- Radar-as-a-Service

- Posts

- RaaS #606: Base Breaks From the OP Stack!

RaaS #606: Base Breaks From the OP Stack!

The Ethereum Foundation Releases Roadmap, Sui ETFs Land With Staking: GM Web3!

Hyperliquid DC Policy Push, World Labs Raises $1B, and Moar!

Quick Intro: Radarblock is a User-First Web3 Growth Agency that increases awareness, TVL, volume, and social metrics for its clients over a consistent time frame without uncertainty or confusion. All tweets are hyperlinked; click to view them on X.

The Ethereum Foundation just laid out its 2026 priorities across three tracks: Scale, Improve UX, and Harden the L1. The Glamsterdam upgrade is eyed for H1 and Hegotá for later in the year. The team hopes to spark fresh developer momentum and clearer upgrade paths that make Ethereum feel faster and friendlier for everyone building on it.

Base is stepping away from the OP Stack and Optimism Superchain over the next few months to run its own unified stack targeting six hardforks a year, 1 gigagas/s scale, 99.99% non-empty blocks, and simpler specs. This autonomy should let them ship features builders actually need way faster while staying aligned with Ethereum, potentially turning Base into an even smoother onramp for mass adoption.

Two spot SUI ETFs just debuted in the US. Canary Capital launched under SUIS on Nasdaq, while Grayscale launched under GSUI on NYSE Arca. Both ETFs are offering staking rewards from the get-go. Institutional supercycle?

Just don’t be a creep, and you’re solid.

OpenAI and Paradigm dropped EVMbench, a fresh benchmark that pits AI agents against real smart-contract vulnerabilities to see how well they can spot, exploit, and patch them. Are AI auditors ready for such an important task? If it works, it could reduce exploit risk across DeFi as agents get smarter.

The Hyperliquid Policy Center, a nonprofit research and advocacy group led by Jake Chervinsky, will introduce policymakers to decentralized finance and Hyperliquid to bridge the gap to next-gen market infrastructure. Having a dedicated voice in DC could help shape clearer rules that let DeFi thrive without the usual regulatory headaches.

Your daily dose of bite-sized crypto news.

Fireplace raised $1.5M to build the smartest trading terminal for prediction markets.

Aave crossed $350M deposits on Mantle in just one week.

LBPs are live on Balancer V3 with zero upfront capital and fixed-price sales fully onchain.

Robinhood Chain testnet saw 4M transactions in its first week.

Custodial wallets are now live in Privy.

Drift is opening applications for 10 new ambassadors with direct team access, early product peeks, brand growth help, and monthly rewards with rolling admissions starting Feb 20. A smart move that could turn community voices into real product evangelists.

World Labs just closed a $1B round with AMD, Autodesk, Emerson, Fidelity, NVIDIA, Sea, and others to accelerate spatial intelligence for storytelling, creativity, robotics, and scientific discovery. This level of backing could fast-track AI agents that understand the physical world, opening huge new use cases for onchain coordination.

Saturn One is live on Rocket Pool. The biggest upgrade ever brings an RPL fee switch, 4 ETH validators, MEGAPOOLs, and more, reinforcing Rocket Pool as the only fully permissionless staking protocol that stays true to Ethereum’s core values.

Maybe it’s just asking you to go take a shower?

Want RaaS without digging through your inbox? Our Telegram channel gives you the same daily crypto roundup in a quick, scrollable format. Easy to read, easy to share. Join here: RaaS Telegram Group.

