- Radar-as-a-Service

- Posts

- RaaS #593: Jupiter Goes Global!

RaaS #593: Jupiter Goes Global!

Polymarket Goes to Solana, CrossCurve Exploited for $3M: GM Web3!

Justin Sun’s Ex Alleges Wash Trading, Whales Gobbling BTC, And Moar!

Quick Intro: Radarblock is a User-First Web3 Growth Agency that increases awareness, TVL, volume, and social metrics for its clients over a consistent time frame without uncertainty or confusion. All tweets are hyperlinked; click to view them on X.

Jupiter just launched Jupiter Global, bridging fiat and crypto with a global payments suite. It includes QR Pay (0% fee onchain payments across APAC), fiat transfers via virtual USD/GBP/EUR accounts, SWIFT to 200+ countries, and a crypto credit card that spends USDC at over 150M merchants.

Justin Sun’s ex-partner alleges he used employee identities to create multiple Binance accounts, manipulate TRX prices, and dump on retail. She claims to have WeChat records and is offering full cooperation with U.S. authorities.

Vitalik says creator coins fail because they reward hype over quality. His fix: DAOs of respected creators gate access and burn token supply upon admission, aligning price with actual value, not attention.

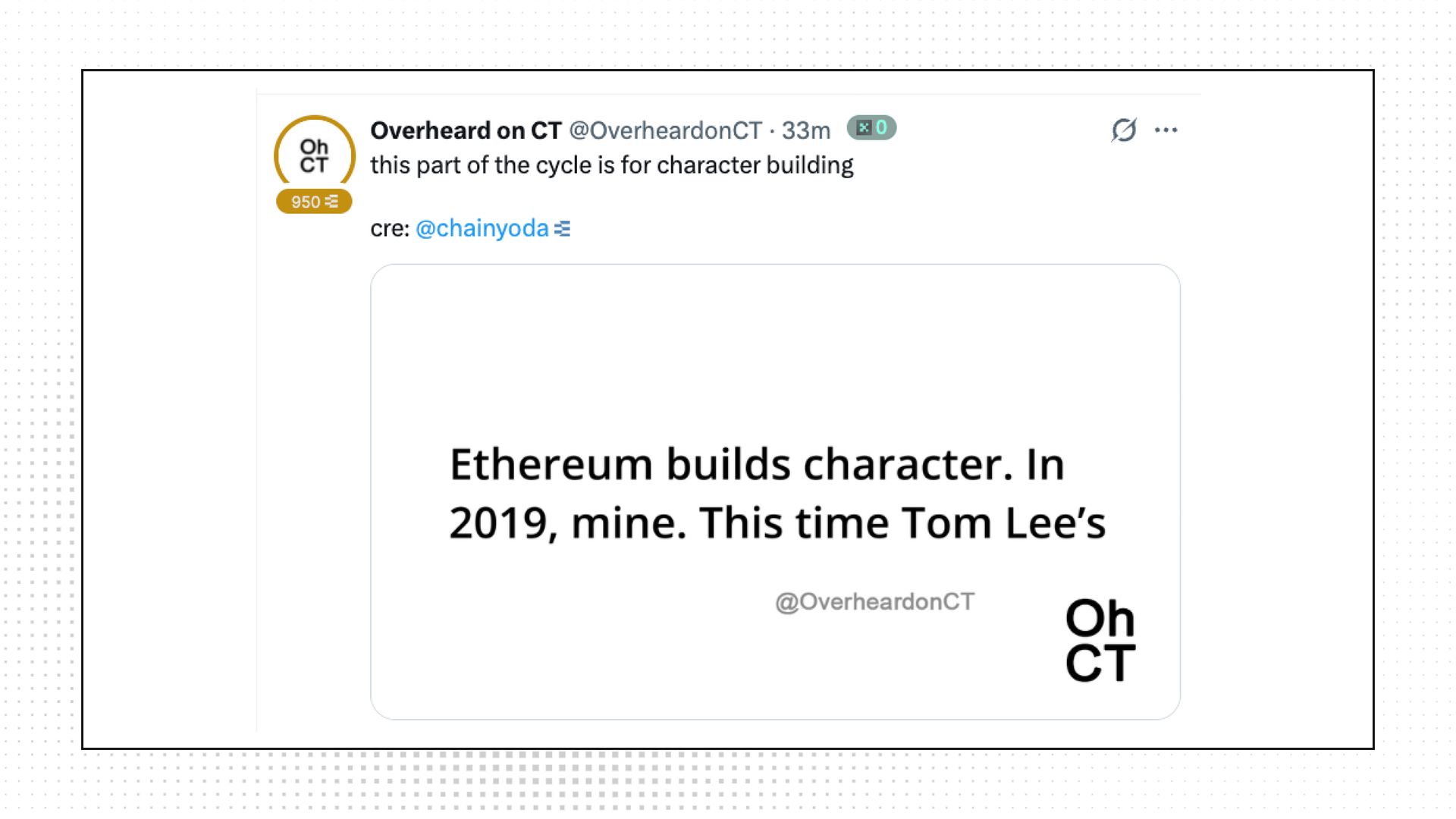

We’ve built too much character.

