- Radar-as-a-Service

- Posts

- RaaS #589: Kraken Launches DeFi Earn!

RaaS #589: Kraken Launches DeFi Earn!

Bitwise Partners With Morpho, Polymarket Partners With MLS: GM Web3!

Coinbase Forms Board on Quantum Computing, AVAX ETF on Nasdaq, And Moar!

Quick Intro: Radarblock is a User-First Web3 Growth Agency that increases awareness, TVL, volume, and social metrics for its clients over a consistent time frame without uncertainty or confusion. All tweets are hyperlinked; click to view them on X.

Jeff shares his first tweet of 2026, announcing that Hyperliquid is now the most liquid venue for crypto and TradFi perps. HIP-3 open interest hits a new ATH of $790M, nearly tripling in a month, driven by rising commodities trading.

Vitalik outlines a core principle of Ethereum’s scaling roadmap: computation is easier to scale than data, and data is easier to scale than state. The North Star? Replace state with data, and data with computation, if decentralization remains intact.

Coinbase has formed an independent advisory board on quantum computing and blockchain. With long-term risks to cryptographic security on the horizon, this signals early preparation for quantum-resilient infrastructure in crypto.

Kraken has launched DeFi Earn, a yield product powered by Aave. It lets users earn yields from within the Kraken interface. Funds are routed via the Ink network into Aave, the leading DeFi lender with over $50B in deposits.

Monad was special!

Jesse Pollak is launching JESSE on Base App under jesse.base.eth. The token, teased since November, is part of a broader thesis on creator-owned upside and the “new global economy.”

Kraken users in the United States, EU, and Canada can now access Chaos Vaults, an AI-powered yield strategy developed by Chaos Labs, via DeFi Earn. Initially human-directed, the system automates risk and reallocation, setting the stage for intent-driven vault management.

Bitwise becomes a curator on Morpho, launching its first onchain vault strategy targeting 6% APY via overcollateralized lending. Led by PM Jonathan Man, the strategy brings Bitwise’s institutional track record and signals growing TradFi adoption of DeFi-native yield infrastructure.

Your daily dose of bite-sized crypto news.

U.S. opens investigations into John Daghita, who allegedly siphoned over $40M from seized U.S. government crypto wallets.

Novig has officially applied to become a CFTC-regulated prediction market exchange.

The first-ever AVAX ETF was listed on the Nasdaq this morning.

Crypto Fear and Greed Index rises from Extreme Fear (20) to Fear (29).

GameStop transferred its entire Bitcoin holdings, roughly $420M, to Coinbase Prime, sparking selling speculation.

Polymarket lands MLS as its latest partner after earlier deals with the NHL and UFC, accelerating prediction market adoption in pro sports. With real-time trading offering a superior UX to sportsbooks, pressure mounts on the NBA, NFL, and MLB to rethink their stance.

GMX will launch on MegaETH, an ultra-low latency chain with 10ms blocks and 100,000+ TPS, aiming to bring CEX-level execution to onchain perps. With BTC/ETH/SOL markets, single-sided GLV liquidity, and 100x leverage, it’s a step toward real-time, institutional-grade DeFi trading.

Tokenized gold is surging as demand for traditional safe havens rises and confidence in the U.S. dollar slips. Tether Gold (XAUt) now commands over half the market at $2.2B, backed by bullion reserves. With Comex gold breaching $5,000 and central banks ramping up purchases, tokenized metals may outpace Bitcoin as the institutional hedge of choice.

That’s how it usually is.

Want RaaS without digging through your inbox? Our Telegram channel gives you the same daily crypto roundup in a quick, scrollable format. Easy to read, easy to share. Join here: RaaS Telegram Group.

Top Gainers: BNKR, AXL, WHITEWHALE, ACU, KNTQ.

High-signal reads are worth your time, all in one place.

Felix is launching tokenized spot equities for onchain traders, offering access to 100+ U.S. stocks and ETFs with sub-10bps execution via offchain liquidity. Built on Ethereum through Ondo’s mint/redeem engine, Felix removes slippage, supports large trades, and syncs seamlessly with HyperCore.

Tokenization is evolving from a niche experiment to core financial infrastructure. In 2026, we’ll see onchain IPOs, DeFi-usable tokenized stocks, stablecoins driving fund demand, vaults as institutional gateways, new shareholder mechanics, and wallets turning into super apps.

New research from Valueverse highlights a growing divide between buyback tokens and direct fee-sharing models. Vote-escrowed tokens such as CRV and AERO deliver up to 7x more yield per dollar than average buybacks, while UNI ranks as the most expensive token relative to revenue, trading at a 179x multiplier.

