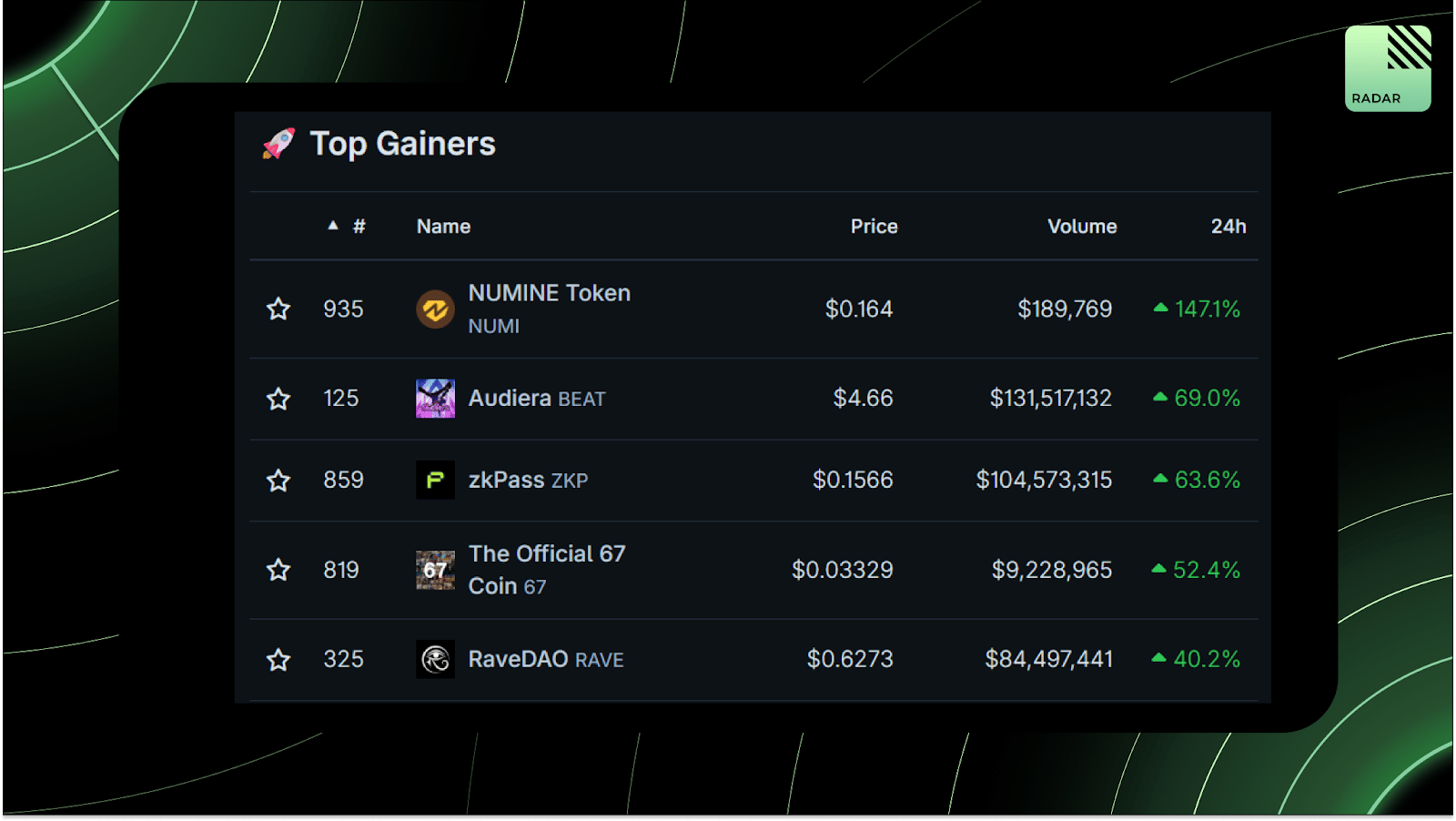

Top Gainers: NUMI, BEAT, ZKP, 67, RAVE.

High-signal reads are worth your time, all in one place.

Galaxy Research projects a strong 2026–2027 cycle, calling for BTC toward $250K, stablecoins overtaking ACH, DeFi capturing 25% of spot volume, $90B in on-chain loans, major growth in tokenized TradFi, and more.

Solus Group exposes how broken token launches really are, showing most 2025 tokens were effectively dead on Day 1, with raise size, Discord numbers, and IDO platforms having almost no impact on performance.

Thiccy examines why even profitable traders gave back gains in 2025, pointing to psychology, sizing mistakes, and failure to adapt during volatile market regimes.

