- Radar-as-a-Service

- Posts

- RaaS #602: Polymarket Launches 5-Min BTC Bets!

RaaS #602: Polymarket Launches 5-Min BTC Bets!

Pumpdotfun Adds GitHub Fee Sharing, X Reverses Crypto Ad Rule: GM Web3!

Trove Accused of Secretly Refunding KOLs, Coinbase Posts $667M Loss, and Moar!

Quick Intro: Radarblock is a User-First Web3 Growth Agency that increases awareness, TVL, volume, and social metrics for its clients over a consistent time frame without uncertainty or confusion. All tweets are hyperlinked; click to view them on X.

Pumpdotfun rolled out GitHub fee sharing, letting memecoin creators allocate 0–1% of trading fees to any GitHub username during free launches, with payouts kicking in once tokens hit $100K and move to Raydium. With over $1B generated since launch, it’s being framed as a win for open-source devs, though skeptics say it may just refine the memecoin meta rather than fix it.

Bubblemaps traced roughly $450K in stablecoins allegedly sent from wallets linked to Trove’s founder to KOL-associated addresses after the token collapsed. Trove previously raised $11.5M for a Hyperliquid DEX, pivoted to Solana before launch, and watched its valuation fall from $20M to under $1M. While $2.4M was refunded to some, critics claim influencers were quietly made whole as retail was left holding the bag.

This week on On the Radar, we’re talking all things design in Web3 and unpacking the latest in crypto and AI with the team that made our rebrand possible, Dacoit. Joining us are co-founders Rahul Singh Bhadoriya and Karan, hosted by our favorite, Luki. Live today at 2:30 PM UTC.

