- Radar-as-a-Service

- Posts

- RaaS #570: Russia Issues First Crypto-Backed Loan!

RaaS #570: Russia Issues First Crypto-Backed Loan!

Hyperliquid Calms Unlock Fears, Mirae Asset Eyes a Korean Exchange: GM Web3!

Prediction Markets Live on Solflare, Uniswap Burns 100M UNI, and Moar!

Quick Intro: Radarblock is a Web3-native growth agency that increases awareness, TVL, volume, and social metrics for its clients over a consistent time frame without uncertainty or confusion. All tweets are hyperlinked; click to view them on X.

Flow had a rough week. After a $3.9M exploit, the team floated a six-hour chain rollback, but faced immediate pushback from bridges and validators. Flow scrapped the idea, opting instead to isolate affected accounts and burn fake assets through governance. User balances were never impacted, but the incident reignited debates around immutability and crisis response.

Hyperliquid Labs announced it will unstake and distribute 1.2M HYPE to team members on January 6, with all future distributions scheduled for the 6th of each month. Combined with ongoing buybacks from the Assistance Fund, the move appears designed to reduce surprise risk and keep volatility muted.

Trust Wallet shared updates on its browser extension v2.68 incident, confirming it has begun the compensation process for affected users. The total damage is estimated at around $7M.

Sberbank, Russia’s biggest bank, issued Russia’s first crypto-backed loan, using self-mined BTC from Intelion Data as collateral. While terms weren’t disclosed, the deal marks a milestone for institutional crypto finance in Russia.

No intern, they’re celebrating Christmas.

Solflare users can now access on-chain prediction markets directly inside the wallet, powered by Kalshi, Drift, and Solana. Over 4 million users now have native access to real-world event markets without leaving their wallets. Distribution is the product.

Coinbase CEO Brian Armstrong argued that Bitcoin is “good for USD,” framing it as a competitive check against inflation and unchecked deficit spending. The message lands as Coinbase doubles down on regulated markets, not rebellion narratives.

Your daily dose of bite-sized crypto news.

Michael Saylor posted the Bitcoin tracker again, hinting at another BTC buy. Strategy now holds 671,268 BTC, its final purchase of 2025.

BREV airdrop registration is live; users have until January 3 to check eligibility and complete any required steps before claiming opens.

Pumpdotfun appears to have cashed out another 50M USDC, pushing total deposits to Kraken past 617M since October.

WLFI tokenholders are voting on using under 5% of the treasury to boost USD1 stablecoin growth. Early sentiment remains split.

Google search interest for crypto has hit yearly lows.

South Korean financial giant Mirae Asset is reportedly negotiating a $70–100M acquisition of Korbit, the country’s fourth-largest crypto exchange. If completed, it would mark another TradFi heavyweight stepping directly into regulated crypto infrastructure.

Uniswap officially executed its fee-burning upgrade on-chain. The changes include zero interface fees, selective v2/v3 fee activation, and the burn of 100M UNI from the treasury. Unichain fees will now flow to UNI burns after data costs. Less theory, more supply reduction.

Mom said we have Egypt at home, too.

Want RaaS without digging through your inbox? Our Telegram channel gives you the same daily crypto roundup in a quick, scrollable format. Easy to read, easy to share. Join here: RaaS Telegram Group.

