- Radar-as-a-Service

- Posts

- RaaS #581: Former NYC Mayor’s Memecoin Rugs!

RaaS #581: Former NYC Mayor’s Memecoin Rugs!

Senate Drops Bipartisan Crypto Bill, Footballdotfun Teases TGE Date: GM Web3!

Pumpdotfun Rethinks Incentives, BitGo Files for IPO, And Moar!

Quick Intro: Radarblock is a Web3-native growth agency that increases awareness, TVL, volume, and social metrics for its clients over a consistent time frame without uncertainty or confusion. All tweets are hyperlinked; click to view them on X.

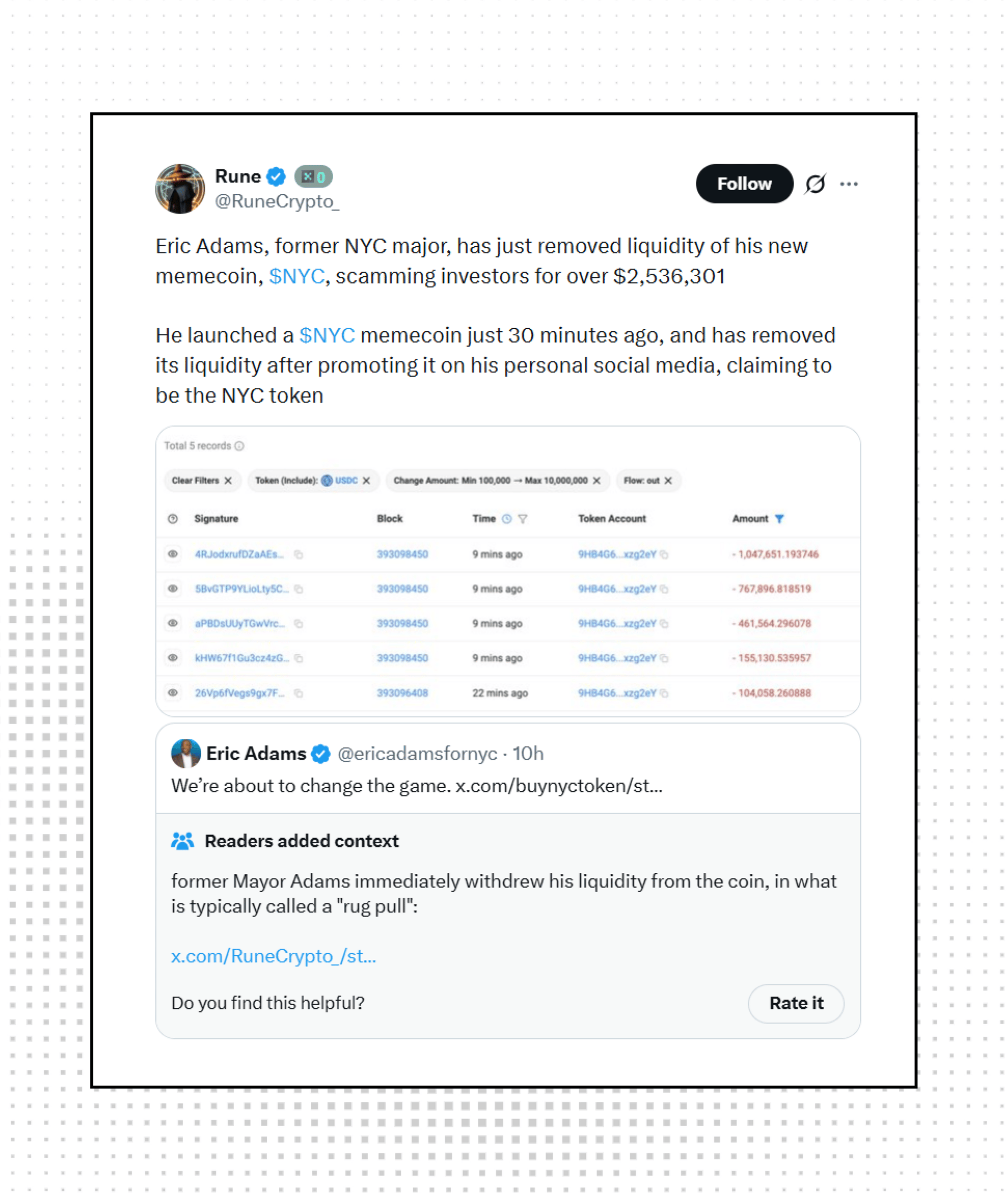

New York City's former mayor, Eric Adams, promoted the NYC token, which aims to fund public safety and scholarships. The endorsement sent it soaring to a $580M market cap, until a deployer-linked wallet pulled approximately $2.5M in liquidity, reducing the token's value by around 80%. On-chain data shows the funds weren’t returned, and Adams has stayed silent as traders cry rug.

U.S. lawmakers unveiled a 278-page bipartisan draft of the CLARITY Act, proposing to split oversight between the SEC (securities) and CFTC (commodities). The bill exempts self-custody and certain DeFi activity, bans Fed-issued CBDCs, and tightens rules for exchanges and stablecoins. A key markup vote is set for this Thursday.

