- Radar-as-a-Service

- Posts

- RaaS #566: Aave Governance Drama Escalates!

RaaS #566: Aave Governance Drama Escalates!

Coinbase Goes All-In on Prediction Markets, Kalshi Expands on BNB: GM Web3!

Polymarket Builds Its Own Chain, Hong Kong Opens the Door to Insurers, and Moar!

Quick Intro: Radarblock is a Web3-native growth agency that increases awareness, TVL, volume, and social metrics for its clients over a consistent time frame without uncertainty or confusion. All tweets are hyperlinked; click to view them on X.

Aave governance just got messy. Ernesto, an Aave ecosystem contributor, publicly criticized Aave Labs for rushing his proposal on brand asset control to a Snapshot vote without his consent. The fallout was immediate, with AAVE dropping around 11% as DAO tensions spilled into the open.

After launching prediction markets last week, Coinbase announced it’s acquiring The Clearing Company to accelerate its regulated, on-chain prediction market push. Brian Armstrong says this is just the beginning of Coinbase’s “Everything Exchange” era.

Kalshi just made it easier to bet on the real world. The CFTC-regulated prediction market now supports direct BNB and USDT deposits on the BNB Smart Chain, reducing fees and friction for users trading yes/no contracts on a wide range of topics, from politics to cryptocurrency prices.

Outages were the last straw. Polymarket confirmed its own Ethereum Layer 2 is now priority number one after infrastructure issues paused trading last week. With $85M in daily volume and a $9B valuation, owning the rails is no longer optional.

Since when do we have savings? Aren’t we all in?

Asia might be next. Hong Kong’s Insurance Authority proposed allowing insurers to hold crypto, as long as they back every dollar of exposure with a dollar of capital. Conservative? Yes. A green light for institutions? Also yes.

The Espresso airdrop portal is officially live. Users can now check eligibility across 33+ paths, from mainnet activity to hackathons. Claims open in early 2026, and more criteria are coming, so staying active still matters.

Your daily dose of bite-sized crypto news.

Trump Media added 451 BTC, pushing holdings past 11,500 BTC, over $1B on its balance sheet.

Seedify introduced the Initial Milestone Offering (IMO), unlocking funding in stages as projects hit milestones.

Hilbert Capital acquired crypto HFT firm Enigma Nordic for $32M.

Tether released QVAC Genesis II, expanding its synthetic education dataset to 148B tokens.

Strategy increased reserves again, now holding $2.19B in cash and 671,268 BTC.

Polygon isn’t just talking adoption, it’s shipping it. Payments giant Shift4 launched stablecoin settlement on Polygon, letting merchants accept USDC, USDT, EURC, or DAI with instant, 24/7 liquidity. TradFi rails are officially getting replaced.

Nasdaq-listed ETHZilla sold $74.5M worth of ETH to clean up its debt and is officially moving away from the “ETH treasury” narrative. The company says its future is now RWA tokenization, not balance-sheet flexing.

Whatever it takes.

Want RaaS without digging through your inbox? Our Telegram channel gives you the same daily crypto roundup in a quick, scrollable format. Easy to read, easy to share. Join here: RaaS Telegram Group.

