- Radar-as-a-Service

- Posts

- RaaS #575: Jupiter Questions the Buyback Meta!

RaaS #575: Jupiter Questions the Buyback Meta!

Helium Halts HNT Buybacks, Iran Accepts Crypto for Weapons Sales: GM Web3!

Tether Backs Real-World QR Payments, Based Foundation Sets Up for Q1 Genesis And Moar!

Quick Intro: Radarblock is a Web3-native growth agency that increases awareness, TVL, volume, and social metrics for its clients over a consistent time frame without uncertainty or confusion. All tweets are hyperlinked; click to view them on X.

Jupiter co-founder Siong Ong floated the idea of stopping JUP buybacks after spending over $70M last year with minimal price impact. The proposal suggests redirecting capital toward growth incentives for users instead. The takeaway is blunt: buybacks don’t work if unlocks and emissions overpower them.

Helium founder Amir Haleem announced the project is pausing HNT buybacks, arguing the market isn’t rewarding them under current conditions. Instead, Helium will focus revenue on growing subscribers and carrier offload. Data credits will continue to be burned through real network usage.

World Liberty tokenholders approved using unlocked treasury funds to incentivize USD1 adoption, passing with 77.75% support. The vote highlighted active governance with real capital consequences, and USD1-linked tokens reacted positively soon after.