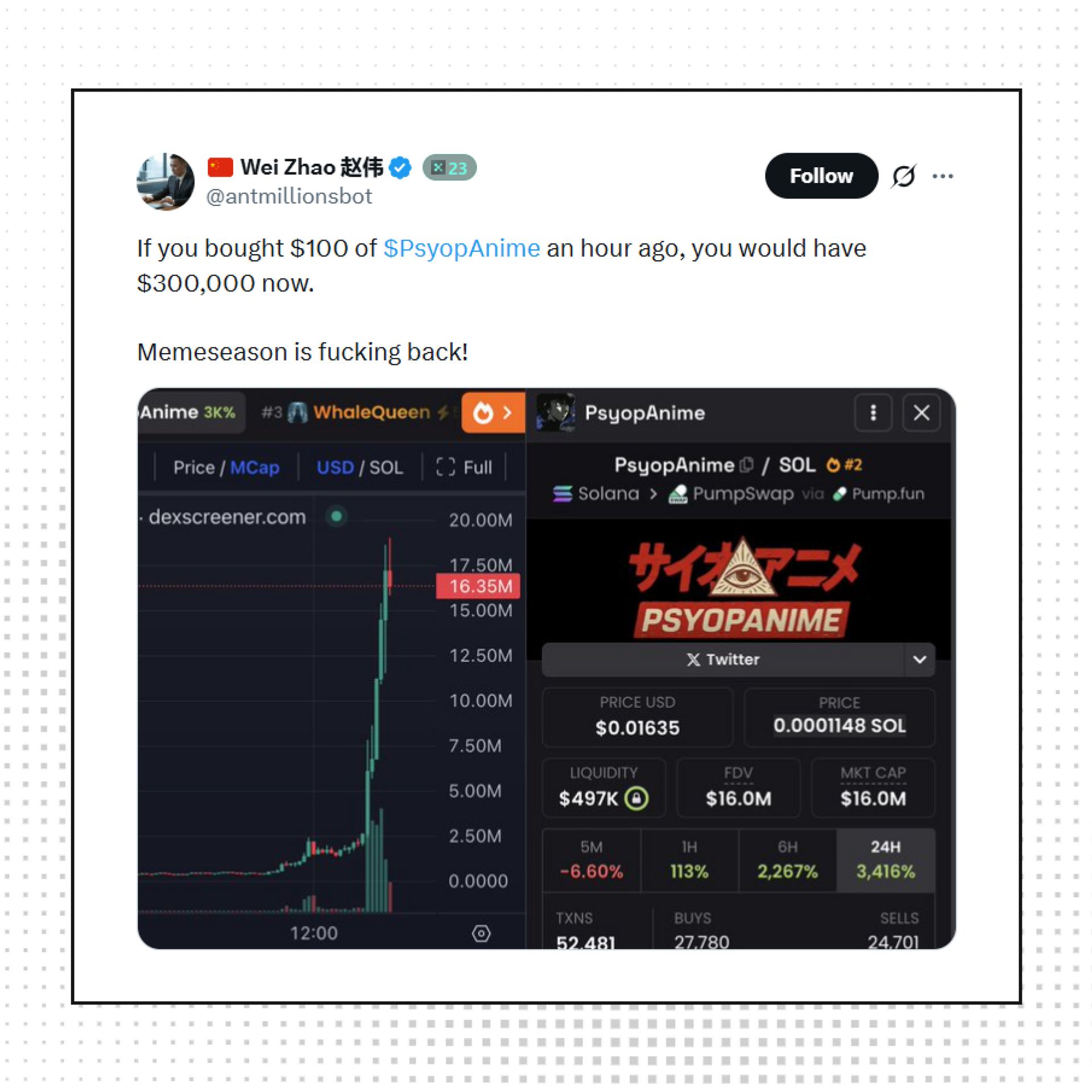

PSYOPANIME surged over 4,400% in 24 hours after Elon Musk followed the account. Market cap briefly hit $28M before cooling near $20M. Same playbook, same outcome: attention is still the most powerful primitive in crypto.

Pumpdotfun co-founder Alon Cohen said the platform will overhaul its creator fee model after realizing it rewarded low-risk token creation instead of high-risk trading. Translation: too many spam launches, not enough real speculation.

Post-TGE projects don’t exist anymore.

World Liberty Financial launched its crypto lending platform, World Liberty Markets, powered by Dolomite. The platform supports lending and borrowing for its USD1 stablecoin, now sitting at a $3.4B market cap. Early usage shows modest but balanced activity as the team eyes debit cards and mobile apps.

Good news for football lovers! Footballdotfun, a Web3 gaming and meme platform built around football predictions and token incentives, teased its TGE for January 15. The project leans heavily on short-term engagement loops rather than long-term fundamentals, perfect for degen season.

Monero ripped to a new all-time high above $649, up 13% in 24 hours as privacy fears around CBDCs and surveillance tech push demand higher, even after years of delistings and bans.

Your daily dose of bite-sized crypto news.

Strategy acquired 13,627 BTC for ~$1.25B, bringing total holdings to 687,410 BTC at an average cost of ~$75,353 per coin.

Aleo announced its Supporters & Ambassador Program to onboard creators and ecosystem advocates.

YouTube viewership for crypto-related content fell to its lowest level since January 2021.

Bitwise announced an upcoming Chainlink ETF, ticker CLNK.

CZ warned traders that aping into meme coins based on his tweets is “almost guaranteed” to lose money.

South Korea’s Financial Services Commission proposed allowing listed companies and professional investors to allocate up to 5% of equity capital into top-20 cryptocurrencies. The move could funnel billions into BTC and ETH while keeping tight risk controls in place.

