- Radar-as-a-Service

- Posts

- RaaS #567: Hyperliquid Burns $900M!

RaaS #567: Hyperliquid Burns $900M!

Cryptodotcom Doubles Down on Prediction Markets, Solana Foundation Unveils Kora: GM Web3!

Hyperliquid Expands FX Markets, Coinbase Bridges Base to Solana, and Moar!

Quick Intro: Radarblock is a Web3-native growth agency that increases awareness, TVL, volume, and social metrics for its clients over a consistent time frame without uncertainty or confusion. All tweets are hyperlinked; click to view them on X.

Hyper Foundation officially recognized 37.5M HYPE in its Assistance Fund as burned after a stake-weighted governance vote passed with 85% approval. The tokens, sourced from trading fees, now sit permanently at an unrecoverable address, shrinking circulating supply without a fork. Clean execution, loud signal.

Despite the burn, CT drama quickly followed. Claims surfaced that Hyperliquid was missing $362M in USDC, sparking fears. Hyperliquid responded with on-chain receipts, showing critics missed native USDC alongside USDC.e. Funds are fully backed, and even the original researcher conceded the gap wasn’t real.

Cryptodotcom is staffing up its prediction markets desk, posting a quant trader role focused on sports contracts. The job involves trading directly against users and managing platform risk. Translation: prediction markets are becoming a core product, not an experiment.

Tradedotxyz launched USDEUR and USDJPY on Hyperliquid via HIP-3, bringing on-chain perps into forex territory. Crypto-native infra is quietly absorbing TradFi’s biggest markets.

Stay at home dog-mom sounds good.

Bybit announced a new multi-layer insurance fund model to reduce ADL during volatility. New USDT perps will route through dedicated pools before joining a shared fund. The exchange says loss absorption per pair jumps by over 200%.

Coinbax raised $4.2M to build a programmable trust infrastructure for stablecoin payments, escrow, policy enforcement, and programmable settlement. Backed by BankTech Ventures and Paxos-linked investors, this is banking-grade crypto plumbing.

Your daily dose of bite-sized crypto news.

Russia’s central bank proposed legal crypto trading while banning domestic payments.

NOCK launched on Aerodrome and surged ~100% after going live on Base.

WalletConnect announced that TON integration is coming.

Arthur Hayes says Zcash may finally get its moment again for anyone saddened that crypto has become just another TradFi asset class.

South Korea’s BC Card completed a stablecoin payments pilot for foreign users.

The Solana Foundation unveiled Kora, a fee relayer and signing node that enables gasless transactions, custom fee tokens such as stablecoins, and secure off-chain signing via Turnkey or AWS KMS. UX matters now, and Solana is shipping.

Gnosis Chain executed a hard fork to recover funds lost in the Balancer exploit, moving assets out of attacker control. Node operators must upgrade immediately or face potential penalties. Not pretty, but decisive.

It’s giving Tom Riddler → Voldemort.

Want RaaS without digging through your inbox? Our Telegram channel gives you the same daily crypto roundup in a quick, scrollable format. Easy to read, easy to share. Join here: RaaS Telegram Group.

