- Radar-as-a-Service

- Posts

- RaaS #580: Ripple Wins in the UK!

RaaS #580: Ripple Wins in the UK!

Vitalik Backs Tornado Cash Dev, Rain Hits $1.95B Valuation: GM Web3!

CT Debates Its Own Death, Tether Freezes 182M USDT, And Moar!

Quick Intro: Radarblock is a Web3-native growth agency that increases awareness, TVL, volume, and social metrics for its clients over a consistent time frame without uncertainty or confusion. All tweets are hyperlinked; click to view them on X.

After years of navigating regulatory challenges with U.S. regulators, Ripple secured both an EMI license and cryptoasset registration from the UK’s FCA. The timing matters: this came just one day after the FCA clarified the rules firms must follow when the UK’s full crypto framework goes live in 2027.

Vitalik Buterin publicly backed Tornado Cash developer Roman Storm, who was convicted last year on a money transmission charge. This isn’t just about one developer; it’s about whether writing open-source privacy code can survive in a world where regulators increasingly conflate tools with misuse.

Stablecoin payments firm Rain raised $250M, pushing its valuation to $1.95B as demand for compliant on-chain payments accelerates. Rain bets that institutions want crypto rails without the crypto UX, invisible, regulated, and boring. Ironically, that might be exactly what brings stablecoins into the mainstream.

Andreessen Horowitz raised over $15B across new funds focused on AI, crypto, defense, and infrastructure. The firm is framing this as a long-term push to secure U.S. leadership in frontier technologies. Translation: capital is still flowing aggressively into crypto, just with longer time horizons and sharper narratives.

Well, now they can vibe code it.

Trove Markets closed its ICO at $11.94M, massively overshooting its $2.5M target after strong testnet performance. But confidence cracked when the team announced, then reversed, a five-day extension amid Sybil wallet concerns. The lesson? Even strong products can lose trust fast if distribution optics slip.

Without fanfare, the U.S. SEC removed crypto from its 2026 priority risk list. It’s not just a policy reversal, but it signals a shift in tone, from crypto as a top-level threat to just another regulated sector.

Your daily dose of bite-sized crypto news.

CZ said he believes a crypto super cycle may be starting, though he noted he could be wrong.

Michael Saylor said Strategy plans to buy more Bitcoin this week and currently holds 673,783 BTC worth about $61.1B.

X will launch “Smart Cashtags” next month, allowing users to view real-time crypto and stock prices.

Vitalik Buterin called for better decentralized stablecoins, highlighting challenges around USD dependence, oracle capture, and staking yield competition.

Valeo announced it will open a limited beta waitlist tomorrow, with only 50 users selected for early access to the app.