Custody giant BitGo filed to raise up to $201M at a ~$2B valuation, planning to list on the NYSE as BTGO. Revenue exploded in 2025, driven by custody, staking, and asset sales, with assets under custody topping $100B. TradFi wants picks-and-shovels crypto exposure.

Please make X great again.

Want RaaS without digging through your inbox? Our Telegram channel gives you the same daily crypto roundup in a quick, scrollable format. Easy to read, easy to share. Join here: RaaS Telegram Group.

Top Gainers: DOLO, SAFE, CJL, QUAI, WKC.

High-signal reads are worth your time, all in one place.

WereTuna accuses Base of abandoning builders, claiming three years of shipping products on Base led to zero support, visibility, or engagement, exposing a widening gap between ecosystem marketing promises and actual builder outcomes.

Han Tengri roasts “poverty strategies” for 2026, arguing that betting on low-quality chains and obvious narrative traps is the fastest way to stay poor as attention, liquidity, and talent consolidate around fewer winners.

a16z crypto shared two notes for crypto builders in 2026, warning against the trading-only trap and arguing that regulation can fix crypto’s structural distortions.

VanEck outlines a risk-on setup for 2026, highlighting reset AI valuations, renewed strength in gold, improved private credit yields, India’s growth story, and crypto as long-term bullish despite near-term uncertainty.

Aasha demystifies vibecoding, showing how non-technical creators can now build polished products using simple prompts and tools like Cursor and Manus, lowering the barrier to shipping without deep engineering skills.

OG Telegram trading bot Trojan is evolving into a full trading terminal, boasting a clean UI, fast execution, and aggressive referral rewards. Rumors of “better than everything else” are flying; the real test will be retention after incentives fade.