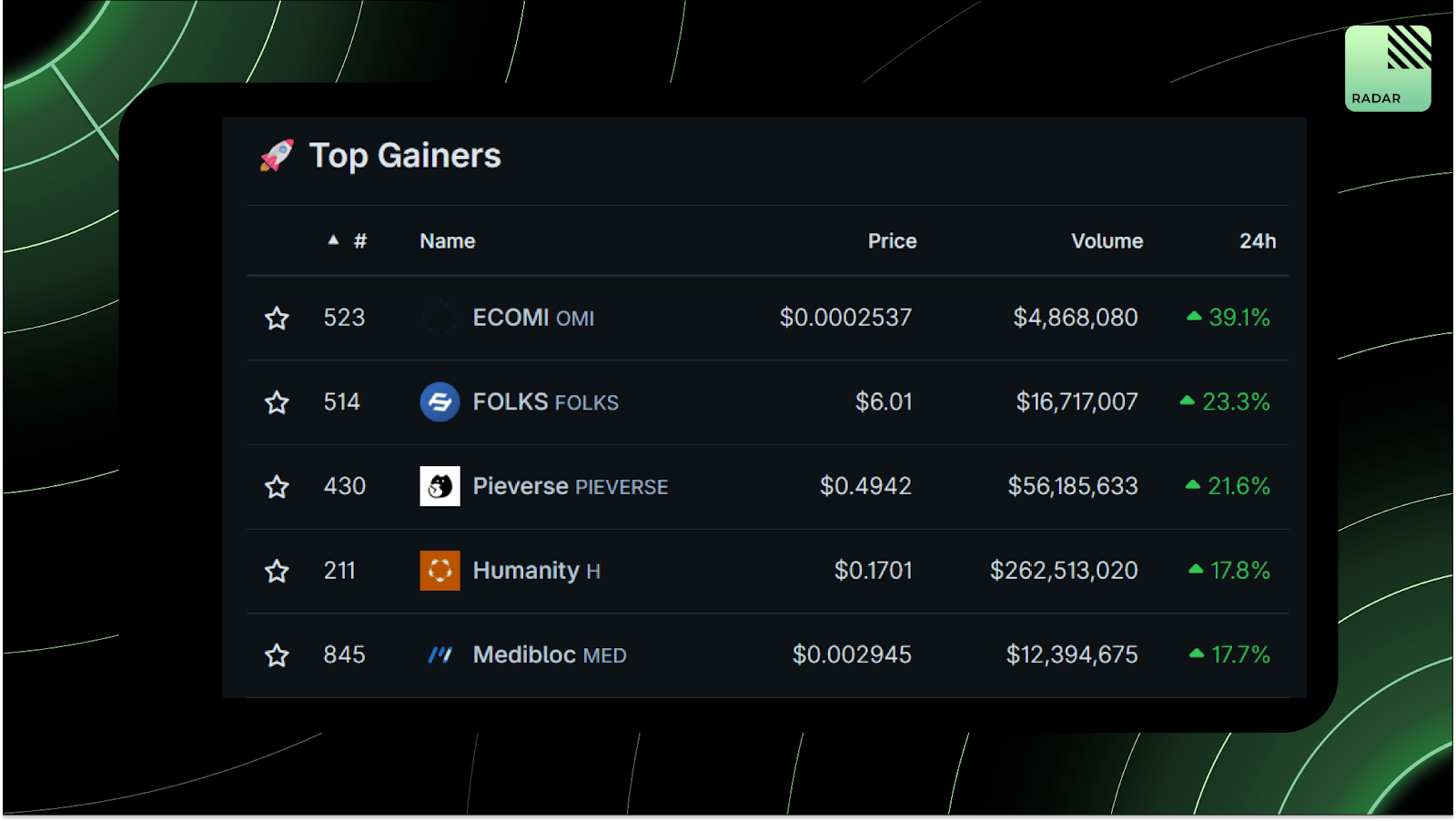

Top Gainers: OMI, FOLKS, PIEVERSE, H, MED.

High-signal reads are worth your time, all in one place.

Jason Yanowitz reminds crypto Twitter how far the industry actually came in 2025, arguing that despite price pain and apathy, the year delivered massive real progress that’s easy to miss when stuck in CT doomscrolling.

SystematicLS explains why hedge fund returns are misunderstood, arguing that critics compare them to the S&P incorrectly, ignoring that allocators pay for uncorrelated, factor-neutral, high-Sharpe returns, not market beta.

Tomasz Tunguz shares 11 predictions for 2026, continuing his annual track record of scoring past calls and outlining where he thinks tech, markets, and venture are heading next.

Cain O’Sullivan breaks down why HyperEVM precompiles are surprisingly expensive, explaining how current gas pricing makes them costlier than expected and why treating them as function calls could fix it.

Jayden lays out a complete Polymarket playbook, arguing it’s not a casino but a market microstructure game, and showing how disciplined traders and bots consistently extract real edges.