Over $100M in forced selling from team unlocks, leverage wipeouts, and a Tornado-funded cluster dragged HYPE from $50 to $20. But the worst seems behind: leverage is reset, whales are out, OTC absorption is in, and HIP-3 portfolio margin sets up a structurally different landscape going forward.

Zypherpunk drew 1,300+ hackers and 300+ projects pushing the frontier of privacy. Trove, a decentralized AI vault system, won top prize, marking a shift toward verifiable, compute-local AI. Explore standout projects, track winners, and the future of private infra.

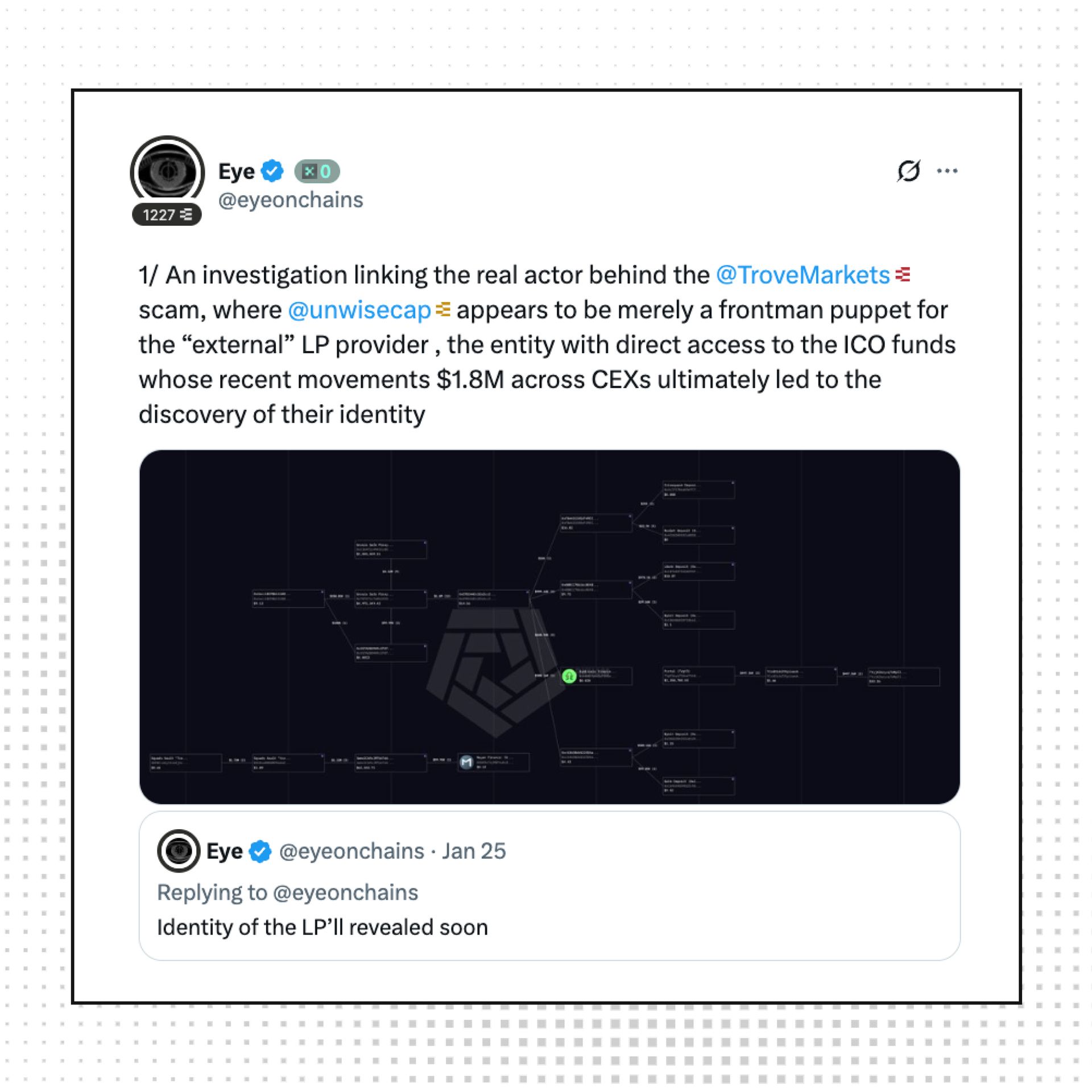

A deeper investigation into Trove reveals it’s part of a broader pattern. Onchain traces connect it to Taker and PoPP, projects tied to the same operator using burner wallets, fake identities, and mass domain registrations. The real story isn’t just Trove’s collapse; it’s how many are still running this playbook.

China is ramping up efforts to internationalize the digital yuan in 2026, signaling long-term intent to challenge dollar dominance. Analysts frame it as a geopolitical move, boosting renminbi demand, easing imports, and expanding Beijing’s financial influence.

That’s all for today!