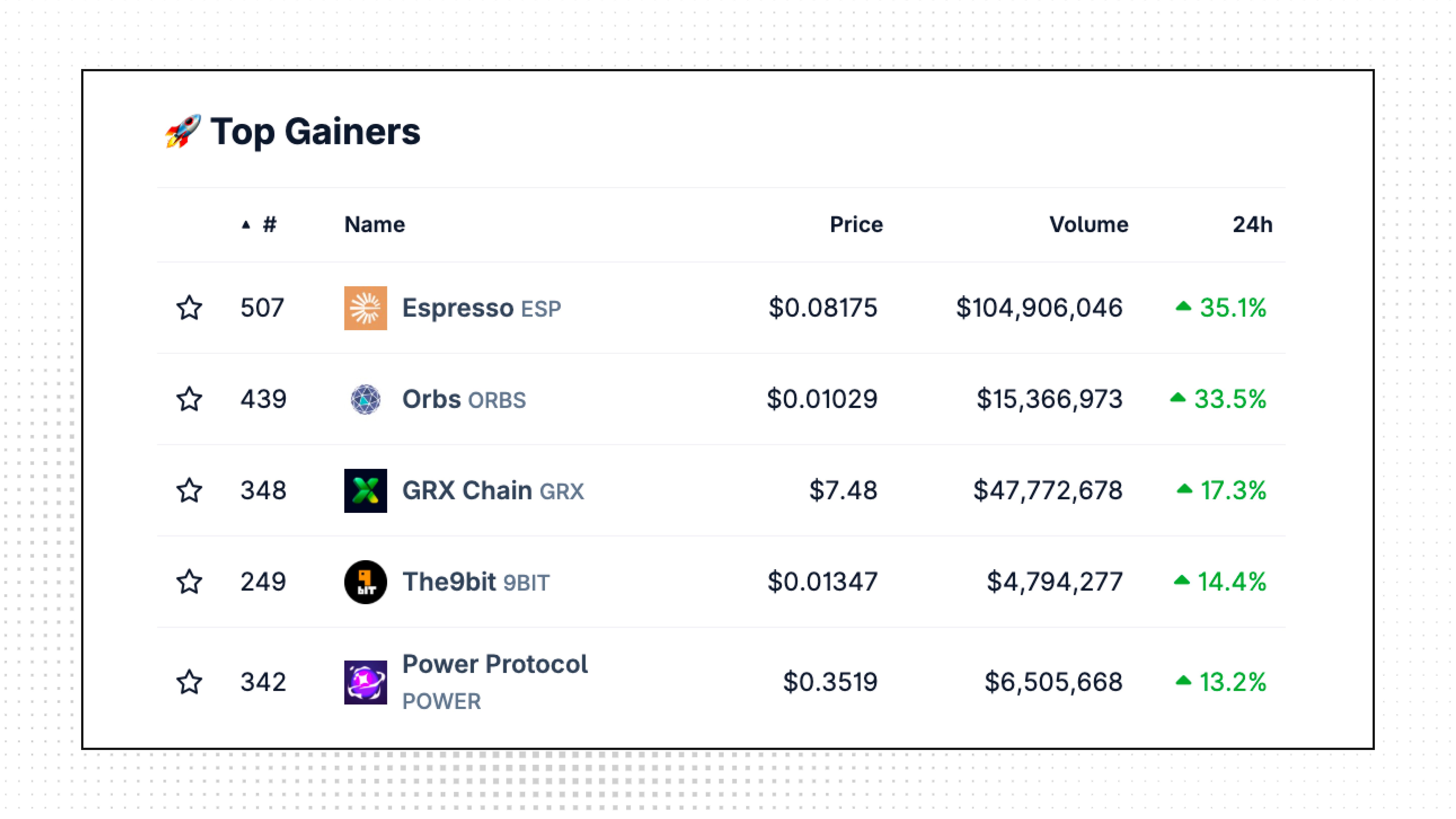

Top Gainers: ESP, ORBS, GRX, 9BIT, POWER.

High-signal reads are worth your time, all in one place.

Crypto was never made for humans, argues Haseeb. We sign legal contracts even when we could use smart contracts because judges are more forgiving than the EVM. But AI agents will love crypto’s deterministic, code-is-law nature, and self-driving wallets are coming fast.

Sam Altman's hiring of the OpenClaw creator was never about winning the AI race, but about commoditizing autonomous agents that can do white-collar work while you sleep.

Ethereum’s blob/DA landscape: blobs are generating solid fees despite lower data posted than competitors; capacity has doubled, but demand is taking time to catch up; long-term signal to L2s and devs that Ethereum has room to grow if they build.

AI needs crypto because agents will need programmable money for micropayments, verifiable ownership, and incentive alignment that traditional finance can’t provide.

How does it feel to raise $100M in under 18 months? Being capital-efficient is about leveraging relationships, building trust early, focusing on individual partners, and making the fund brand matter less than the quality of the partners.

a16z just launched Speedrun Alpha for pre-idea and pre-team founders. Perfect timing for anyone grinding on agents and apps on nights and weekends who want structured time to cook real startups in 2026’s wild AI wave.

Novig closed a $75M Series B round led by Pantera to build a sports prediction market with zero vig for retail, 10x better win odds, and a mission to fix broken betting rails, which could make regulated prediction markets go mainstream fast.

That’s all for today!