- Radar-as-a-Service

- Posts

- RaaS #603: Solana RWAs Smash $1.66B ATH!

RaaS #603: Solana RWAs Smash $1.66B ATH!

$130M+ Token Unlocks Incoming, Strategy Eyes Debt Equitization: GM Web3!

Polygon Gas Hits 100M Limit, Algorand Capped Hot January, and Moar!

Quick Intro: Radarblock is a User-First Web3 Growth Agency that increases awareness, TVL, volume, and social metrics for its clients over a consistent time frame without uncertainty or confusion. All tweets are hyperlinked; click to view them on X.

Solana's RWAs just reached a new all-time high with over $1.66B in tokenized value. A steady climb that's pulling in more TradFi players, potentially adding bigger inflows and liquidity plays as real-world assets keep blending with onchain speed.

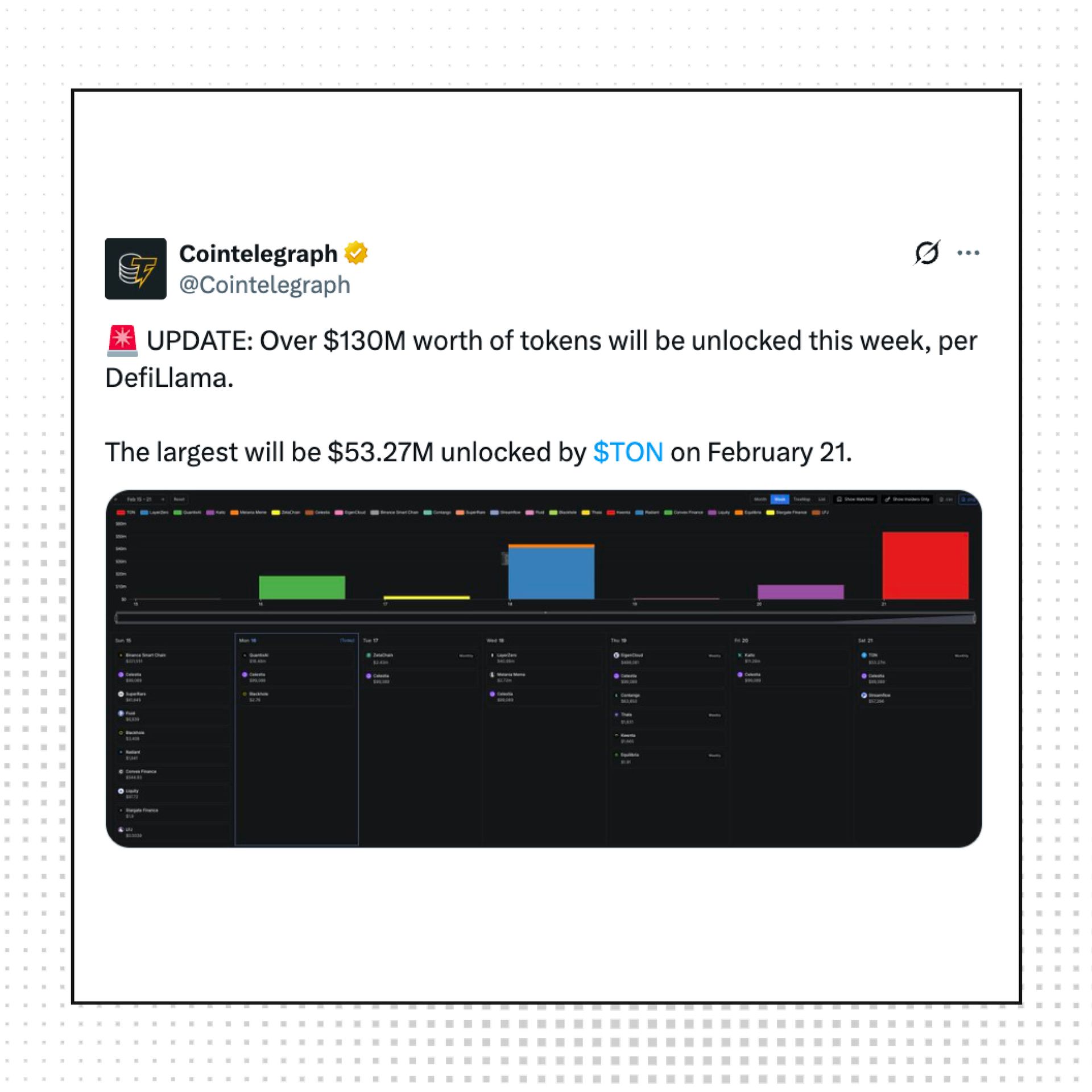

Over $130M in tokens are unlocking this week per DefiLlama. TON leads with $53M on Feb 21, which could juice liquidity but also add sell pressure if holders cash out amid the dip, keeping eyes on how it shakes up those ecosystems.