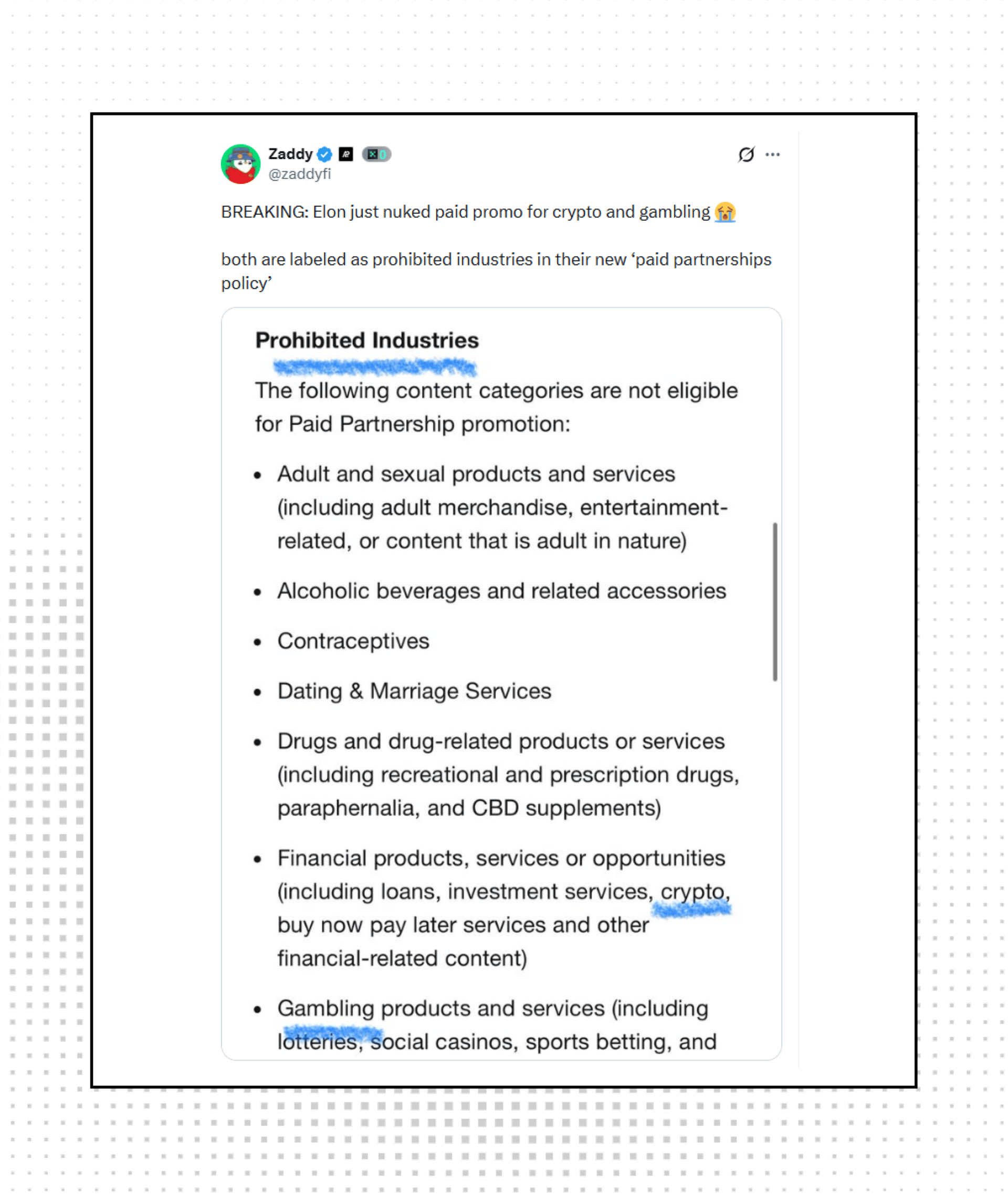

X briefly updated its Help Center to list crypto and financial products as ineligible for paid partnership labels, triggering backlash across CT, before quietly reversing the change within hours. While gambling remains prohibited, crypto content stays eligible for disclosures, showing how quickly platform policies can shift without formal announcements.

That doesn’t make me feel better at all.

Aave unveiled its “Aave Will Win” framework, proposing to ratify Aave V4 as its core technical foundation while directing 100% of Aave-branded product revenue to the DAO treasury. The plan also seeks structured funding and operational autonomy for Aave Labs in the future.

Polymarket rolled out ultra-short-term markets that let users bet on Bitcoin’s price direction in five-minute intervals, leaning into high-frequency, volatility-driven speculation. It is currently limited to BTC, with plans to expand to major altcoins.

Your daily dose of bite-sized crypto news.

Robinhood now supports shorts, but they’re already sold out.

The Commodity Futures Trading Commission formed a 35-member Innovation Advisory Committee featuring execs from Coinbase, Polymarket, Ripple, Kraken, Gemini, Chainlink Labs, and Robinhood.

SWIFT joined the Bank of England Synchronisation Lab to test cross-border FX and tokenized securities settlements.

LayerZero partnered with Google Cloud to explore AI agents making instant micropayments without bank accounts.

Jupiter officially launched Jupiter Lend out of beta after six months of testing.

Druk Holding & Investments sold another 100 BTC worth $6.77M, marking its third consecutive week of sales and taking total holdings down to 5,600 BTC valued at around $371M. Bhutan appears to be locking in profits rather than exiting, continuing a strategy that began in 2023 through state-backed mining operations.

Coinbase just posted a $667M quarterly loss as revenue slid 20% with trading volumes cooling off. The numbers missed expectations, and it’s a reminder that when volatility dries up, exchange revenues dry up with it; even the biggest players aren’t immune.

Diamond hands don’t need permission from anyone.

Want RaaS without digging through your inbox? Our Telegram channel gives you the same daily crypto roundup in a quick, scrollable format. Easy to read, easy to share. Join here: RaaS Telegram Group.

Top Gainers: BTR, WKC, 9BIT, ZKC, BURN.

High-signal reads are worth your time, all in one place.

Intern lays out 21 actions to take if you believe AI acceleration will make the world unrecognizable in 5–10 years, arguing that once you internalize rapid takeoff, you should radically adjust how you build, learn, and position yourself today.

Stacy Muur breaks down why AI agents don’t just need more intelligence, but crypto rails, explaining how blockchain, KYA, and micropayments create the trust and coordination layer for autonomous agents to safely transact and collaborate.

Defi Warhol compiles a mega Q1 points farming guide covering 45 protocols across eight sectors, noting that 2026 token launches are increasingly institutional and that only a handful of opportunities still justify the grind.

Adithya urges crypto builders to pivot to AI by embedding it into every workflow rather than abandoning crypto entirely, arguing that roles will become obsolete unless AI becomes core to how you think, decide, and ship.

Jay Yu presents a 4,000-word thesis on building permissionless neobanks, outlining how crypto rails can unify storing, spending, growing, and borrowing into a global, self-custodial financial interface.

ETHZilla launched Ethereum-based tokens backed by leased commercial jet engines, bringing aviation infrastructure into the tokenized real-world asset narrative.

World Liberty Financial announced plans to launch “World Swap,” a forex platform aimed at challenging traditional remittance providers using its USD1 stablecoin. Positioned as part of a broader ecosystem that already includes a lending platform with hundreds of millions in deposits, the move signals ambitions to build a full-stack financial infrastructure around its dollar-pegged asset.

That’s all for today!