- Radar-as-a-Service

- Posts

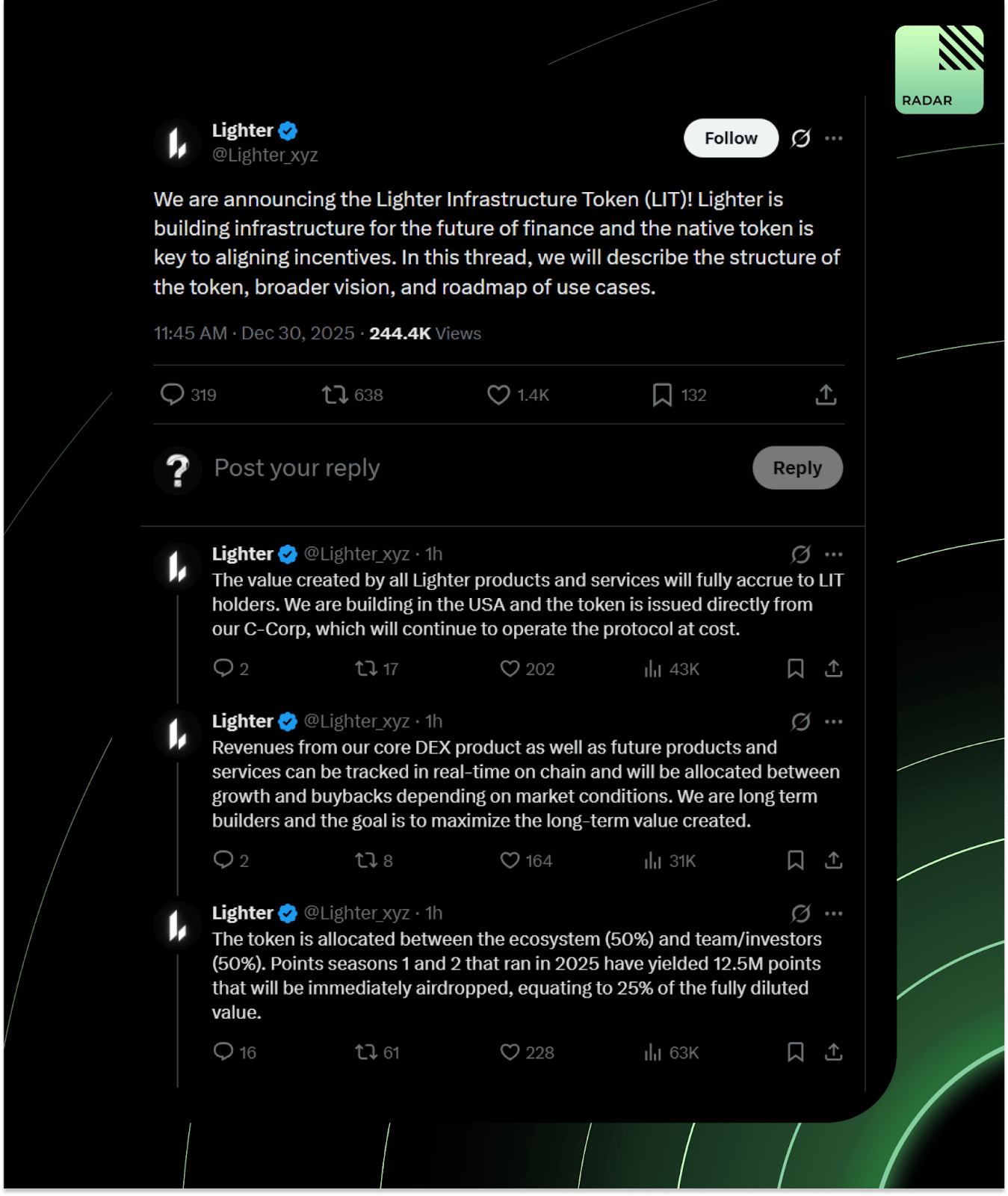

- RaaS #571: LIT Launches on Lighter!

RaaS #571: LIT Launches on Lighter!