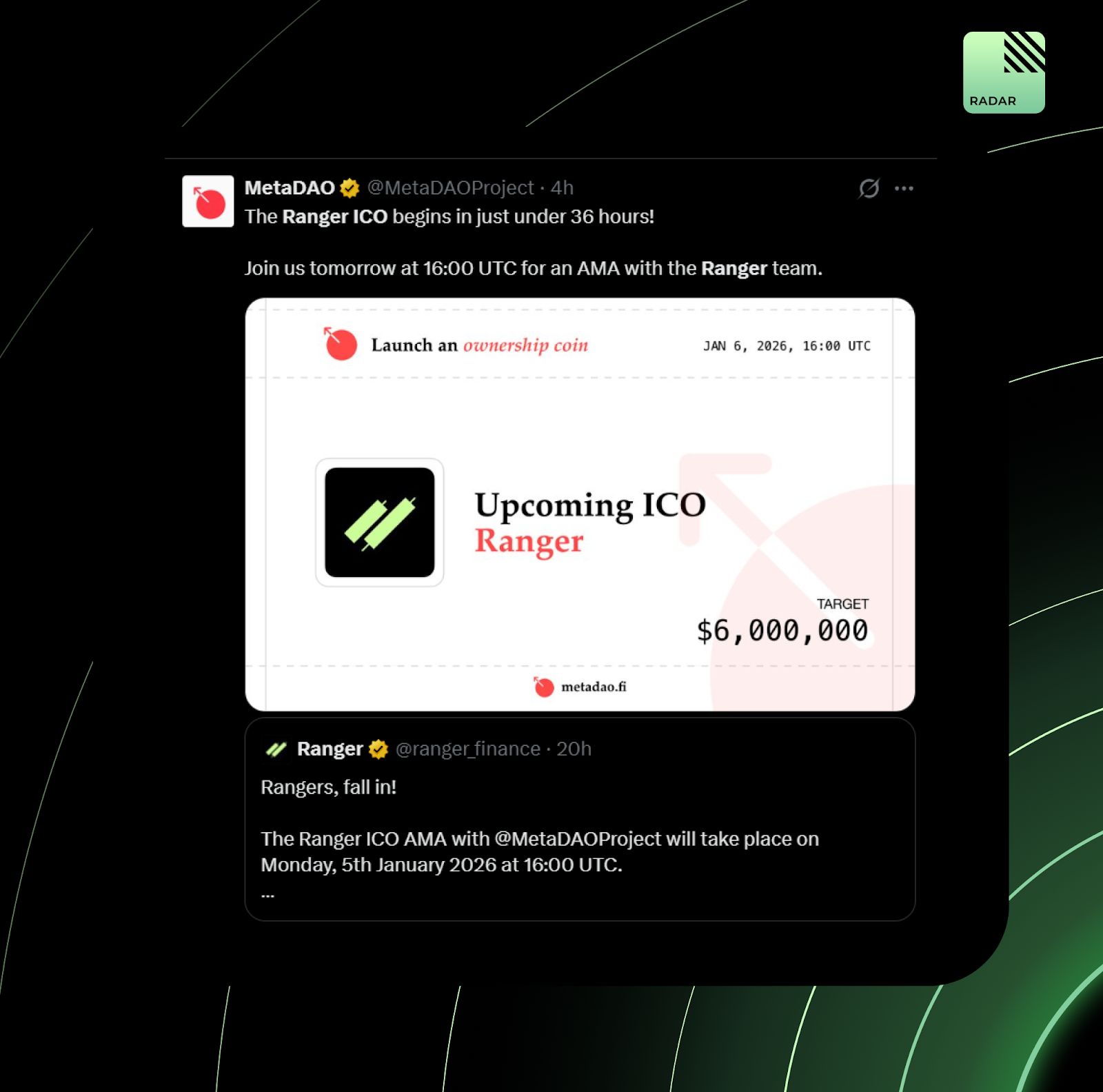

Ranger’s ICO goes live on January 6 via MetaDAO, targeting a $6M minimum raise with 39% of the supply liquid at the TGE. Allocation favors early users through Ranger Points, while team tokens vest via performance milestones. Old lessons, applied properly.

And I’m not mad about that.

The Based Foundation launched to coordinate ecosystem growth across perps, prediction markets, payments, and commerce. The BASED token genesis is planned for Q1 2026, with users required to opt in by February 8 to participate.

Tether disclosed an investment in SQRIL, a payments API enabling scan-to-pay QR transactions across Asia, Africa, and Latin America. Banks and fintechs can integrate once and let users pay globally in local currencies. Stablecoins quietly expand their moat.

Your daily dose of bite-sized crypto news.

The U.S. captured Venezuela’s President Nicolás Maduro, triggering pumps in Trump-linked tokens like TRUMP, WLFI, and MELANIA.

Bitcoin miner Bitfarms is exiting Latin America entirely after selling its Paraguay operations, pivoting fully toward AI and high-performance computing.

Tom Lee is asking BitMine shareholders to approve expanding authorized shares from $500M to $50B, positioning the company for stock splits as its valuation tracks Ethereum.

Big Four firm PwC is expanding its full crypto audit, tax, and consulting services following U.S. regulatory clarity.

Bank of America officially recommends clients allocate up to 4% of their portfolio to Bitcoin and crypto.

Iran’s Ministry of Defence Export Center reportedly began accepting crypto for advanced weapons sales to bypass sanctions. It’s a reminder that crypto neutrality cuts both ways, and global adoption isn’t limited to friendly use cases.

According to on-chain data shared by MLM, Justin Sun transferred his remaining ~$5.4M Lighter spot balance into perpetuals and began selling LIT. From an original ~$200M LLP deposit, he previously withdrew capital and accumulated over 13M LIT. Spot exposure is now fully cleared.

Literally me on Christmas.

Want RaaS without digging through your inbox? Our Telegram channel gives you the same daily crypto roundup in a quick, scrollable format. Easy to read, easy to share. Join here: RaaS Telegram Group.

Top Gainers: PONKE, BROCCOLI, BETA, CLO, VIRTUAL.

High-signal reads are worth your time, all in one place.

Marianne lays out a zero-to-one blueprint for 2026, arguing that people who actually change their lives don’t over-plan; they execute daily, ruthlessly cut distractions, and review their progress weekly.

Scribbler compiles 69 airdrops to farm in 2026, framing time, not capital, as the real edge. The playbook is simple: structure your day, farm consistently, and treat attention like money if you’re starting from $0.

Stacy Muur breaks down a16z’s 2026 thesis, highlighting where value accrues next: stablecoins as internet settlement rails, on-chain RWA origination, agent-native payments, privacy as a moat, and more.

M0h curates essential AI tools for writers, emphasizing that AI accelerates output but doesn’t replace thinking. Clear prompts, iteration, fact-checking, and human editing are non-negotiable if you want quality over slop.

Gum delivers a blunt reality check for 2026, warning that most people sabotage themselves early by obsessing over setups instead of doing the work. Progress comes from shipping imperfectly, not waiting to feel “ready.”

CZ called crypto’s ~$3T market cap “tiny” compared to global financial assets, framing today’s market as early infrastructure rather than a mature asset class. Trading still dominates activity, while real adoption remains largely unrealized. The message: the ceiling is nowhere in sight.

Solana CEO Mert advised students to study math or physics, not for direct career utility, but to train first-principles thinking. In an AI-heavy future, learning how to reason may matter more than mastering any specific tool or stack.

That’s all for today!