Exitpump breaks down how to read order books properly, explaining heatmaps, depth, and liquidity clusters that signal where price is likely to stall or accelerate.

Spicy explains why volume is the most misunderstood indicator, sharing a prop-trader framework for using volume to identify real participation, filter noise, and improve strategy win rates.

Klarna is partnering with Coinbase to raise short-term institutional funding denominated in USDC. The move adds stablecoins to Klarna’s treasury stack alongside deposits and commercial paper, signaling deeper TradFi adoption of crypto-native liquidity rails.

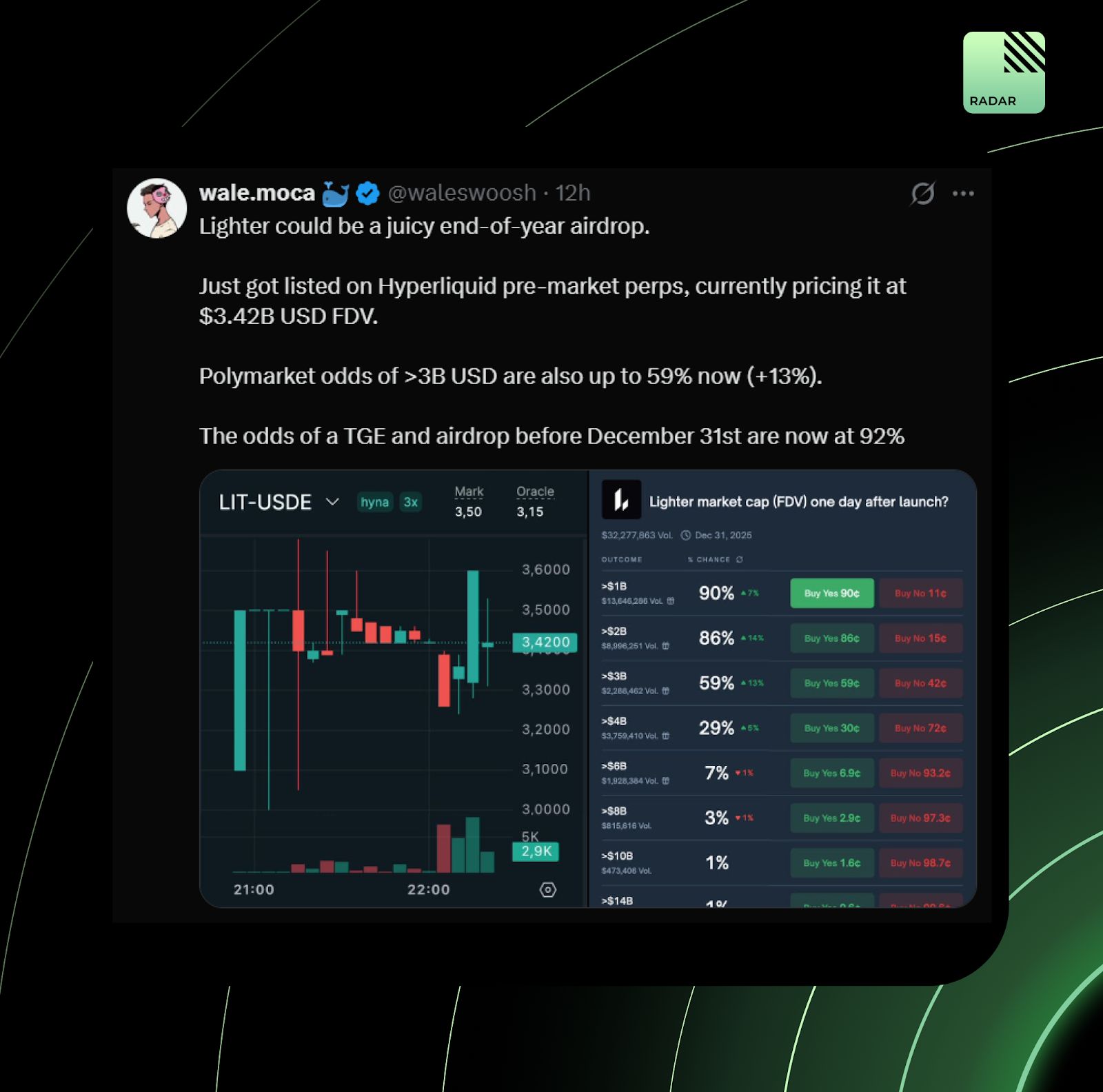

Lighter transferred 250M LIT tokens (25% of total supply), sparking fresh airdrop speculation ahead of its TGE. With a network upgrade scheduled and Polymarket betting on a late-December launch, attention is quickly building around the token’s distribution.

That’s all for today!