BlackRock’s BUIDL Hits $100M Distributed Dividends, Tron Inc. Gets $18M Backing: GM Web3!

Privacy Tokens Lead Q4, ElizaOS Is Back Online, and Moar!

Quick Intro: Radarblock is a Web3-native growth agency that increases awareness, TVL, volume, and social metrics for its clients over a consistent time frame without uncertainty or confusion. All tweets are hyperlinked; click to view them on X.

Lighter announced its native infrastructure token, LIT, alongside a massive community airdrop. The token supply is split 50% to the ecosystem and 50% to the team and investors. LIT is already live for spot trading on Lighter, with early prices ranging roughly from $2.4 to $2.7. For grinders, this one paid.

BlackRock’s BUIDL became the first tokenized Treasury fund to distribute $100M in lifetime dividends. The fund now sits at $1.746B in supply and recently expanded onto BNB Chain, issuing $500M worth of tokens.

Tron Inc. secured an $18M strategic equity investment from Justin Sun, reinforcing its push to expand a TRX-heavy corporate treasury. The Nasdaq-listed firm plans to deploy the capital directly into its TRX holdings, positioning itself as the most TRON-aligned public company as stablecoin settlement and on-chain payments continue to surge.

Shaw, founder of Eliza Labs, returned to X after a six-month suspension and announced the completion of elizaOS, an open-source AI agent framework now boasting more than 17K GitHub stars and over 90 plugins. Holders are being asked to migrate from ai16z to elizaOS at a 1:6 ratio, with the token jumping over 60% following the announcement.

It’s once again lock-in szn on CT.

Senator Cynthia Lummis said the Responsible Financial Innovation Act of 2026 will clearly separate securities from commodities, allowing legitimate crypto projects to scale while maintaining investor protections. Not hype, but meaningful signals that the U.S. market structure is finally catching up.

Perle Labs issued a final call for beta contributors as it wraps up its platform ahead of upcoming releases. The team has raised $17M to build a Web3-powered AI training stack focused on attribution, incentives, and human feedback, spanning data collection through model fine-tuning.

Your daily dose of bite-sized crypto news.

CZ says Bitcoin, BNB, and the industry “will be fine,” as holiday liquidity thins and markets cool.

Caldera teased plans for a prediction-market-native chain launching in 2026.

Michael Saylor says crypto’s biggest challenge isn’t tech, it’s long-term public education.

Charles Hoskinson claims Cardano’s Midnight could supercharge XRP DeFi.

Metaplanet bought 4,279 BTC in Q4, bringing total holdings to 35,102 BTC.

Subberdotxyz officially announced its shutdown after the NFT market failed to recover. Once a staple for raffles, whitelists, and cross-chain community tooling, the team pointed to a 72% collapse in NFT market cap since January. The vibes shifted; utility has to lead now.

Paradex posted a tongue-in-cheek “we messed up” apology, then revealed explosive growth. Open interest is up 30x, volumes 22x, TVL 6.5x, and users 6x, with nearly $1B in daily volume and $650M open interest. Zero-fee perps and Starknet upgrades are doing work.

And how does that make you feel?

Want RaaS without digging through your inbox? Our Telegram channel gives you the same daily crypto roundup in a quick, scrollable format. Easy to read, easy to share. Join here: RaaS Telegram Group.