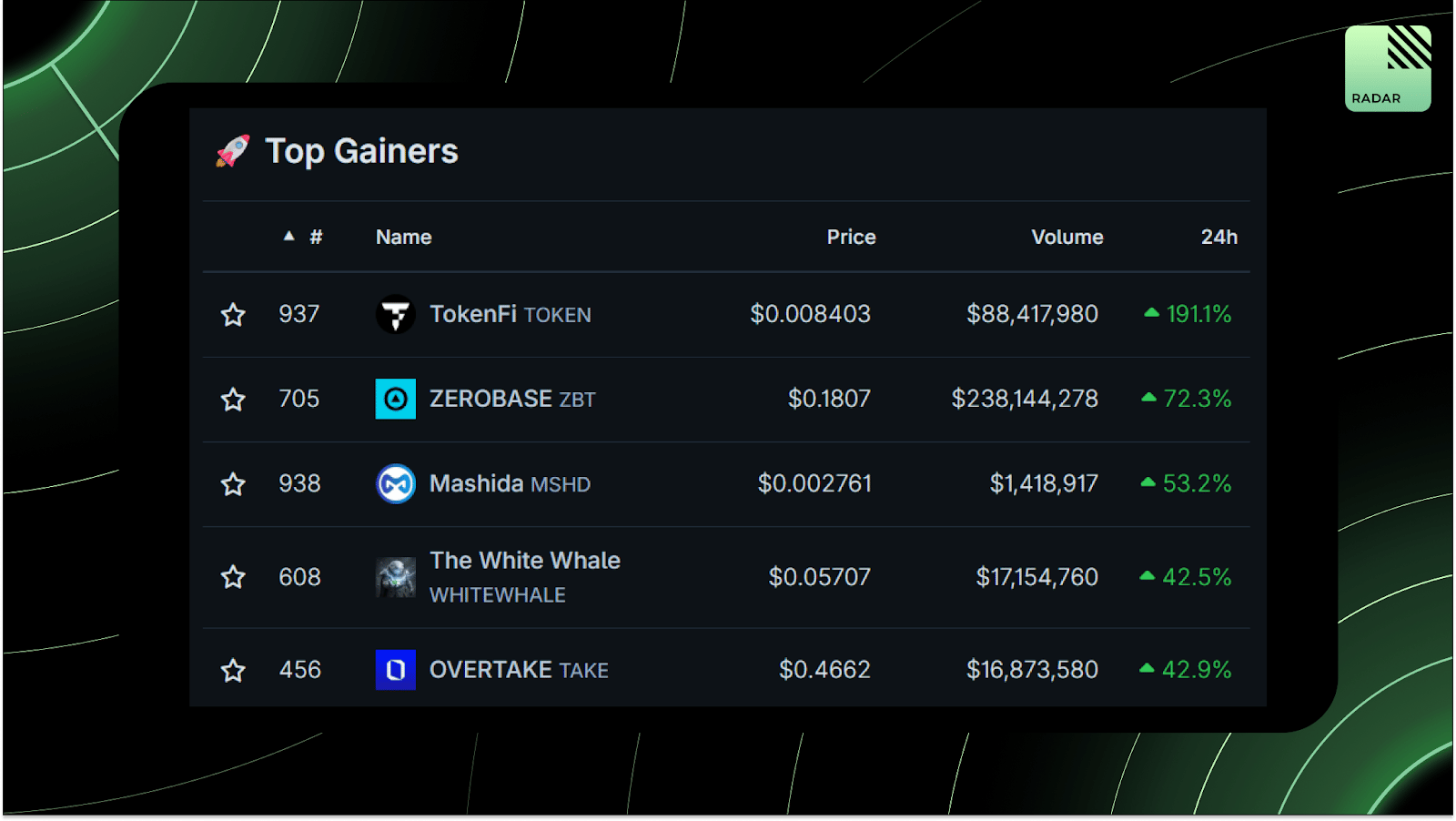

Top Gainers: TOKEN, ZBT, MSHD, WHITEWHALE, TAKE.

High-signal reads are worth your time, all in one place.

Vikt0r recaps DeFi research in 2025, breaking down AMM mechanics and liquidation systems so readers don’t have to dig through dense protocol docs.

Dr. Einstein argues InfoFi isn’t dead, just evolving. Upcoming TGEs are still pulling attention, DeFi tools like Aave remain sticky, NFTs are nearing another meta shift, and memes aren’t going anywhere. The takeaway: interest never disappears; it just reallocates.

Fiyalkin explains how not to become exit liquidity on perp DEXes, arguing most farmers underperform due to bad timing and poor cost management. The issue isn’t farming itself, but when and how users enter.

Khan Abbas highlights Bitmine’s aggressive ETH accumulation, pushing back on skepticism around Tom Lee’s ETH thesis.

Stoiiic reflects on 2025 as a year of recalibration and mental toughness, framing progress as how well you move through adversity rather than avoid it.

After completing audits on its perps and spot circuits, Lighter has open-sourced the code that verifies every operation on its L2; orders, cancels, and liquidations are included. Anyone can now independently verify how the system works on Ethereum.

