- Radar-as-a-Service

- Posts

- RaaS #569: Trust Wallet Exploited on Christmas!

RaaS #569: Trust Wallet Exploited on Christmas!

Uniswap Burns 100M UNI, SEC Cracks Down on Crypto Scams: GM Web3!

Russia Prepares Crypto Trading, Maple Hits $500M Loan, and Moar!

Quick Intro: Radarblock is a Web3-native growth agency that increases awareness, TVL, volume, and social metrics for its clients over a consistent time frame without uncertainty or confusion. All tweets are hyperlinked; click to view them on X.

Not exactly festive news, but Trust Wallet confirmed a supply chain attack affecting its Chrome extension (v2.68), draining roughly $7M from over 500 users across multiple chains. The malicious code extracted private keys before the issue was patched in v2.69. CZ confirmed the damage and promised full reimbursement.

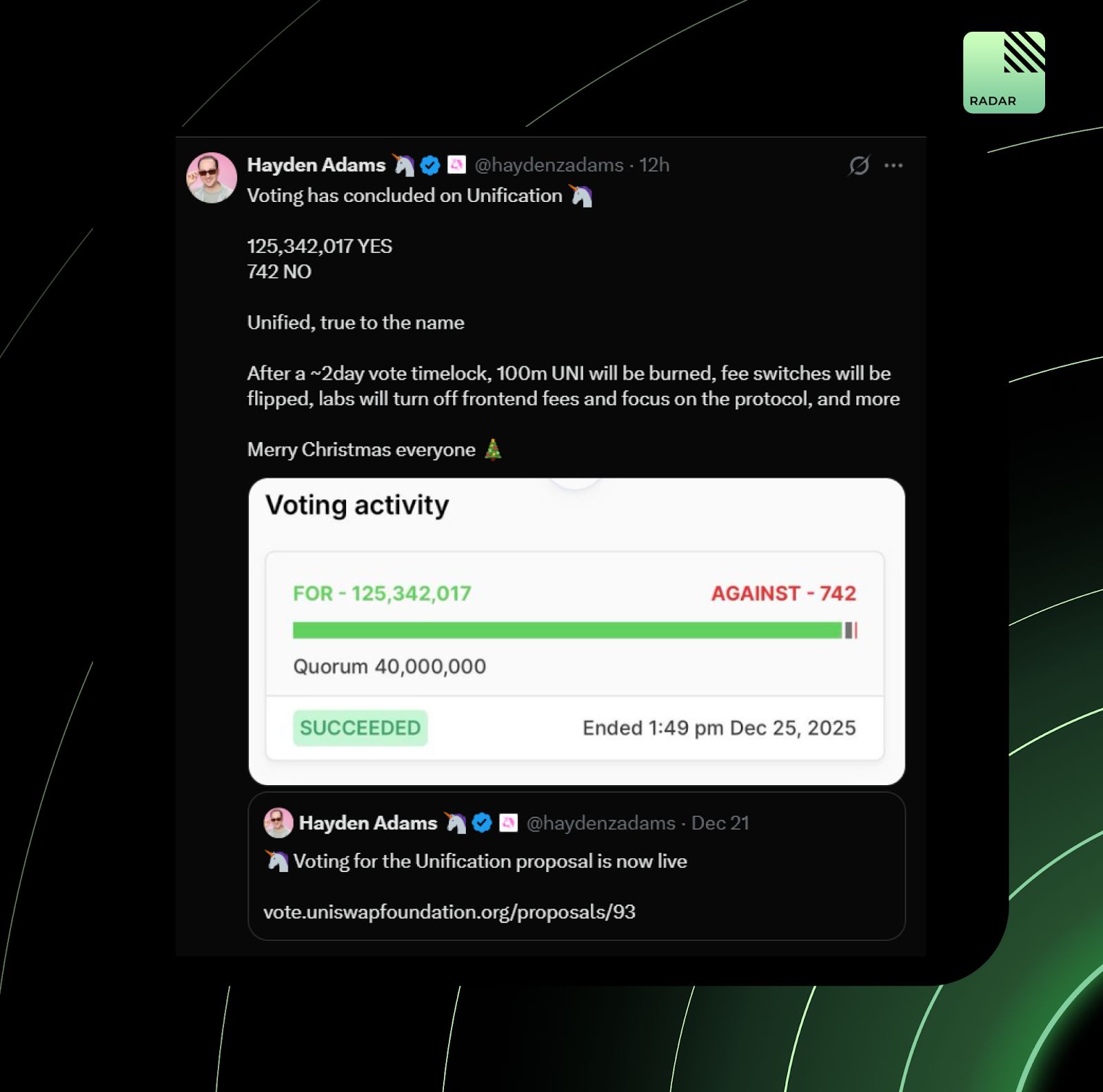

The Uniswap community overwhelmingly approved the “Unification” proposal, passing with over 125M YES votes. The plan triggers a 100M UNI burn after a short timelock, flips fee switches across v2, v3, and Unichain, and sees Uniswap Labs shutting off frontend fees to focus fully on protocol growth.

The U.S. Securities and Exchange Commission (SEC) charged three crypto trading platforms and four investment clubs for allegedly running a $14M investment scam targeting social media users, per The Block. Just another day in crypto.

Russia’s two largest stock exchanges, Moscow Exchange (MOEX) and St. Petersburg Exchange (SPB), said they’re prepared to launch crypto trading once regulations are finalized. The proposal would allow retail investors limited exposure while granting qualified investors broader access.

Say thank you to your BD.

Wintermute weighed in on Aave’s ongoing governance debate, voting NO on the brand asset control proposal. Founder Evgeny Gaevoy pointed to a core issue: value accrual. The mismatch between Aave Labs and token holders over who captures value remains unresolved, but Wintermute says solving this could set a precedent for all DAOs.