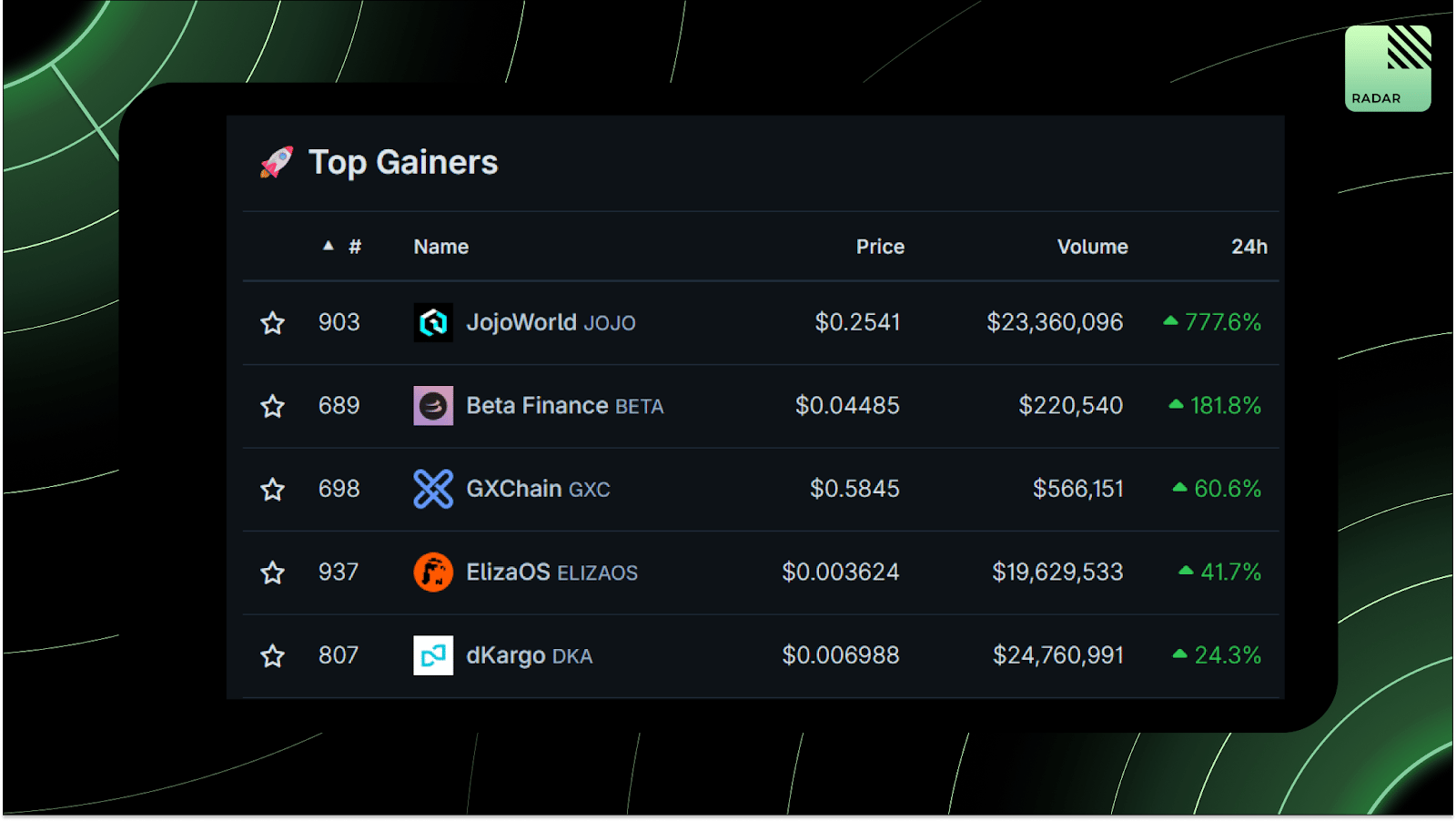

Top Gainers: JOJO, BETA, GXC, ELIZAOS, DKA.

High-signal reads are worth your time, all in one place.

Prince explains why most people never give crypto a second chance. When crypto feels like a rigged casino instead of a technology, that first impression sticks, and it’s incredibly hard to reverse.

Ola Ξlixir breaks down why most “lock-in” posts are fake. New Year’s motivation, gym pics, and bio resets fade fast. Real progress, he says, came from shutting out CT noise entirely.

Josh Kessler presents the Vault Bull Mega Thesis. By 2026, vaults may become the default way capital is stored and deployed, a shift that the market is still underpricing.

Rishotics shares hard lessons from failing infra startups. After years of building complex protocols that no one used, he realized that complexity isn’t a measure of credibility, but rather that simple consumer products matter more.

Fip Crypto argues 2026 marks the end of traditional airdrops. The strategy going forward isn’t farming harder; it’s positioning smarter so rewards come naturally.