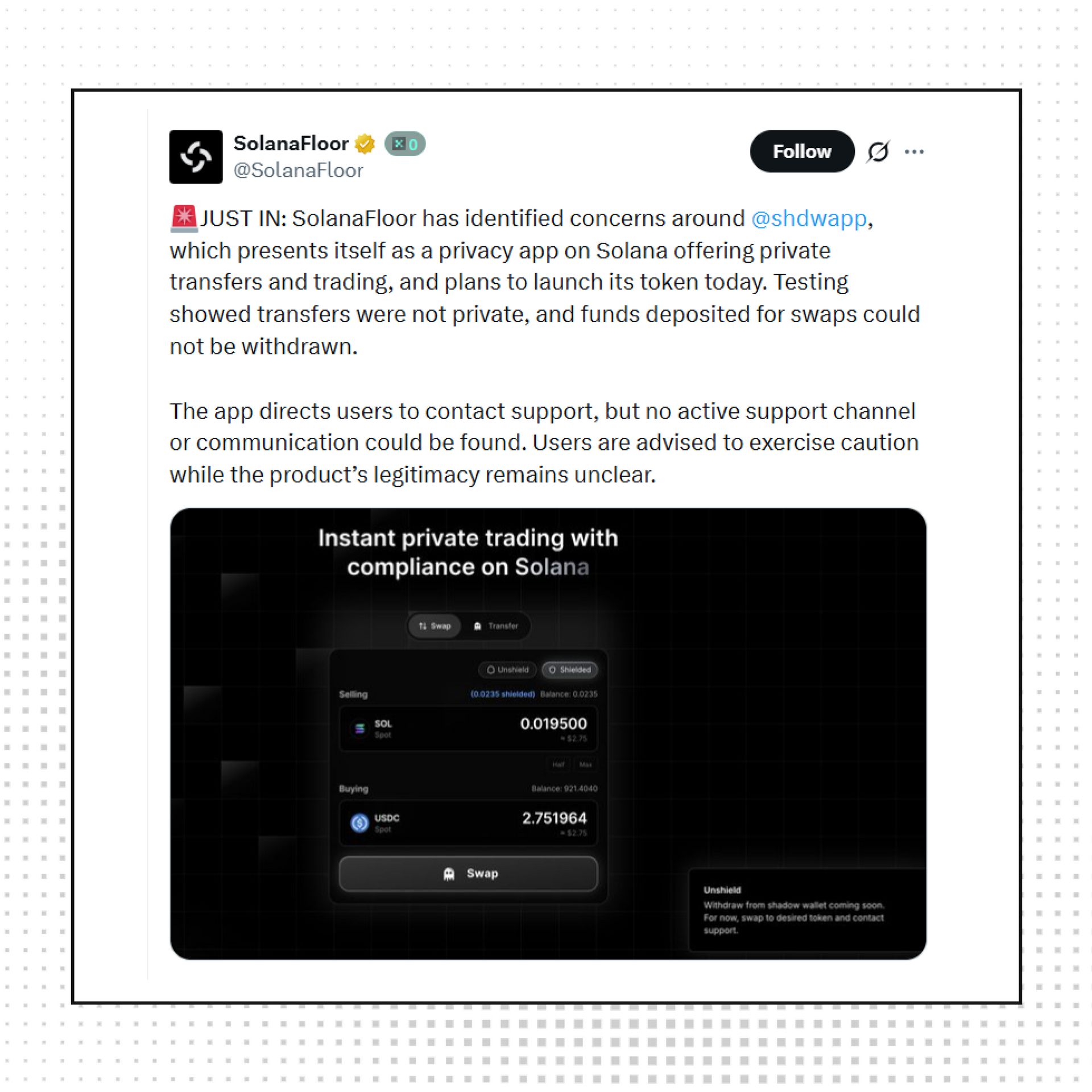

SolanaFloor raised concerns about shdwapp, a Solana-based “privacy app” launching its token today. Testing showed transfers weren’t private, and swap deposits couldn’t be withdrawn, with no active support channels found. Users are advised to proceed with caution.

That’s all for today!