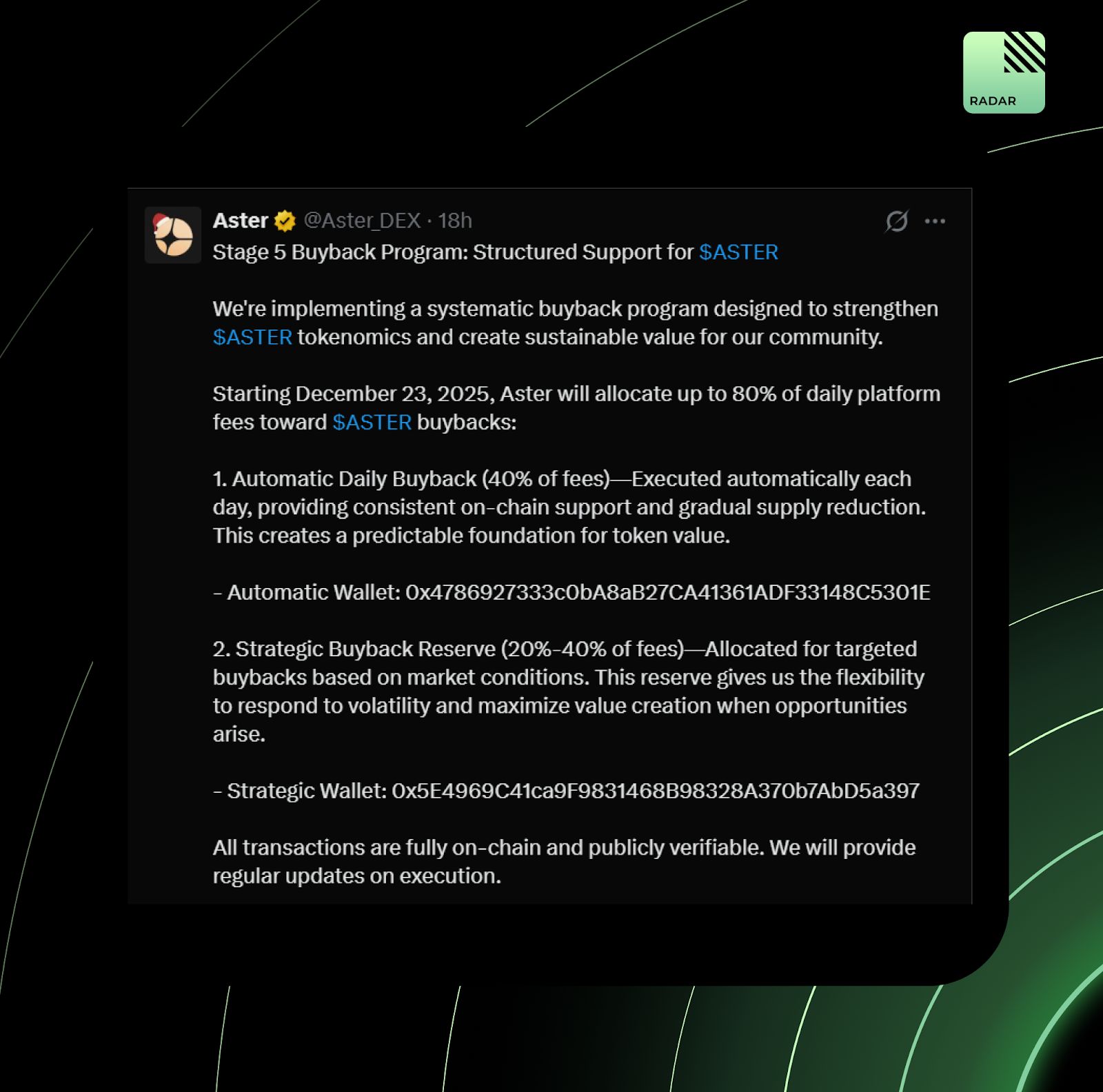

Aster announced a new buyback program starting December 23, directing up to 80% of daily platform fees toward ASTER buybacks. Less talk, more on-chain support.