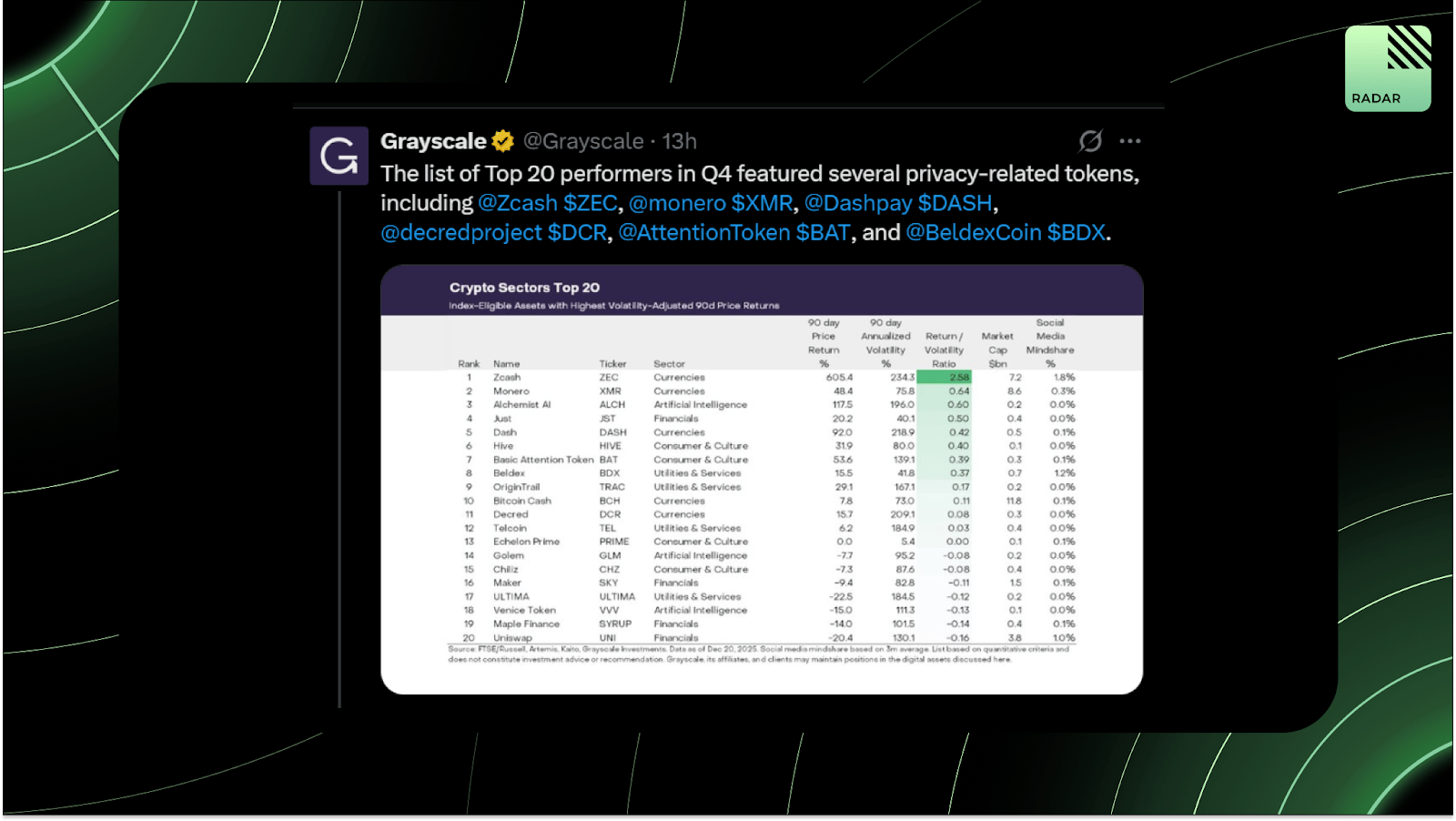

Grayscale data shows privacy coins dominated Q4 performance, led by ZEC, XMR, DASH, and others, despite broader market weakness. When narratives fade, fundamentals rotate.