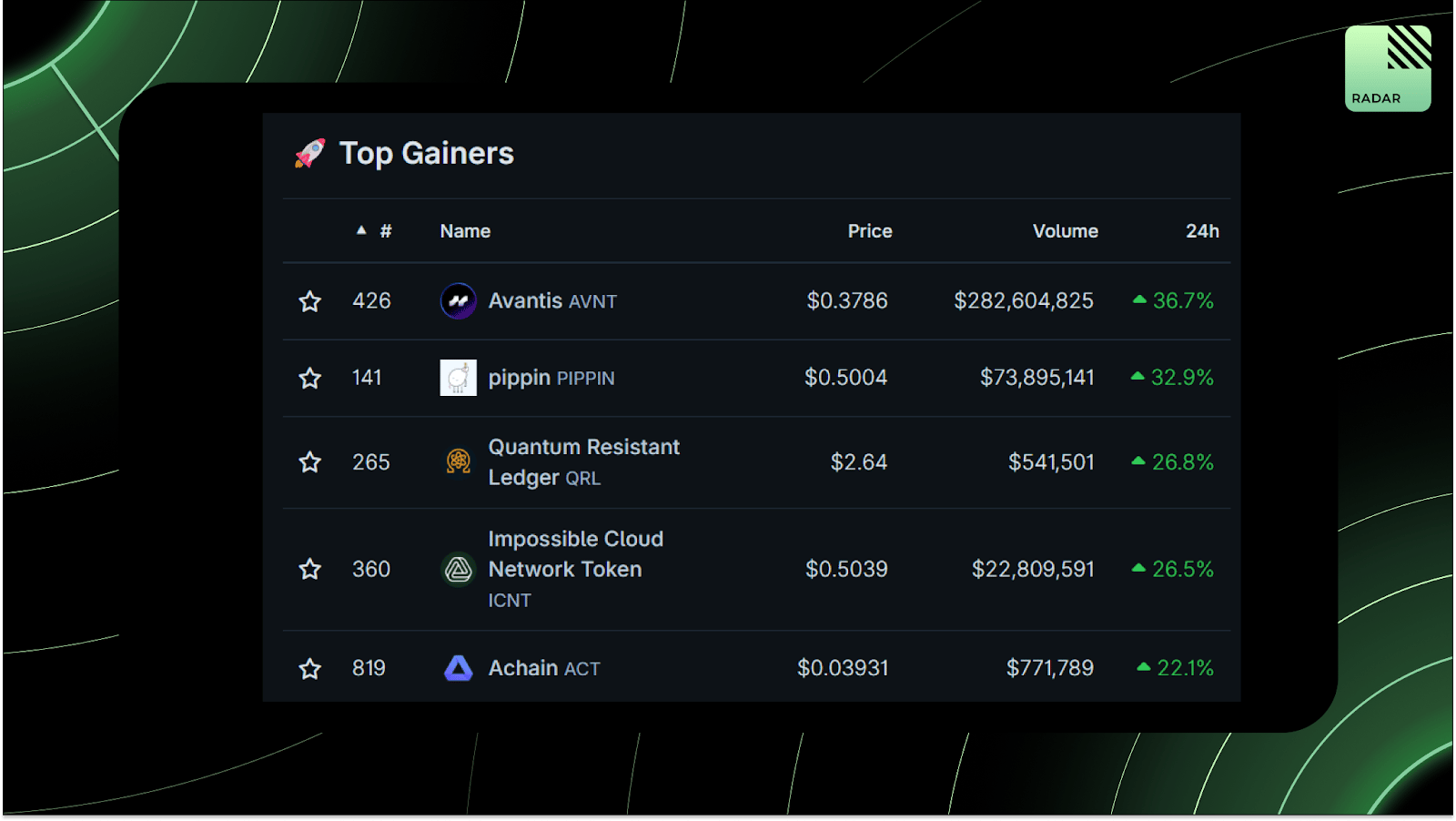

Top Gainers: AVNT, PIPPIN, QRL, ICNT, ACT.

High-signal reads are worth your time, all in one place.

Obol Collective recaps Ethereum’s biggest year yet, outlining 10 defining moments from 2025 as the network hit its 10th anniversary with zero downtime, expanding adoption, infrastructure maturity, and reinforcing its position as the global settlement layer heading into 2026.

Circle reflects on a breakout 2025, highlighting regulatory progress, its IPO and trust charter momentum, and the expansion of USDC, EURC, and USYC across payments, treasury, FX, and capital markets, framing programmable money as the backbone of an internet-native financial system.

Sammy lays out 2026 predictions for crypto AI and robotics, forecasting deeper convergence between on-chain infrastructure, autonomous agents, and real-world robotics as the next frontier for crypto-powered automation.

Marc Zeller defends Aave DAO governance, arguing the protocol’s real strength comes from its decentralized engine, contributors, delegates, and builders, while warning that brand control concentrated in private entities risks undermining the DAO keeping the system alive.

BitMEX Research revisits Bitcoin’s quantum risk debate, noting that while quantum computing could threaten early exposed public keys, the risk remains distant and mitigable through post-quantum cryptography upgrades already discussed in academic circles since 2008.

Movement Labs announced the first-ever migration of a Move-based chain from L2 to sovereign L1 with its new M1 network. Faster execution, decentralized validators, and no dependency on upstream chains. Independence arc unlocked.

Coinbase now supports SOL deposits and withdrawals via Base, powered by the Base to Solana bridge. Users can move SOL cross-chain and use it on Base as an ERC20. Interop keeps getting less painful.

That’s all for today!