Strategy's plotting to equitize its convertible debt over 3-6 years, their stack could weather BTC down to $8K and still cover obligations. A bold treasury move that might inspire more corps to HODL through volatility if it pays off.

That doesn’t make me feel better at all.

Polygon pushed its gas limit to 100 million with TPS blasting past 2,380, tailor-made for Polymarket's 5-min frenzy, hitting 10% of gigagas goals and setting up for denser traffic that could pull in more apps chasing that speed edge.

Algorand wrapped up January with jumps in wallets, transactions, active accounts, smart contracts, and stablecoin volume. Plus, 2B ALGO staked for top-tier decentralization, a flex that might lure more devs if it keeps proving resilient against rivals.

Your daily dose of bite-sized crypto news.

Forex trading is now live on Shield Mode on Aster.

Rocket Pool announced their Smart Node drops v1.19.1 upgrades

Logan Paul's Pikachu card sold for $16.49M.

OpenClaw added new features in their 2026.2.15 update.

Solv is teaming up with Stellar for programmable BTC yield on global rails.

Bithumb extended zero-fee USDT withdrawals on Kaia till March 15. One more month of cheap moves that could cement Kaia as Korea's go-to bridge to global spots.

FairScale's battling a liquidation proposal amid the dip, after shipping x402 micropays, sybil detection, and revenue in weeks, they're pushing rep-gated governance to fend off shutdowns and keep building Solana's cred layer.

After ignoring every warning sign on the chart and watching it all vanish.

Want RaaS without digging through your inbox? Our Telegram channel gives you the same daily crypto roundup in a quick, scrollable format. Easy to read, easy to share. Join here: RaaS Telegram Group.

Top Gainers: INIT, SIREN, GRX, CHECK, STABLE.

High-signal reads are worth your time, all in one place.

Stani's thesis on scaling Aave to $30-$50T by backing solar/batteries as collateral, tokenizing future-proof assets to juice yields and flip scarcity finance on its head.

ETH yields are heating up again, says Stephen (DeFi Dojo). Pendle's fixed plays at 4-6%, Morpho/Unichain lending 3-5% in UNI, looped vaults pushing 20-28%, Avant tranches 4-10%, MerchantMoe LPing 24% with low-risk farms to high-leverage bets if you play smart.

Four Pillars research on x402's agent economy, from A2A protocols to trust stacks like TEEs/ERC-8004, shows fraud down to 10%, but needs killers with Solana/Base/Polygon competing. The trust layer is key to scaling bots paying bots.

Alex Finn's thesis on the permanent underclass vs. overclass in 12 months. Adopt OpenClaw/Claude/Codex/local models daily or get left behind, AI widens gaps, ditch distractions for action before tools price out the slow.

AI anxiety is fueling liquidity crunch by ericonomic. Post-COVID gambling wave fading, poorer masses, UBI, free time turning into investing boom, but tokens mostly trash.

OpenClaw creator Peter Steinberger joined OpenAI to build personal AI agents. Sam Altman confirmed he’ll help drive the next generation of personal agents.

Tokenomist is tracking $321M+ in token unlocks hitting over the next few days. Big ones, like ZRO/YZY/ARB/KAITO, over $5M each. The steady daily pressure from RAIN, SOL, CC, and TRUMP could easily stir up volatility if sell-offs come in hot.

Spice Flow x Elitra Devnet campaign wrapped after 12 hours. With the Spice Flow integration, users from any of the Spicenet-supported networks can now access and trade on Elitra natively, without any UX or liquidity fragmentation. This means your wallets are on your preferred networks to connect to Elitra and trade natively cross-chain.

That’s all for today!