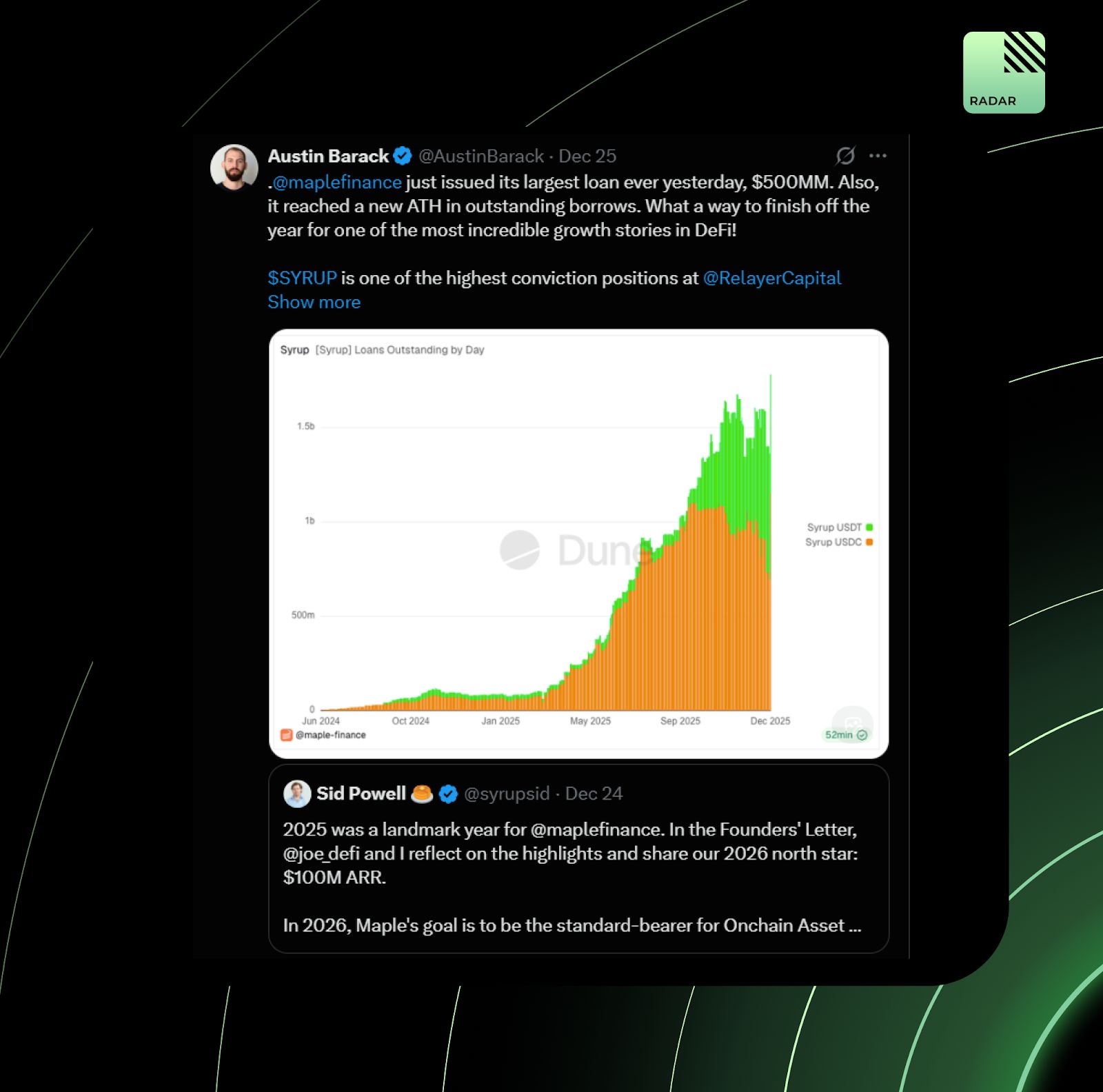

Maple just hit an all-time high with a $500M loan issuance, as assets under management (AUM) surged past $5B. The protocol has now originated $8.5B in volume, generated over $25M in Annual Recurring Revenue (ARR), and paid $60M to lenders. The 2026 goal? $100M ARR. DeFi credit isn’t slowing down.

Your daily dose of bite-sized crypto news.

Billions launched Official Profiles, a privacy-first identity system using ZK proofs to fight bots and scams.

Tea Protocol postponed its TGE to February 5, launching via Aerodrome Ignition on Base.

Metaplanet approved a plan to buy up to 210,000 BTC by 2027.

Strategy CEO Phong Le says Bitcoin fundamentals have “never been stronger,“ despite recent price declines.

SCR is now live on OSL, Hong Kong’s largest exchange.

Architect Financial closed a $35M Series A to scale AX, a centralized and regulated exchange for perpetual futures on traditional assets. FX, rates, equities, and commodities, all under a Bermuda regulatory framework. TradFi perps are officially on-chain adjacent.

Brevis shared tokenomics for its 1B-supply BREV token, with allocations focused on ecosystem growth, community incentives, team, and seed investors. BREV will power ProverNet via auctions, staking, and governance, with slashing tied to performance. Coinbase listing roadmap included.

I’m in this photo, and I don’t like it.

Want RaaS without digging through your inbox? Our Telegram channel gives you the same daily crypto roundup in a quick, scrollable format. Easy to read, easy to share. Join here: RaaS Telegram Group.