Bitcoin briefly plunged below $76K, triggering $2.5B in liquidations, with $767M from BTC longs alone. ETH dipped under $2.3K, SOL under $100, and over $200B was wiped from the market.

A 5-year crypto veteran lost $12.4M to address poisoning. The attacker slipped a fake address into their history with a tiny transfer. When the victim later copied and pasted it, the funds went straight to the scammer. Even OGs aren’t immune to simple traps.

CrossCurve’s bridge was exploited for ~$3M after attackers spoofed cross-chain messages via a missing validation check in the ReceiverAxelar contract. The flaw let them bypass gateway verification and trigger token unlocks, echoing Nomad’s 2022 exploit. Even Curve is advising caution.

Your daily dose of bite-sized crypto news.

SoDEX opens to all users with 150M SOSO in ecosystem incentives.

Step Finance suffered a $27M treasury breach, sending its STEP token down over 90%.

CZ unfollowed Solana’s Toly after he reposted a critique of Binance by OKX’s founder.

ParaFi Capital has invested $35M into Jupiter, settled entirely in JupUSD.

HIP-3 markets reached new ATHs of $1B in open interest and $4.8B in 24-hour volume.

Crypto Fear and Greed Index drops to "Extreme Fear".

Polymarket’s integration into Jupiter is a structural shift. By embedding prediction markets directly into the spot trading interface, event risk now clears alongside tokens. No friction, no context switch, just faster flow, higher turnover, and true mechanical adoption.

Whales are buying while retail exits. Glassnode data shows wallets with 10K+ BTC are accumulating, as sub-10 BTC holders continue selling into strength.

Flying Tulip’s sale capital stays unspent, funds are parked in liquid, conservative strategies like Aave lending and ETH staking. Yield first funds ops, then fuels FT buyback-and-burn. Redemptions stay open while PUT runs, with built-in downside protection.

Are any of us profitable today?

Want RaaS without digging through your inbox? Our Telegram channel gives you the same daily crypto roundup in a quick, scrollable format. Easy to read, easy to share. Join here: RaaS Telegram Group.

Top Gainers: PYTHIA, BNKR, STABLE, TBK, ULTIMA.

High-signal reads are worth your time, all in one place.

Story has pushed all locked IP token unlocks for team, investors, and insiders by six months, from February to August 13, 2026. This aims to strengthen long-term alignment, reduce supply shock risk, and support disciplined token emissions as the network scales. Core allocations and vesting terms remain unchanged.

OpenClaw’s agent economy is live on Base. 36K+ AI agents are trading, launching tokens, hiring each other, and coordinating onchain—no humans needed. It’s chaotic, sci-fi native, and already reshaping how social, execution, and payments stack in crypto.

Research tools evolve with the cycle. From SurfAI to Coresight, we break down 7 platforms to sharpen your alpha edge in 2026, whether you’re trading, farming, or applying for jobs. Winning isn’t about knowing 100 tools; it’s mastering the right ones.

After losing 90% in Luna, Deebs argues that bear markets reward persistence. When prices crash and influencers disappear, the few who stay, build, and create fill the vacuum. His takeaway is simple: protect capital, step back briefly, then return with intent. The next cycle is shaped quietly, not at the top.

Flying Tulip’s raise guarantees principal return and offers uncapped upside. Capital goes into putNFTs: wait and ride the upside, divest and exit at par, or sell FT and burn supply. Every path deflates token supply. Yield and revenue fund buybacks post-TGE. Smart contracts are the only risk.

IBIT holders are now in the red. Dollar-weighted returns flipped negative as late entrants bought near highs. $1.73B exited crypto funds last week, led by U.S. Bitcoin ETFs. Gold, not BTC, is winning the debasement trade.

Hyperliquid is now testing native prediction markets on testnet, starting with user-defined markets like “What will Hypurr eat the most of in 2026?” The test hints at flexible question formats, fallback logic, and onchain resolution, part of Hyperliquid’s broader push to embed prediction primitives into its unified trading layer.

That’s all for today!