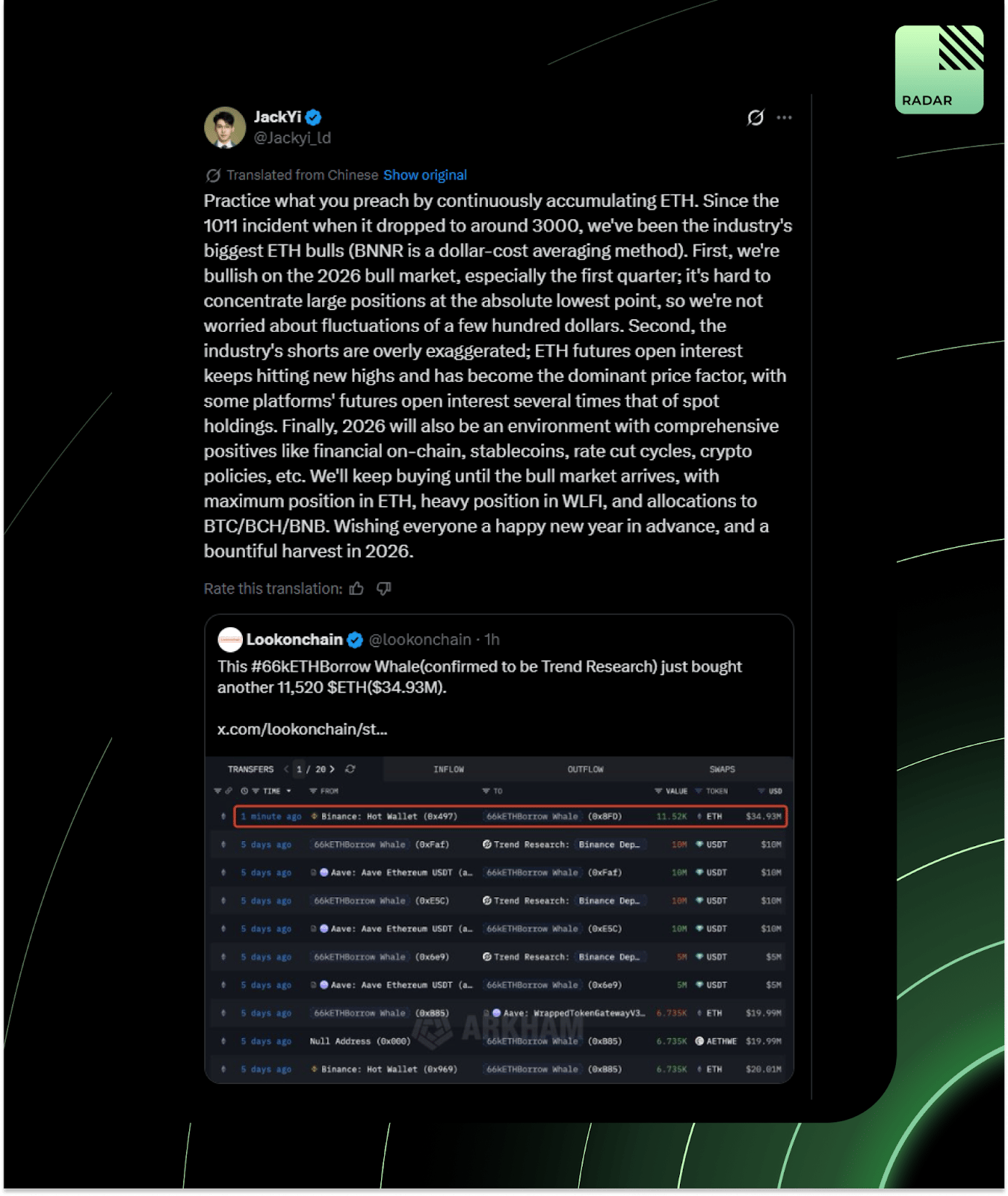

Trend Research’s JackYi doubled down on Ethereum, saying the team has been aggressively accumulating ETH since the 10/11 drawdown near $3,000. Their thesis is simple: timing exact bottoms doesn’t matter when you’re positioned for a 2026 bull market, especially early in the year.

That’s all for today!