Top Gainers: ALI, ZKP, FLOCK, DCR, CPOOL.

High-signal reads are worth your time, all in one place.

Dirichlet reflects on “starting over” and why stablecoins matter beyond crypto narratives, arguing they preserve financial momentum across borders where traditional systems force people to reset.

ShotgunCaio breaks down how storytelling actually works, framing it as a skill built through daily reps, not talent.

Jaya Gupta argues that AI’s next trillion-dollar opportunity lies in “context graphs,” a new system of record that captures decision traces, not just data.

MAD Vincent breaks down why chasing impressions on X is a trap. After racking up 29M impressions and earning just ~$70, he argues the creator payout system rewards bots and spam, not real value.

BlockStreet’s CEO Hedy outlines why on-chain equities require more than faster settlement, warning that speed without proper liquidity, governance, and safeguards simply amplifies risk.

SNOWBALL crashed nearly 80% after hype around a supposed integration with PIPPIN turned out to be false. A verification bug caused the bot to display incorrect data, triggering a pump-and-dump cycle. The team admitted the mistake, pushed a fix, and blamed unverified API inputs. Trust, however, took the real hit.

Solstice Finance’s USX briefly dipped during holiday illiquidity, but the team moved fast. Overcollateralization remained intact, redemptions worked as designed, and market makers restored the peg by morning UTC.

That’s all for today!