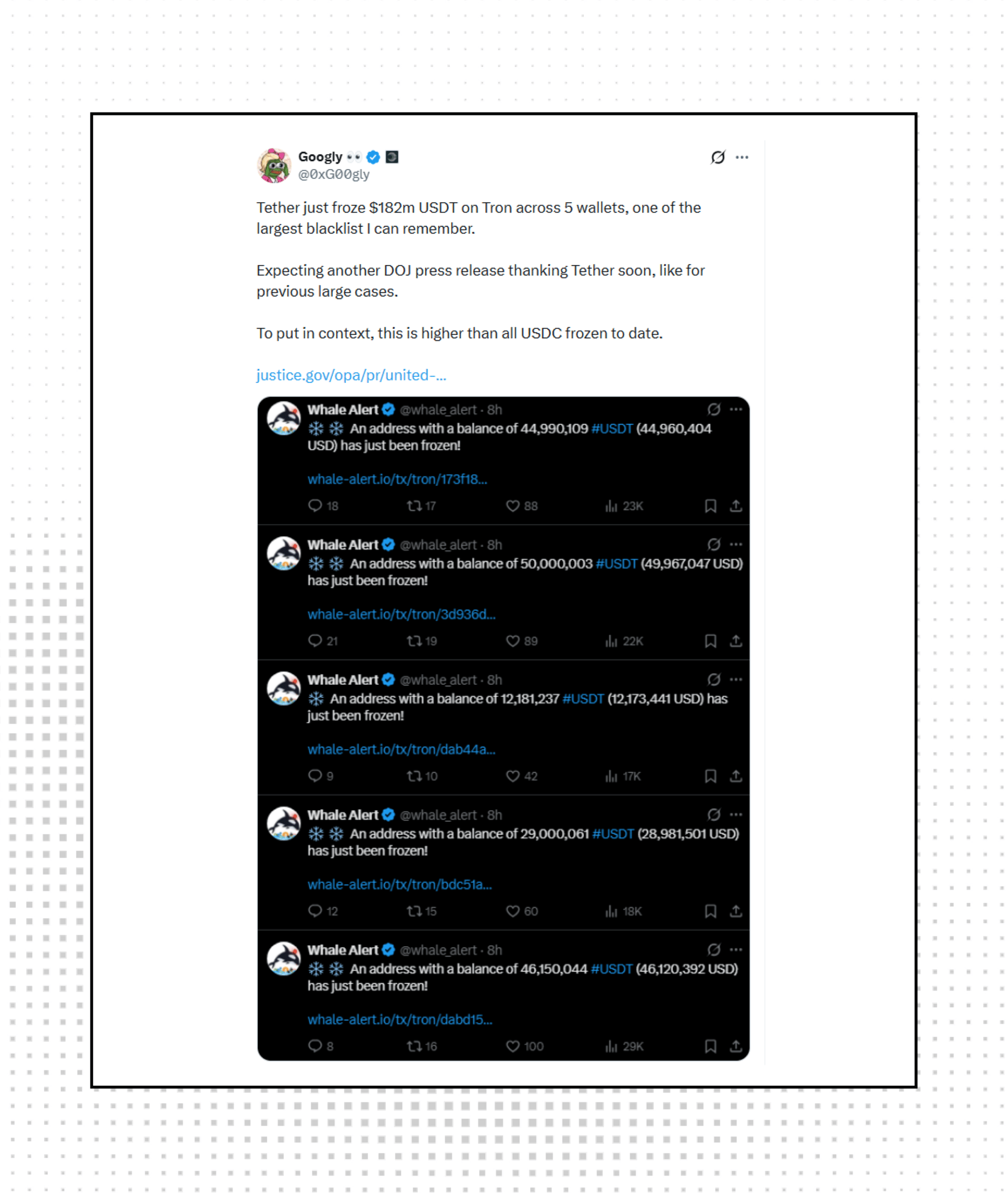

Tether blacklisted 182M USDT across five Tron wallets, marking one of the largest freezes ever. The number is bigger than all USDC freezes combined to date. Once again, Tether demonstrates its double-edged role: censorship-resistant enough to scale globally, centralized enough to enforce law-enforcement demands.

Ranger pulled in over $86M in commitments, then capped the raise at $8M to preserve distribution integrity. Non-points users will receive roughly 93% refunds, setting the token’s initial FDV at $20.5M. In a market obsessed with demand, this was a rare reminder that restraint can still earn respect.

Gm.

Want RaaS without digging through your inbox? Our Telegram channel gives you the same daily crypto roundup in a quick, scrollable format. Easy to read, easy to share. Join here: RaaS Telegram Group.

Top Gainers: GLEEC, NOCK, ARRR, FRAX, WFRAX.

High-signal reads are worth your time, all in one place.

Radarblock’s YugiOnChain warns that vibecoding isn’t the real shift, arguing that while AI-assisted coding matters, the bigger change is broader adaptation to how fast the world is restructuring.

Vasuman reframes the money obsession, explaining that while money solves most physical problems, obsessing over it actually prevents wealth creation.

Khan Abbas highlights the quiet decline of DevRel, noting that once-glamorous developer relations roles often fail to deliver measurable value, leading companies to rethink community-heavy positions that don’t clearly tie back to product growth.

Fabiano breaks down how Polymarket could power the biggest 2026 airdrop, arguing that real-volume platforms historically generate outsized rewards, and mapping out tools that help users navigate Polymarket efficiently.

Debayo shares lessons from four years in Web3, outlining how staying valuable requires continuous skill upgrades, ownership mentality, and long-term thinking to unlock more opportunities beyond just landing the first job.

Nikita Bier called “GM” reply spam “suicide” for reach, sparking backlash from CT veterans. CT pushed back, arguing that activity still matters, just not brainless engagement. The takeaway? The algorithm hasn’t changed much; the bar for quality has.

After hovering unnaturally stable on Binance Alpha, LISA dropped nearly 80% in a single move. Early participants exited with profits, while late traders absorbed the losses. Whether manipulation or structural risk, the outcome was the same: stability without transparency is usually a warning sign.

That’s all for today!