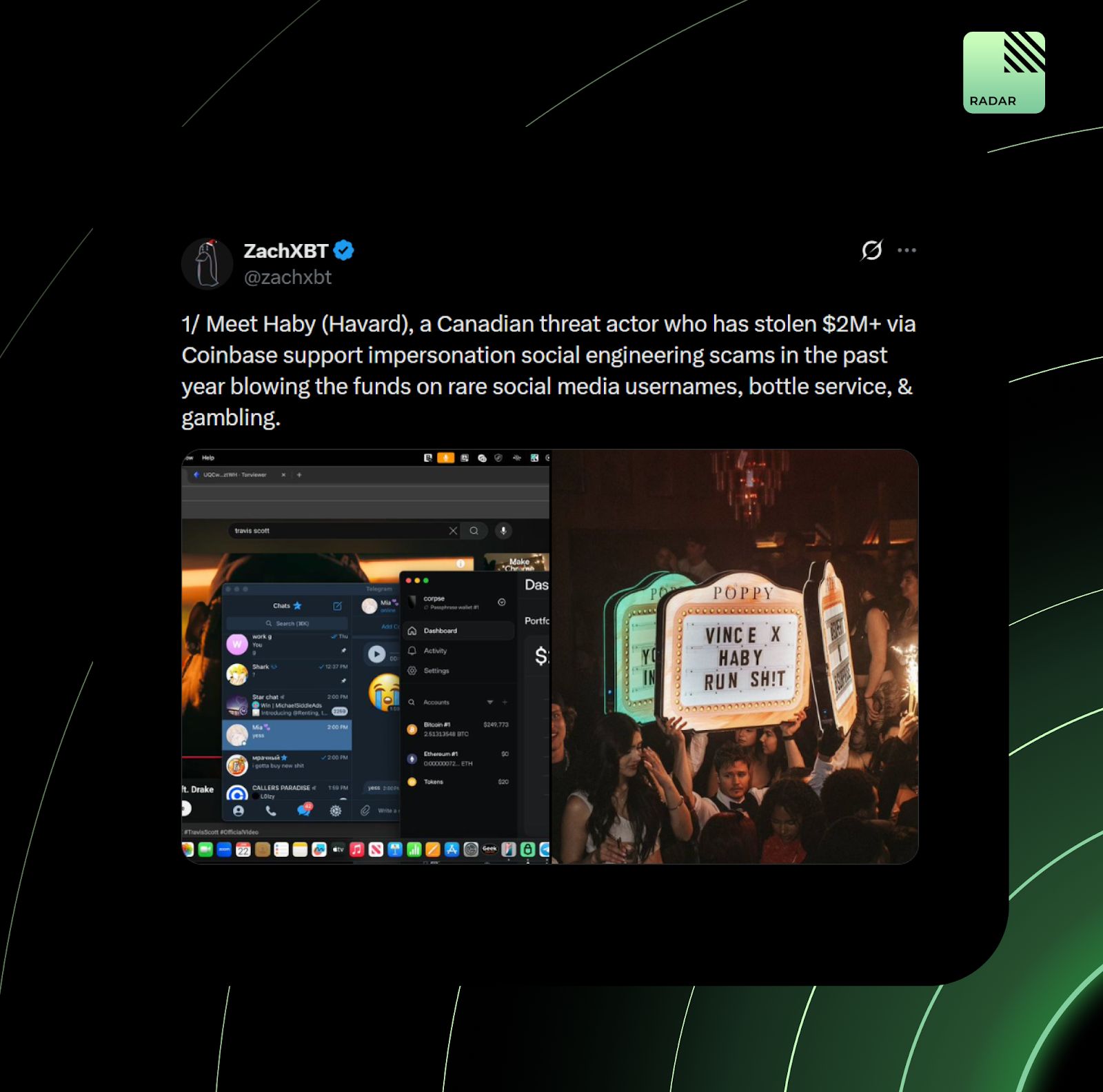

ZachXBT identified a Canadian scammer who stole over $2M by impersonating Coinbase support. The funds were traced on-chain, linked to leaked wallet screenshots, and shown to be spent on rare usernames, nightlife, and gambling. Clean forensics, loud reminder: social engineering is still the biggest attack vector.

That’s all for today!