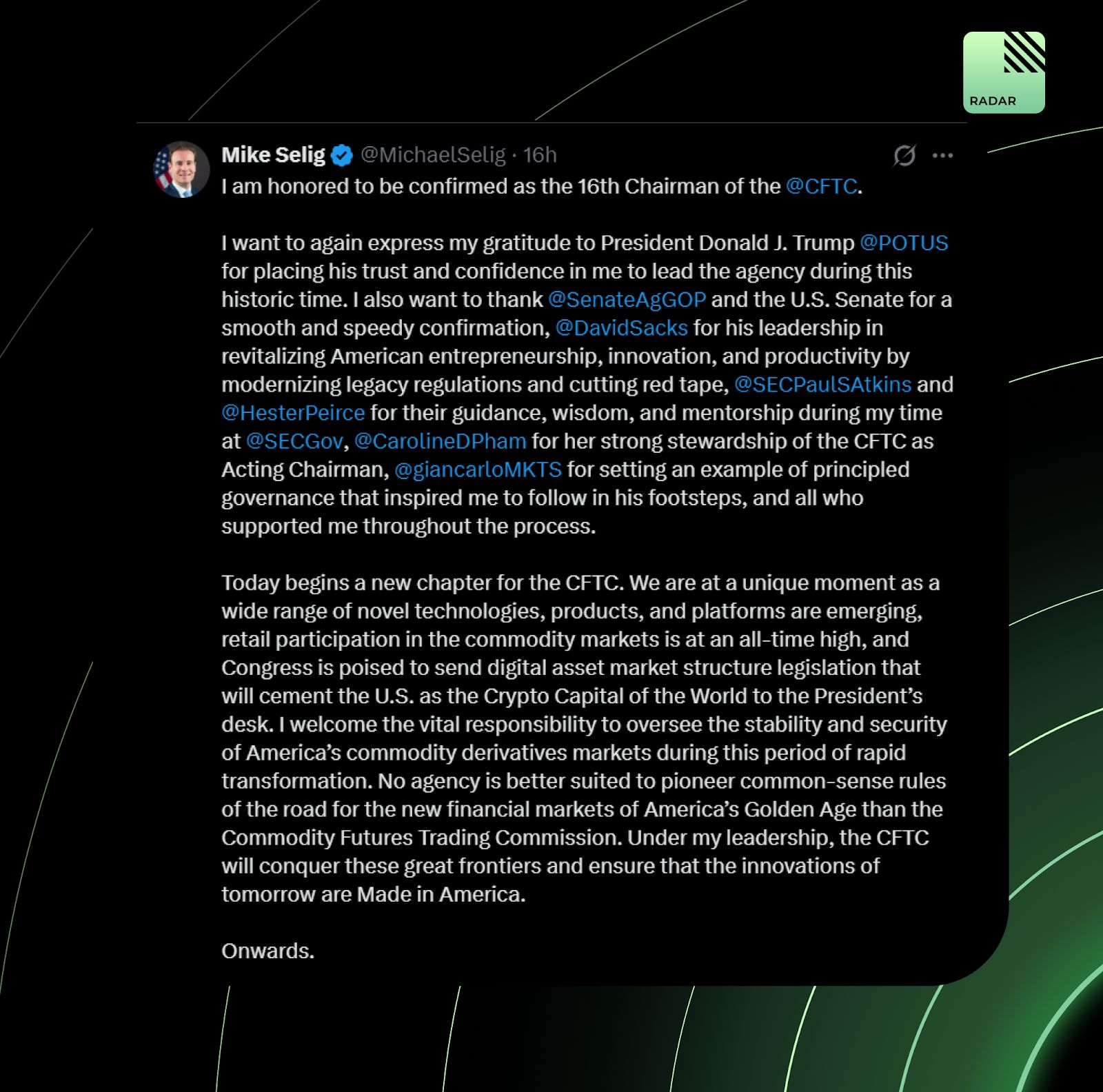

Michael Selig has officially been confirmed as Chairman of the CFTC. A former SEC Crypto Task Force member, Selig steps in as retail participation surges and digital asset market structure bills move through Congress. Regulators aren’t circling crypto anymore; they’re gearing up to govern it.

That’s all for today!